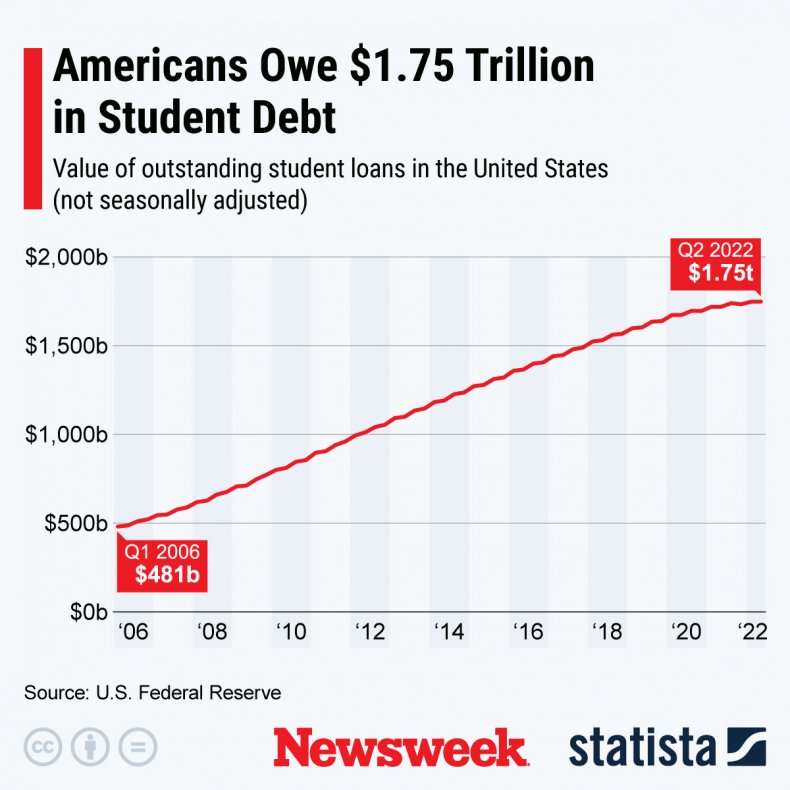

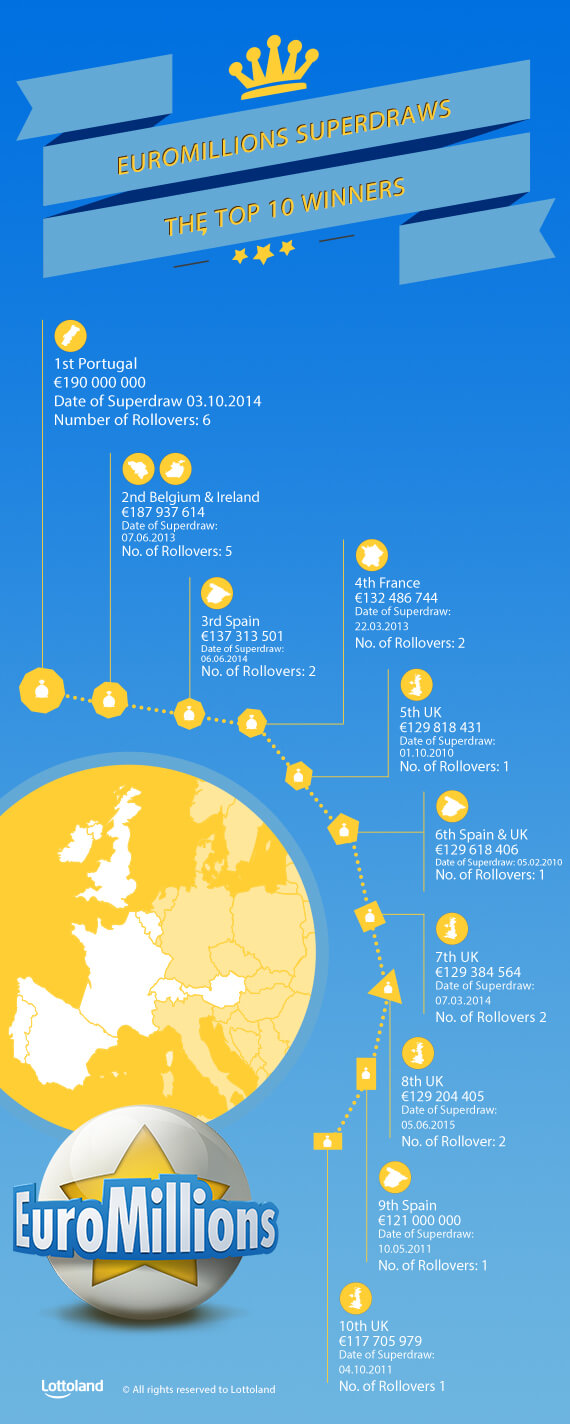

How The Student Loan Crisis Will Impact The US Economy

Table of Contents

Reduced Consumer Spending and Economic Growth

High student loan debt significantly restricts disposable income for millions of Americans. This limitation directly impacts consumer spending, a cornerstone of US economic growth. Many borrowers dedicate a substantial portion of their monthly income – often exceeding 20% – to loan repayments, leaving little for other expenses. This impacts various sectors of the economy.

- Delayed Major Purchases: The burden of student loan repayments often delays major purchases like houses and cars, impacting related industries.

- Reduced Spending on Non-Essential Goods and Services: With less disposable income, consumers cut back on spending on non-essential items, affecting retailers and service providers.

- Lower Overall Economic Activity: This reduced spending translates to lower overall economic activity, potentially slowing down economic growth.

- Potential Impact on Businesses Reliant on Consumer Spending: Businesses that depend heavily on consumer spending, from restaurants to retail stores, feel the pinch of reduced consumer confidence and spending power. This ripple effect significantly impacts job creation and overall economic stability.

Impact on Housing Market and Real Estate

The student loan crisis is deeply intertwined with the housing market. For young adults, already facing high housing costs, substantial student loan debt makes homeownership a distant dream. This impacts both individual financial well-being and the broader real estate market.

- Lower Demand for Housing: The debt burden prevents many young adults from entering the housing market, reducing demand for homes.

- Difficulty in Securing Mortgages: High debt-to-income ratios make it difficult to secure mortgages, further restricting homeownership opportunities.

- Potential Slowdown in the Real Estate Market: Reduced demand and difficulty in securing financing can contribute to a slowdown in the real estate market, impacting construction, mortgage lending, and related industries.

- Impact on Related Industries: The knock-on effects extend to related industries like construction, mortgage lending, and even furniture and appliance sales. The reduced activity in the housing market creates a ripple effect throughout the economy.

Implications for Higher Education and Future Workforce

Ironically, the rising cost of higher education and the resulting student loan crisis could lead to reduced enrollment. This paradox creates a vicious cycle, potentially impacting the future workforce and the nation's economic competitiveness.

- Decreased College Enrollment Rates: Prospective students may forgo higher education due to the fear of insurmountable debt, potentially leading to decreased enrollment rates.

- Impact on Specific Industries Due to Skill Gaps: A less-educated workforce can lead to skill gaps in specific industries, hindering innovation and growth.

- Potential Implications for Innovation and Technological Advancement: A less-skilled workforce can limit innovation and technological advancement, potentially hindering long-term economic growth.

- Reduced Social Mobility: The high cost of education exacerbates existing inequalities, reducing social mobility and limiting opportunities for individuals from lower socioeconomic backgrounds.

Potential Government Intervention and its Economic Effects

The government is exploring various interventions to address the student loan crisis, such as loan forgiveness programs or repayment reforms. However, these policies have significant economic implications.

- Fiscal Impact of Loan Forgiveness Programs on the National Budget: Large-scale loan forgiveness programs would place a substantial burden on the national budget, potentially impacting other government programs and services.

- Potential Impact on Inflation Due to Increased Consumer Spending: Loan forgiveness could stimulate consumer spending, but it might also lead to inflationary pressures if the increased demand outpaces the supply of goods and services.

- Long-Term Effects on Government Debt and National Finances: Government interventions need careful consideration of long-term effects on government debt and national finances.

- Effectiveness of Different Intervention Strategies: The effectiveness of different intervention strategies needs rigorous evaluation to ensure they achieve their intended goals without creating unintended negative consequences.

Conclusion: Understanding the Long-Term Effects of the Student Loan Crisis

The student loan crisis presents a multifaceted challenge to the US economy. Reduced consumer spending, difficulties in the housing market, impacts on higher education, and the potential economic consequences of government interventions all contribute to a complex and concerning economic outlook. Understanding the long-term implications of this issue is crucial for ensuring future economic stability and growth. We must actively work towards addressing the student loan debt problem, finding solutions for the student loan debt burden, and collaboratively seeking ways to solve the student loan crisis to build a more sustainable and equitable future. For more information and resources, explore the websites of the Federal Student Aid (FSA) and the Consumer Financial Protection Bureau (CFPB).

Featured Posts

-

Direct Payday Loans With Guaranteed Approval For Bad Credit

May 28, 2025

Direct Payday Loans With Guaranteed Approval For Bad Credit

May 28, 2025 -

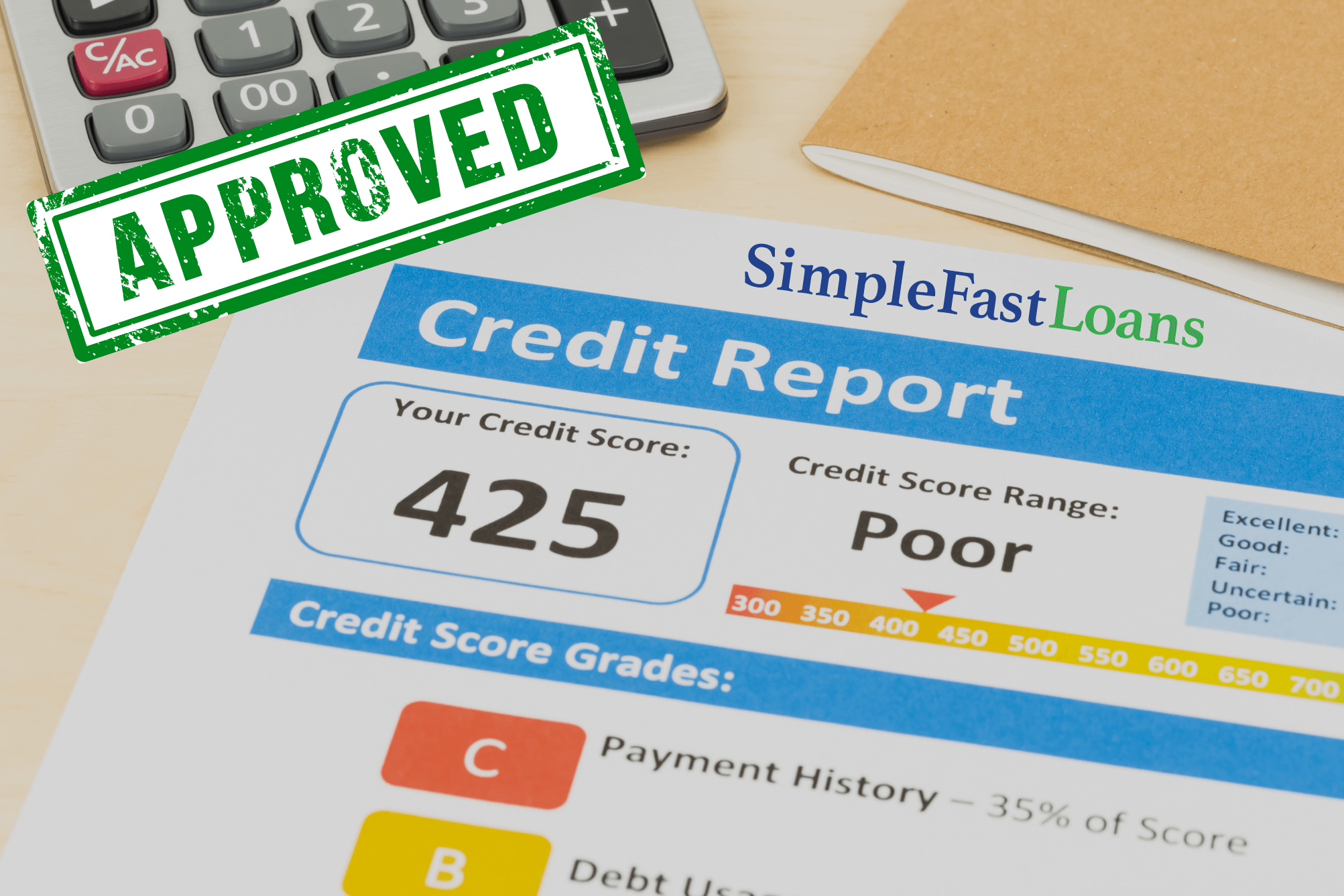

Next Euromillions Draw 202m Prize Could Make You A Multi Millionaire

May 28, 2025

Next Euromillions Draw 202m Prize Could Make You A Multi Millionaire

May 28, 2025 -

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025 -

Man Utd Transfer News Players Future Uncertain Amidst Conflicting Interests

May 28, 2025

Man Utd Transfer News Players Future Uncertain Amidst Conflicting Interests

May 28, 2025 -

Hujan Masih Turun Di Jawa Timur Prakiraan Cuaca 24 Maret

May 28, 2025

Hujan Masih Turun Di Jawa Timur Prakiraan Cuaca 24 Maret

May 28, 2025