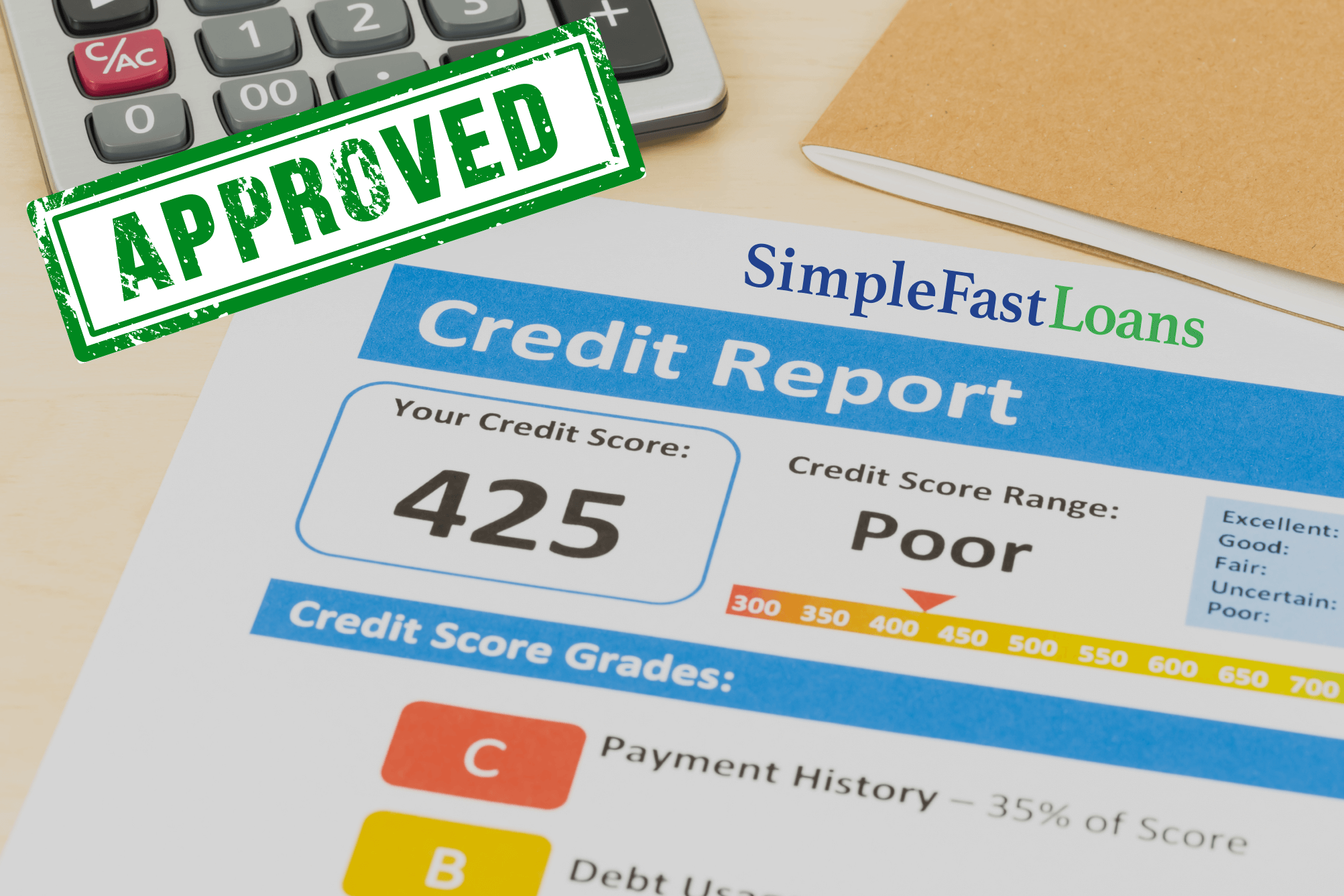

Direct Payday Loans With Guaranteed Approval For Bad Credit

Table of Contents

Understanding Direct Payday Loans

Direct payday loans are short-term, small-amount loans designed to bridge the gap until your next payday. Unlike loans offered through brokers who connect you with multiple lenders, a direct payday loan involves dealing directly with the lending institution. This direct interaction often translates to faster processing times and a more streamlined application process.

- Faster processing times: Direct lenders often process applications and disburse funds much quicker than traditional banks or credit unions.

- Direct interaction: You communicate directly with the lender, eliminating the delays and potential complications of working through a third party.

- Small loan amounts: These loans typically cater to smaller, immediate financial needs, not large purchases or long-term debt consolidation.

- Short repayment period: Repayment is usually due on your next payday, making them inherently high-interest loans.

Guaranteed Approval: Fact or Fiction?

The phrase "guaranteed approval" in the context of payday loans is often a marketing tactic. While direct lenders may advertise this, it's crucial to understand the reality. No lender can guarantee approval; they still assess risk. However, "guaranteed approval" often implies a higher likelihood of approval than with traditional loans, especially for those with bad credit.

- Higher likelihood, not certainty: Lenders employing this term typically have less stringent approval criteria compared to banks.

- Risk assessment still occurs: Lenders still evaluate your ability to repay, even if their criteria are less strict than traditional lenders.

- High interest rates: The higher risk associated with lending to individuals with poor credit translates to significantly higher interest rates.

- Thorough understanding is key: Carefully review the terms and conditions, including all fees and interest charges, before agreeing to any loan.

Direct Payday Loans for Bad Credit: What to Expect

Individuals with bad credit can access direct payday loans, but it's essential to manage expectations. The ease of access often comes with a price.

- Higher interest rates: Expect substantially higher interest rates than those offered to individuals with good credit histories.

- Stricter repayment terms: Lenders may impose stricter repayment terms to mitigate risk. Missed payments can lead to severe penalties.

- Careful budgeting: Responsible borrowing and meticulous budgeting are crucial to successfully repay the loan and avoid a debt cycle.

- Credit score improvement: Consider strategies to improve your credit score in the long term to avoid relying on high-interest loans in the future.

Finding Reputable Lenders for Payday Loans with Bad Credit

Navigating the payday loan market requires caution. Many unscrupulous lenders operate online, preying on individuals in financial distress.

- Check online reviews: Scrutinize reviews from reputable sources like the Better Business Bureau.

- Verify licensing: Ensure the lender is properly licensed and registered in your state or jurisdiction.

- Transparency in fees: Understand all fees and interest rates upfront – avoid lenders who are vague or secretive.

- Avoid unrealistic promises: Beware of lenders promising "guaranteed approval" without transparent criteria.

Alternatives to Payday Loans for Bad Credit

While direct payday loans offer speed, exploring alternatives is crucial for responsible financial management.

- Credit unions: Credit unions often offer more affordable loans and may be more lenient with borrowers who have bad credit.

- Peer-to-peer lending: Platforms like LendingClub connect borrowers directly with individual investors, potentially offering better rates than payday lenders.

- Credit counseling: A credit counselor can help you develop a debt management plan and improve your credit score over time.

Conclusion

Direct payday loans with guaranteed approval for bad credit can provide quick financial relief, but they come with significant risks. Understanding the implications of "guaranteed approval," the importance of responsible borrowing, and exploring alternative financing options is crucial before considering this route. While the speed and convenience are attractive, high interest rates and stringent repayment terms necessitate careful consideration. Before applying for a direct payday loan with guaranteed approval for bad credit, thoroughly research lenders, meticulously review the terms and conditions, and weigh the advantages against the potential disadvantages. Only borrow what you can comfortably afford to repay.

Featured Posts

-

Challenging Draw For Sinners Italian Open Return Alcaraz Zverev In The Mix

May 28, 2025

Challenging Draw For Sinners Italian Open Return Alcaraz Zverev In The Mix

May 28, 2025 -

Padre Luis Arraez Carted Off Field Following Violent Collision

May 28, 2025

Padre Luis Arraez Carted Off Field Following Violent Collision

May 28, 2025 -

Mlb Playoffs Padres Vs Astros Prediction And Analysis

May 28, 2025

Mlb Playoffs Padres Vs Astros Prediction And Analysis

May 28, 2025 -

Microsoft Outlook April Update A Comprehensive Overview

May 28, 2025

Microsoft Outlook April Update A Comprehensive Overview

May 28, 2025 -

Hailee Steinfelds Rare Comments On Josh Allen Engagement And Wedding Plans

May 28, 2025

Hailee Steinfelds Rare Comments On Josh Allen Engagement And Wedding Plans

May 28, 2025

Latest Posts

-

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisive

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisive

May 30, 2025 -

L Assemblee Nationale Tensions Entre Le Rn Et Lfi Enjeux Et Strategies

May 30, 2025

L Assemblee Nationale Tensions Entre Le Rn Et Lfi Enjeux Et Strategies

May 30, 2025 -

Elections Assemblee Nationale Le Rn Tente De Destabiliser Lfi

May 30, 2025

Elections Assemblee Nationale Le Rn Tente De Destabiliser Lfi

May 30, 2025 -

Probleme De Rats Et Manque De Remplacements A L Ecole Bouton D Or Florange Appel A L Action

May 30, 2025

Probleme De Rats Et Manque De Remplacements A L Ecole Bouton D Or Florange Appel A L Action

May 30, 2025 -

Assemblee Nationale Frontieres Et Desordres La Strategie Du Rn Face A Lfi

May 30, 2025

Assemblee Nationale Frontieres Et Desordres La Strategie Du Rn Face A Lfi

May 30, 2025