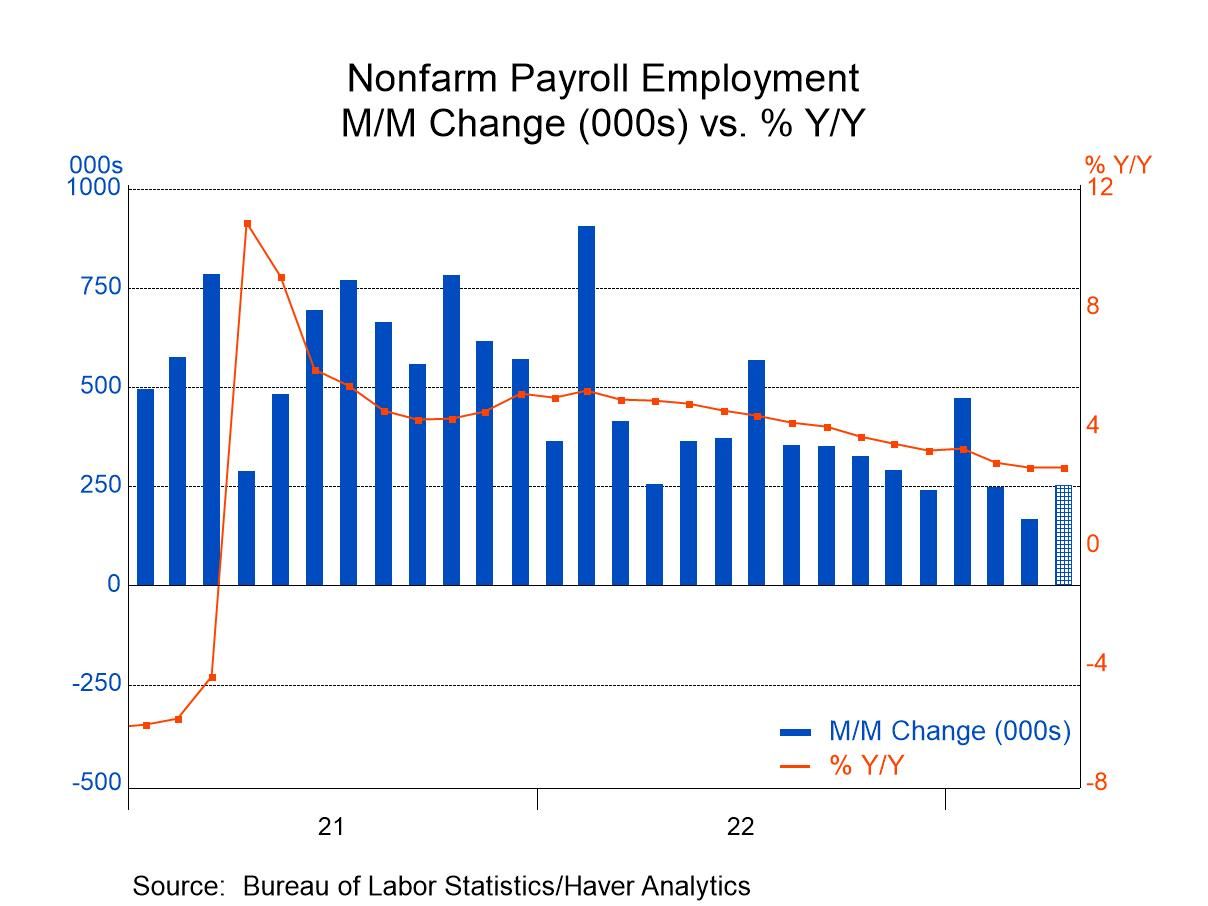

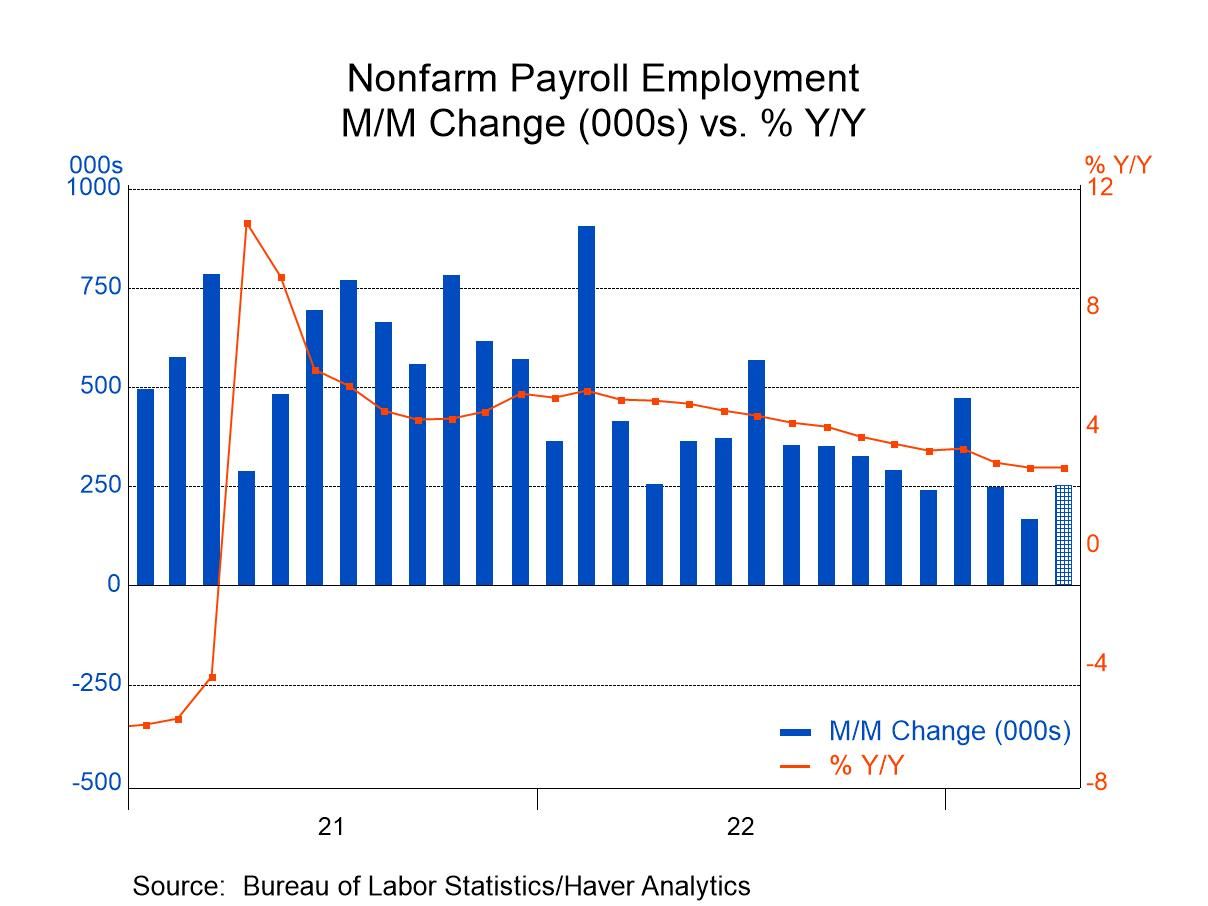

U.S. Economy Adds 177,000 Jobs In April; Unemployment Rate Remains At 4.2%

Table of Contents

Strong Job Growth Across Key Sectors

The April jobs report showcased robust job growth across several key sectors, contributing to the overall positive economic picture. Sectoral job growth provided a clearer understanding of where the new employment opportunities were concentrated. This data is crucial for policymakers and businesses alike, offering valuable insights into the evolving dynamics of the U.S. labor market.

- Leisure and Hospitality: This sector added 71,000 jobs, reflecting a continued recovery in the travel and tourism industry following the pandemic. This strong performance indicates increased consumer spending and confidence in the economy. This growth reflects the increased demand for travel and entertainment services. The sector is still recovering from pandemic related job losses, with opportunities abounding for those seeking employment.

- Professional and Business Services: This sector saw a significant boost, adding 60,000 jobs. This growth suggests increased business activity and investments, signaling a positive outlook for the overall economy. This is a key sector to watch, as growth here is usually correlated with overall economic health.

- Other notable sectors: While not as pronounced, growth was also seen in healthcare, education, and construction, albeit at a more modest pace. These additions contribute to the overall positive picture of employment in the U.S. economy. However, a deeper dive into the numbers is necessary to understand the nuances of growth in each sector.

These positive employment numbers paint a picture of a healthy and recovering labor market. However, the detailed breakdown of sectoral job growth offers a nuanced understanding of the current economic landscape. Analyzing these economic indicators helps us better gauge the overall health of the economy.

Unemployment Rate Holds Steady at 4.2% – What Does it Mean?

The unemployment rate remaining stable at 4.2% is a double-edged sword. While a low unemployment rate generally signals a healthy economy, it also raises concerns about potential labor shortages and inflationary pressures. Understanding the nuances of the unemployment rate requires analyzing several contributing factors.

- Labor Force Participation Rate: The labor force participation rate remained relatively stable, suggesting that a large portion of the population continues to seek employment. This is a good sign for a healthy labor market.

- Jobless Claims: Analyzing weekly jobless claims data provides a more real-time snapshot of the labor market's health. While jobless claims remain low, consistent monitoring is essential to identify any potential shifts.

- Underlying Economic Factors: The stability in the unemployment rate could also be a result of factors like skills mismatch, where available jobs don't match the skills of the unemployed, and geographic imbalances, where job opportunities are concentrated in specific areas.

Analyzing these factors provides a more complete picture of the labor market's health. While a low unemployment rate is positive, it’s crucial to understand the contributing factors to anticipate potential challenges. The stability of the unemployment rate should be interpreted alongside other economic indicators for a holistic view. The jobless claims data is particularly helpful for this.

Average Hourly Earnings and Wage Growth

Average hourly earnings saw a modest increase, indicating that wage growth is happening but may not be keeping pace with inflation. This is a critical aspect of the report, as it affects consumer spending and overall economic growth.

- Inflationary Pressures: The modest increase in average hourly earnings needs to be analyzed alongside the current inflation rate. If wage growth doesn't outpace inflation, it could limit consumer spending and potentially hinder economic growth.

- Purchasing Power: The real impact of wage growth is seen in the purchasing power of consumers. If inflation outpaces wage growth, the purchasing power of consumers decreases, potentially impacting economic activity.

Analyzing the relationship between wage growth and inflation is crucial for understanding the overall economic health. It's not just about nominal wage increases but the real impact on consumers' ability to purchase goods and services. Understanding this dynamic is crucial for policy decisions affecting consumer spending and economic growth.

Looking Ahead: Future Outlook for the U.S. Economy

Predicting the future of the U.S. economy is complex, but current trends suggest continued growth, albeit with potential challenges.

- GDP Growth: Economists anticipate moderate GDP growth for the remainder of the year, driven by consumer spending and business investments. However, the exact rate of growth depends on various factors, including inflation and global economic conditions.

- Inflation Outlook: Inflation remains a key concern, and the Federal Reserve's monetary policy will play a significant role in managing inflation expectations. The impact of the Fed's actions on employment and economic growth needs careful monitoring.

- Geopolitical Risks: Global geopolitical events and supply chain disruptions could also influence the U.S. economy, creating uncertainty and potentially impacting growth.

The future outlook for the U.S. economy hinges on effectively managing inflation, mitigating geopolitical risks, and fostering continued investment and consumer spending. The Federal Reserve's policy decisions will be critical in guiding the economy through potential challenges and maintaining sustainable growth. Monitoring these key factors will be crucial in accurately forecasting future economic performance.

Conclusion: Analyzing the April Jobs Report and its Impact on the U.S. Economy

The April jobs report paints a picture of a U.S. economy experiencing steady growth. While the 177,000 job additions are positive, the stable unemployment rate and moderate wage growth suggest a need for continued monitoring. Inflation and geopolitical factors remain key concerns impacting the future economic outlook. Understanding the nuances of the report requires analyzing various economic indicators, including sectoral job growth, unemployment rate, wage growth, and inflation.

Stay up-to-date on the latest US economic data and job market analysis by subscribing to our newsletter or following us on social media! Understanding these key economic reports and job market trends is vital for making informed financial and career decisions.

Featured Posts

-

How To Watch The Chicago Cubs Vs La Dodgers Game In Tokyo Online

May 05, 2025

How To Watch The Chicago Cubs Vs La Dodgers Game In Tokyo Online

May 05, 2025 -

Ford Remains Exclusive Automotive Partner For The Kentucky Derby

May 05, 2025

Ford Remains Exclusive Automotive Partner For The Kentucky Derby

May 05, 2025 -

Nhl Standings Crucial Friday Games And Playoff Scenarios

May 05, 2025

Nhl Standings Crucial Friday Games And Playoff Scenarios

May 05, 2025 -

Is Marvels Thunderbolts Team The Answer To Its Problems

May 05, 2025

Is Marvels Thunderbolts Team The Answer To Its Problems

May 05, 2025 -

Indy Car On Fox What To Expect From The New Broadcast Deal

May 05, 2025

Indy Car On Fox What To Expect From The New Broadcast Deal

May 05, 2025

Latest Posts

-

Oskar 2024 I Entasi Metaksy Emma Stooyn Kai Margkaret Koyalei

May 05, 2025

Oskar 2024 I Entasi Metaksy Emma Stooyn Kai Margkaret Koyalei

May 05, 2025 -

I Style

May 05, 2025

I Style

May 05, 2025 -

Emma Stooyn Kai Margkaret Koyalei Plakothikan Sta Oskar Analysi Vinteo

May 05, 2025

Emma Stooyn Kai Margkaret Koyalei Plakothikan Sta Oskar Analysi Vinteo

May 05, 2025 -

Emma Stones Unique Dress At Snls 50th Pictures And Reactions

May 05, 2025

Emma Stones Unique Dress At Snls 50th Pictures And Reactions

May 05, 2025 -

Snl 50th Anniversary Emma Stones Daring Fashion Choice

May 05, 2025

Snl 50th Anniversary Emma Stones Daring Fashion Choice

May 05, 2025