House Votes On Revised Trump Tax Bill: What You Need To Know

Table of Contents

Key Changes in the Revised Trump Tax Bill

The original Trump Tax Bill, enacted in 2017, significantly lowered corporate and individual income tax rates. Key provisions included a reduction in the top individual income tax rate and a decrease in the corporate tax rate from 35% to 21%. However, this initial bill faced criticism for its perceived benefits skewed towards higher-income earners and corporations.

The revised version aims to address some of these criticisms through several key changes:

- Increased Standard Deduction: The standard deduction has been increased, potentially benefiting lower and middle-income taxpayers. This change could simplify tax filings for many individuals.

- Changes to Itemized Deductions: Certain itemized deductions, such as those for state and local taxes (SALT), may have been modified or capped. This could impact taxpayers who previously relied heavily on itemized deductions.

- Modifications to Corporate Tax Rates: While the overall corporate tax rate remains low, specific provisions regarding deductions and credits for corporations might have been adjusted.

- Alterations to Individual Tax Brackets: The revised bill may include adjustments to individual tax brackets, potentially affecting the tax liability of individuals at different income levels.

The rationale behind these revisions often centers on addressing concerns raised by critics, improving the bill's projected economic impact, and achieving broader political support. For detailed information and official documentation, refer to the official website of the House Ways and Means Committee and reputable news sources like the New York Times, Wall Street Journal, and Reuters.

Potential Impacts of the Revised Tax Bill on Different Income Groups

The projected impact of the revised Trump Tax Bill varies significantly across different income brackets:

- Low-Income Households: The increased standard deduction might provide substantial tax relief for low-income families, potentially resulting in larger tax refunds or lower tax liabilities. However, changes to certain credits could offset some of these benefits.

- Middle-Income Households: The impact on middle-income families is complex. While the standard deduction increase might help, adjustments to itemized deductions could negatively affect some families.

- High-Income Households: High-income earners might see a smaller reduction in their tax burden compared to the initial Trump Tax Bill, due to potential changes in tax brackets and deductions. However, lower corporate taxes could still benefit those with significant investments in businesses.

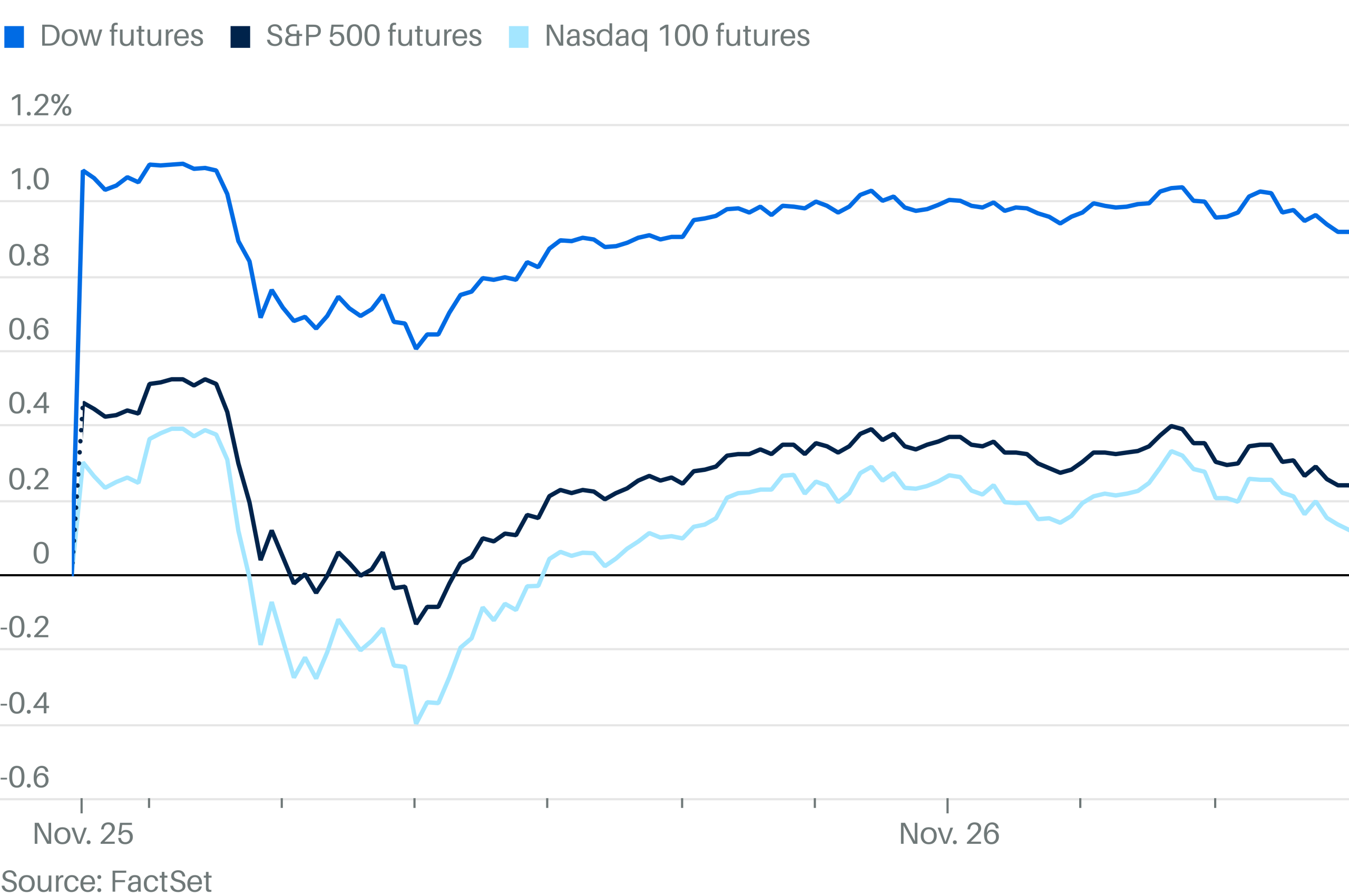

[Insert a chart or graph here visually representing the projected tax changes for different income brackets].

Beyond direct tax implications, indirect economic effects like job creation, inflation, and economic growth are anticipated, though the extent and direction remain subject to debate among economists.

Political Fallout and Future of the Revised Trump Tax Bill

The revised Trump Tax Bill has sparked considerable political debate. Support for the bill is likely to come primarily from Republicans, who championed the original tax cuts, while Democrats are expected to oppose it, citing concerns about its impact on income inequality and the national debt.

The bill's passage through the Senate remains uncertain. Even if it clears the House, it will need to overcome potential hurdles and amendments in the Senate before it can become law. Potential future challenges include overcoming filibusters, navigating differing opinions within the Senate, and potentially facing further revisions.

The long-term consequences of the bill's passage or failure will be significant, affecting everything from federal revenue and the national debt to economic growth and individual financial planning.

Understanding the Implications for Businesses

The revised Trump Tax Bill significantly impacts businesses through alterations to corporate tax rates and deductions. Lower corporate tax rates, while potentially boosting investment and hiring, could also exacerbate income inequality if not properly balanced with other social policies.

Concerns remain about the potential for tax loopholes to be exploited, leading to unintended consequences and favoring large corporations over smaller businesses. The overall effect on business investment, hiring practices, and economic growth remains a subject of ongoing analysis and debate.

Conclusion

The revised Trump Tax Bill represents a significant alteration to the US tax code, potentially impacting individuals and businesses across the income spectrum. While the increased standard deduction may benefit some, changes to itemized deductions and potential adjustments to tax brackets create complexities in assessing its overall impact. The political climate surrounding this vote is highly charged, and the bill's future remains uncertain.

Call to Action: Stay informed about the House vote on this crucial revised Trump Tax Bill and its ultimate impact on your finances. Continue researching the updated details and consult with a tax professional to understand how these changes might affect your personal tax situation. Keep up-to-date on further developments regarding the revised Trump Tax Bill by regularly checking reliable news sources and government websites.

Featured Posts

-

Nrw Harte Urteile Im Fall Der Manipulierten Uni Noten

May 24, 2025

Nrw Harte Urteile Im Fall Der Manipulierten Uni Noten

May 24, 2025 -

Latest Tariff Hike By Trump Causes 2 Drop In Amsterdam Stock Exchange

May 24, 2025

Latest Tariff Hike By Trump Causes 2 Drop In Amsterdam Stock Exchange

May 24, 2025 -

Svadebniy Bum Na Kharkovschine 600 Brakov Za Mesyats

May 24, 2025

Svadebniy Bum Na Kharkovschine 600 Brakov Za Mesyats

May 24, 2025 -

Jan 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News Explained

May 24, 2025

Jan 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News Explained

May 24, 2025 -

German Stock Market Closes In Negative Territory Dax Update

May 24, 2025

German Stock Market Closes In Negative Territory Dax Update

May 24, 2025

Latest Posts

-

Pobeda Aleksandrovoy Nad Samsonovoy V Pervom Kruge Turnira V Shtutgarte

May 24, 2025

Pobeda Aleksandrovoy Nad Samsonovoy V Pervom Kruge Turnira V Shtutgarte

May 24, 2025 -

Shtutgart Aleksandrova Oderzhala Pobedu Nad Samsonovoy V Pervom Kruge

May 24, 2025

Shtutgart Aleksandrova Oderzhala Pobedu Nad Samsonovoy V Pervom Kruge

May 24, 2025 -

Final Kubka Billi Dzhin King Kazakhstan Vozvraschaetsya

May 24, 2025

Final Kubka Billi Dzhin King Kazakhstan Vozvraschaetsya

May 24, 2025 -

Aleksandrova Proshla Samsonovu Na Turnire V Shtutgarte

May 24, 2025

Aleksandrova Proshla Samsonovu Na Turnire V Shtutgarte

May 24, 2025 -

Kubok Billi Dzhin King Kazakhstan Snova V Finale

May 24, 2025

Kubok Billi Dzhin King Kazakhstan Snova V Finale

May 24, 2025