House Passes Trump Tax Bill: Key Changes And Impact

Table of Contents

Keywords: Trump Tax Bill, Tax Reform, Tax Cuts and Jobs Act, Tax Changes, Tax Impact, individual tax rates, corporate tax rates, standard deduction, itemized deductions, estate tax

The passage of the Trump Tax Bill (officially known as the Tax Cuts and Jobs Act) significantly altered the US tax landscape. Understanding these changes is crucial for individuals and businesses alike, as they impact everything from individual income tax rates to corporate profitability and national debt. This article delves into the key provisions of the bill and analyzes their potential impact on American taxpayers.

Individual Tax Changes Under the Trump Tax Bill

The Trump Tax Bill brought about several notable changes affecting individual taxpayers. These alterations impacted tax brackets, deductions, and credits, significantly changing the tax burden for many Americans.

Lower Individual Income Tax Rates

The bill reduced individual income tax rates across the board. This meant taxpayers faced lower marginal tax rates, potentially leading to substantial savings, depending on their income level.

- Old Rates (example): A simplified example might show a range like 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

- New Rates (example): The new rates might be presented as 10%, 12%, 22%, 24%, 32%, 35%, and 37%. (Note: These are illustrative examples and may not reflect the exact rates from the actual legislation.)

The impact varied significantly based on income bracket. Higher-income earners generally benefited more from the lower rates in percentage terms, although the absolute dollar savings were often greater for those in higher tax brackets. Keywords: individual income tax rates, tax brackets, tax rate reduction, marginal tax rates

Increased Standard Deduction

The Trump Tax Bill substantially increased the standard deduction amounts. This meant more taxpayers could choose to take the standard deduction instead of itemizing, simplifying tax preparation for many.

- Single Filers: A significant increase compared to previous years.

- Married Filing Jointly: A substantial rise in the standard deduction for married couples.

- Head of Household: A notable increase for those filing as head of household.

This change disproportionately benefited lower- and middle-income taxpayers who previously itemized but now found the increased standard deduction more advantageous. Keywords: standard deduction, itemized deductions, tax deductions, filing status

Changes to Itemized Deductions

While the standard deduction increased, the bill also modified several itemized deductions. Some were limited, and others were eliminated entirely.

- State and Local Tax (SALT) Deduction: This deduction was significantly capped, impacting taxpayers in high-tax states.

- Other Itemized Deductions: Other deductions may have faced limitations or changes.

These changes primarily affected higher-income taxpayers and those residing in states with high state and local taxes. Keywords: itemized deductions, SALT deduction, state and local taxes, tax deductions, mortgage interest deduction

Child Tax Credit Expansion

The Child Tax Credit (CTC) also underwent expansion under the Trump Tax Bill. The credit amount increased, and eligibility requirements were altered.

- Increased Credit Amount: The maximum credit amount was raised.

- Expanded Eligibility: More families became eligible for the credit or received a larger credit.

This expansion provided significant tax relief to families with children. Keywords: child tax credit, child tax credit expansion, family tax benefits, tax credits for families

Corporate Tax Changes Under the Trump Tax Bill

The Trump Tax Bill significantly impacted corporate taxation, aiming to boost economic growth through reduced tax burdens on businesses.

Reduced Corporate Tax Rate

The most prominent corporate tax change was a substantial reduction in the corporate tax rate. This aimed to incentivize business investment and increase corporate profitability.

- Old Corporate Tax Rate: The pre-bill rate was considerably higher.

- New Corporate Tax Rate: The significantly reduced rate.

The impact of this reduction on corporate behavior and investment was a subject of much debate and analysis. Keywords: corporate tax rate, corporate tax reform, business tax cuts, corporate tax reduction

Pass-Through Business Taxation

The bill also addressed the taxation of pass-through entities, such as S corporations and partnerships. Changes were made to how these businesses were taxed, impacting small business owners.

- Deduction for Qualified Business Income (QBI): This new deduction aimed to provide tax relief for pass-through business owners.

- Impact on Small Business Owners: The effects varied depending on factors such as business income and structure.

This aspect of the bill aimed to stimulate small business activity and investment. Keywords: pass-through business, S corporation, partnership taxation, small business taxes

Long-Term Impact and Economic Consequences of the Trump Tax Bill

The long-term effects of the Trump Tax Bill remain a subject of ongoing discussion and analysis. The bill's economic consequences are complex and multifaceted.

Economic Growth Projections

Proponents argued the tax cuts would stimulate economic growth through increased investment and consumer spending. Critics, however, raised concerns about potential inflationary pressures and the long-term sustainability of the tax cuts given their impact on the national debt. Keywords: economic impact, national debt, fiscal policy, income inequality, economic growth

National Debt Implications

The significant tax cuts naturally led to concerns about their impact on the national debt. The reduced tax revenue needed to be weighed against the potential economic benefits of increased growth.

Income Inequality

Another area of debate centered on the bill’s potential to affect income inequality. While some argued the tax cuts would broadly benefit the economy, others expressed concern that they would disproportionately benefit higher-income earners, potentially exacerbating existing inequalities.

Conclusion

The Trump Tax Bill brought about substantial changes to both individual and corporate taxation. Understanding these alterations is critical for effective financial planning. From changes in individual income tax rates and the standard deduction to modifications in corporate tax rates and pass-through business taxation, the bill's impact is far-reaching and continues to be evaluated. To fully grasp how these Trump Tax Bill changes affect your specific circumstances, seek professional tax advice. Learn more about the Trump Tax Bill changes and their implications for your financial future today.

Featured Posts

-

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Isplecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

Ae Xplore England Airpark And Alexandria International Airports New Global Travel Initiative

May 24, 2025

Ae Xplore England Airpark And Alexandria International Airports New Global Travel Initiative

May 24, 2025 -

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 24, 2025 -

Londons Odd Burger Vegan Food Arrives At 7 Eleven Locations Across Canada

May 24, 2025

Londons Odd Burger Vegan Food Arrives At 7 Eleven Locations Across Canada

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Latest Posts

-

Memorial Day Weekend Gas Prices Decades Low Expectations

May 24, 2025

Memorial Day Weekend Gas Prices Decades Low Expectations

May 24, 2025 -

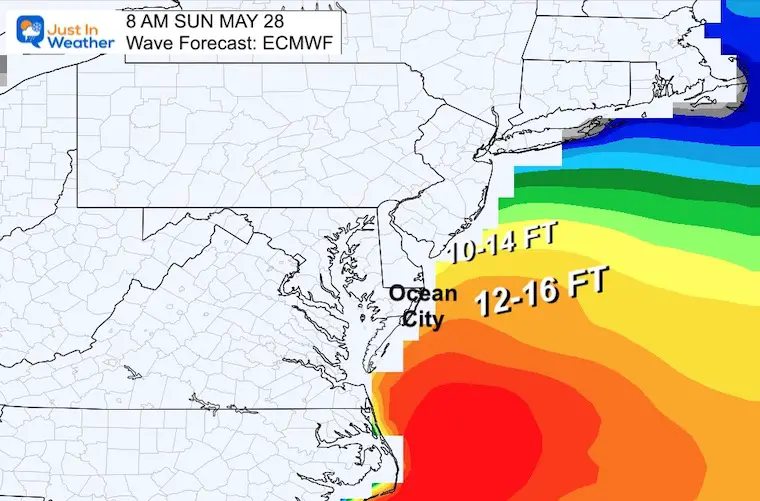

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025 -

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025