HMRC Payslip Check: Millions Eligible For Refunds – Claim Yours

Table of Contents

This article will guide you through the process of examining your payslips to identify any errors that might have led to underpayment, and we'll show you exactly how to claim your HMRC tax refund. An HMRC payslip check is a crucial step in ensuring your tax calculations are accurate and that you receive all the tax relief you're entitled to.

Understanding Your Payslip and Tax Codes

Understanding your payslip is the first step towards identifying potential tax underpayments. Your payslip contains crucial information, including your tax code, National Insurance contributions, gross pay (your earnings before deductions), and net pay (your earnings after deductions). Familiarizing yourself with these elements is essential for conducting an effective HMRC payslip check.

Common payslip errors that can lead to underpayment include:

- Incorrect tax code allocation: An incorrect tax code can significantly impact your tax deductions, leading to overpayment of tax. The HMRC website provides a tool to check your tax code's accuracy.

- Errors in calculating tax deductions: Mistakes in calculating your income tax can result in underpayment or overpayment. A simple discrepancy can add up over time.

- Overpayment of National Insurance: Errors in calculating National Insurance contributions can also lead to overpayment. Regularly checking this figure is important.

- Missing tax relief entitlements: You might be entitled to tax relief that isn't being applied correctly. This could be due to factors like marriage allowance or charitable donations.

For more detailed information on tax codes and payslips, refer to the official HMRC guidance: [Insert link to relevant HMRC guidance here].

How to Conduct an Effective HMRC Payslip Check

A thorough HMRC payslip check involves a systematic review of your payslips for discrepancies. Here’s a step-by-step guide:

- Compare your payslip with previous payslips: Look for inconsistencies in tax deductions, National Insurance contributions, or gross/net pay. Any significant variations warrant further investigation.

- Check your tax code against the HMRC website: Use the HMRC website's online tool to verify the accuracy of your tax code and ensure it matches your personal circumstances.

- Review your P60 for yearly tax summaries: Your P60 provides a summary of your annual tax deductions. Comparing your P60 with your payslips can highlight any discrepancies.

- Calculate your tax liability manually: For a more in-depth check, use a payslip calculator or spreadsheet to manually calculate your expected tax deductions based on your income and tax code. This provides a more thorough comparison.

Remember to keep all your payslips in a safe and organized manner. This is crucial for any future HMRC tax refund claims.

Claiming Your HMRC Tax Refund: A Step-by-Step Guide

Once you've identified a potential underpayment, claiming your HMRC tax refund is relatively straightforward. Here’s how:

- Gather necessary documentation: Collect all relevant payslips, P60s, and any other supporting documentation that proves your underpayment.

- Complete the relevant HMRC forms accurately: Ensure all information is accurate and complete to avoid delays. Double-check all figures.

- Submit your claim online or via post: Submitting your claim online is generally faster and more convenient. However, you can still submit your claim via post if needed. The HMRC website details the advantages and disadvantages of both methods.

- Understand the timeframe for receiving a refund: HMRC usually processes claims within several weeks, but processing times can vary.

If your claim is rejected, carefully review the rejection reason and consider seeking professional advice to understand the next steps.

Seeking Professional Help with Your HMRC Payslip Check

While conducting your own HMRC payslip check is often possible, seeking professional assistance might be beneficial in certain circumstances:

- Complex tax situations involving multiple income sources: If you have multiple income streams, it can be challenging to accurately calculate your tax liability. A tax advisor can help navigate complex tax situations.

- Difficulty understanding HMRC guidelines: HMRC guidelines can be complex. Professional help ensures you understand your rights and obligations.

- Need for help with preparing and submitting claims: An accountant can prepare and submit your claim, saving you time and effort.

- Concerns about making accurate calculations: If you are unsure about your calculations, it's better to seek professional help to ensure accuracy.

You can find qualified tax professionals through various online directories and professional bodies. [Insert link to resources for finding qualified tax professionals here].

Secure Your HMRC Tax Refund Today

Conducting an HMRC payslip check is a crucial step in ensuring you receive all the tax relief you're entitled to. By carefully reviewing your payslips and following the steps outlined above, you can identify potential underpayments and claim your rightful HMRC tax refund. Millions are claiming their HMRC refunds – could you be next? Don't miss out on your potential tax refund! Start your HMRC payslip check now! Check your payslips today and claim what's rightfully yours!

For further information and resources, visit the HMRC website: [Insert link to HMRC website here]

Featured Posts

-

Le Bo Cafe De Biarritz Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025

Le Bo Cafe De Biarritz Une Nouvelle Page S Ecrit Avec Des Gerants Experimentes

May 20, 2025 -

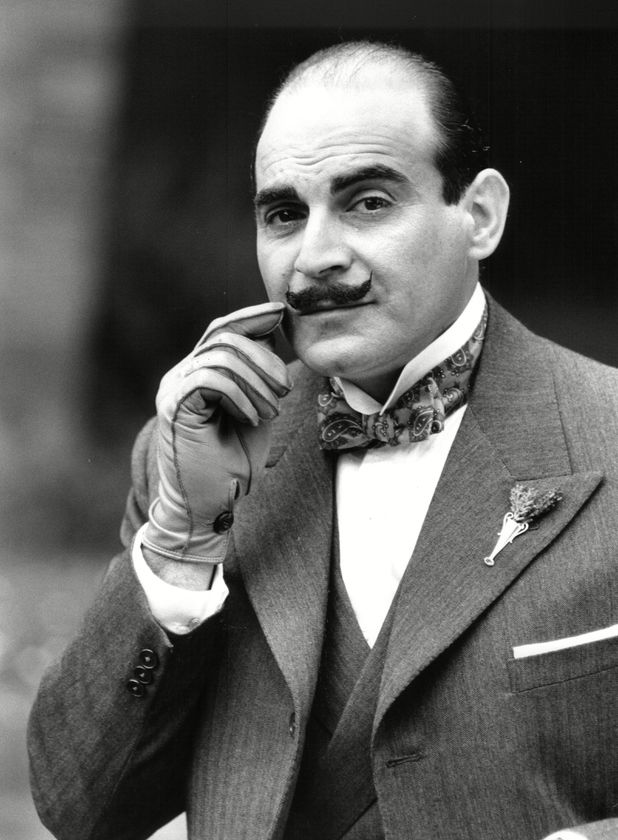

Agatha Christies Poirot Adaptations And Legacy

May 20, 2025

Agatha Christies Poirot Adaptations And Legacy

May 20, 2025 -

Pro D2 Resultats Et Analyse Des Matchs Colomiers Oyonnax Et Montauban Brive

May 20, 2025

Pro D2 Resultats Et Analyse Des Matchs Colomiers Oyonnax Et Montauban Brive

May 20, 2025 -

Second Child For Jennifer Lawrence And Husband Cooke Maroney

May 20, 2025

Second Child For Jennifer Lawrence And Husband Cooke Maroney

May 20, 2025 -

The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025

The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025

Latest Posts

-

Palisades Fires Which Celebrities Lost Their Homes

May 20, 2025

Palisades Fires Which Celebrities Lost Their Homes

May 20, 2025 -

Dubai Holding Increases Reit Ipo Size To 584 Million

May 20, 2025

Dubai Holding Increases Reit Ipo Size To 584 Million

May 20, 2025 -

545 Million Economic Zone Investment Maybanks Role

May 20, 2025

545 Million Economic Zone Investment Maybanks Role

May 20, 2025 -

Maybanks 545 Million Economic Zone Investment Boost

May 20, 2025

Maybanks 545 Million Economic Zone Investment Boost

May 20, 2025 -

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025

Iznenadenje Jennifer Lawrence Ponovno Mama

May 20, 2025