HMRC Letters To High Earners: What You Need To Know

Table of Contents

Types of HMRC Letters High Earners Might Receive

High-income individuals may receive various types of correspondence from HMRC. Understanding the nature of the letter is the first step in formulating an effective response. Here are some examples of the types of HMRC letters you might receive:

-

Tax assessments (including estimated assessments): These letters inform you of the tax you owe based on your self-assessment tax return or HMRC's estimate of your income. Discrepancies often lead to further investigation. Understanding high-income tax calculations is crucial.

-

Enquiries into self-assessment tax returns: If HMRC identifies inconsistencies or potential errors in your self-assessment, they may contact you for further information. This can involve requests for supporting documentation or clarification on specific entries. Accurate record-keeping is vital for self-assessment compliance.

-

Information requests regarding offshore income or assets: HMRC is increasingly focused on detecting undeclared offshore income and assets. Letters in this category request details of any income or assets held outside the UK. Transparency regarding offshore finances is essential for HMRC compliance.

-

Letters concerning potential tax avoidance or evasion: These letters are more serious and indicate that HMRC suspects you may be engaging in tax avoidance or evasion schemes. This can lead to a full-scale tax investigation, potentially resulting in significant penalties.

-

Letters requesting further information or clarification: These letters usually request additional information to clarify aspects of your tax return or financial situation. Promptly providing the necessary details prevents delays and potential penalties. This also demonstrates good HMRC compliance.

Understanding Your Responsibilities When Receiving an HMRC Letter

Responding promptly and appropriately to HMRC correspondence is paramount. Failure to do so can result in penalties and interest charges being applied to any outstanding tax. The consequences of ignoring HMRC letters can be severe, impacting your credit rating and potentially leading to legal action.

When you receive an HMRC letter, you should:

-

Carefully read the letter and understand its content: Identify the specific request and the deadline for response. Don't hesitate to seek clarification if needed.

-

Gather all relevant documentation and information: This might include bank statements, payslips, invoices, and any other supporting documents related to the issue raised.

-

Respond within the specified timeframe: Adherence to deadlines demonstrates cooperation and minimizes the risk of penalties.

-

Seek professional tax advice if needed: Don't hesitate to consult a qualified tax advisor if you are unsure how to respond or if the matter is complex. Professional guidance ensures proper response and avoids HMRC penalties.

Seeking Professional Tax Advice

For high earners, the complexities of tax legislation can be daunting. Engaging a qualified accountant or tax advisor offers several crucial benefits:

-

Navigating complex tax issues: Professionals can help you understand HMRC's requests and ensure accurate and timely responses.

-

Reducing the risk of penalties: Expert advice helps prevent mistakes that might lead to penalties and interest.

-

Proactive tax planning: A tax advisor can assist with strategic tax planning to minimize your tax liability legally. This includes high net worth individual strategies for tax optimization.

-

Maintaining accurate records: Professional guidance ensures your financial records are meticulously maintained, simplifying future tax returns and complying with HMRC's requirements.

Common Mistakes to Avoid When Dealing with HMRC Letters

Several common mistakes can exacerbate the situation when dealing with HMRC correspondence. Avoid these pitfalls:

-

Ignoring or delaying responses: This is a critical error that can lead to significant penalties.

-

Providing inaccurate or incomplete information: This can lead to further investigation and potentially more severe penalties.

-

Failing to keep proper records: Maintaining meticulous financial records is crucial for responding to HMRC inquiries effectively.

-

Not seeking professional help when needed: Trying to handle complex tax issues alone can lead to costly errors.

Conclusion

Receiving an HMRC letter can be stressful, but understanding your responsibilities and responding appropriately is essential. Ignoring HMRC correspondence or making mistakes in your response can result in significant financial penalties and legal repercussions. Seeking professional tax advice, particularly for high earners, is strongly recommended. Whether you've received an HMRC letter or want to proactively manage your tax affairs, consulting a qualified tax advisor provides peace of mind in navigating the complexities of "HMRC Letters to High Earners." Contact a qualified tax advisor today for assistance with any questions or concerns regarding your tax obligations.

Featured Posts

-

L Integrale Agatha Christie Une Vie D Aventures Et De Mysteres

May 20, 2025

L Integrale Agatha Christie Une Vie D Aventures Et De Mysteres

May 20, 2025 -

The Mysteries Of Agatha Christies Poirot A Critical Analysis

May 20, 2025

The Mysteries Of Agatha Christies Poirot A Critical Analysis

May 20, 2025 -

Hmrc Payslip Check Millions Eligible For Refunds Claim Yours

May 20, 2025

Hmrc Payslip Check Millions Eligible For Refunds Claim Yours

May 20, 2025 -

Biarritz Ou Manger En 2024 Nouveaux Restaurants Et Chefs A Decouvrir

May 20, 2025

Biarritz Ou Manger En 2024 Nouveaux Restaurants Et Chefs A Decouvrir

May 20, 2025 -

Analyzing Michael Schumachers Comeback A Failure To Heed Red Bulls Counsel

May 20, 2025

Analyzing Michael Schumachers Comeback A Failure To Heed Red Bulls Counsel

May 20, 2025

Latest Posts

-

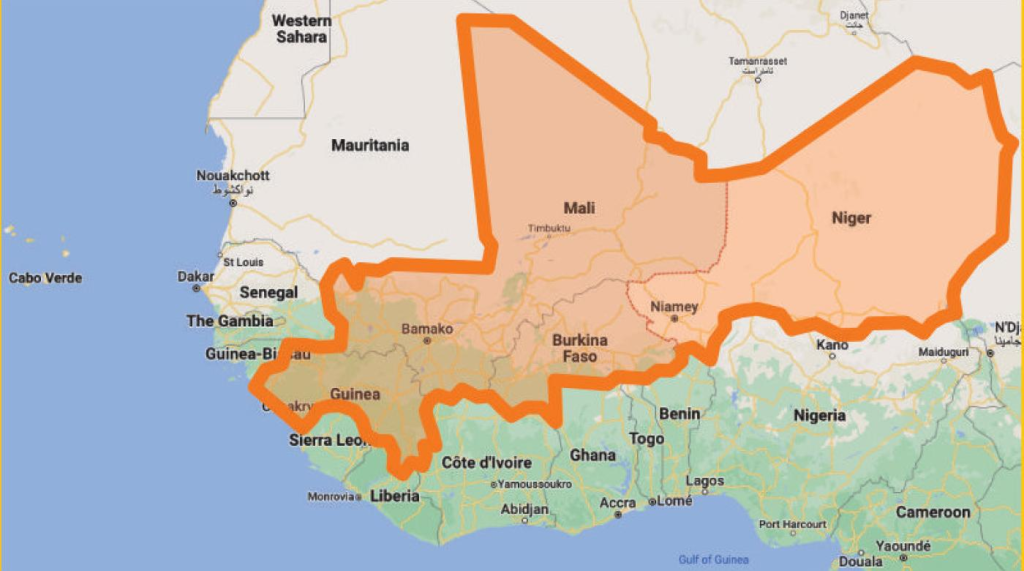

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025

Niger Retreat Ecowas Economic Affairs Department Defines Strategic Priorities

May 20, 2025 -

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025

Ecowas Charts Course For Economic Development At Niger Retreat

May 20, 2025 -

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025

Eurovision 2025 Finalists Ranked From Hypnotic To Horrible

May 20, 2025 -

The Eurovision Song Contest 2025 Definitive Ranking Of Finalists

May 20, 2025

The Eurovision Song Contest 2025 Definitive Ranking Of Finalists

May 20, 2025 -

Philippine Typhon Missile Deployment Weighing The Pros And Cons

May 20, 2025

Philippine Typhon Missile Deployment Weighing The Pros And Cons

May 20, 2025