GOP Plan To Restructure Student Loans: Pell Grants, Repayment, And Key Changes

Table of Contents

Proposed Changes to Pell Grants

The GOP student loan plan likely includes modifications to the Pell Grant program, a cornerstone of federal student aid for low-income students. These changes could affect Pell Grant eligibility, funding amounts, and overall accessibility. The keywords surrounding this section are crucial for anyone searching for information on Pell Grant reform and the GOP's stance.

- Changes to Eligibility Criteria: The GOP plan might adjust income thresholds, GPA requirements, or even the types of institutions eligible for Pell Grant funding. For example, there might be stricter income limits, potentially excluding some families who currently qualify. This could drastically reduce the number of students receiving this vital aid.

- Increase or Decrease in Grant Amounts: The proposed plan might alter the maximum Pell Grant award amount, either increasing or decreasing the financial assistance provided. A reduction could severely limit a student's ability to cover tuition, fees, and living expenses.

- Impact on Low-Income Students and Minority Groups: Any changes to Pell Grant eligibility or funding levels will disproportionately impact low-income students and minority groups, who often rely heavily on Pell Grants to afford college.

- Potential for Increased Competition for Pell Grants: If eligibility requirements become stricter or funding is reduced, competition for the limited Pell Grants available will intensify, potentially leaving many deserving students without the necessary financial support.

Repayment Plan Modifications

The heart of the GOP student loan plan likely involves modifications to existing student loan repayment plans. This section focuses on keywords related to student loan repayment plans, income-driven repayment (IDR), and student loan forgiveness. The details of these proposed alterations are critical for current borrowers.

- Changes to Existing IDR Plans (PAYE, REPAYE, IBR): The GOP might propose alterations to existing income-driven repayment (IDR) plans, such as PAYE, REPAYE, and IBR. These changes could affect the calculation of monthly payments, the loan forgiveness timeline, or even the eligibility criteria for these plans. Borrowers currently relying on these plans need to carefully follow the proposed changes.

- Introduction of New Repayment Plans: The plan might introduce entirely new repayment structures, potentially offering different payment options based on factors like income, loan amount, or career field. This could benefit some borrowers but potentially disadvantage others.

- Impact on Loan Forgiveness Programs: The GOP's stance on student loan forgiveness is crucial. The plan might significantly curtail or even eliminate existing loan forgiveness programs, leading to substantial increases in the total debt repayment burden for borrowers.

- Potential Increase or Decrease in Monthly Payments for Borrowers: Depending on the specific changes, borrowers might experience higher or lower monthly payments under the new repayment plans. This could impact their financial stability and long-term budgeting.

Focus on Market-Based Solutions

A key aspect of the GOP approach might involve a shift towards market-based solutions for student loans. This includes exploring the role of private student loans and alternative financing options.

- Increased Role of Private Lenders: The plan might encourage increased participation from private lenders, potentially offering a wider range of loan products but also potentially leading to higher interest rates and less borrower protection.

- Potential for Higher Interest Rates: A greater reliance on private lenders could translate to higher interest rates for borrowers, increasing the overall cost of their education.

- Accessibility for Borrowers with Varying Credit Scores: The availability of private loans might vary depending on a borrower's credit score, potentially excluding those with limited or poor credit history from accessing needed funds.

- Impact on Overall Student Loan Debt: The shift towards market-based solutions could have a profound impact on the overall level of student loan debt, potentially leading to either a reduction or an increase, depending on the specific mechanisms implemented.

Overall Impact and Potential Consequences of the GOP Student Loan Plan

The GOP student loan plan will have far-reaching consequences across multiple sectors. This section focuses on the keywords related to the broader economic and societal impact of student loan debt and the proposed GOP plan.

- Projected Changes in Total Student Loan Debt: The plan's impact on the total amount of student loan debt is a critical factor. Will it reduce the overall debt burden, or will it exacerbate the existing crisis?

- Impact on College Enrollment Rates: The affordability of higher education is directly linked to student loan accessibility. Changes to Pell Grants and repayment plans could significantly influence college enrollment rates.

- Effect on the Affordability of Higher Education: The plan will directly influence whether higher education remains accessible and affordable for future generations.

- Potential Implications for Economic Growth: The burden of student loan debt has broader economic implications. The GOP plan's effect on this debt could impact consumer spending, economic growth, and overall economic stability.

Conclusion

The GOP's proposed student loan restructuring plan promises significant changes to Pell Grants, repayment options, and the overall landscape of student loan debt. Understanding these changes is vital for both current and prospective borrowers. The potential impact on Pell Grant eligibility, repayment plans, and the increased reliance on market-based solutions could profoundly alter the accessibility and affordability of higher education. Stay informed about the latest updates on the GOP student loan plan and how it will impact your student loan repayment. Learn more about potential changes to Pell Grants and other crucial aspects of the proposed student loan restructuring by researching relevant government websites and advocacy groups. The future of student loan debt, and higher education itself, may depend on the details of this plan.

Featured Posts

-

Reduce Student Loan Burden A Financial Planners Guide

May 17, 2025

Reduce Student Loan Burden A Financial Planners Guide

May 17, 2025 -

Rockwell Automation Angi And Borg Warner Among Top Performers Market Update

May 17, 2025

Rockwell Automation Angi And Borg Warner Among Top Performers Market Update

May 17, 2025 -

Review Of The Leading Bitcoin And Crypto Casinos For 2025

May 17, 2025

Review Of The Leading Bitcoin And Crypto Casinos For 2025

May 17, 2025 -

Is Refinancing Federal Student Loans With A Private Lender Right For You

May 17, 2025

Is Refinancing Federal Student Loans With A Private Lender Right For You

May 17, 2025 -

The Rise Of Modular Homes A Potential Solution To Canadas Housing Crisis

May 17, 2025

The Rise Of Modular Homes A Potential Solution To Canadas Housing Crisis

May 17, 2025

Latest Posts

-

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trump Family Tree Update Tiffany And Michaels Son Alexander

May 17, 2025 -

Tesla Berlin Prosvjed I Optuzbe Za Prijetnju Okolisu

May 17, 2025

Tesla Berlin Prosvjed I Optuzbe Za Prijetnju Okolisu

May 17, 2025 -

Prosvjednici U Teslinom Izlozbenom Prostoru U Berlinu Prijetnja Planetu

May 17, 2025

Prosvjednici U Teslinom Izlozbenom Prostoru U Berlinu Prijetnja Planetu

May 17, 2025 -

Donald Trumps Family Tree Welcoming Alexander Tiffany And Michaels First Child

May 17, 2025

Donald Trumps Family Tree Welcoming Alexander Tiffany And Michaels First Child

May 17, 2025 -

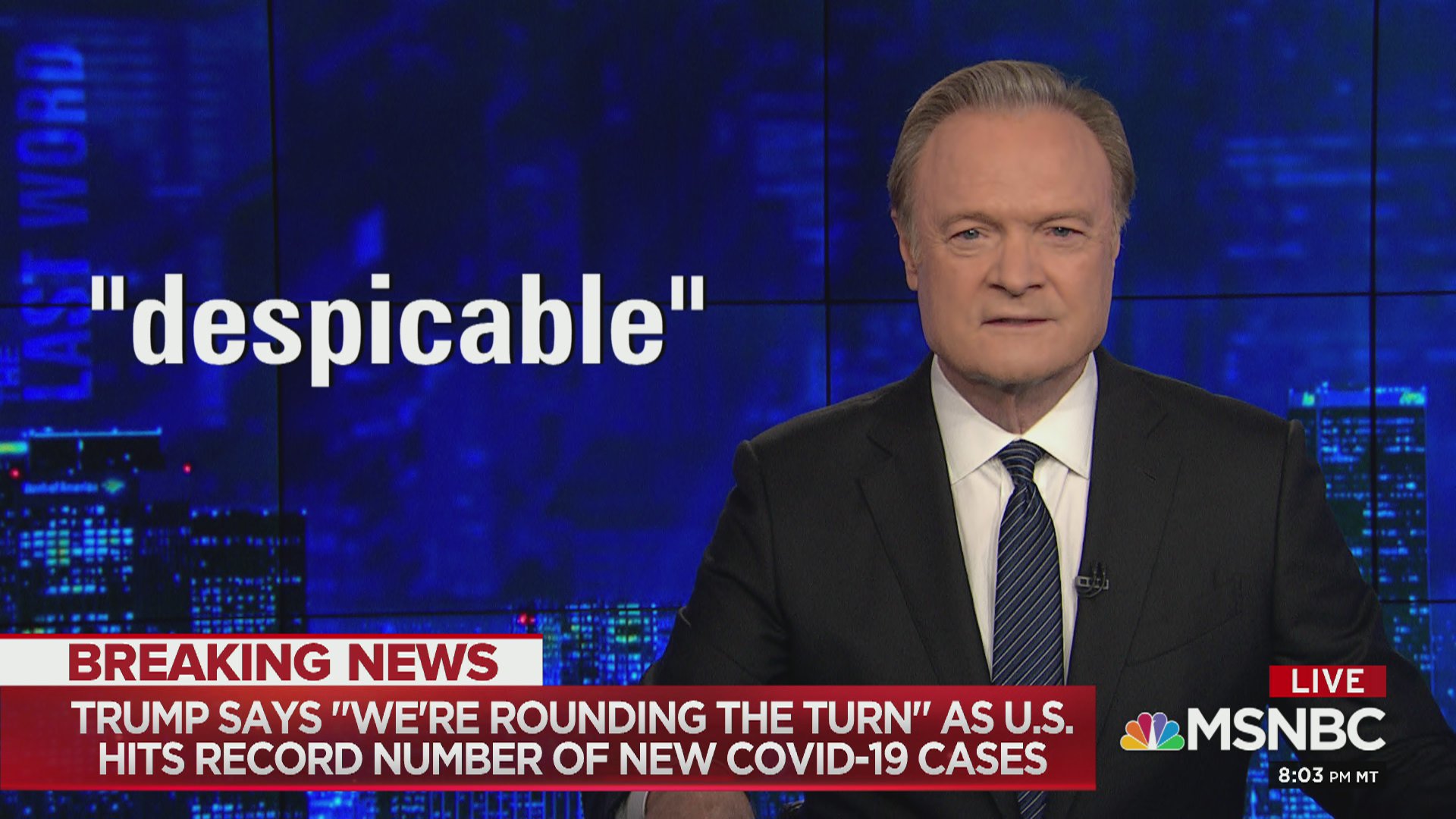

Witness Trumps Public Humiliation A Lawrence O Donnell Moment

May 17, 2025

Witness Trumps Public Humiliation A Lawrence O Donnell Moment

May 17, 2025