Reduce Student Loan Burden: A Financial Planner's Guide

Table of Contents

Understanding Your Student Loan Debt

Before you can effectively reduce your student loan burden, you need a clear understanding of your current financial landscape. This involves identifying your loan types, calculating your total debt and interest accrual, and assessing your overall financial situation.

Identifying Loan Types (Federal vs. Private)

Understanding the difference between federal and private student loans is crucial for developing an effective repayment strategy. Federal loans often offer more flexible repayment options and potential forgiveness programs, unlike private loans.

- Federal Loan Programs:

- Stafford Loans (subsidized and unsubsidized)

- Perkins Loans

- PLUS Loans (for parents and graduate students)

- Private Loans: These loans are offered by banks, credit unions, and other private lenders. They typically have less stringent eligibility requirements but may come with higher interest rates and fewer repayment options.

Interest rates, repayment periods, and the availability of forgiveness programs (like Public Service Loan Forgiveness) vary significantly between federal and private loans. Thoroughly reviewing your loan documents is crucial for understanding the specifics of your repayment terms.

Calculating Your Total Debt and Interest Accrual

Accurately calculating your total student loan debt and projecting future interest accumulation is vital for effective financial planning. Failing to account for the compounding effect of interest can lead to significantly underestimated total repayment costs.

- Resources for Calculating Loan Interest: Many online calculators and loan repayment trackers can help you project your total interest payments over time. Your loan servicer's website should also provide this information.

Understanding the compounding effect of interest means recognizing that interest accrues not only on your principal balance but also on the accumulated interest itself. This exponential growth can dramatically increase your total repayment amount over time, highlighting the urgency of developing a robust repayment strategy to reduce your student loan burden.

Assessing Your Current Financial Situation

Creating a realistic personal budget is paramount to managing your student loan repayment effectively. This allows you to prioritize loan repayment alongside other essential expenses.

- Budgeting Apps and Methods:

- Mint

- YNAB (You Need A Budget)

- EveryDollar

- 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment)

By carefully tracking your income and expenses, you can identify areas where you can cut back and allocate more funds toward your student loan payments. This disciplined approach is essential for reducing your student loan burden and achieving financial stability.

Strategies to Reduce Your Student Loan Burden

Several strategies can help you manage and reduce your student loan debt more effectively.

Income-Driven Repayment Plans (IDRs)

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans can significantly lower your monthly payments, making them more manageable.

- Various IDR Plans:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

While IDRs offer lower monthly payments, they often extend your repayment period, potentially leading to higher total interest paid over the life of the loan. Carefully weigh the pros and cons of each plan based on your individual circumstances. Some plans even offer loan forgiveness after a specified number of qualifying payments.

Loan Refinancing

Refinancing your student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate.

- Factors to Consider When Refinancing:

- Interest rates

- Fees

- Eligibility requirements

- Loan terms

Refinancing can potentially lower your monthly payments or shorten your repayment period, helping you reduce your student loan burden faster. However, it's crucial to compare offers from multiple lenders and carefully consider the terms before refinancing.

Debt Consolidation

Consolidating multiple student loans into a single loan can simplify your repayment process.

- Advantages of Consolidation:

- Simplified payment process

- Potential for a lower interest rate (though not guaranteed)

- Disadvantages of Consolidation:

- May extend the repayment period

- May lose benefits associated with specific federal loan programs

Carefully evaluate the potential impact on your interest rate and repayment terms before consolidating your loans.

Negotiating with Lenders

Don't underestimate the power of negotiation! You can sometimes negotiate lower interest rates or more favorable repayment terms with your lenders.

- Tips for Effective Communication:

- Be polite and professional.

- Clearly explain your financial situation.

- Present a well-reasoned case for a reduced interest rate or modified repayment plan.

Building a strong case and demonstrating your commitment to repayment can significantly increase your chances of a successful negotiation.

Seeking Professional Help

Navigating the complexities of student loan debt can be challenging. Seeking professional assistance can provide valuable support and guidance.

Consulting a Financial Advisor

A financial advisor can create a personalized repayment plan tailored to your specific circumstances, helping you develop a comprehensive strategy to reduce your student loan burden.

- Questions to Ask a Financial Advisor:

- What repayment strategies are best suited for my situation?

- How can I best manage my budget to prioritize loan repayment?

- What are the long-term financial implications of my current debt load?

A financial advisor can provide valuable insights and support in managing your student loan debt effectively.

Utilizing Government Resources

Numerous government resources offer assistance with student loan repayment.

- Relevant Websites and Hotlines:

- StudentAid.gov (US Department of Education)

- National Foundation for Credit Counseling (NFCC)

These resources provide information on various repayment options, financial aid, and debt management strategies.

Conclusion: Take Control of Your Student Loan Burden

Reducing your student loan burden requires a proactive and strategic approach. By understanding your loan types, calculating your total debt, assessing your financial situation, and exploring repayment strategies like IDRs, refinancing, consolidation, and negotiation, you can take significant steps towards financial freedom. Don't hesitate to seek professional help from a financial advisor or utilize available government resources. Remember, managing student loan debt effectively is a journey, and with the right plan and support, you can successfully navigate this challenge and achieve your financial goals. Don't let student loan debt define your future. Start reducing your student loan burden today by exploring the strategies outlined in this guide and seeking professional financial advice. Take control of your finances and build a brighter financial future! Start managing your student loan debt effectively now and secure a more prosperous tomorrow.

Featured Posts

-

Nba Playoffs Pistons Frustration Mounts After Game 4 Foul Call

May 17, 2025

Nba Playoffs Pistons Frustration Mounts After Game 4 Foul Call

May 17, 2025 -

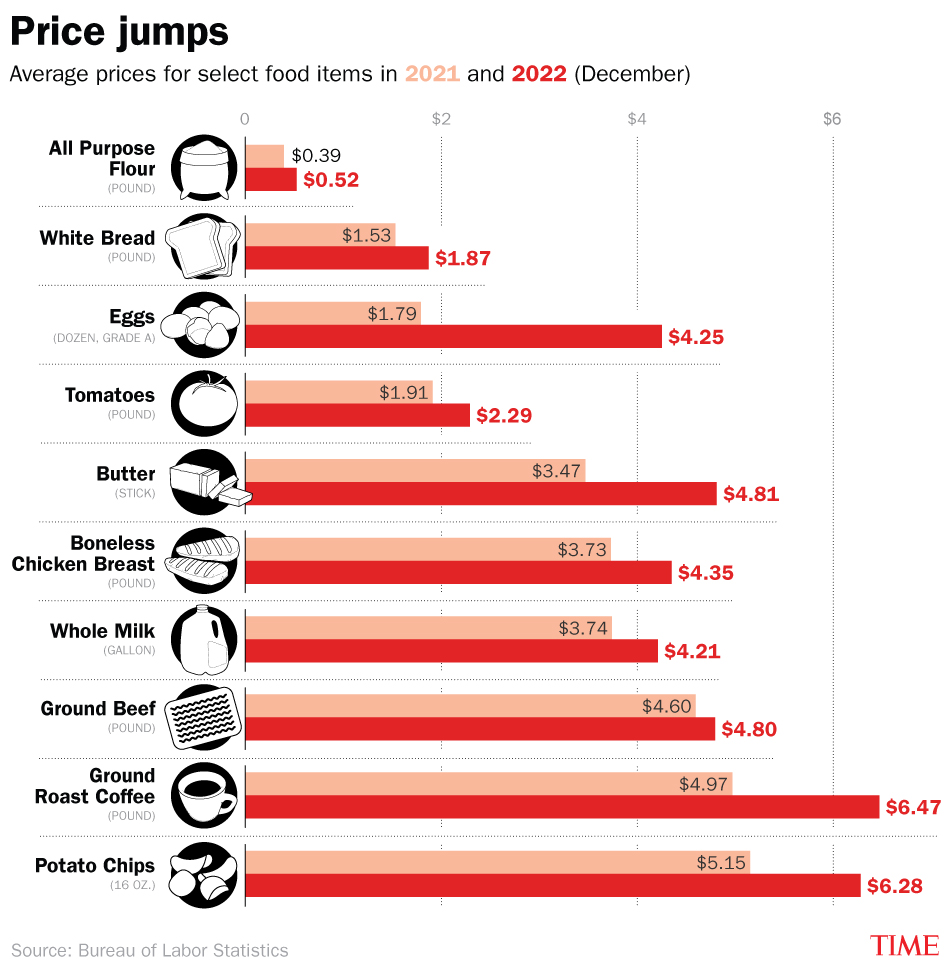

The Impact Of Trumps Policies Rep Crockett Highlights Rising Grocery Costs And Reduced Pay

May 17, 2025

The Impact Of Trumps Policies Rep Crockett Highlights Rising Grocery Costs And Reduced Pay

May 17, 2025 -

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025

Top Bitcoin And Crypto Casinos For 2025 A Comprehensive Review

May 17, 2025 -

Stem Scholarships Awarded To Local Students A Comprehensive Guide

May 17, 2025

Stem Scholarships Awarded To Local Students A Comprehensive Guide

May 17, 2025 -

Tokyo Real Estate Soundproof Apartments And Quiet Salons For Peaceful Living

May 17, 2025

Tokyo Real Estate Soundproof Apartments And Quiet Salons For Peaceful Living

May 17, 2025

Latest Posts

-

Olimpia Golea A Penarol 2 0 Resumen Del Encuentro

May 17, 2025

Olimpia Golea A Penarol 2 0 Resumen Del Encuentro

May 17, 2025 -

Bahia Vence Al Paysandu 1 0 Cronica Goles Y Resumen Del Encuentro

May 17, 2025

Bahia Vence Al Paysandu 1 0 Cronica Goles Y Resumen Del Encuentro

May 17, 2025 -

Wnba Draft Kaitlyn Chen Makes History As First Taiwanese American

May 17, 2025

Wnba Draft Kaitlyn Chen Makes History As First Taiwanese American

May 17, 2025 -

Venezia Vs Napoles Partido En Vivo

May 17, 2025

Venezia Vs Napoles Partido En Vivo

May 17, 2025 -

Sigue El Partido Roma Monza En Vivo

May 17, 2025

Sigue El Partido Roma Monza En Vivo

May 17, 2025