Google Ad Tech Monopoly: US Demands Forced Asset Sale

Table of Contents

The Allegations of Antitrust Violations by Google's Ad Tech Dominance

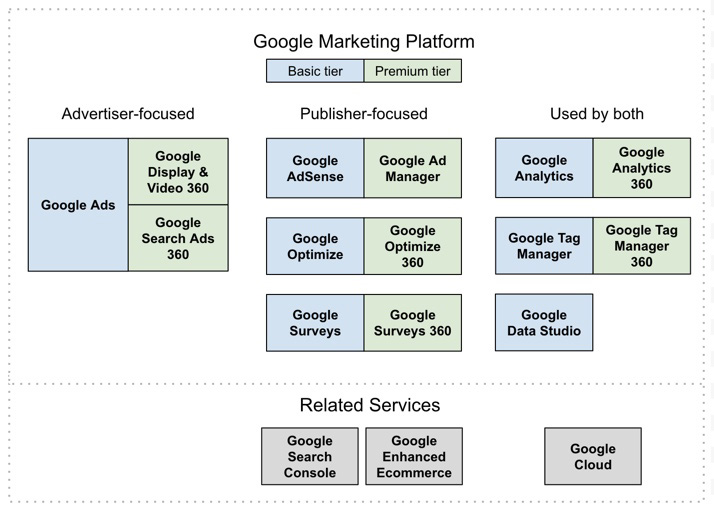

Google's power in the digital advertising world is undeniable. It boasts a significant market share across various ad tech segments, including programmatic advertising, ad exchanges, and ad serving. This dominance, however, has drawn intense scrutiny from regulators who allege anti-competitive behavior. The core argument revolves around Google leveraging its strength in one area to stifle competition in others, creating a self-reinforcing cycle of dominance.

Specific allegations include:

- Self-preferencing: Google allegedly prioritizes its own ad products in its auctions, giving them an unfair advantage over competitors.

- Opaque and manipulative bidding practices: Critics claim Google employs opaque bidding processes that favor its own interests and disadvantage rival ad platforms.

- Restricting access to data and technology: Competitors allege Google restricts access to crucial data and technology, hindering their ability to compete effectively.

These actions, according to the Department of Justice (DOJ), violate established antitrust laws such as the Sherman Act and Clayton Act, which prohibit monopolistic practices that harm competition. Keywords like Programmatic Advertising, Ad Exchanges, Ad Serving, Market Share, Anti-competitive Behavior, and Self-preferencing are central to understanding these allegations.

The Department of Justice's Case and the Demand for a Forced Asset Sale

The DOJ's lawsuit against Google argues that a forced asset sale is the only effective remedy to address the company's alleged monopolistic practices. This drastic measure aims to break up Google's dominance in ad tech, fostering a more competitive market. The DOJ’s rationale for this remedy over others, such as fines or behavioral remedies, is that only a structural change can effectively address the entrenched nature of Google’s market power.

The potential assets subject to divestiture could include specific ad tech products or entire divisions within Google's advertising ecosystem. This decision will be a significant undertaking, requiring careful consideration of which assets are key to Google’s alleged monopolistic behavior and how their separation would most effectively promote competition. The DOJ faces potential legal challenges from Google, who may argue that the proposed remedy is excessive, impractical, or even counterproductive. Keywords such as Department of Justice (DOJ), Antitrust Lawsuit, Remedy, Divestiture, Asset Sale, and Legal Challenges are crucial to following this case.

Potential Impacts of a Forced Asset Sale on the Digital Advertising Ecosystem

A forced asset sale would have far-reaching consequences. For Google, it could mean a significant reduction in revenue and a substantial weakening of its market position. However, this might lead to a more dynamic market, ultimately benefiting consumers. For advertisers, the potential impacts include:

- Increased competition: A more fragmented market would likely lead to increased competition among ad platforms.

- Potentially lower prices: Increased competition could drive down the cost of advertising.

- Potentially better transparency: A more competitive environment could encourage greater transparency in ad bidding and placement.

Publishers could also experience changes:

- Changes in revenue streams: The shift in the ad tech landscape may alter their revenue models.

- Increased competition for ad inventory: More players in the market could lead to increased competition for ad placements.

Ultimately, the impact on innovation is uncertain. While reduced market concentration might hinder Google’s massive investment in new technologies, it could also encourage innovation from smaller, more agile competitors.

Industry Reactions and Expert Opinions on the Google Ad Tech Monopoly and Proposed Remedy

The DOJ's action has sparked diverse reactions across the digital advertising industry. Some welcome the move as a necessary step towards a more competitive market, arguing that Google's dominance has stifled innovation and harmed consumers. Others express concerns, highlighting the potential disruption and uncertainty that a forced asset sale could create.

Expert opinions are divided. Some analysts believe a forced asset sale is the only way to effectively address Google's alleged monopolistic practices, while others suggest alternative remedies, such as stricter regulations or behavioral changes. The success of the forced asset sale and its long-term effects on the market remain to be seen. Keywords such as Industry Reaction, Expert Opinion, Market Analysis, Digital Advertising Industry, Monopoly, and Competition Policy are vital for understanding diverse perspectives.

The Future of Competition in Google's Ad Tech Landscape

The Google Ad Tech monopoly case and the proposed forced asset sale present a critical juncture for the digital advertising ecosystem. The outcome will significantly impact Google’s market power, the pricing and transparency of advertising, and the overall competitive landscape. The implications for advertisers and publishers are profound, potentially reshaping their revenue streams and operational strategies. Ultimately, the success of the DOJ's intervention will hinge on its ability to create a more balanced and competitive market, fostering innovation and ensuring fair play for all players.

Stay informed about the ongoing developments in the Google Ad Tech Monopoly case and its implications for the future of digital advertising. Follow this case closely to understand how the forced asset sale might reshape the competitive landscape. Engage in discussions about fair competition in the digital advertising market.

Featured Posts

-

Historys Funniest April Fools Day Hoaxes

May 07, 2025

Historys Funniest April Fools Day Hoaxes

May 07, 2025 -

Simone Biles Post Gymnastics Career A New Chapter

May 07, 2025

Simone Biles Post Gymnastics Career A New Chapter

May 07, 2025 -

Lion Electrics Potential Liquidation A Court Appointed Monitors Assessment

May 07, 2025

Lion Electrics Potential Liquidation A Court Appointed Monitors Assessment

May 07, 2025 -

How Front Loading Protects Exporters From Malaysian Ringgit Myr Fluctuations

May 07, 2025

How Front Loading Protects Exporters From Malaysian Ringgit Myr Fluctuations

May 07, 2025 -

Alkhtwt Almlkyt Almghrbyt Tkhtt Lzyadt Edd Rhlatha Byn Albrazyl Walmghrb

May 07, 2025

Alkhtwt Almlkyt Almghrbyt Tkhtt Lzyadt Edd Rhlatha Byn Albrazyl Walmghrb

May 07, 2025

Latest Posts

-

Boosting Productivity David Dodges Advice For Governor Carney

May 08, 2025

Boosting Productivity David Dodges Advice For Governor Carney

May 08, 2025 -

Rogue From Reluctant Mutant To Team Leader

May 08, 2025

Rogue From Reluctant Mutant To Team Leader

May 08, 2025 -

Carneys Economic Agenda Dodge Advocates For Productivity Focus

May 08, 2025

Carneys Economic Agenda Dodge Advocates For Productivity Focus

May 08, 2025 -

Rogue One Stars Insight How Andor Season 2 Redefines Star Wars

May 08, 2025

Rogue One Stars Insight How Andor Season 2 Redefines Star Wars

May 08, 2025 -

Productivity Dodges Call For Action To Governor Carney

May 08, 2025

Productivity Dodges Call For Action To Governor Carney

May 08, 2025