Lion Electric's Potential Liquidation: A Court-Appointed Monitor's Assessment

Table of Contents

The Court-Appointed Monitor's Role and Responsibilities

When a company faces severe financial distress and potential insolvency, a court may appoint an independent monitor to oversee its operations and finances. This is a crucial step in insolvency proceedings, designed to protect creditors and ensure fairness. The monitor's role in the Lion Electric case is multifaceted and legally defined. Their responsibilities include:

- Review of Financial Records: The monitor meticulously examines Lion Electric's financial records, including balance sheets, income statements, and cash flow statements, to assess the extent of its financial troubles. This involves scrutinizing past performance and identifying any irregularities.

- Assessment of Assets and Liabilities: A comprehensive valuation of Lion Electric's assets (e.g., manufacturing facilities, intellectual property, and inventory) and liabilities (e.g., outstanding debt obligations and other financial commitments) is undertaken to determine the company's net worth.

- Investigation of Potential Mismanagement: The monitor investigates the possibility of any mismanagement or fraudulent activities that might have contributed to Lion Electric's financial predicament. This includes examining corporate governance practices and financial decision-making.

- Reporting to the Court: The monitor regularly reports their findings to the court, providing updates on the company's financial situation and recommending appropriate courses of action.

- Recommendations for Restructuring or Liquidation: Based on their assessment, the monitor advises the court on the best course of action, whether it's restructuring the company to improve its financial health or recommending Lion Electric liquidation. This decision hinges on factors such as the severity of the financial distress, the viability of restructuring options, and the potential recovery for creditors. Keywords: Court-appointed monitor, Lion Electric financial health, insolvency proceedings, restructuring options, debt obligations.

Key Findings of the Monitor's Assessment (Lion Electric's Financial Situation)

The monitor's report on Lion Electric's financial situation is expected to detail the severity of the company's distress. Key findings likely include:

- Cash Flow Problems: Lion Electric might be experiencing significant difficulties generating sufficient cash flow to meet its operating expenses and debt obligations. This could be due to lower-than-anticipated sales, increased production costs, or supply chain disruptions.

- High Debt Levels: The company may be burdened with substantial debt, making it difficult to service its obligations and hindering its ability to invest in growth and innovation.

- Profitability Challenges: Lion Electric might be struggling to achieve profitability, with operating losses impacting its financial stability. This could be attributed to factors such as intense competition in the EV market, pricing pressures, or production inefficiencies.

- Operational Inefficiencies: The monitor's assessment might reveal operational inefficiencies within Lion Electric, impacting its cost structure and profitability.

- Market Competition: The highly competitive electric vehicle market, characterized by established players and emerging startups, poses a significant challenge to Lion Electric's market share and growth prospects. Keywords: Lion Electric financial distress, profitability analysis, cash flow issues, debt restructuring, competitive landscape, EV market challenges.

Potential Scenarios: Restructuring vs. Liquidation

Based on the monitor's assessment, several scenarios are possible for Lion Electric:

- Debt Restructuring Negotiations: Lion Electric might attempt to negotiate with its creditors to restructure its debt, potentially extending repayment terms or reducing the overall debt burden.

- Potential Investors: The company could seek new investors to inject capital and help stabilize its financial position. This might involve issuing new equity or securing additional debt financing.

- Asset Sales: Lion Electric might consider selling some of its assets (e.g., factories, intellectual property) to generate cash and reduce its debt load.

- Chapter 11 Bankruptcy (if applicable): If restructuring efforts fail, Lion Electric might file for Chapter 11 bankruptcy protection to reorganize its finances and potentially emerge from bankruptcy as a viable entity.

- Complete Liquidation: The most severe outcome is complete Lion Electric liquidation, where the company's assets are sold off to pay creditors, and the business ceases operations. Keywords: Lion Electric restructuring, bankruptcy proceedings, asset sale, investor acquisition, liquidation process.

Implications for Stakeholders (Investors, Employees, Suppliers)

The outcome of the Lion Electric situation significantly impacts various stakeholders:

- Investors: Depending on the scenario, investors may face losses, ranging from partial to complete loss of their investments.

- Employees: Lion Electric liquidation would likely lead to widespread job losses, causing significant hardship for affected employees. Restructuring might involve layoffs or salary reductions.

- Suppliers: Suppliers might face financial difficulties due to outstanding payments if Lion Electric fails to meet its obligations. They may also face legal challenges to recover their debts. Keywords: Lion Electric stakeholders, investor impact, employee layoffs, supplier risk, legal ramifications.

The Future of Lion Electric and the Electric Vehicle Market

The Lion Electric situation has broader implications for the electric vehicle industry:

- Impact on EV Innovation: A potential Lion Electric liquidation could stifle innovation within the EV sector, particularly if it impacts the development of crucial technologies or expertise.

- Investor Confidence in the Sector: The outcome will influence investor confidence in the broader EV market, potentially impacting funding for other EV companies.

- The Role of Government Subsidies: The case might prompt a review of government policies and subsidies aimed at supporting the EV industry.

- Competition from Established Players: Established automotive manufacturers are already strong competitors in the EV market; the failure of a smaller player could reinforce the dominance of larger players. Keywords: Electric vehicle industry, EV market outlook, investor confidence, government regulation, competition in the EV sector.

Conclusion

The court-appointed monitor's assessment of Lion Electric's financial situation is crucial in determining the company's future. The findings, including the severity of the financial distress and the potential scenarios—restructuring or liquidation—have significant implications for investors, employees, suppliers, and the electric vehicle market as a whole. The outcome will undoubtedly shape the landscape of the EV industry. Staying informed about further developments in the Lion Electric liquidation process is crucial for all stakeholders. Continue monitoring the situation closely to understand the next steps and their impact.

Featured Posts

-

The Karate Kid A Comprehensive Guide To The Film Series

May 07, 2025

The Karate Kid A Comprehensive Guide To The Film Series

May 07, 2025 -

Lewis Capaldis Rare Public Appearance A Thumbs Up For Fans

May 07, 2025

Lewis Capaldis Rare Public Appearance A Thumbs Up For Fans

May 07, 2025 -

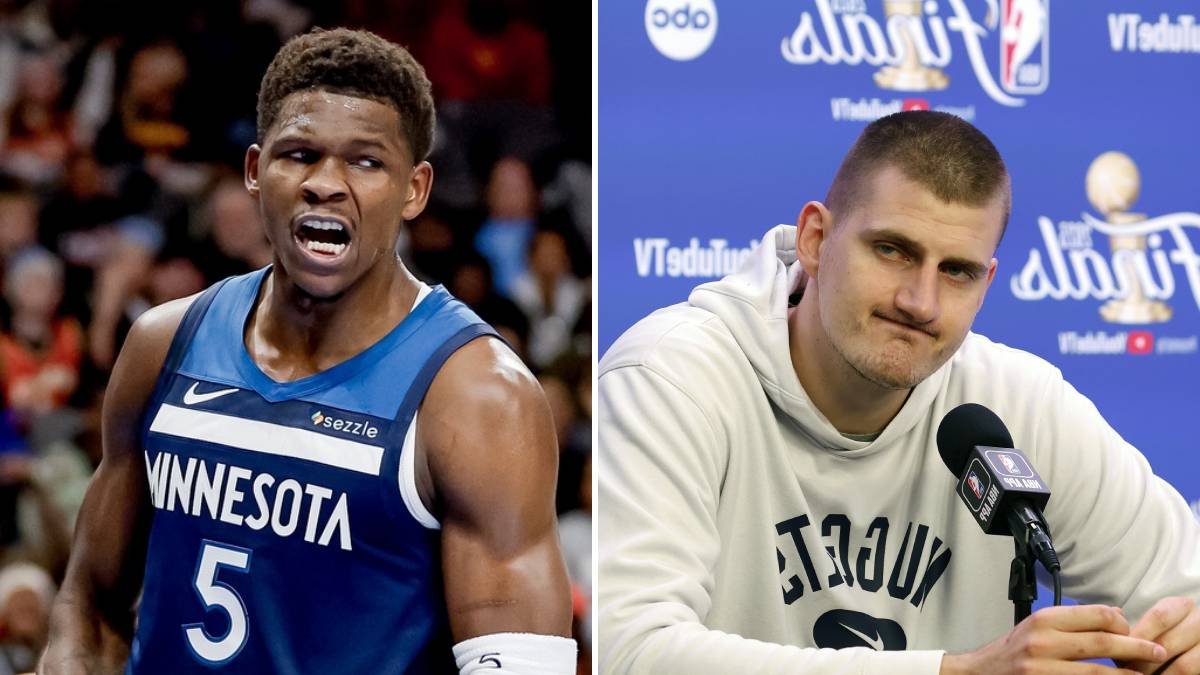

Anthony Edwards Shoving Match What Happened During The Lakers Game

May 07, 2025

Anthony Edwards Shoving Match What Happened During The Lakers Game

May 07, 2025 -

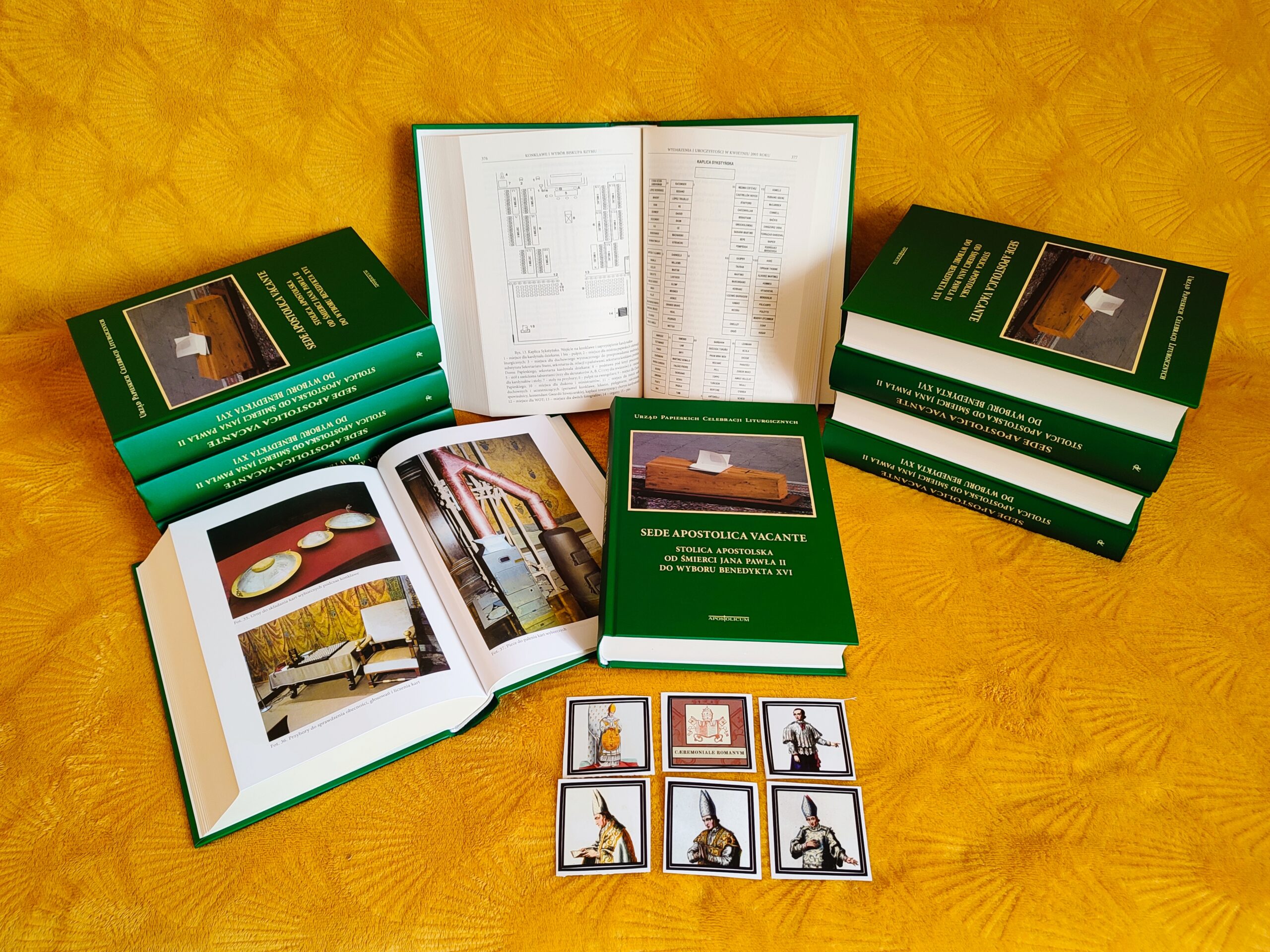

Tajemnice Wyborow Papieskich Ksiazka Ks Sliwinskiego Premiera W Warszawie

May 07, 2025

Tajemnice Wyborow Papieskich Ksiazka Ks Sliwinskiego Premiera W Warszawie

May 07, 2025 -

Jenna Ortega And Glen Powell New Fantasy Film To Start Filming In London

May 07, 2025

Jenna Ortega And Glen Powell New Fantasy Film To Start Filming In London

May 07, 2025

Latest Posts

-

Tri Poljupca Deandre Dzordan Otkriva Zasto On I Nikola Jokic Tako Cine

May 08, 2025

Tri Poljupca Deandre Dzordan Otkriva Zasto On I Nikola Jokic Tako Cine

May 08, 2025 -

Deandre Dzordan I Nikola Jokic Objasnjenje Za Trostruki Poljubac

May 08, 2025

Deandre Dzordan I Nikola Jokic Objasnjenje Za Trostruki Poljubac

May 08, 2025 -

Deandre Dzordan Zasto Se Ljubi Sa Jokicem Tri Puta Bobi Marjanovic Krivac

May 08, 2025

Deandre Dzordan Zasto Se Ljubi Sa Jokicem Tri Puta Bobi Marjanovic Krivac

May 08, 2025 -

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025 -

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025

New Trailer For Stephen Kings The Long Walk Adaptation

May 08, 2025