Goldman Sachs: Trump's Stance On $40-$50 Oil Price Range

Table of Contents

This article analyzes Goldman Sachs' assessment of the impact of Donald Trump's policies on the oil price, specifically focusing on the $40-$50 price range. We'll examine Trump's energy agenda, its potential effects on oil production and consumption, and Goldman Sachs' predictions regarding market stability and volatility within this crucial price band. Understanding this relationship is vital for investors, policymakers, and anyone interested in the future of the energy market.

Trump's Energy Policy and its Influence on Oil Prices

Trump's "America First" energy policy significantly influenced global oil markets. His administration's approach prioritized domestic energy production, leading to considerable shifts in the global supply-demand dynamic and impacting the $40-$50 oil price range.

Deregulation and Increased Domestic Production

Trump's emphasis on deregulation spurred a significant increase in US oil and gas production.

- Reduced environmental regulations: Easing restrictions on drilling and extraction, particularly in areas like shale oil formations, boosted output.

- Increased access to federal lands: Opening up federal lands for energy exploration further expanded production capabilities.

- Impact on shale oil production: The US became a major shale oil producer, significantly altering the global oil supply landscape.

- Potential for increased supply and downward pressure on prices: This surge in domestic production put downward pressure on global oil prices, potentially keeping them within the $40-$50 range, depending on global demand.

Impact on OPEC and Global Oil Supply

Trump's policies directly impacted OPEC's strategies and the global oil market.

- Increased US oil production's effect on OPEC's market share: The rise of US production challenged OPEC's dominance, forcing them to adjust their production quotas.

- OPEC's response to increased US supply: OPEC responded with production cuts in an attempt to stabilize prices and maintain market share, sometimes resulting in price wars.

- Geopolitical implications of US energy independence: Increased US energy independence reduced reliance on foreign oil imports, altering geopolitical relationships and potentially influencing global stability.

- Goldman Sachs' view on the interplay between US production and global supply: Goldman Sachs' analysis likely incorporated these complex interactions between US production, OPEC's response, and global demand to predict oil prices within the $40-$50 range.

Goldman Sachs' Predictions within the $40-$50 Oil Price Range

Goldman Sachs, a leading financial institution, offered insights into market behavior within the $40-$50 oil price band under Trump's policies.

Market Stability and Volatility

Goldman Sachs' analysis likely considered various factors affecting market stability and volatility in this price range.

- Factors contributing to price fluctuations: Demand fluctuations, geopolitical events (e.g., Middle East instability), and unexpected supply disruptions all impacted price stability.

- Goldman Sachs' forecast for price stability or volatility within this range: Their predictions likely encompassed a range of scenarios, considering the interplay of these factors.

- Potential risks and opportunities for investors: Investors needed to understand the potential for price swings within this range to manage risk effectively.

Investment Implications and Recommendations

Goldman Sachs likely provided investment recommendations based on their $40-$50 oil price range projections.

- Recommendations for investors in oil and gas companies: They might have advised investors on which oil and gas companies to invest in, based on their perceived resilience in this price environment.

- Strategies for mitigating risks associated with price fluctuations: Hedging strategies and diversification were likely recommended to mitigate risks from price volatility.

- Potential for returns within this specific price band: Goldman Sachs likely assessed the potential for returns within this price range, guiding investors' decision-making.

Alternative Perspectives and Criticisms

While Goldman Sachs' analysis provides valuable insights, alternative perspectives and criticisms need consideration.

Environmental Concerns and Sustainability

Trump's deregulation policies faced criticism regarding environmental consequences.

- Increased carbon emissions due to higher fossil fuel production: Increased production led to concerns about rising greenhouse gas emissions and their impact on climate change.

- Impact on climate change and global warming: Critics argued that the emphasis on fossil fuels hindered efforts to transition to cleaner, more sustainable energy sources.

- Alternative energy sources and their role in the future energy mix: The debate emphasized the need for investment in renewable energy sources to mitigate environmental damage.

Economic Impact on Different Sectors

The $40-$50 oil price range significantly impacts various economic sectors.

- Effects on consumer spending and inflation: Lower oil prices generally benefit consumers through lower transportation and energy costs.

- Impact on the profitability of oil-dependent industries: Oil companies' profitability is directly linked to oil prices; this range could have influenced their financial performance.

- Potential job creation or losses in different sectors: Changes in oil prices ripple through the economy, affecting job creation and losses in various related sectors.

Conclusion

This article examined Goldman Sachs' analysis of the impact of Donald Trump's energy policies on the oil price, focusing on the $40-$50 range. We discussed the influence of deregulation, increased domestic production, and the interplay with OPEC. Goldman Sachs' predictions regarding market stability, investment implications, and counterarguments regarding environmental concerns and economic impacts were also considered. Understanding the interplay between Goldman Sachs' assessments, Trump’s policies, and the crucial $40-$50 oil price range is vital for navigating this complex energy market. To stay informed on future energy market trends and the ongoing impact of government policies on oil prices, continue researching the relationship between Goldman Sachs, Trump’s energy policies, and the crucial $40-$50 oil price range.

Featured Posts

-

Paysandu Vs Bahia Resumen Del Encuentro Y Goles 0 1

May 16, 2025

Paysandu Vs Bahia Resumen Del Encuentro Y Goles 0 1

May 16, 2025 -

Warriors Vs Opponent Jimmy Butler Game Status Update

May 16, 2025

Warriors Vs Opponent Jimmy Butler Game Status Update

May 16, 2025 -

Trumps Second Term An Examination Of Presidential Pardons

May 16, 2025

Trumps Second Term An Examination Of Presidential Pardons

May 16, 2025 -

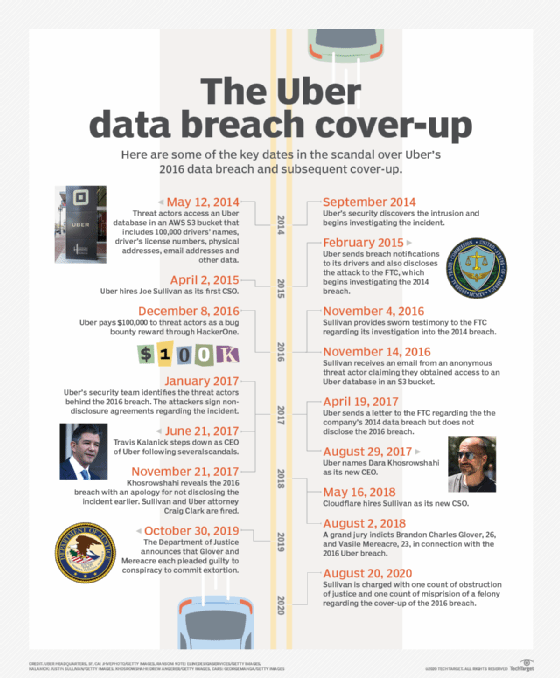

16 Million Penalty For T Mobile A Three Year Data Breach Timeline

May 16, 2025

16 Million Penalty For T Mobile A Three Year Data Breach Timeline

May 16, 2025 -

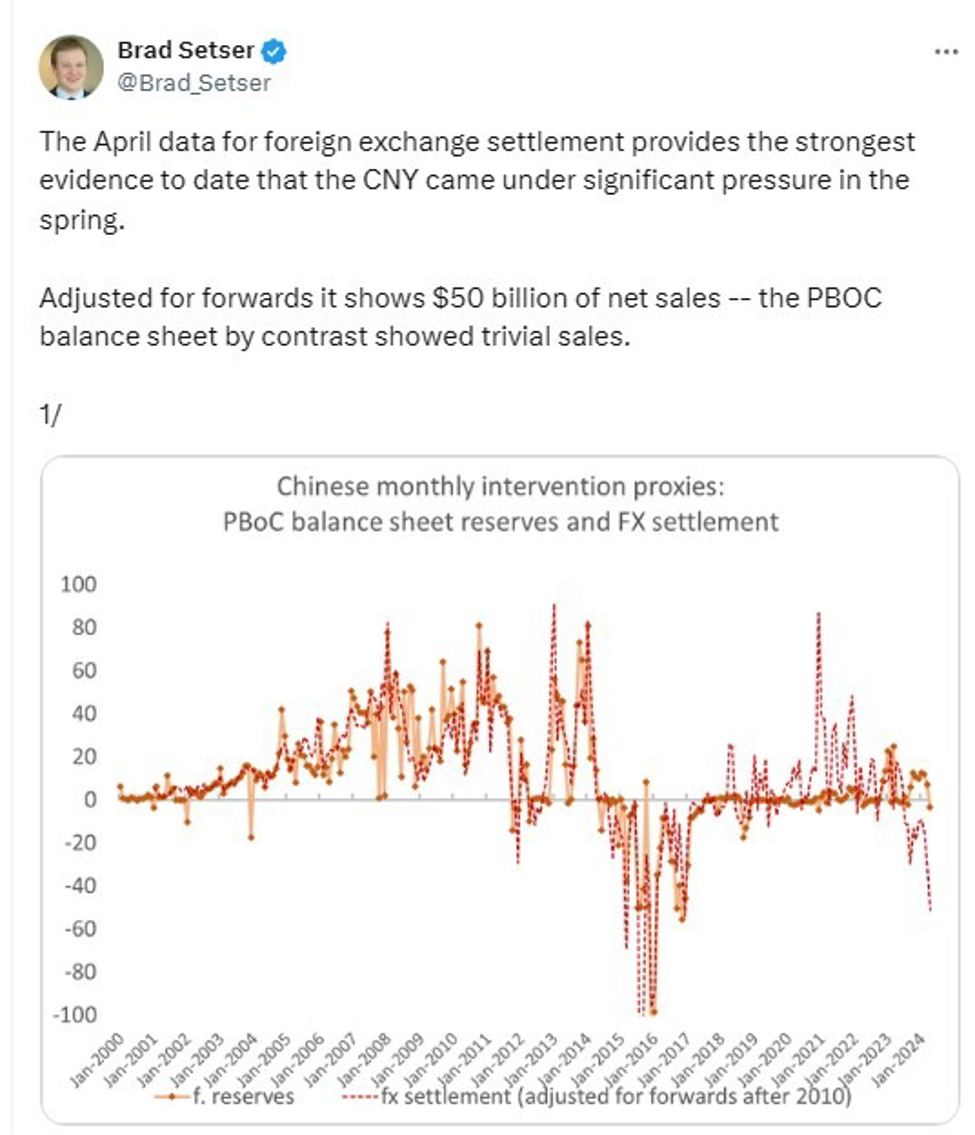

Yuan Support Measures Underwhelm Pbocs 2024 Intervention

May 16, 2025

Yuan Support Measures Underwhelm Pbocs 2024 Intervention

May 16, 2025

Latest Posts

-

Chandler Doubts Pimblett Can Handle His Aggressive Style At Ufc 314

May 16, 2025

Chandler Doubts Pimblett Can Handle His Aggressive Style At Ufc 314

May 16, 2025 -

Michael Chandler Questions Paddy Pimbletts Ability To Withstand His Pace At Ufc 314

May 16, 2025

Michael Chandler Questions Paddy Pimbletts Ability To Withstand His Pace At Ufc 314

May 16, 2025 -

From Chandler Fight To Title Fight Ufc Legends Paddy Pimblett Prediction

May 16, 2025

From Chandler Fight To Title Fight Ufc Legends Paddy Pimblett Prediction

May 16, 2025 -

Will Paddy Pimblett Win The Ufc Title A Veterans Bold Prediction

May 16, 2025

Will Paddy Pimblett Win The Ufc Title A Veterans Bold Prediction

May 16, 2025 -

Paddy Pimblett From Write Off To Title Contender A Legends Prediction

May 16, 2025

Paddy Pimblett From Write Off To Title Contender A Legends Prediction

May 16, 2025