Gold (XAUUSD) Finds Support: Impact Of Weaker US Economic Indicators

Table of Contents

Weakening US Economic Data and its Implications

The recent trend of weaker-than-expected US economic data paints a picture of potential economic slowdown. Key indicators like GDP growth, consumer confidence, and manufacturing PMI have all shown signs of weakening, significantly impacting market sentiment and expectations.

- Lower-than-projected GDP growth for Q2 2024: The underwhelming GDP figures sparked concerns about a potential recession, prompting a reassessment of economic forecasts. This uncertainty fuels investor flight to safer assets like gold.

- Weakening consumer confidence index: The decline in consumer confidence indicates reduced consumer spending, a key driver of economic growth. This dampened outlook contributes to a more pessimistic market sentiment, boosting gold's appeal as a safe haven.

- Manufacturing PMI slowdown: A contraction in the manufacturing Purchasing Managers' Index (PMI) signals weakening industrial activity and potential job losses, further reinforcing the narrative of an economic slowdown.

These indicators collectively suggest a less robust US economy than previously anticipated, directly influencing expectations about the Federal Reserve's future monetary policy actions.

The Federal Reserve's Response and its Effect on Gold (XAUUSD)

Weaker economic data significantly impacts the Federal Reserve's (Fed) decision-making process regarding interest rate hikes. The likelihood of a less aggressive, or even paused, rate hike schedule is increasing. This shift in the Fed's stance has profound implications for the US dollar and, consequently, gold prices.

- A less hawkish Fed typically leads to a weaker dollar. Reduced interest rate hikes make the dollar less attractive to international investors, leading to a decline in its value.

- A weaker dollar makes gold cheaper for buyers using other currencies, boosting demand. This increase in affordability drives up demand for gold, pushing its price higher.

This interplay between Fed policy, the US dollar, and gold prices is a crucial factor shaping the XAUUSD market.

Increased Safe-Haven Demand for Gold Amidst Uncertainty

Gold has long held its position as a premier safe-haven asset. During periods of economic uncertainty, investors flock to gold as a hedge against potential market volatility and economic downturn. This increased safe-haven demand is amplified by current geopolitical risks and persistent inflationary pressures.

- Geopolitical tensions often drive investors towards gold. Uncertainty surrounding international relations and conflicts often leads to increased demand for safe-haven assets like gold, providing a stable store of value during turbulent times.

- High inflation erodes the value of fiat currencies, increasing the attractiveness of gold as a store of value. Inflation concerns further solidify gold's position as a hedge against currency devaluation, bolstering investor confidence.

This combination of economic uncertainty, geopolitical risks, and inflation concerns significantly contributes to the current support for gold prices.

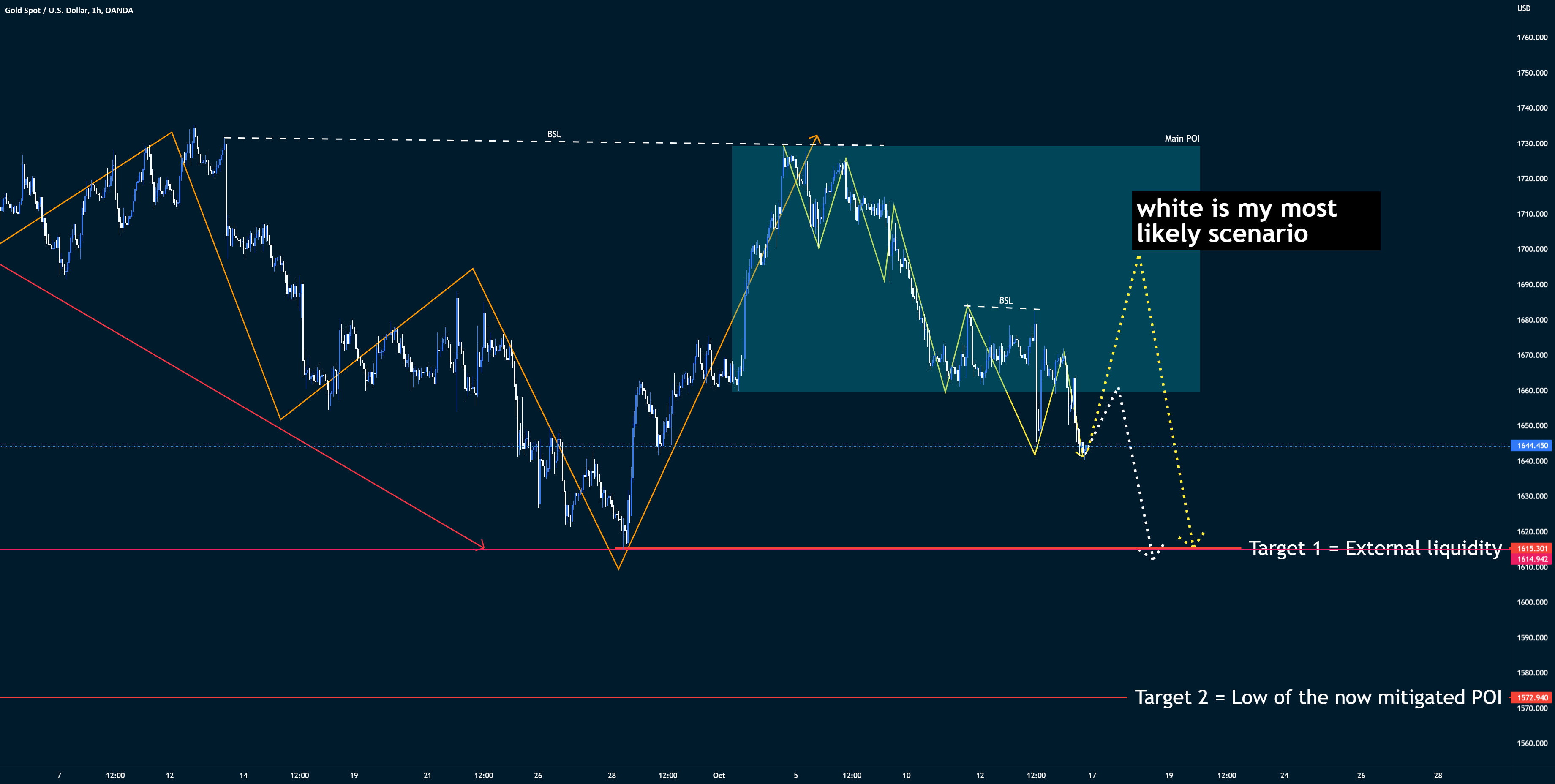

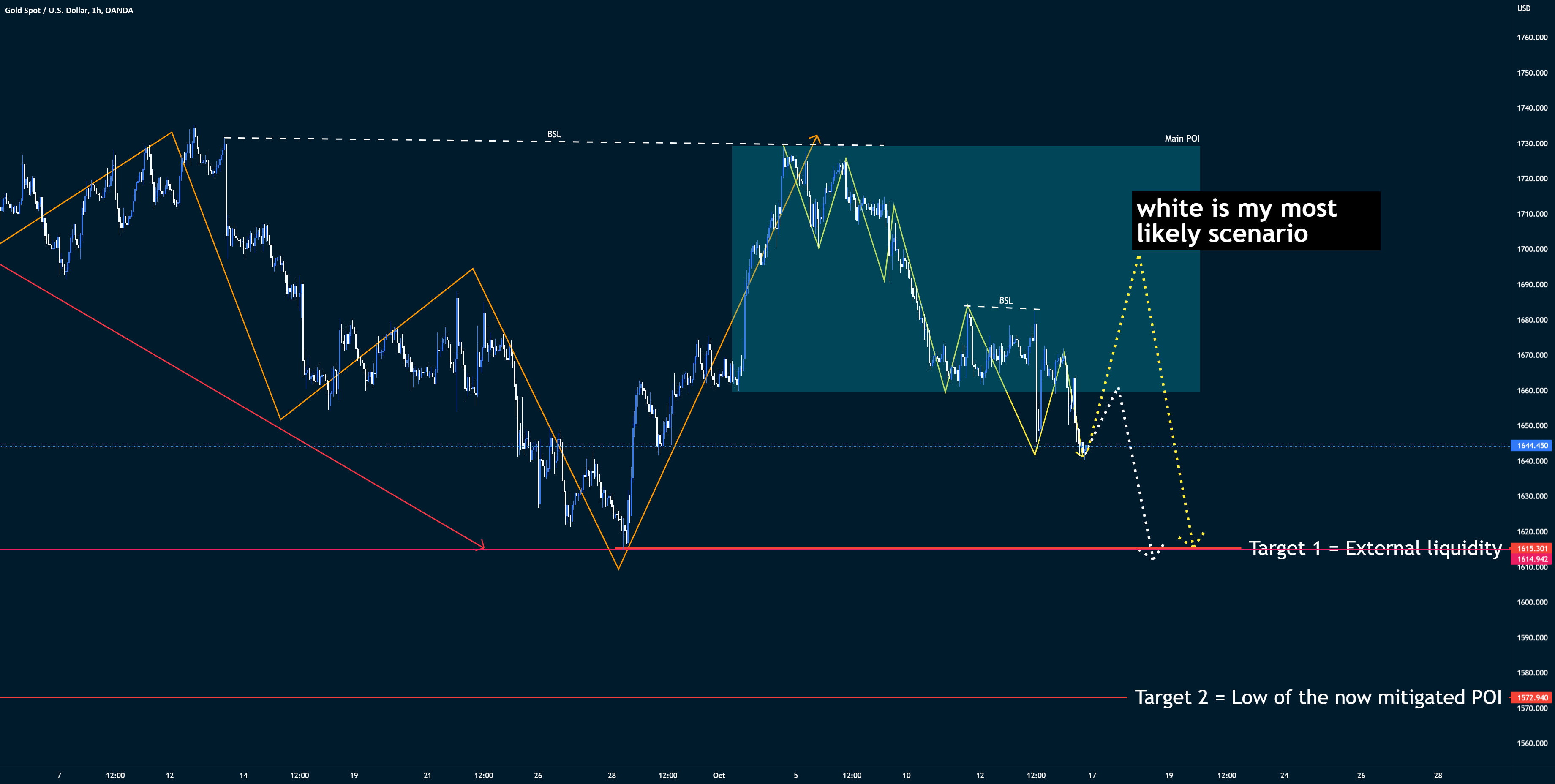

Technical Analysis of Gold (XAUUSD) Support Levels

Analyzing recent gold price charts reveals key support levels that have held firm despite market volatility. Technical indicators suggest a potential for price rebounds or further consolidation in the near term. However, it's crucial to also identify potential resistance levels that could impede further upward momentum. [Insert relevant charts and graphs here showing support and resistance levels, along with relevant technical indicators like moving averages and RSI]. The interplay between these support and resistance levels will shape the short-term trajectory of the XAUUSD.

Conclusion: Gold (XAUUSD) Outlook and Investment Strategies

In summary, weaker US economic indicators are providing substantial support to gold prices. These indicators influence the Federal Reserve's monetary policy, impacting the US dollar and boosting safe-haven demand for gold. Monitoring US economic data and Federal Reserve announcements is crucial for understanding potential shifts in gold's price trajectory.

Based on this analysis, investors with a higher risk tolerance might consider increasing their gold exposure, while more conservative investors may choose to maintain their existing positions or gradually increase allocation. However, it's crucial to remember that this is not financial advice, and investment decisions should be made based on your individual risk profile and financial goals.

Stay informed about the latest developments in the XAUUSD market and adjust your gold investment strategy accordingly. Monitor key economic indicators and Federal Reserve pronouncements to make informed decisions about your gold (XAUUSD) investments.

Featured Posts

-

This Air Traffic Controllers Exclusive Account Of A Midair Collision

May 17, 2025

This Air Traffic Controllers Exclusive Account Of A Midair Collision

May 17, 2025 -

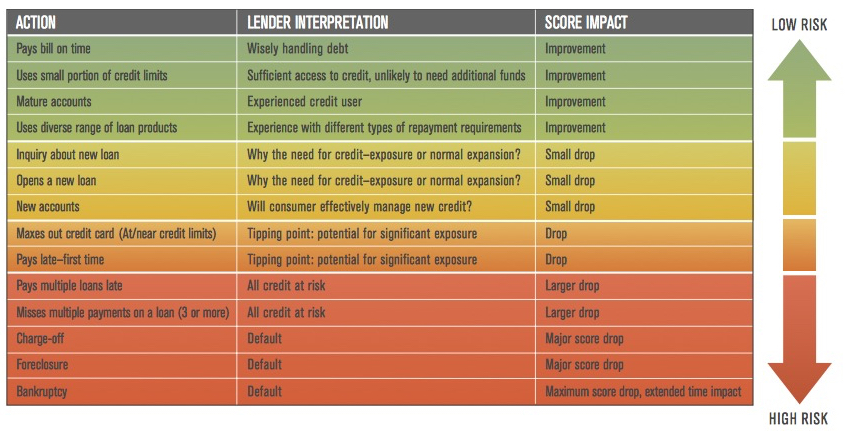

Understanding The Credit Score Impact Of Late Student Loan Payments

May 17, 2025

Understanding The Credit Score Impact Of Late Student Loan Payments

May 17, 2025 -

Understanding Principal Financial Group Pfg An Analysis Of 13 Analyst Ratings

May 17, 2025

Understanding Principal Financial Group Pfg An Analysis Of 13 Analyst Ratings

May 17, 2025 -

Will Trumps China Tariffs Remain At 30 Until 2025 Analysis And Implications

May 17, 2025

Will Trumps China Tariffs Remain At 30 Until 2025 Analysis And Implications

May 17, 2025 -

Msum Bestows Honorary Degree On North Dakotas Wealthiest Individual

May 17, 2025

Msum Bestows Honorary Degree On North Dakotas Wealthiest Individual

May 17, 2025

Latest Posts

-

Why Were These 10 Great Tv Shows Cancelled A Retrospective

May 17, 2025

Why Were These 10 Great Tv Shows Cancelled A Retrospective

May 17, 2025 -

12 Essential Sci Fi Series For Every Fan

May 17, 2025

12 Essential Sci Fi Series For Every Fan

May 17, 2025 -

Top 10 Prematurely Cancelled Tv Series A Fans Lament

May 17, 2025

Top 10 Prematurely Cancelled Tv Series A Fans Lament

May 17, 2025 -

Top 12 Sci Fi Tv Shows To Binge Watch

May 17, 2025

Top 12 Sci Fi Tv Shows To Binge Watch

May 17, 2025 -

10 Tv Shows Cut Short Why We Still Miss Them

May 17, 2025

10 Tv Shows Cut Short Why We Still Miss Them

May 17, 2025