Understanding The Credit Score Impact Of Late Student Loan Payments

Table of Contents

How Late Student Loan Payments Affect Your Credit Score

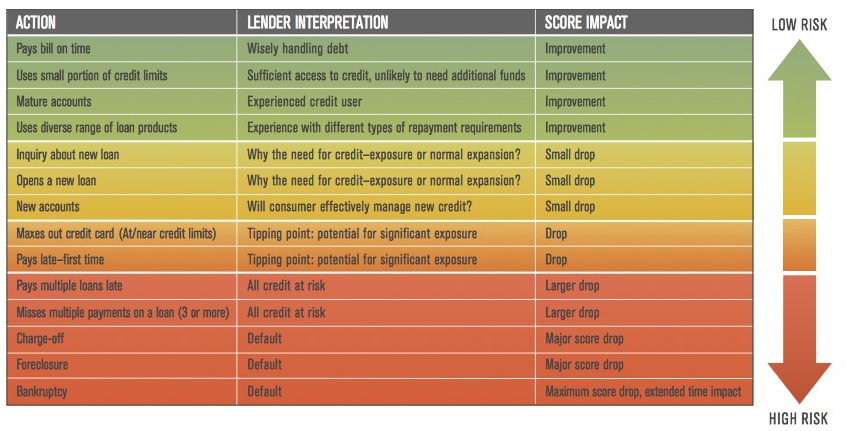

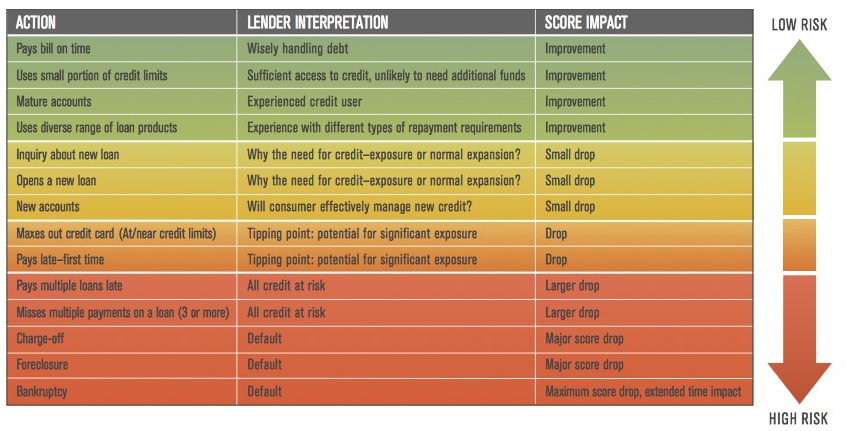

Your payment history is the most significant factor influencing your credit score, making on-time student loan payments paramount. When you miss a payment, this delinquency is reported to the three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus use the information they receive to calculate your credit score, most commonly using the FICO scoring system. Even a single late student loan payment can negatively impact your FICO score and other credit ratings. The weight given to payment history in credit scoring models means that consistently making on-time payments is essential for building and maintaining good credit.

- Late payments remain on your credit report for 7 years. This means the negative impact lingers for a considerable period.

- The severity of the impact depends on the length of delinquency. A 30-day late payment has a less significant impact than a 90-day late payment or a default.

- Multiple late payments significantly lower your credit score. Consistent late payments can severely damage your creditworthiness, making it much harder to secure future loans or credit.

- Late payments can make it harder to qualify for loans, credit cards, or even rent an apartment. Landlords and lenders often check credit reports, and a poor credit score can make securing housing or financing extremely difficult.

Understanding the Severity of Delinquency

The consequences of late student loan payments increase in severity with the length of the delinquency. A 30-day late payment is less damaging than a 60-day late payment, and a 90-day late payment signifies a more serious problem. If your student loan payments remain delinquent for an extended period, your loan could enter default. Defaulting on your student loans has the most severe consequences, including:

- Reporting to collections agencies: These agencies aggressively pursue payment, and their actions further damage your credit score.

- Wage garnishment: A portion of your wages could be legally seized to repay the debt.

- Tax refund offset: Your tax refund could be used to pay off your delinquent student loans.

- Difficulty obtaining future credit: Defaulting makes it extremely hard to get loans, credit cards, or even rent an apartment.

Understanding these stages of delinquency is critical to taking proactive steps to avoid such severe repercussions.

Protecting Your Credit Score: Strategies for Avoiding Late Student Loan Payments

Proactive financial planning is essential to avoid the negative consequences of late student loan payments. Several strategies can help you stay on track:

- Set up automatic payments: Automating your student loan payments ensures that payments are made on time, preventing late payment fees and negative impacts on your credit score.

- Create a budget: A realistic budget helps you track income and expenses, allowing you to prioritize student loan payments and avoid missed payments.

- Explore different repayment plans: Your loan servicer may offer various repayment plans, such as income-driven repayment, that can make your payments more manageable.

- Consider professional financial counseling: If you're struggling to manage your student loan debt, a financial counselor can provide guidance and support.

The Importance of Monitoring Your Credit Report

Regularly monitoring your credit report is crucial for identifying and addressing potential problems. You are entitled to a free credit report from each of the three major credit bureaus annually through . Checking your report allows you to:

- Detect errors: Mistakes on your credit report can negatively affect your score. Disputing these errors is essential.

- Identify fraudulent activity: Monitoring helps you detect and report any unauthorized use of your credit.

- Track your credit score's progress: This allows you to assess the effectiveness of your debt management strategies.

Conclusion

Late student loan payments can significantly damage your credit score, impacting your ability to secure loans, rent an apartment, and even obtain employment. By understanding the severity of delinquency and implementing proactive strategies, you can protect your financial future. Regularly monitor your credit report and take advantage of available resources to manage your debt effectively. Protect your credit score by understanding the impact of late student loan payments and taking proactive steps today! If you need assistance, consider contacting a credit counseling agency or exploring resources provided by the federal government.

Featured Posts

-

Best Online Casinos In Canada 2025 7 Bit Casino And Competitor Analysis

May 17, 2025

Best Online Casinos In Canada 2025 7 Bit Casino And Competitor Analysis

May 17, 2025 -

Zayavlenie Zhevago Buduschee Investitsiy Ferrexpo V Ukraine Pod Voprosom

May 17, 2025

Zayavlenie Zhevago Buduschee Investitsiy Ferrexpo V Ukraine Pod Voprosom

May 17, 2025 -

Tom Cruises Dating History A Complete Timeline

May 17, 2025

Tom Cruises Dating History A Complete Timeline

May 17, 2025 -

Knicks Turnaround Thibodeaus Transformation And The Key To Success

May 17, 2025

Knicks Turnaround Thibodeaus Transformation And The Key To Success

May 17, 2025 -

Where To Watch Seattle Mariners Vs Chicago Cubs Spring Training Online For Free

May 17, 2025

Where To Watch Seattle Mariners Vs Chicago Cubs Spring Training Online For Free

May 17, 2025

Latest Posts

-

Prensa Latina Previsiones Deportivas Y Resultados De La Semana

May 17, 2025

Prensa Latina Previsiones Deportivas Y Resultados De La Semana

May 17, 2025 -

Noticias Deportivas Y Previsiones Semanales De Prensa Latina

May 17, 2025

Noticias Deportivas Y Previsiones Semanales De Prensa Latina

May 17, 2025 -

La Alegria De Alcaraz Su Camino Al Triunfo En Montecarlo

May 17, 2025

La Alegria De Alcaraz Su Camino Al Triunfo En Montecarlo

May 17, 2025 -

Previsiones Deportivas De Prensa Latina Pronosticos Para La Semana

May 17, 2025

Previsiones Deportivas De Prensa Latina Pronosticos Para La Semana

May 17, 2025 -

Lieu Djokovic Co The Vuot Qua Alcaraz De Gianh Chuc Vo Dich Miami Open 2025

May 17, 2025

Lieu Djokovic Co The Vuot Qua Alcaraz De Gianh Chuc Vo Dich Miami Open 2025

May 17, 2025