Gold Price (XAUUSD) Gains Momentum After Soft US Data

Table of Contents

Declining US Dollar Strength Fuels Gold Price Rally (XAUUSD)

The US dollar and gold prices share an inverse relationship. When the US dollar weakens, the price of gold (XAUUSD) tends to rise, and vice versa. This is because gold, priced in US dollars, becomes cheaper for international investors holding other currencies when the dollar depreciates. The recent weakening of the US dollar, driven by several factors, has significantly contributed to the current gold price rally.

- Weakening dollar makes gold cheaper for international investors: A weaker dollar increases the purchasing power of other currencies, leading to increased demand for gold from international buyers.

- Reduced US interest rate hike expectations contribute to dollar weakness: Lower expectations for future interest rate hikes by the Federal Reserve reduce the attractiveness of the dollar as an investment, causing it to weaken.

- Increased demand for safe-haven assets like gold: Economic uncertainty often drives investors towards safe-haven assets like gold, further increasing demand and pushing the XAUUSD price upwards.

Soft US Inflation Data Boosts Gold Price (XAUUSD)

Lower-than-expected inflation figures released recently have had a significant impact on the gold price (XAUUSD). This softer-than-anticipated inflation data influences the Federal Reserve's monetary policy decisions.

- Lower inflation reduces the need for aggressive interest rate hikes: With inflation easing, the pressure on the Fed to aggressively raise interest rates diminishes. This is positive news for gold, as higher interest rates typically increase the opportunity cost of holding non-yielding assets like gold.

- Reduced interest rates make gold a more attractive investment: Lower interest rates decrease the attractiveness of bonds and other interest-bearing assets, making gold a relatively more appealing investment option.

- Lower inflation eases concerns about future economic growth: While some inflation is healthy, excessively high inflation can signal economic instability. Lower inflation eases these concerns, but not enough to eliminate the need for gold as a safe haven.

Geopolitical Uncertainty Continues to Support Gold Price (XAUUSD)

Ongoing geopolitical uncertainties continue to fuel demand for gold as a safe-haven asset, providing additional support to the XAUUSD price. The world remains a volatile place, and this volatility impacts investor sentiment.

- Rising geopolitical tensions increase demand for gold as a safe haven: Investors often flock to gold during times of political instability or international conflict, seeking to preserve capital in a turbulent environment.

- Uncertain global economic outlook boosts gold investment: Concerns about a potential global recession or other economic downturns often lead investors to seek the security of gold.

- Specific examples of geopolitical events affecting XAUUSD: The ongoing war in Ukraine, tensions in the South China Sea, and other global conflicts all contribute to the perception of risk, bolstering gold's safe-haven appeal.

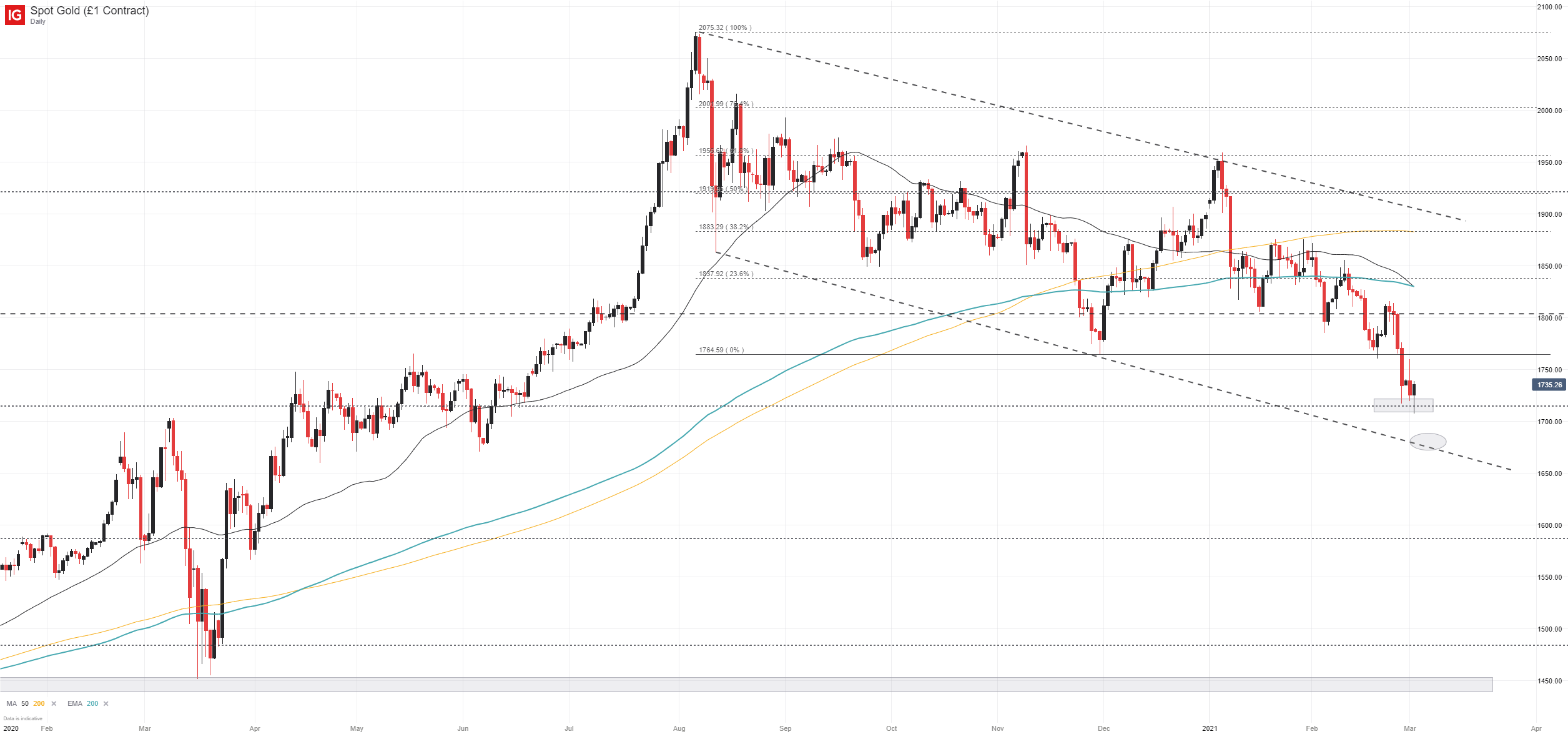

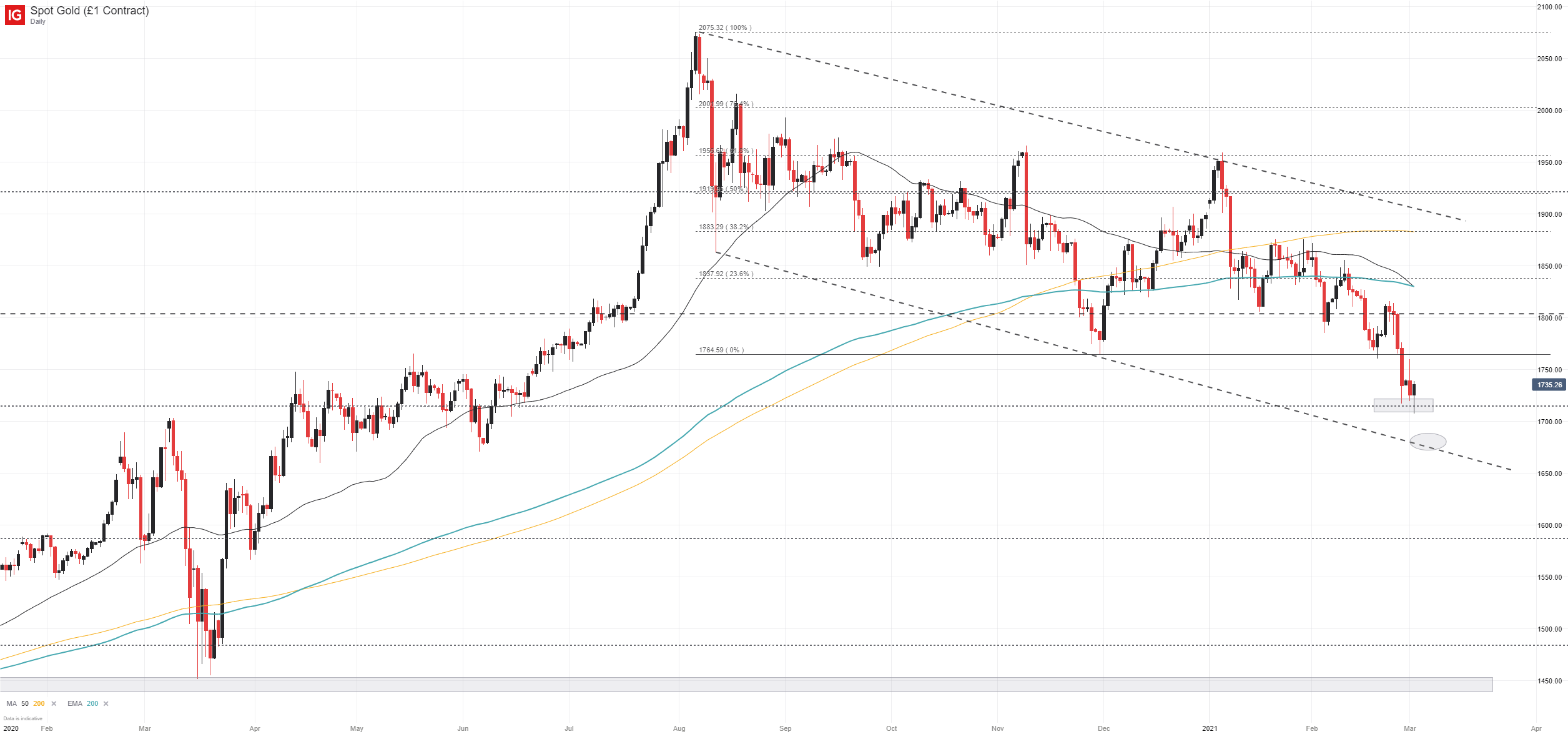

Technical Analysis of Gold Price (XAUUSD) Chart

A look at the XAUUSD chart reveals several technical indicators suggesting further upward momentum. The recent breakout above key resistance levels, coupled with increasing trading volume, points towards a sustained rally in the gold price. (Insert relevant gold price chart here) These technical signals, combined with the fundamental factors discussed above, paint a bullish picture for the XAUUSD in the short term.

Conclusion: Capitalize on the Rising Gold Price (XAUUSD)

The recent surge in the gold price (XAUUSD) is a confluence of factors, primarily stemming from weak US economic data, a declining US dollar, soft inflation, and persistent geopolitical uncertainty. This combination has created a favorable environment for gold, driving significant demand and pushing the XAUUSD price higher. While predicting the future price of gold is always speculative, the current trends suggest further upward potential. With the gold price (XAUUSD) showing strong momentum, now might be a strategic time to reassess your investment portfolio and consider incorporating gold. Stay informed about the latest developments in the gold market to make informed investment decisions. Remember to consult with a qualified financial advisor before making any investment decisions regarding gold price (XAUUSD) and its potential.

Featured Posts

-

Kevin Durant Fuels Angel Reese Dating Speculation With Pre Game Remark

May 17, 2025

Kevin Durant Fuels Angel Reese Dating Speculation With Pre Game Remark

May 17, 2025 -

Severances Lumon Industries A Look At Its Apple Like Corporate Design

May 17, 2025

Severances Lumon Industries A Look At Its Apple Like Corporate Design

May 17, 2025 -

North Dakotas Leading Businessperson Receives Msum Honorary Degree

May 17, 2025

North Dakotas Leading Businessperson Receives Msum Honorary Degree

May 17, 2025 -

Quiet Winter For Mariners Former Infielder Sounds Off

May 17, 2025

Quiet Winter For Mariners Former Infielder Sounds Off

May 17, 2025 -

Nba Rungtyniu Rezultato Pakitimas Teisejo Klaidos Analize

May 17, 2025

Nba Rungtyniu Rezultato Pakitimas Teisejo Klaidos Analize

May 17, 2025

Latest Posts

-

Laporan Keuangan Alat Penting Untuk Pengambilan Keputusan Bisnis Yang Bijak

May 17, 2025

Laporan Keuangan Alat Penting Untuk Pengambilan Keputusan Bisnis Yang Bijak

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025 -

Analisis Laporan Keuangan Kunci Sukses Dalam Mengelola Bisnis Anda

May 17, 2025

Analisis Laporan Keuangan Kunci Sukses Dalam Mengelola Bisnis Anda

May 17, 2025 -

Memahami Laporan Keuangan Panduan Lengkap Untuk Bisnis Kecil Dan Menengah

May 17, 2025

Memahami Laporan Keuangan Panduan Lengkap Untuk Bisnis Kecil Dan Menengah

May 17, 2025 -

Jenis Jenis Laporan Keuangan Dan Pentingnya Bagi Kesuksesan Bisnis

May 17, 2025

Jenis Jenis Laporan Keuangan Dan Pentingnya Bagi Kesuksesan Bisnis

May 17, 2025