Gold Market Update: Price Increase After Trump's Change In Tone

Table of Contents

Trump's Changed Tone and its Market Impact

Shifting Political Landscape

Recent alterations in Trump's public statements and policy decisions have sent ripples through the financial markets. Specifically, a perceived softening of his stance on trade, coupled with less aggressive language towards certain geopolitical adversaries, has influenced investor sentiment. This change, while subtle to some, has been interpreted by many as a reduction in the perceived level of political and economic risk.

- Examples of Trump's statements: Specific examples of Trump's altered statements on trade deals or foreign policy should be cited here, linking to reliable news sources for verification. For example, a statement indicating a willingness to negotiate could be mentioned, followed by a link to the relevant news article.

- Market Reactions: A detailed analysis of market reactions immediately following these announcements is crucial. Did the gold price increase or decrease? What were the immediate responses from major financial indices? Quantifiable data supports the claim.

- Trade War Developments: Any recent developments or shifts in the ongoing trade disputes should be noted here, as they directly impact market volatility and investor confidence.

Safe-Haven Demand for Gold

Gold's price increase is intrinsically linked to its role as a safe-haven asset. During periods of heightened uncertainty, investors often move towards assets perceived as stable and less susceptible to market fluctuations. Gold, with its inherent value and limited supply, fits this description perfectly.

- Definition of Safe-Haven Assets: A clear definition of safe-haven assets and their characteristics is needed. Highlight gold's position within this asset class and why it is favored.

- Historical Examples: Referencing historical instances where gold acted as a safe haven during times of crisis (e.g., the 2008 financial crisis) strengthens the argument. Use data to show gold's price performance during such periods.

- Inflation Hedge: Explain how gold acts as a hedge against inflation. When inflation rises, the purchasing power of fiat currencies decreases, while gold's value tends to hold steady or increase.

Impact on US Dollar

The relationship between the US dollar and gold prices is inversely correlated. A weakening dollar often leads to a rise in gold prices, as gold becomes relatively cheaper for holders of other currencies. Conversely, a strengthening dollar tends to depress gold prices.

- Inverse Relationship: Explain this inverse relationship clearly, and provide charts or graphs to visually demonstrate the correlation between USD movements and gold price fluctuations.

- Dollar Value Factors: Analyze the factors currently affecting the US dollar's value. Are interest rates playing a role? Are there any concerns about the US economy influencing the dollar's strength? Detailed analysis strengthens the argument.

Other Factors Influencing Gold Prices

Global Economic Uncertainty

Beyond Trump's changed tone, broader global economic factors are influencing gold prices. Slowing global growth, Brexit uncertainties, and other geopolitical tensions contribute to investor anxiety.

- Specific Examples: Give specific examples of global economic uncertainty. For instance, mention concerns about slowing economic growth in major economies, or uncertainties surrounding Brexit's ultimate impact on the global economy.

- Impact on Investor Confidence: Explain how these global uncertainties impact investor confidence and why this leads to increased demand for safe-haven assets like gold.

- Data Supporting Slowing Growth: Provide data points (e.g., GDP growth figures, manufacturing PMI) supporting claims of slowing global growth.

Central Bank Activity

Central banks' actions significantly impact the gold market. Their gold purchases or sales influence the overall supply and demand dynamics, affecting prices.

- Specific Central Bank Actions: Mention specific central banks that have recently bought or sold gold reserves and quantify their actions. For example, mention the volume of gold purchased or sold by a major central bank.

- Impact on Market Sentiment: Analyze the impact of these actions on market sentiment. Did these actions signal a belief in gold as a safe-haven asset?

- Links to Relevant Reports: Include links to official reports from central banks or reputable financial institutions that support your claims.

Supply and Demand Dynamics

The interplay of gold supply and demand significantly impacts prices. Factors like gold mining production, jewelry demand, and investment demand all contribute.

- Gold Production Data: Present data on global gold production, highlighting any significant changes in output.

- Gold Consumption Analysis: Analyze data on gold consumption in key sectors (e.g., jewelry, technology, investment).

- Supply and Demand Balance: Analyze the balance between supply and demand, explaining how an imbalance might influence price movements.

Future Outlook for Gold Prices

Price Predictions and Analysis

Predicting future gold prices is inherently challenging, but various analysts offer forecasts based on the factors discussed above.

- Expert Opinions: Summarize forecasts from reputable financial analysts, clearly attributing the predictions to their sources.

- Reasoning Behind Predictions: Explain the reasoning behind each prediction. What factors did the analysts weigh most heavily?

- Potential Price Trajectories: Illustrate potential price trajectories using charts or graphs to visualize the forecasts.

Investment Strategies

Investing in gold carries risks and rewards. Potential investment vehicles include physical gold, gold ETFs, and gold mining stocks.

- Investment Options: Detail various options for investing in gold, explaining the advantages and disadvantages of each.

- Risks Associated with Each Option: Discuss the risks associated with each investment option. For example, physical gold storage presents security concerns, while gold mining stocks are subject to market volatility.

- Considerations for Different Investor Profiles: Provide guidance tailored to different investor profiles (e.g., risk-averse vs. aggressive investors).

Conclusion

This Gold Market Update highlights the significant price increase in gold, largely attributed to a change in Trump's political rhetoric and the resulting surge in global uncertainty. This uncertainty, coupled with other economic factors, has increased demand for gold as a safe-haven asset. Central bank activity and supply and demand dynamics further influence price fluctuations. To stay ahead of the curve, staying updated on the latest gold market update and monitoring the gold price increase is crucial. Consider adding gold to your portfolio as part of a diversified investment strategy, but carefully weigh the risks and rewards before making any investment decisions. Learn more about investing in gold and making informed choices to protect your financial future.

Featured Posts

-

Istanbul Anafartalar Caddesi Aslina Uygun Yenileme Projesi

Apr 25, 2025

Istanbul Anafartalar Caddesi Aslina Uygun Yenileme Projesi

Apr 25, 2025 -

2025s Rpg Sensation Uncovering The All Star Lineup

Apr 25, 2025

2025s Rpg Sensation Uncovering The All Star Lineup

Apr 25, 2025 -

From Scatological Documents To Podcast Gold An Ai Powered Solution

Apr 25, 2025

From Scatological Documents To Podcast Gold An Ai Powered Solution

Apr 25, 2025 -

Stagecoach Festival 2025 Livestream Where And How To Watch

Apr 25, 2025

Stagecoach Festival 2025 Livestream Where And How To Watch

Apr 25, 2025 -

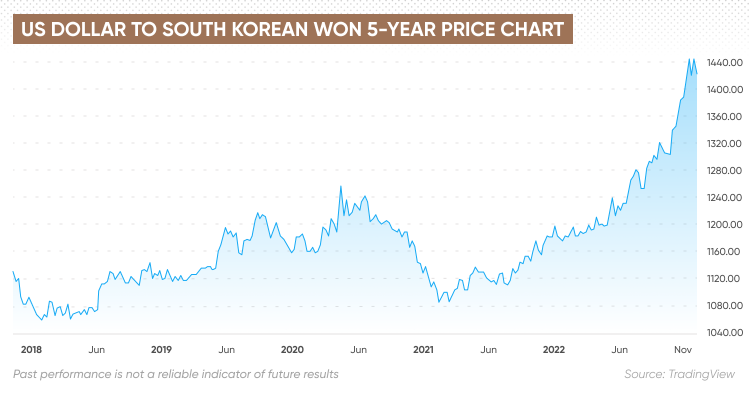

Trumps Criticism And The Krw Usd Will The South Korean Won Rise

Apr 25, 2025

Trumps Criticism And The Krw Usd Will The South Korean Won Rise

Apr 25, 2025

Latest Posts

-

Unprovoked Racist Stabbing Leaves Man Dead Woman In Custody

May 10, 2025

Unprovoked Racist Stabbing Leaves Man Dead Woman In Custody

May 10, 2025 -

Details Emerge In Racist Stabbing Death Of Man By Woman

May 10, 2025

Details Emerge In Racist Stabbing Death Of Man By Woman

May 10, 2025 -

Fatal Racist Stabbing Woman Charged In Unprovoked Killing

May 10, 2025

Fatal Racist Stabbing Woman Charged In Unprovoked Killing

May 10, 2025 -

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025 -

Unprovoked Racist Attack Woman Stabs Man To Death

May 10, 2025

Unprovoked Racist Attack Woman Stabs Man To Death

May 10, 2025