Trump's Criticism And The KRW/USD: Will The South Korean Won Rise?

Table of Contents

Trump's Past Criticisms and their Impact on the KRW/USD

Trump's presidency was marked by several pronouncements criticizing South Korea's trade balance with the US and its defense spending contributions. These criticisms directly impacted the KRW/USD exchange rate.

- Trade Imbalances: Trump repeatedly labeled the trade relationship as unfair, citing a significant US trade deficit with South Korea. These statements often triggered immediate market reactions.

- Defense Spending: His demands for increased South Korean defense spending within the context of the US-South Korea alliance also created uncertainty in the market.

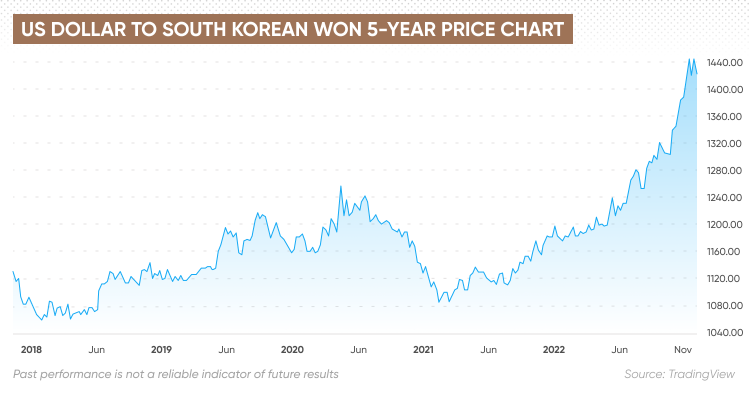

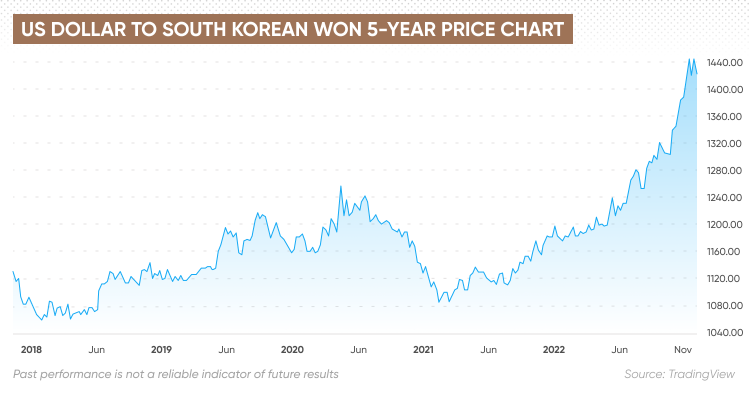

- Market Reactions: While not consistently unidirectional, Trump's criticisms often led to a weakening of the KRW against the USD in the short term, reflecting investor uncertainty. [Insert chart/graph illustrating KRW/USD fluctuations during periods of heightened Trump criticism, citing data sources].

- Underlying Economic Factors: The impact of Trump's rhetoric was intertwined with other economic factors, including interest rate differentials between the US and South Korea, and global economic conditions. For example, periods of global economic uncertainty often amplified the negative effect of Trump's statements on the KRW. [Cite relevant economic reports and news articles].

Current Geopolitical Landscape and its Influence on the KRW/USD

The current geopolitical landscape presents a complex picture for the KRW/USD. While the direct influence of Trump's rhetoric is lessened, the broader US-South Korea relationship remains a key factor.

- US-South Korea Relations: While relations have normalized since the change in US administration, ongoing geopolitical tensions in the region, especially concerning North Korea, remain a source of uncertainty.

- Trade Negotiations: Any new trade agreements or disputes between the US and South Korea could significantly influence the KRW/USD exchange rate. [Mention any ongoing or potential trade negotiations].

- Global Economic Factors: Global inflation, recessionary fears, and the strength of other major currencies (like the Chinese Yuan and Japanese Yen) all exert influence on the KRW/USD pair. A strengthening USD, often driven by global events, naturally weakens the KRW.

- Supply Chain Dynamics: South Korea's crucial role in global supply chains means that disruptions or shifts in these chains can impact the KRW's value.

Economic Fundamentals of South Korea and their Role in the KRW/USD

South Korea's strong economic fundamentals play a crucial role in determining the KRW's long-term value.

- Economic Strength and Resilience: South Korea boasts a robust and technologically advanced economy, showcasing resilience in the face of global economic downturns.

- Key Economic Indicators: Analyzing key indicators such as GDP growth, inflation rates, and the current account balance provides valuable insights into the KRW's strength. A positive current account balance, for example, generally supports a stronger currency. [Include data on these indicators].

- Future Economic Growth: Projections for future economic growth in South Korea directly affect investor confidence and the KRW's value. [Cite economic forecasts].

- Impact on KRW Value: Strong economic fundamentals generally support a strong KRW, mitigating the negative impact of geopolitical uncertainties.

Predicting the Future of the KRW/USD: Potential Scenarios

Predicting exchange rates is inherently uncertain, but we can outline potential scenarios based on various developments:

- Scenario 1 (Positive): Strong global economic growth, stable US-South Korea relations, and continued strength in South Korea's economy could lead to KRW appreciation against the USD.

- Scenario 2 (Neutral): Moderate global growth, relatively stable geopolitical conditions, and consistent South Korean economic performance might result in a relatively stable KRW/USD exchange rate.

- Scenario 3 (Negative): Global recession, heightened geopolitical tensions, and economic slowdown in South Korea could lead to KRW depreciation. [Use charts or graphs to illustrate these scenarios].

Disclaimer: Exchange rate predictions are inherently uncertain and subject to unforeseen events.

Conclusion

Trump's past criticisms of South Korea's trade practices undoubtedly impacted the KRW/USD exchange rate, often leading to short-term KRW weakness. However, the long-term trajectory of the KRW depends on a complex interplay of factors, including the current state of US-South Korea relations, global economic conditions, and South Korea's own economic performance. While the potential for the South Korean Won to rise exists, particularly under positive scenarios, predicting its future with certainty is impossible. Staying informed about developments in US-South Korea relations and the global economy is crucial for understanding the fluctuations in the KRW/USD exchange rate. Continue to monitor reliable financial news sources and economic indicators to track the impact of "Trump's Criticism and the KRW/USD" and make informed decisions.

Featured Posts

-

Arsenals Bundesliga Targets A Journalists Insight

Apr 25, 2025

Arsenals Bundesliga Targets A Journalists Insight

Apr 25, 2025 -

Are Canadian Condos Still A Smart Investment A Current Market Overview

Apr 25, 2025

Are Canadian Condos Still A Smart Investment A Current Market Overview

Apr 25, 2025 -

Unilevers Q Quarter Results Sales Beat Forecasts On Price Adjustments And Stronger Consumer Demand

Apr 25, 2025

Unilevers Q Quarter Results Sales Beat Forecasts On Price Adjustments And Stronger Consumer Demand

Apr 25, 2025 -

Northern Echo County Durham Hairdresser Awards 2025

Apr 25, 2025

Northern Echo County Durham Hairdresser Awards 2025

Apr 25, 2025 -

The Closure Of Anchor Brewing Company A Look Back At Its History

Apr 25, 2025

The Closure Of Anchor Brewing Company A Look Back At Its History

Apr 25, 2025

Latest Posts

-

Indiana High School Athletic Association Bans Transgender Girls After Trump Order

May 10, 2025

Indiana High School Athletic Association Bans Transgender Girls After Trump Order

May 10, 2025 -

How Trumps Executive Orders Affected The Transgender Community Shared Stories

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community Shared Stories

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

The Trump Era And Transgender Rights Personal Accounts

May 10, 2025

The Trump Era And Transgender Rights Personal Accounts

May 10, 2025 -

Impact Of Trump Order Ihsaas Ban On Transgender Athletes In Girls Sports

May 10, 2025

Impact Of Trump Order Ihsaas Ban On Transgender Athletes In Girls Sports

May 10, 2025