Gold Market Trends: Analyzing The Recent Double Dip

Table of Contents

Macroeconomic Factors Driving Gold Price Volatility

Several macroeconomic factors have significantly influenced the recent volatility in gold prices, contributing to the observed double dip. Understanding these factors is crucial for any investor attempting to navigate the complexities of the gold market.

Inflation and Interest Rate Hikes

Gold and interest rates share an inverse relationship. When interest rates rise, the opportunity cost of holding non-yielding assets like gold increases, making other investments more attractive. Rising interest rates, often implemented to combat inflation, typically exert downward pressure on gold prices.

- Impact of Fed policy: The Federal Reserve's (Fed) monetary policy decisions, particularly interest rate hikes, have a direct impact on the US dollar and consequently, gold prices. Aggressive rate hikes tend to strengthen the dollar, weakening gold's appeal.

- Inflation expectations: High inflation expectations can initially drive gold prices up, as investors seek a hedge against inflation. However, if the central bank effectively controls inflation through interest rate increases, this positive effect on gold can reverse.

- Real interest rates: Real interest rates (nominal rates adjusted for inflation) play a crucial role. High real interest rates reduce the appeal of gold as an inflation hedge, leading to lower prices.

Recessionary Fears and Safe-Haven Demand

Gold often serves as a safe-haven asset during times of economic uncertainty. When recessionary fears grip markets, investors tend to flock to gold, driving up its price. The recent surge in recessionary concerns globally has significantly impacted gold's price trajectory.

- Global economic slowdown: Concerns about a global economic slowdown, driven by factors like high inflation, geopolitical instability, and supply chain disruptions, fuel demand for gold as a safe haven.

- Geopolitical risks: Escalating geopolitical tensions, such as the war in Ukraine, increase uncertainty and risk aversion, further boosting demand for gold.

- Flight-to-safety capital flows: During periods of economic instability, investors move their capital towards safer assets, including gold, contributing to its price appreciation.

US Dollar Strength

The US dollar and gold prices typically exhibit an inverse relationship. A strong dollar makes gold more expensive for holders of other currencies, reducing demand and thus suppressing its price.

- Dollar index movements: The US Dollar Index (DXY) directly impacts gold prices. A rising DXY usually correlates with a falling gold price, and vice versa.

- Global currency dynamics: Global currency fluctuations influence the relative value of gold across different markets.

- Impact on gold's purchasing power: A strong dollar reduces gold's purchasing power for international investors, decreasing demand.

Geopolitical Events and their Influence on Gold Prices

Geopolitical events often introduce significant volatility into the gold market. Uncertainty and risk aversion, fueled by geopolitical tensions, enhance gold's appeal as a safe-haven asset.

The Ukraine Conflict and its Ramifications

The ongoing conflict in Ukraine has had profound ramifications for global markets, significantly impacting gold prices.

- Sanctions: The imposition of sanctions on Russia has disrupted global supply chains and created economic uncertainty, driving up gold prices.

- Energy crisis: The conflict has exacerbated the global energy crisis, fueling inflation and further boosting demand for gold as a hedge against economic instability.

- Supply chain disruptions: Disruptions to global supply chains contribute to inflation and economic uncertainty, enhancing the safe-haven appeal of gold.

- Refugee crisis: The humanitarian crisis caused by the war adds to the overall global instability and uncertainty, boosting demand for gold.

Other Geopolitical Tensions

Beyond the Ukraine conflict, other geopolitical tensions contribute to gold's safe-haven appeal and influence gold market trends.

- US-China relations: The ongoing trade tensions and geopolitical rivalry between the US and China create uncertainty in the global economic landscape, supporting gold prices.

- Market sentiment: Overall market sentiment, heavily influenced by geopolitical developments, plays a significant role in determining gold price movements. Negative sentiment tends to increase gold demand.

Technical Analysis of the Gold Market Double Dip

Technical analysis provides another perspective on understanding the recent double dip in gold prices. Studying chart patterns and trading volumes offers valuable insights into market sentiment and potential future price movements.

Chart Patterns and Price Action

Analyzing gold price charts helps identify the two distinct dips and understand the underlying market dynamics.

- Technical indicators: Using technical indicators such as moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI) helps identify potential support and resistance levels, trend reversals, and momentum changes.

- Chart patterns: Recognizing chart patterns like head and shoulders or double bottoms can offer clues about potential future price movements. These patterns often indicate trend reversals or periods of consolidation.

Trading Volume and Open Interest

Trading volume and open interest provide further insights into market sentiment and the strength of price movements.

- Relationship between volume and price movements: High trading volume accompanying a price move suggests strong conviction behind the movement. Conversely, low volume might indicate a weak trend that could be easily reversed.

- Interpretation of open interest changes: Open interest, which represents the total number of outstanding contracts, can provide insights into the overall market sentiment. Rising open interest during a price increase suggests increasing bullish sentiment.

Conclusion

The "double dip" in gold market trends reflects a complex interplay of macroeconomic factors, geopolitical events, and market-specific dynamics. Understanding these influences is critical for navigating the inherent volatility of gold investments. While recessionary fears and geopolitical uncertainty continue to support gold’s safe-haven demand, the strength of the US dollar and interest rate hikes present significant headwinds. By carefully analyzing both fundamental and technical indicators, investors can better assess the future direction of gold market trends and make informed investment decisions. Stay informed on current gold market trends to capitalize on the opportunities presented by this dynamic asset class. Understanding gold price volatility and mastering gold market analysis is key to successful investing.

Featured Posts

-

Nhl Standings Crucial Friday Games And Playoff Scenarios

May 05, 2025

Nhl Standings Crucial Friday Games And Playoff Scenarios

May 05, 2025 -

Kolkata Temperature Forecast March Heatwave Warning

May 05, 2025

Kolkata Temperature Forecast March Heatwave Warning

May 05, 2025 -

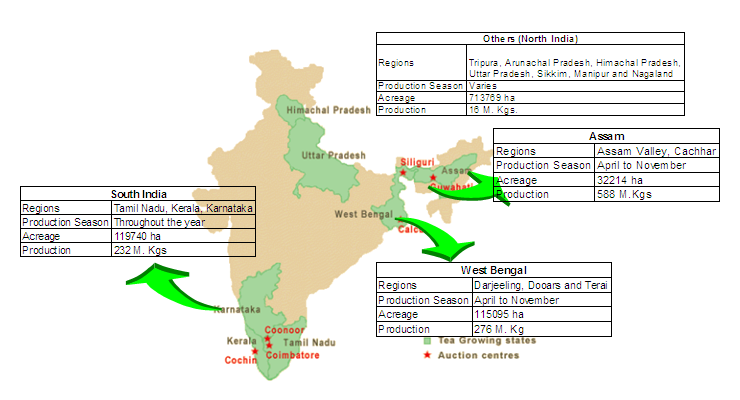

Darjeeling Tea Production Growing Concerns

May 05, 2025

Darjeeling Tea Production Growing Concerns

May 05, 2025 -

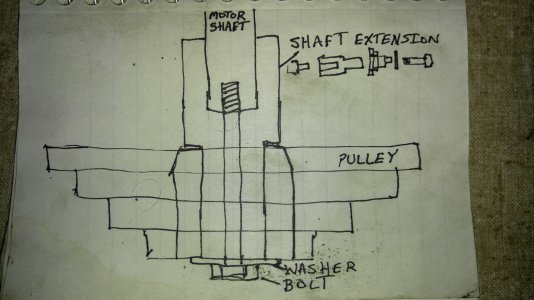

Securing Electric Motor Supplies Alternatives To Chinese Manufacturing

May 05, 2025

Securing Electric Motor Supplies Alternatives To Chinese Manufacturing

May 05, 2025 -

La Fire Aftermath Rent Increases Spark Debate Over Landlord Practices

May 05, 2025

La Fire Aftermath Rent Increases Spark Debate Over Landlord Practices

May 05, 2025

Latest Posts

-

Eurovision 2025 Germanys Next Eurovision Act Post Eurovision 2024

May 05, 2025

Eurovision 2025 Germanys Next Eurovision Act Post Eurovision 2024

May 05, 2025 -

Abor And Tynnas Basel Trip Germany To Switzerland Flight Details

May 05, 2025

Abor And Tynnas Basel Trip Germany To Switzerland Flight Details

May 05, 2025 -

Eurovision 2024 And The Road To Eurovision 2025 Germanys Selection Process

May 05, 2025

Eurovision 2024 And The Road To Eurovision 2025 Germanys Selection Process

May 05, 2025 -

Deutschland Beim Esc Abor And Tynna Aus Wien Im Rennen

May 05, 2025

Deutschland Beim Esc Abor And Tynna Aus Wien Im Rennen

May 05, 2025 -

Germanys Eurovision 2025 Hopeful The Search Begins After Eurovision 2024

May 05, 2025

Germanys Eurovision 2025 Hopeful The Search Begins After Eurovision 2024

May 05, 2025