Global Bond Market Instability: A Posthaste Analysis Of The Risks

Table of Contents

Rising Interest Rates and Their Impact

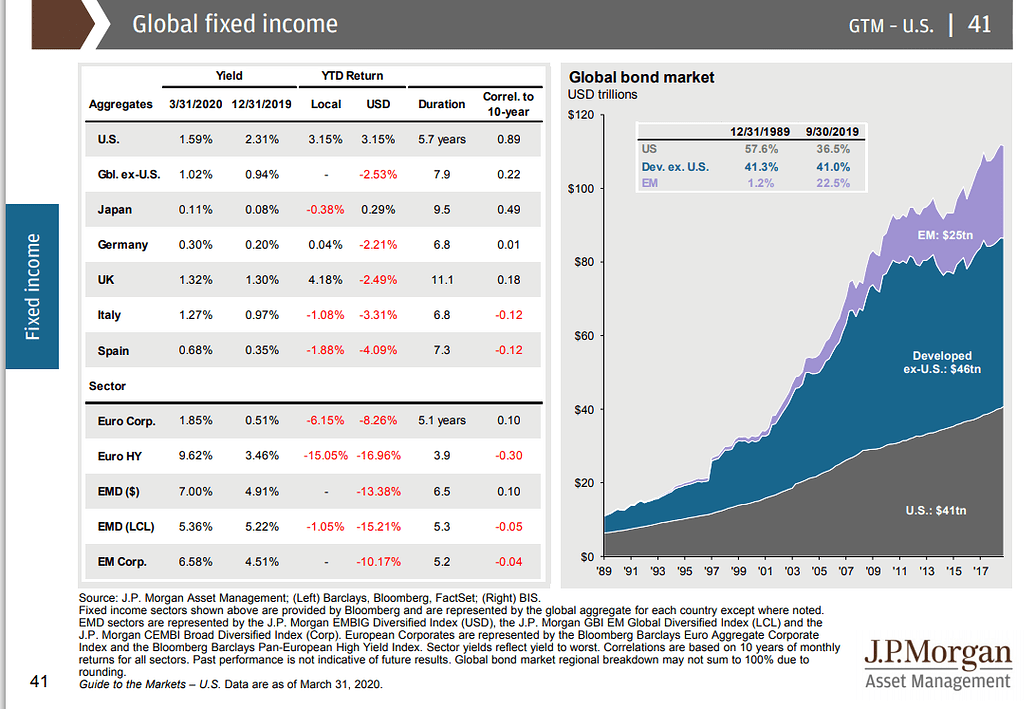

The aggressive interest rate hikes implemented by central banks worldwide to combat inflation are significantly impacting bond prices. Higher interest rates make existing bonds less attractive, leading to price declines. This is particularly true for longer-maturity bonds, which are more sensitive to interest rate changes. This interest rate risk is a primary concern for fixed-income investors.

- Increased borrowing costs for governments and corporations: Higher rates increase the cost of borrowing for both public and private entities, potentially slowing economic growth.

- Potential for increased defaults on high-yield bonds: Companies with weaker credit ratings may struggle to service their debt obligations in a higher-rate environment, increasing the risk of default.

- Steepening yield curve indicating future rate hikes: A steeper yield curve (where long-term bond yields are significantly higher than short-term yields) suggests that markets anticipate further interest rate increases.

- Impact on bond valuations and portfolio returns: Falling bond prices directly translate to lower valuations and potentially negative returns for bond portfolios. Investors need to carefully assess their duration (sensitivity to interest rate changes) to gauge the potential impact on their holdings.

Inflationary Pressures and Their Effect on Bond Yields

Persistently high inflation erodes the purchasing power of fixed-income investments. Investors demand higher yields to compensate for inflation, leading to increased bond yields and potentially lower bond prices. The real yield (nominal yield minus inflation) is a crucial factor for investors to consider. Understanding inflation risk is paramount to successful bond investing.

- Impact of unexpected inflation spikes on bond returns: Sudden increases in inflation can severely impact bond returns, potentially eroding principal and leading to significant losses.

- Strategies for inflation hedging within bond portfolios: Investors can employ strategies such as investing in inflation-protected securities (TIPS) or incorporating commodities or real estate into their portfolios to mitigate inflation risk.

- Relationship between inflation expectations and bond yields: Market expectations of future inflation are directly reflected in bond yields. Higher inflation expectations translate to higher bond yields.

- Analysis of the break-even inflation rate: The break-even inflation rate, derived from comparing the yields of nominal and inflation-protected bonds, provides insights into market expectations of future inflation.

Geopolitical Risks and Their Influence on Global Bond Markets

Geopolitical events, such as wars, trade disputes, and political instability, can significantly impact investor sentiment and cause volatility in the global bond market. Concerns about sovereign debt and the stability of certain countries can lead to capital flight and increased risk premiums. Navigating geopolitical risk requires careful analysis and proactive portfolio management.

- Impact of the Ukraine conflict on global bond yields: The ongoing war in Ukraine has introduced significant uncertainty into the global economy, impacting investor confidence and influencing bond yields globally.

- Assessment of the risk of sovereign debt defaults: Geopolitical instability can increase the likelihood of sovereign debt defaults, particularly in emerging markets.

- Analysis of investor flight to safety during times of geopolitical instability: During periods of heightened geopolitical risk, investors often flock to safe-haven assets, such as US Treasury bonds, leading to decreased yields in those markets.

- Strategies for mitigating geopolitical risk in bond portfolios: Diversification across different countries and geographies, along with careful analysis of sovereign credit ratings, can help mitigate geopolitical risk.

Credit Risk and Default Concerns

The risk of default is a crucial factor in bond investing, especially in the corporate bond market. Rising interest rates and economic slowdowns can increase the likelihood of defaults, particularly among companies with weak credit ratings. Proper due diligence and credit risk assessment are vital.

- Importance of credit rating analysis: Analyzing credit ratings from reputable agencies such as Moody's, S&P, and Fitch is essential to assess the creditworthiness of bond issuers.

- Diversification strategies to reduce credit risk: Diversifying investments across different issuers and industries can reduce the impact of potential defaults.

- Assessment of the potential for corporate bond defaults: Careful monitoring of a company's financial health, industry trends, and economic outlook is crucial in assessing the likelihood of default.

Conclusion

The global bond market is currently navigating a period of significant instability, driven by rising interest rates, persistent inflation, and geopolitical uncertainty. Understanding the interplay of these factors – interest rate risk, inflation risk, geopolitical risk, and credit risk – is crucial for investors seeking to manage risk and potentially capitalize on opportunities in the fixed-income markets. By carefully analyzing these risks, investors can make informed decisions to mitigate potential losses and optimize their bond portfolios. To stay ahead of the curve and navigate this complex landscape, continuous monitoring of the global bond market and its underlying drivers is essential. Learn more about mitigating global bond market instability and protecting your investments today.

Featured Posts

-

Get Tickets For Bbc Big Weekend 2025 In Sefton Park

May 24, 2025

Get Tickets For Bbc Big Weekend 2025 In Sefton Park

May 24, 2025 -

Porsche 911 80 Millio Forintert Extrakban Gazdag

May 24, 2025

Porsche 911 80 Millio Forintert Extrakban Gazdag

May 24, 2025 -

Tracking The Net Asset Value Amundi Msci World Ex Us Ucits Etf Acc Performance

May 24, 2025

Tracking The Net Asset Value Amundi Msci World Ex Us Ucits Etf Acc Performance

May 24, 2025 -

Shtutgart Aleksandrova Oderzhala Pobedu Nad Samsonovoy V Pervom Kruge

May 24, 2025

Shtutgart Aleksandrova Oderzhala Pobedu Nad Samsonovoy V Pervom Kruge

May 24, 2025 -

Bitcoin Reaches New Peak Amidst Positive Us Regulatory Outlook

May 24, 2025

Bitcoin Reaches New Peak Amidst Positive Us Regulatory Outlook

May 24, 2025

Latest Posts

-

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025 -

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025 -

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025