FTC Challenges Court Ruling On Microsoft's Activision Blizzard Buyout

Table of Contents

The Original Court Ruling and its Implications

A US District Judge initially ruled in favor of Microsoft's acquisition of Activision Blizzard, dismissing the FTC's attempt to block the deal. The judge's reasoning centered on the belief that the merger wouldn't substantially lessen competition within the gaming market. This decision followed a lengthy trial where both sides presented extensive evidence and arguments. The immediate market reaction was a surge in Microsoft's stock price, reflecting investor confidence in the deal's success.

- Key arguments presented by Microsoft in their defense: Microsoft argued that the merger would benefit consumers by expanding game access and fostering innovation. They also emphasized the competitive landscape, highlighting the presence of other major players like Sony and Nintendo.

- Key concerns raised by the FTC regarding the deal's impact on competition: The FTC's primary concern focused on the potential for Microsoft to leverage its ownership of Activision Blizzard titles, particularly Call of Duty, to stifle competition, potentially making them exclusive to Xbox.

- Analysis of the judge's interpretation of antitrust laws in this specific context: The judge's interpretation appeared to favor a more lenient approach to antitrust law in the context of the rapidly evolving gaming market, emphasizing the dynamism and potential for future competition.

The FTC's Arguments Against the Ruling

The FTC, unsatisfied with the initial ruling, has appealed the decision, arguing that the judge misinterpreted key aspects of antitrust law. The FTC maintains that the Microsoft Activision Blizzard buyout will substantially reduce competition, harming consumers and stifling innovation within the gaming industry. Their strategy is focused on demonstrating the potential for anti-competitive behavior stemming from Microsoft's control over key franchises.

- Specific examples cited by the FTC to illustrate potential anti-competitive behavior: The FTC heavily emphasized the potential for Microsoft to make popular Activision Blizzard titles, like Call of Duty, exclusive to its Xbox ecosystem, thereby harming competitors like Sony PlayStation.

- Evidence presented by the FTC supporting their claims: The FTC presented evidence regarding Microsoft's past behavior and statements, suggesting a pattern of leveraging market power to gain an unfair advantage. This includes internal communications and market analysis.

- Discussion of potential repercussions for Microsoft if the FTC prevails: If the FTC prevails, the deal could be unwound, resulting in substantial financial losses for Microsoft and a significant setback for its gaming ambitions.

The Future of the Microsoft Activision Blizzard Buyout

The future of the Microsoft Activision Blizzard buyout remains uncertain. The FTC's appeal sets the stage for a protracted legal battle, potentially involving higher courts and further legal challenges. The outcome will not only impact Microsoft but also shape future mergers and acquisitions in the tech industry.

- Potential scenarios depending on the outcome of the appeals process: Several scenarios are possible: the appellate court could uphold the original ruling, reverse it completely, or remand the case for further proceedings.

- Impact on other proposed mergers and acquisitions in the tech industry: The outcome will serve as a significant precedent, influencing future antitrust reviews of similar mergers and acquisitions in the tech sector.

- Long-term implications for game developers, publishers, and consumers: The decision will have a profound and lasting impact on the competitive landscape of the gaming industry, affecting game pricing, availability, and innovation for developers, publishers, and ultimately, consumers.

The Role of Call of Duty

The role of Call of Duty is central to the FTC’s arguments. The immensely popular franchise holds significant market share and is considered a key factor in the console wars. The FTC argues that making Call of Duty exclusive to Xbox would severely harm competitors like PlayStation, effectively stifling competition.

- Market share of Call of Duty and its impact on competition: Call of Duty's massive market share gives Microsoft significant leverage, raising concerns about its potential misuse.

- Arguments made by both sides regarding the future of Call of Duty: Microsoft insists it has no intention of making Call of Duty exclusive, while the FTC argues that Microsoft's past actions and statements suggest otherwise.

- Possible compromises to address the FTC’s concerns about Call of Duty: Possible compromises could include contractual agreements to ensure Call of Duty remains available on competing platforms for a defined period.

Conclusion

The FTC's challenge to the court ruling on the Microsoft Activision Blizzard buyout represents a significant legal battle with wide-ranging implications for the gaming industry and antitrust law. The case underscores the complexities of antitrust regulation in the rapidly evolving tech landscape. The outcome will have significant implications for future mergers and acquisitions in the sector, impacting game developers, publishers, and consumers alike. The central question remains: will the merger ultimately benefit or harm competition in the gaming market?

Call to Action: Stay informed on this developing legal battle concerning the Microsoft Activision Blizzard buyout. Follow this website for updates on the case and its implications for the gaming world. Further research into the complexities of antitrust law in the digital age is encouraged. Understanding the details of the Microsoft Activision Blizzard buyout is crucial for anyone interested in the future of the gaming industry.

Featured Posts

-

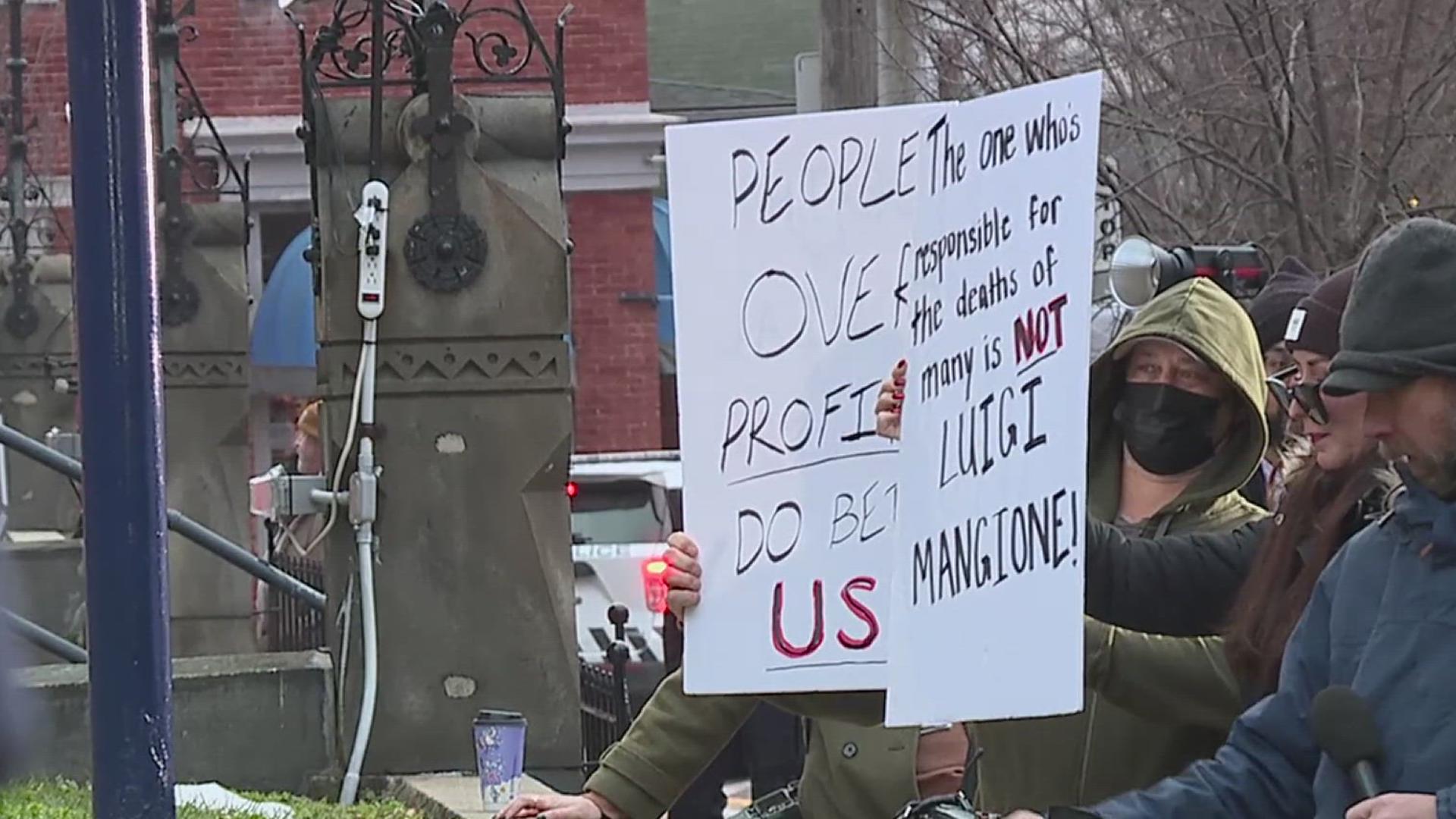

The Luigi Mangione Supporters Their Perspectives And Priorities

Apr 28, 2025

The Luigi Mangione Supporters Their Perspectives And Priorities

Apr 28, 2025 -

Key Messages From Luigi Mangiones Support Base

Apr 28, 2025

Key Messages From Luigi Mangiones Support Base

Apr 28, 2025 -

Assessing The Damage The Us Economy Under Pressure From A Canadian Travel Boycott

Apr 28, 2025

Assessing The Damage The Us Economy Under Pressure From A Canadian Travel Boycott

Apr 28, 2025 -

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025

From Scatological Documents To Podcast Success The Power Of Ai

Apr 28, 2025 -

V Mware Costs To Skyrocket 1050 At And T On Broadcoms Proposed Price Increase

Apr 28, 2025

V Mware Costs To Skyrocket 1050 At And T On Broadcoms Proposed Price Increase

Apr 28, 2025

Latest Posts

-

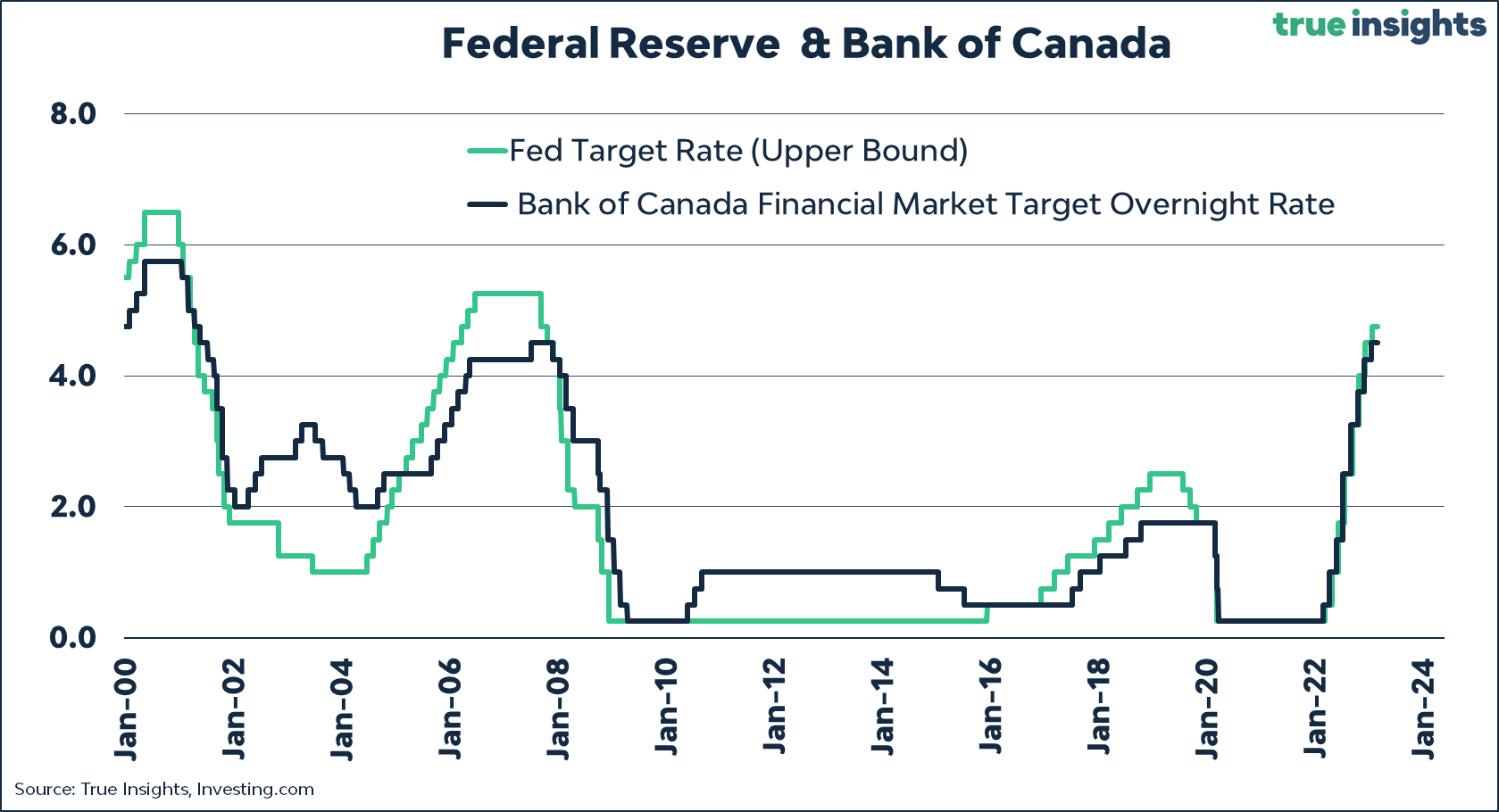

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Apr 28, 2025

Retail Sales Slump Will The Bank Of Canada Reverse Course On Interest Rates

Apr 28, 2025 -

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025

2000 Yankees Diary Posadas Homer Silences The Royals

Apr 28, 2025 -

70 Off Hudsons Bays Final Store Closing Sale

Apr 28, 2025

70 Off Hudsons Bays Final Store Closing Sale

Apr 28, 2025 -

Alberta Feels The Impact Dow Project Delay And Tariff Fallout

Apr 28, 2025

Alberta Feels The Impact Dow Project Delay And Tariff Fallout

Apr 28, 2025 -

Hudsons Bay Liquidation Find Deep Discounts Now

Apr 28, 2025

Hudsons Bay Liquidation Find Deep Discounts Now

Apr 28, 2025