Five Crucial Commodity Market Charts To Monitor This Week

Table of Contents

1. Crude Oil Price Chart: Assessing Global Energy Dynamics

Understanding the crude oil price chart is paramount for assessing global energy dynamics and their ripple effects on the broader economy.

Understanding Supply and Demand

The price of crude oil is a complex interplay of supply and demand, heavily influenced by geopolitical events and economic growth.

- OPEC+ Decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) significantly influence global oil supply through production quotas. Unexpected changes to these quotas can cause significant price volatility.

- Geopolitical Instability: The ongoing Russia-Ukraine conflict continues to disrupt global energy markets, impacting supply chains and creating uncertainty. Sanctions on Russian oil exports have tightened global supply, impacting commodity market charts significantly.

- Global Economic Growth: Strong global economic growth typically leads to increased energy demand, pushing oil prices higher. Conversely, a slowdown can dampen demand and lead to lower prices.

- Correlation with Inflation: Crude oil prices are closely linked to inflation. Rising oil prices contribute to increased production costs across various sectors, fueling inflationary pressures. Monitoring this relationship is crucial when analyzing commodity market charts.

- Impact of Alternative Energy Sources: The increasing adoption of renewable energy sources, such as solar and wind power, is gradually reducing the reliance on fossil fuels. However, the transition is gradual, and oil remains a crucial energy source in the short to medium term.

Technical Analysis of Crude Oil Charts

Technical analysis of the crude oil price chart provides insights into potential future price movements. Traders use various tools to predict trends.

- Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, help identify trends and potential support and resistance levels.

- Support and Resistance Levels: These are price levels where the price has historically struggled to break through. Identifying these levels can help predict potential price reversals.

- Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD): These are momentum indicators that help identify overbought and oversold conditions, suggesting potential price corrections.

- Candlestick Patterns: Interpreting candlestick patterns can provide insights into short-term price movements. Patterns such as hammer, engulfing, and shooting star candlesticks signal potential trend reversals.

2. Natural Gas Price Chart: A Focus on Weather and Storage Levels

The natural gas price chart is highly sensitive to weather patterns and storage levels.

The Impact of Seasonal Changes

Natural gas demand fluctuates significantly throughout the year, driven by seasonal changes.

- Heatwaves and Cold Snaps: Heatwaves increase demand for electricity generation (often using natural gas), driving prices up. Similarly, cold snaps increase demand for heating, causing a similar effect. This seasonal impact is crucial to consider when analyzing commodity market charts for natural gas.

- Storage Levels: Natural gas storage levels relative to historical averages provide a crucial indicator of future price movements. Low storage levels signal potential price increases, whereas high storage levels suggest downward pressure.

- Government Policies: Government regulations and policies related to natural gas production and consumption also influence price dynamics.

- Geopolitical Factors: Geopolitical events affecting supply routes or production in key regions can also impact natural gas prices.

Interpreting Natural Gas Chart Patterns

Analyzing the natural gas price chart using technical analysis techniques helps in identifying trends and predicting future movements.

- Support and Resistance: Identifying support and resistance levels is crucial for predicting price reversals.

- Trendlines: Drawing trendlines helps identify the overall direction of the price and potential breakout levels.

- Technical Indicators: Applying technical indicators like RSI and MACD helps confirm price trends and identify overbought or oversold conditions.

3. Agricultural Commodity Charts (e.g., Corn, Wheat, Soybeans): Weather and Geopolitical Risks

Agricultural commodity charts, such as those for corn, wheat, and soybeans, are sensitive to both weather patterns and geopolitical events.

The Influence of Global Weather Patterns

Weather events significantly influence crop yields and, consequently, commodity prices.

- Droughts and Floods: These extreme weather events can drastically reduce crop yields, leading to price spikes.

- Weather Forecasts: Accurate weather forecasts can help predict potential supply disruptions and impact future prices. This is crucial information for those analyzing commodity market charts.

- Climate Change: Climate change is expected to increase the frequency and intensity of extreme weather events, adding to the volatility of agricultural commodity markets.

Geopolitical Instability and Supply Chain Disruptions

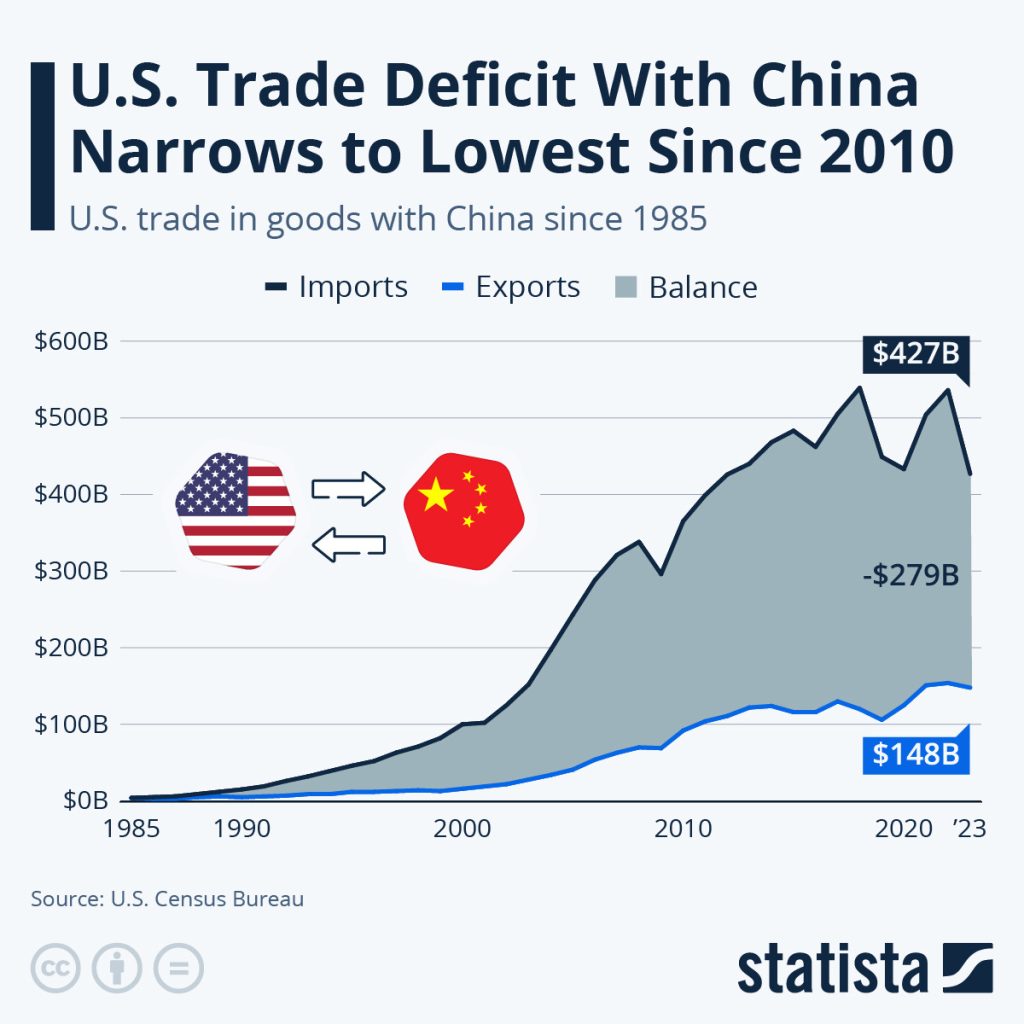

Geopolitical events, trade wars, and sanctions significantly impact agricultural commodity markets.

- Conflicts and Sanctions: Conflicts in major agricultural producing regions can disrupt supply chains and lead to price increases.

- Export Restrictions: Government policies restricting exports can limit global supply and drive up prices.

- Speculation: Speculation in agricultural commodity futures markets can also contribute to price volatility.

4. Precious Metals Chart (e.g., Gold, Silver): Safe-Haven Demand and Inflation Hedges

Precious metals, such as gold and silver, are often seen as safe-haven assets and inflation hedges.

Gold as a Safe Haven Asset

During times of economic uncertainty or geopolitical instability, investors often flock to gold as a safe-haven asset.

- Inverse Relationship with the US Dollar: Gold prices often have an inverse relationship with the US dollar. A weaker dollar tends to push gold prices higher.

- Impact of Interest Rate Hikes: Interest rate hikes typically increase the opportunity cost of holding gold (which doesn't pay interest), potentially putting downward pressure on gold prices.

- Geopolitical Risks: Geopolitical instability often boosts gold's appeal as a safe-haven asset, driving prices higher.

Silver's Industrial Applications and Price Drivers

Silver's price is driven by both its safe-haven appeal and its industrial applications.

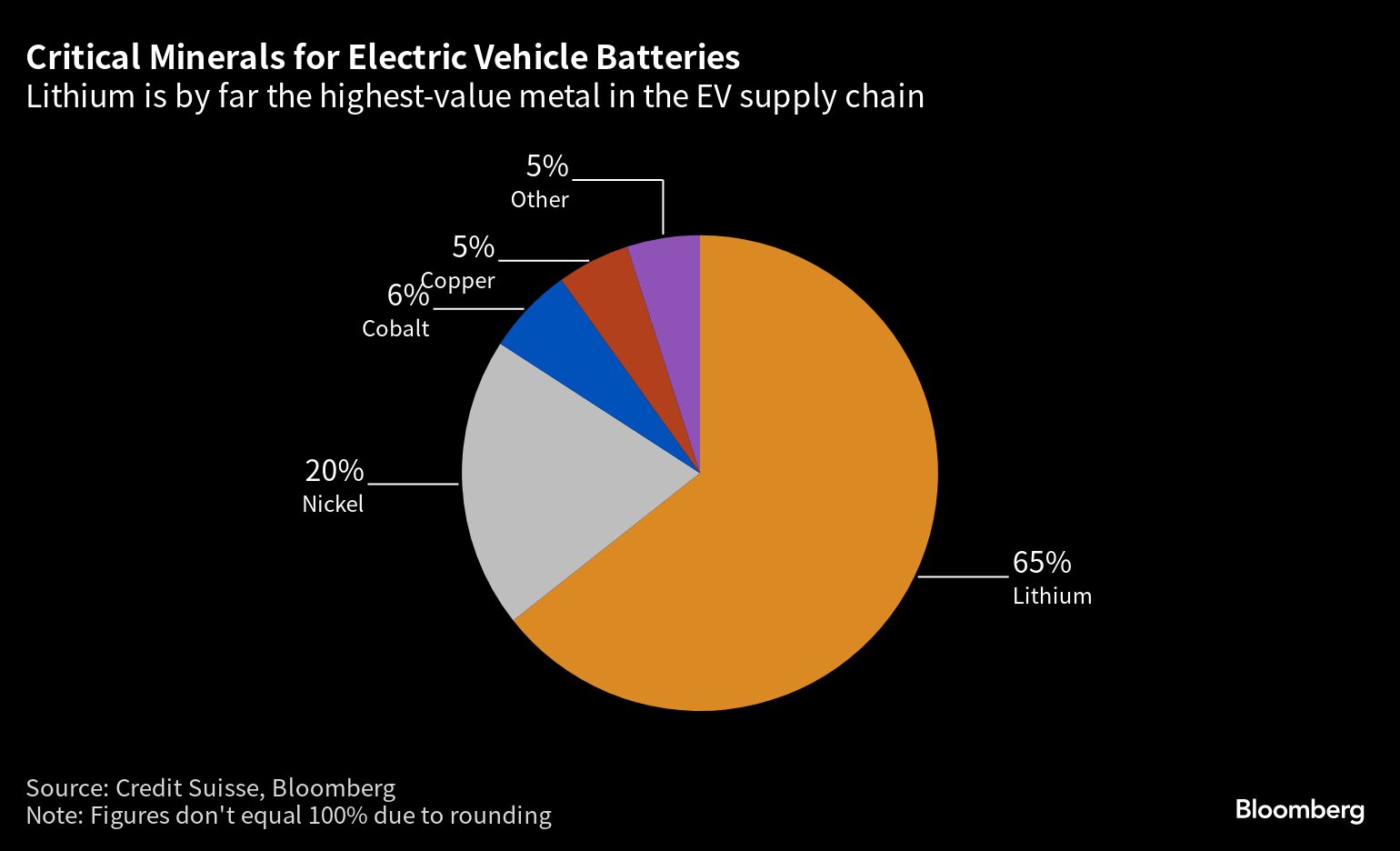

- Industrial Demand: Silver's industrial applications in electronics, solar panels, and other sectors drive its demand.

- Correlation with Industrial Production: Silver prices often correlate with industrial production levels. Strong industrial activity tends to boost silver demand and prices.

- Technological Advancements: Technological advancements requiring silver (e.g., electric vehicles) can boost demand and prices.

5. Base Metals Chart (e.g., Copper, Aluminum): Global Economic Growth and Industrial Activity

Base metals like copper and aluminum are closely tied to global economic growth and industrial activity.

Copper as an Indicator of Economic Health

Copper is often considered an indicator of economic health due to its widespread use in construction, manufacturing, and infrastructure projects.

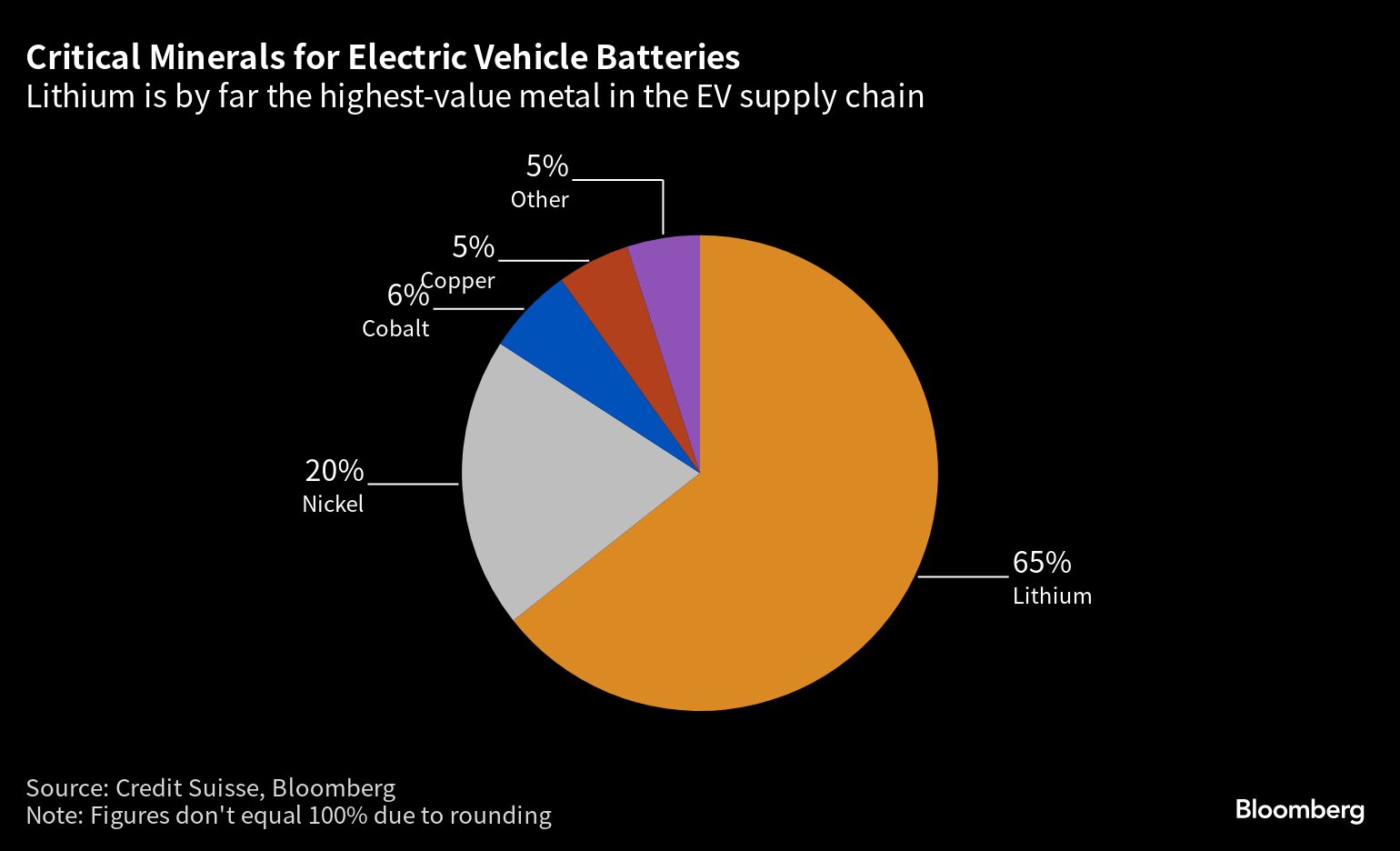

- Correlation with Construction Activity: Copper prices often correlate with construction activity. Strong construction activity boosts copper demand and prices.

- Electric Vehicle Adoption: The increasing adoption of electric vehicles (EVs) is boosting demand for copper, which is used extensively in EV batteries and wiring.

- Supply Chain Disruptions: Supply chain disruptions in copper production can significantly impact prices.

Aluminum's Role in Various Industries

Aluminum's price is affected by its use in various industries, including transportation, packaging, and construction.

- Energy Prices: Energy prices play a significant role in aluminum production costs. High energy prices can put upward pressure on aluminum prices.

- Recycling: Aluminum recycling plays a crucial role in reducing the reliance on primary aluminum production, influencing market supply and price.

- Government Regulations: Government regulations related to aluminum production (e.g., emissions standards) can impact production costs and, ultimately, prices.

Conclusion

Monitoring these five crucial commodity market charts – crude oil, natural gas, agricultural commodities, precious metals, and base metals – is vital for understanding current market trends and potential future price movements. Each chart offers unique insights into the global economic landscape, reflecting supply and demand dynamics, geopolitical risks, and technological advancements. By understanding the factors influencing each commodity, you can make more informed investment decisions. Stay ahead of the curve by regularly monitoring these five crucial commodity market charts. Understanding these indicators is key to navigating the complexities of the commodity markets. For more detailed analysis and market updates, check out [link to relevant resource].

Featured Posts

-

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts

May 06, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts

May 06, 2025 -

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025 -

Analysis Of Ddgs Dont Take My Son Diss Track Aimed At Halle Bailey

May 06, 2025

Analysis Of Ddgs Dont Take My Son Diss Track Aimed At Halle Bailey

May 06, 2025

Latest Posts

-

Fans Go Wild Sabrina Carpenter To Headline Fortnite Virtual Concert

May 06, 2025

Fans Go Wild Sabrina Carpenter To Headline Fortnite Virtual Concert

May 06, 2025 -

Fortnite Announces Sabrina Carpenter As Headlining Virtual Artist

May 06, 2025

Fortnite Announces Sabrina Carpenter As Headlining Virtual Artist

May 06, 2025 -

Fortnites Next Big Event Sabrina Carpenters Virtual Show

May 06, 2025

Fortnites Next Big Event Sabrina Carpenters Virtual Show

May 06, 2025 -

Fortnite Season 8 Sabrina Carpenter Takes The Stage

May 06, 2025

Fortnite Season 8 Sabrina Carpenter Takes The Stage

May 06, 2025 -

Virtual Concert Sabrina Carpenter Headlines Fortnite Festival

May 06, 2025

Virtual Concert Sabrina Carpenter Headlines Fortnite Festival

May 06, 2025