Fremantle Q1 Revenue Down 5.6%: Impact Of Buyer Budget Cuts

Table of Contents

The Extent of the Revenue Decline and its Financial Implications for Fremantle

The 5.6% decrease in Fremantle's Q1 revenue represents a substantial setback, marking a significant deviation from previous quarters and years of consistent growth. While the exact figures require further official disclosure from Fremantle, the impact on profitability is undeniable. This revenue shortfall directly affects Fremantle's ability to invest in new projects, potentially delaying or cancelling promising productions. The financial implications extend beyond immediate profitability; reduced investment could hinder future growth and competitiveness within the dynamic media industry.

- Specific figures illustrating the revenue drop: (Insert specific figures once available from official Fremantle reports. For example: "Revenue dropped from X million in Q1 2023 to Y million in Q1 2024.")

- Impact on share prices: (Insert information about share price fluctuations, if applicable. Example: "This revenue dip resulted in a Z% decrease in Fremantle's share price.")

- Mention of any cost-cutting measures implemented by Fremantle: (Include any publicly announced cost-cutting measures, such as staff reductions or project cancellations. Example: "In response, Fremantle announced a restructuring plan including a focus on higher-margin productions.")

Identifying the Key Factors Contributing to Buyer Budget Cuts

Several interconnected factors contribute to the widespread buyer budget cuts impacting Fremantle and the wider media industry. The current macroeconomic climate, characterized by inflation and an economic slowdown, plays a significant role. Consumers are tightening their belts, leading to decreased spending on entertainment subscriptions, impacting streaming platforms' revenue streams and their subsequent content acquisition budgets.

Furthermore, intense competition and consolidation within the streaming landscape are forcing platforms to re-evaluate their content strategies. This involves stricter budgeting and a more cautious approach to content acquisition, prioritizing only projects with a high probability of success.

- Examples of specific buyers reducing their budgets: (Include examples of streaming platforms or broadcasters that have publicly announced budget cuts.)

- Specific reasons cited by buyers for budget cuts: (Include quotes or paraphrased statements from industry reports detailing reasons for reduced spending, such as subscriber growth challenges or changing viewership habits.)

- Mention of shifts in content consumption patterns: (Discuss changes in viewer behavior, such as increased cord-cutting or shifts in preferred content genres.)

Impact on Different Fremantle Production Sectors (TV, Film, etc.)

The impact of buyer budget cuts is not uniform across all of Fremantle's production sectors. While precise data is awaited, it's likely that certain genres and formats are disproportionately affected. For instance, high-budget productions, particularly in film, may face greater challenges securing funding compared to lower-budget TV series. The consequences for future project development and greenlighting are significant, potentially leading to delays or cancellations and a shift towards lower-risk productions.

- Data illustrating the impact on different production sectors: (Insert data once available from official sources comparing the impact across different production sectors – TV, film, digital.)

- Examples of projects potentially delayed or cancelled: (Cite examples, if available, of Fremantle projects affected by budget cuts.)

- Discussion of potential adaptation strategies by Fremantle: (Analyze potential strategies Fremantle might employ to navigate this challenging environment, like focusing on co-productions or exploring alternative revenue streams.)

Potential Long-Term Consequences and Fremantle's Response

The long-term consequences of these budget cuts extend beyond Fremantle's immediate financial performance. Increased competition among production companies for a shrinking pool of funds is likely. This could lead to a consolidation within the industry, with larger companies potentially acquiring smaller ones.

Fremantle's response will be crucial in determining its future success. Strategies may include diversification into new content formats or platforms, focusing on cost-efficient production models, and strengthening relationships with key buyers. Innovation and adaptability will be key to navigating this challenging period.

- Potential for increased competition among production companies: (Discuss the competitive landscape and the potential for mergers and acquisitions.)

- Discussion of Fremantle's innovative strategies to mitigate the impact: (Speculate on possible strategies like exploring alternative financing models or focusing on international co-productions.)

- Predictions about future revenue and market share: (Offer cautious predictions about Fremantle's future performance based on the current situation.)

Conclusion: Navigating the Challenges: Fremantle's Future Amidst Buyer Budget Cuts

The 5.6% dip in Fremantle's Q1 revenue underscores the significant impact of buyer budget cuts on the media industry. Macroeconomic factors, streaming platform competition, and shifting content consumption patterns are key contributors to this trend. While the challenges are substantial, Fremantle's response will be critical in shaping its future. Adapting to changing market dynamics, embracing innovative strategies, and forging strong partnerships will be crucial for navigating this challenging landscape. To stay informed about the evolving media landscape and Fremantle’s performance amidst these buyer budget cuts, subscribe to our updates or follow reputable industry news sources for continued analysis of Fremantle's performance and the challenges faced by production companies in this competitive market.

Featured Posts

-

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 20, 2025

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 20, 2025 -

Adressage Des Batiments D Abidjan Explication Du Nouveau Systeme De Numerotation

May 20, 2025

Adressage Des Batiments D Abidjan Explication Du Nouveau Systeme De Numerotation

May 20, 2025 -

Is Big Bear Ai Bbai A Smart Defense Investment Buy Rating Suggests Yes

May 20, 2025

Is Big Bear Ai Bbai A Smart Defense Investment Buy Rating Suggests Yes

May 20, 2025 -

Albrlman Ysdq Ela Mkhalfat Wardt Btqaryr Dywan Almhasbt Leamy 2022 W 2023

May 20, 2025

Albrlman Ysdq Ela Mkhalfat Wardt Btqaryr Dywan Almhasbt Leamy 2022 W 2023

May 20, 2025 -

Solve The Nyt Mini Crossword March 15 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 15 Answers

May 20, 2025

Latest Posts

-

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025 -

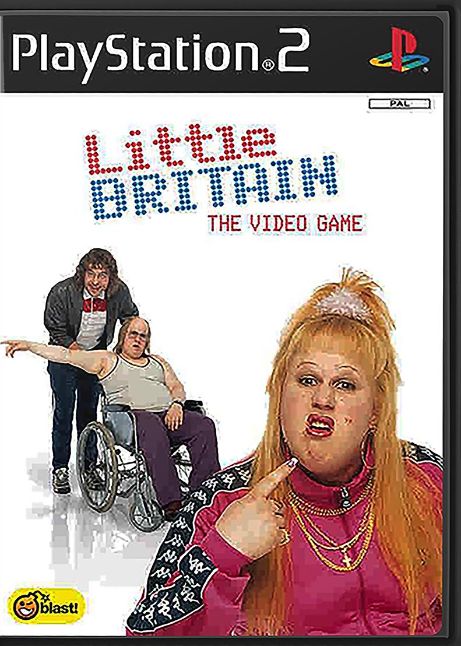

Gen Z And Little Britain A Post Cancellation Phenomenon

May 21, 2025

Gen Z And Little Britain A Post Cancellation Phenomenon

May 21, 2025 -

David Walliams And Simon Cowell Britains Got Talent Feud Explodes

May 21, 2025

David Walliams And Simon Cowell Britains Got Talent Feud Explodes

May 21, 2025 -

Little Britains Resurgence Understanding Gen Zs Appreciation

May 21, 2025

Little Britains Resurgence Understanding Gen Zs Appreciation

May 21, 2025 -

Klopps Future Uncertain Agents Comments On Real Madrid Interest

May 21, 2025

Klopps Future Uncertain Agents Comments On Real Madrid Interest

May 21, 2025