Is BigBear.ai (BBAI) A Smart Defense Investment? Buy Rating Suggests Yes

Table of Contents

BigBear.ai's Core Capabilities and Competitive Advantage

BigBear.ai's core strength lies in its advanced AI and data analytics capabilities specifically tailored for defense applications. This provides a significant competitive advantage in the burgeoning AI defense market.

Advanced AI and Data Analytics for Defense

BigBear.ai offers a suite of AI-driven solutions designed to enhance national security and defense capabilities. Their technology is at the forefront of AI defense solutions.

- Predictive Analytics: BigBear.ai utilizes machine learning algorithms to analyze vast datasets, predicting potential threats and optimizing resource allocation for proactive defense strategies. This contributes to more efficient and effective defense operations.

- Intelligence Analysis: Their AI tools automate the process of sifting through massive amounts of intelligence data, identifying patterns and insights that would otherwise be missed, leading to improved decision-making. This is a key element of their AI defense solutions.

- Cybersecurity Solutions: BigBear.ai provides advanced cybersecurity solutions leveraging AI to detect and respond to cyber threats in real-time, protecting sensitive defense systems and data. This strengthens the overall security posture of their clients.

- Unique Selling Proposition: BigBear.ai's unique blend of cutting-edge AI technology and deep domain expertise in defense makes them a highly sought-after partner for government agencies. Their solutions are not just technologically advanced but also strategically relevant.

Government Contracts and Market Share

BigBear.ai's success is significantly driven by its strong track record of securing substantial government contracts. This demonstrates their ability to deliver high-value AI defense solutions.

- Key Contract Wins: [Insert specific examples of significant contract wins, including contract values and details if publicly available]. These contracts highlight the trust placed in BigBear.ai's capabilities by government organizations.

- Contract Pipeline: [Discuss the company's pipeline of potential future contracts, indicating the potential for continued growth]. A robust pipeline signifies the ongoing demand for their AI defense solutions and ensures future revenue streams.

- Market Share: While precise market share data can be difficult to obtain in the rapidly evolving defense AI sector, BigBear.ai's prominence and consistent contract wins suggest a significant and growing market presence.

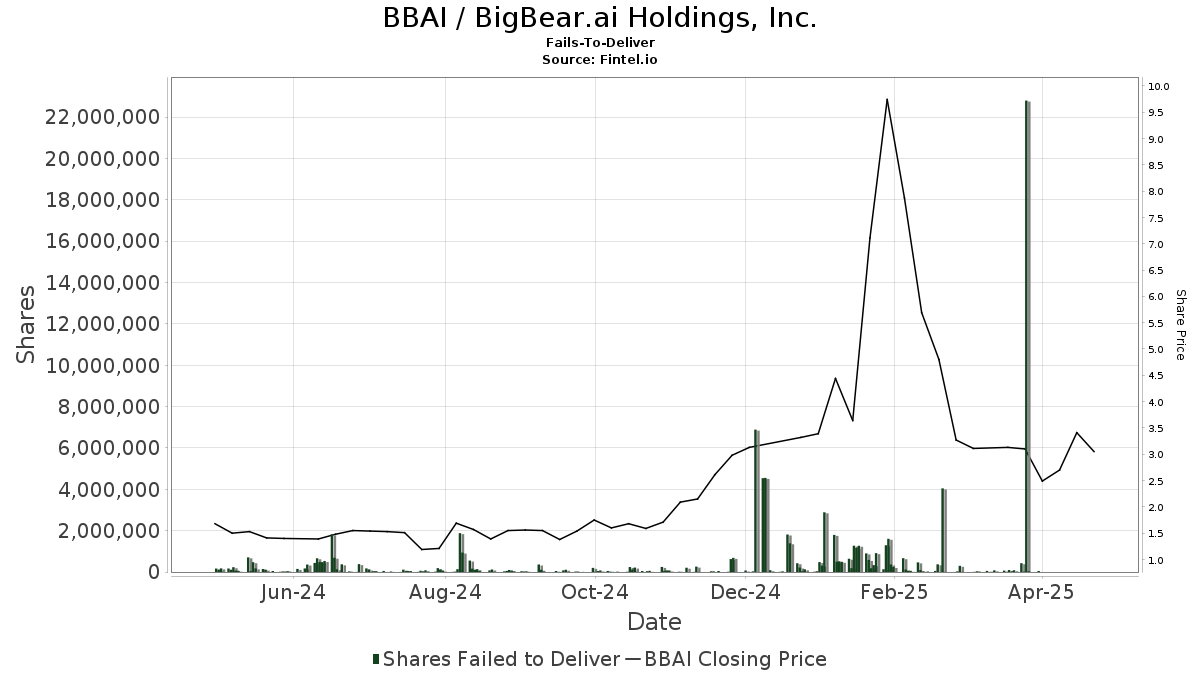

Financial Performance and Future Growth Potential

Analyzing BigBear.ai's financial performance offers valuable insights into its potential for future growth and profitability. Strong financials are crucial for any smart investment.

Revenue Growth and Profitability

BigBear.ai has shown [insert data on revenue growth, e.g., percentage increase year-over-year]. While profitability may still be developing, [discuss any indications of improving profit margins or paths to profitability]. Investors should carefully assess the company's financials, focusing on revenue growth, operating expenses, and the trajectory of profitability.

- Key Financial Metrics: [Include specific financial data points such as revenue, earnings per share (EPS), and debt-to-equity ratio, referencing reliable financial sources]. These metrics offer a comprehensive view of BigBear.ai's financial health.

- Financial Health: [Analyze the company's financial health using relevant ratios and metrics, assessing its solvency, liquidity, and overall financial stability]. A thorough analysis of these factors is crucial for evaluating the investment's long-term viability.

Analyst Ratings and Price Targets

Several financial analysts have issued buy ratings for BBAI stock, bolstering the positive outlook on the company's future.

- Buy Ratings: [List specific analysts and their buy ratings, including their rationale and price targets]. These buy ratings from reputable firms signal considerable confidence in the company's future prospects.

- Price Targets: [Summarize the range of price targets provided by different analysts, highlighting the potential for significant upside]. The price targets offer a range of potential returns, informing the investor's risk assessment.

Risks and Considerations for Investors

While the outlook for BigBear.ai is positive, potential investors must carefully consider the inherent risks associated with the defense sector and the technology industry.

Market Volatility and Geopolitical Risks

The defense sector is susceptible to market volatility and geopolitical instability.

- Government Spending Fluctuations: Changes in government spending priorities can significantly impact demand for defense technology, affecting BigBear.ai's revenue.

- Geopolitical Instability: Global geopolitical events and conflicts can influence government budgets and the demand for defense solutions.

- Competition: Intense competition among defense contractors, including larger, more established firms, can impact market share and profitability.

Competition and Technological Disruption

The rapid pace of technological advancement necessitates continuous innovation to maintain a competitive edge.

- Key Competitors: [List key competitors and analyze their strengths and weaknesses relative to BigBear.ai]. Understanding the competitive landscape is essential for assessing the company's long-term prospects.

- Technological Disruption: New and emerging technologies could render existing defense technologies obsolete, impacting BigBear.ai's market position.

- Adaptability: BigBear.ai's ability to adapt to emerging technologies and maintain its competitive edge is crucial for its long-term success.

Conclusion

BigBear.ai (BBAI) presents a compelling investment opportunity within the rapidly growing AI defense market. The positive analyst ratings, coupled with the company's strong technological capabilities and growing presence in the defense sector, point towards substantial growth potential. However, investors must carefully weigh these potential rewards against the inherent risks associated with investing in the defense sector and technology companies, including market volatility, geopolitical factors, and the ever-present threat of technological disruption.

Is BigBear.ai (BBAI) a smart defense investment for your portfolio? Further research and careful consideration of your individual investment strategy are crucial before making any decisions regarding BBAI stock or other defense sector investments. Conduct thorough due diligence before investing in BBAI or any stock. Learn more about BigBear.ai and explore other defense technology investment opportunities. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Zoey Stark Sidelined After Wwe Raw Injury

May 20, 2025

Zoey Stark Sidelined After Wwe Raw Injury

May 20, 2025 -

Job Exchange Scheme Navys Burke Convicted On Bribery Charges

May 20, 2025

Job Exchange Scheme Navys Burke Convicted On Bribery Charges

May 20, 2025 -

Understanding The Big Bear Ai Bbai Stock Market Performance In 2025

May 20, 2025

Understanding The Big Bear Ai Bbai Stock Market Performance In 2025

May 20, 2025 -

Nagelsmann Names Goretzka To Germanys Nations League Team

May 20, 2025

Nagelsmann Names Goretzka To Germanys Nations League Team

May 20, 2025 -

Ferraris Chinese Gp Start Hamilton Leclerc Contact And Its Fallout

May 20, 2025

Ferraris Chinese Gp Start Hamilton Leclerc Contact And Its Fallout

May 20, 2025

Latest Posts

-

New The Amazing World Of Gumball Teaser Trailer On Hulu

May 21, 2025

New The Amazing World Of Gumball Teaser Trailer On Hulu

May 21, 2025 -

The Amazing World Of Gumball Streaming Now On Hulu And Disney

May 21, 2025

The Amazing World Of Gumball Streaming Now On Hulu And Disney

May 21, 2025 -

New Dexter Funko Pop Vinyls Released

May 21, 2025

New Dexter Funko Pop Vinyls Released

May 21, 2025 -

The Amazing World Of Gumball Hulu Drops Premiere Teaser Trailer

May 21, 2025

The Amazing World Of Gumball Hulu Drops Premiere Teaser Trailer

May 21, 2025 -

Gumball Moves To Hulu And Disney What To Expect

May 21, 2025

Gumball Moves To Hulu And Disney What To Expect

May 21, 2025