Frankfurt Stock Exchange: DAX Opens Steady Following Record-Breaking Period

Table of Contents

The DAX's Recent Record-Breaking Performance

The DAX, Germany's leading stock market index, scaled new heights in recent weeks, achieving levels previously unseen. This remarkable performance reflects a confluence of positive factors bolstering the German economy and the broader global market. Strong corporate earnings, positive economic indicators, and supportive global market trends all played a crucial role. The impressive market capitalization growth underscores the robust health of German companies and the overall confidence in the German economy.

- Specific Dates and DAX Values: For instance, on [Date], the DAX reached [Value], surpassing its previous record high of [Value] set on [Date].

- Key Contributing Companies: Companies like [Company A] and [Company B], significantly contributed to the DAX's rise, driven by [reason for Company A's growth] and [reason for Company B's growth], respectively.

- Supporting Evidence: Reports from [Financial News Source 1] and [Financial News Source 2] corroborate this impressive growth, highlighting strong economic fundamentals and positive investor sentiment. These reports detail the positive impact of [specific policy or event].

Factors Contributing to the Steady Opening

Despite the recent record-breaking run, the DAX opened relatively steadily. This cautious optimism reflects a complex interplay of factors. While some investors might be taking profits after the significant gains, others remain confident in the long-term prospects of the German economy and the companies listed on the Frankfurt Stock Exchange.

- Trading Volume Analysis: Initial trading volume on the opening day indicated [high/low/moderate] investor activity, suggesting [interpretation of trading volume – e.g., profit-taking, cautious optimism, etc.].

- Sectoral Performance: The automotive sector showed [positive/negative/neutral] performance, while the technology sector displayed [positive/negative/neutral] trends, reflecting the overall market sentiment and sector-specific dynamics within the Frankfurt Stock Exchange.

- Analyst Predictions: Analysts at [Financial Institution] predict [prediction about DAX performance], citing [reason for prediction] as a key factor influencing their outlook. This sentiment is largely shared across the investment community, though differing views exist regarding the specific trajectory. Geopolitical events, such as [mention specific geopolitical event], may also impact the market in the coming months.

Potential Future Trends for the Frankfurt Stock Exchange and the DAX

Predicting the future trajectory of the DAX is inherently challenging; however, several factors suggest potential future trends for the Frankfurt Stock Exchange. Continued growth is certainly possible, driven by factors such as sustained corporate earnings, technological advancements, and global economic stability. However, potential headwinds, such as inflation, geopolitical uncertainties, and shifts in central bank policies, could lead to market corrections.

- Short-Term/Long-Term Predictions: In the short term, the DAX is expected to [prediction], while the long-term outlook hinges on [factors influencing long-term growth].

- Risks and Rewards: Investing in the DAX presents both significant opportunities and risks. Investors should carefully assess their risk tolerance and diversification strategies before making any investment decisions.

- Upcoming Events: The upcoming [important economic event or announcement] could significantly impact investor sentiment and the overall performance of the Frankfurt Stock Exchange and the DAX.

Conclusion: Frankfurt Stock Exchange and DAX Outlook

The Frankfurt Stock Exchange, and its flagship index, the DAX, recently experienced a remarkable period of growth, reaching record highs. The subsequent steady opening reflects a balance between profit-taking and continued optimism for the future. While several factors point towards continued growth, investors should remain vigilant about potential challenges. To navigate this dynamic market effectively, it's crucial to monitor the DAX closely and stay informed about global economic trends, central bank policies, and geopolitical events that might influence the Frankfurt Stock Exchange. Track the Frankfurt Stock Exchange and invest wisely in the DAX by staying informed and diversifying your portfolio. Learn more about the Frankfurt Stock Exchange and its impact on the global market through reputable financial news sources and research platforms.

Featured Posts

-

M56 Traffic Delays Real Time Updates Following Accident

May 24, 2025

M56 Traffic Delays Real Time Updates Following Accident

May 24, 2025 -

Frances National Rally Sundays Demonstration And Its Implications For Le Pen

May 24, 2025

Frances National Rally Sundays Demonstration And Its Implications For Le Pen

May 24, 2025 -

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025 -

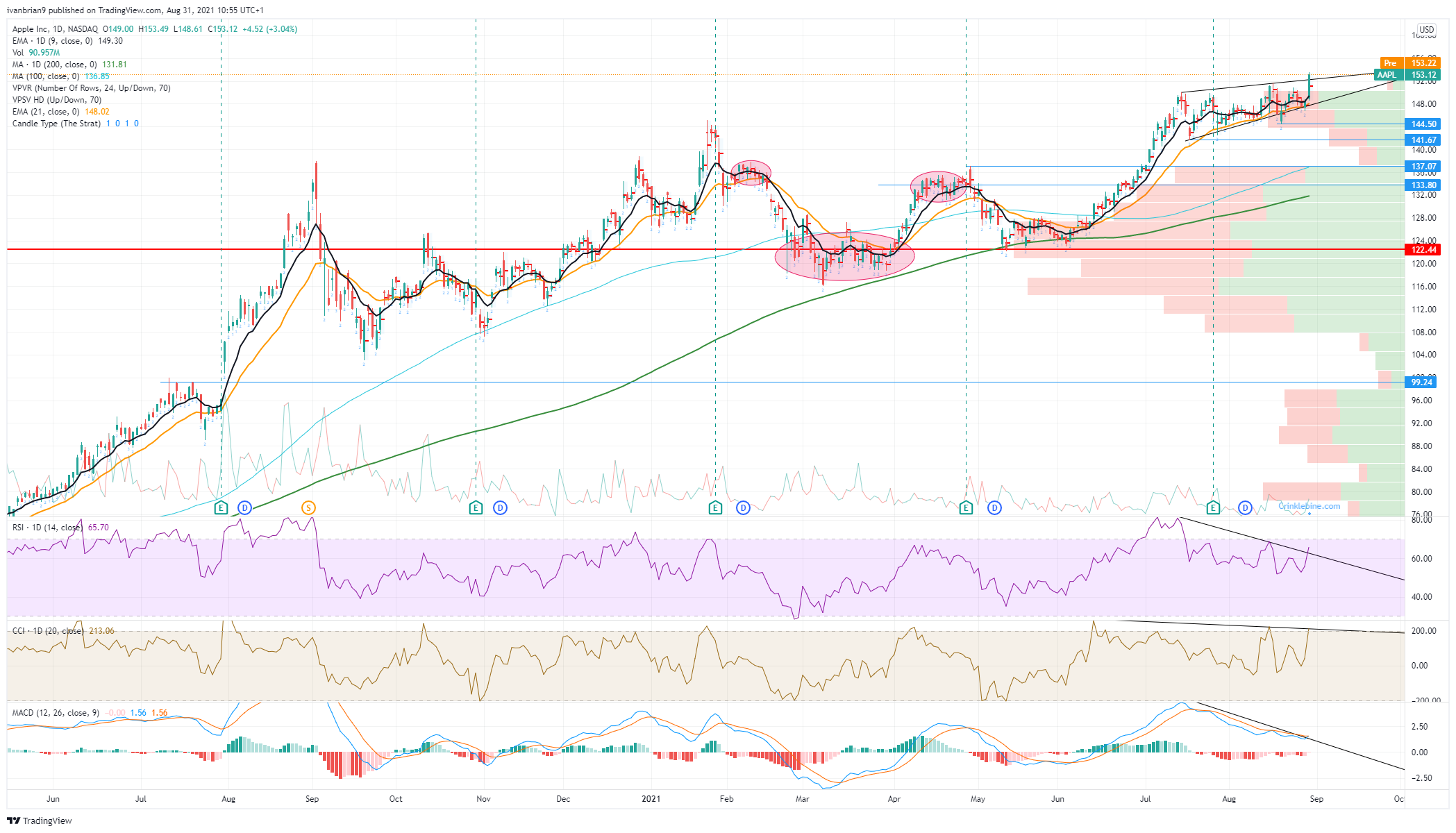

Apple Stocks Q2 Report What Investors Need To Know

May 24, 2025

Apple Stocks Q2 Report What Investors Need To Know

May 24, 2025 -

Where Will Apple Stock Aapl Go Next Key Price Level Predictions

May 24, 2025

Where Will Apple Stock Aapl Go Next Key Price Level Predictions

May 24, 2025

Latest Posts

-

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025 -

Apple Stock Performance Ahead Of Q2 Earnings Announcement

May 24, 2025

Apple Stock Performance Ahead Of Q2 Earnings Announcement

May 24, 2025 -

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025