Ford's Brazilian Struggle: BYD's Global EV Leadership Expands

Table of Contents

Ford's Challenges in the Brazilian Market

Declining Sales and Market Share

Ford Brazil sales have consistently declined, leading to a significant drop in its market share. This downturn is a result of several interconnected factors. The Brazilian automotive market, once a key region for Ford, is now proving increasingly challenging.

- Declining popularity of key models: The Ford Ka, once a popular compact car, has seen dramatically reduced sales, mirroring a broader trend across the Ford range in Brazil.

- Pricing challenges: Ford's pricing strategy has failed to keep pace with competitors offering comparable vehicles at lower prices.

- Increased competition: The rise of other international and local brands offering attractive alternatives has further eroded Ford's market position. This intense Ford Brazil sales pressure has forced a reevaluation of its market strategy.

Analyzing Ford market share Brazil reveals a concerning trend, illustrating the brand's struggle to remain competitive in this vital market.

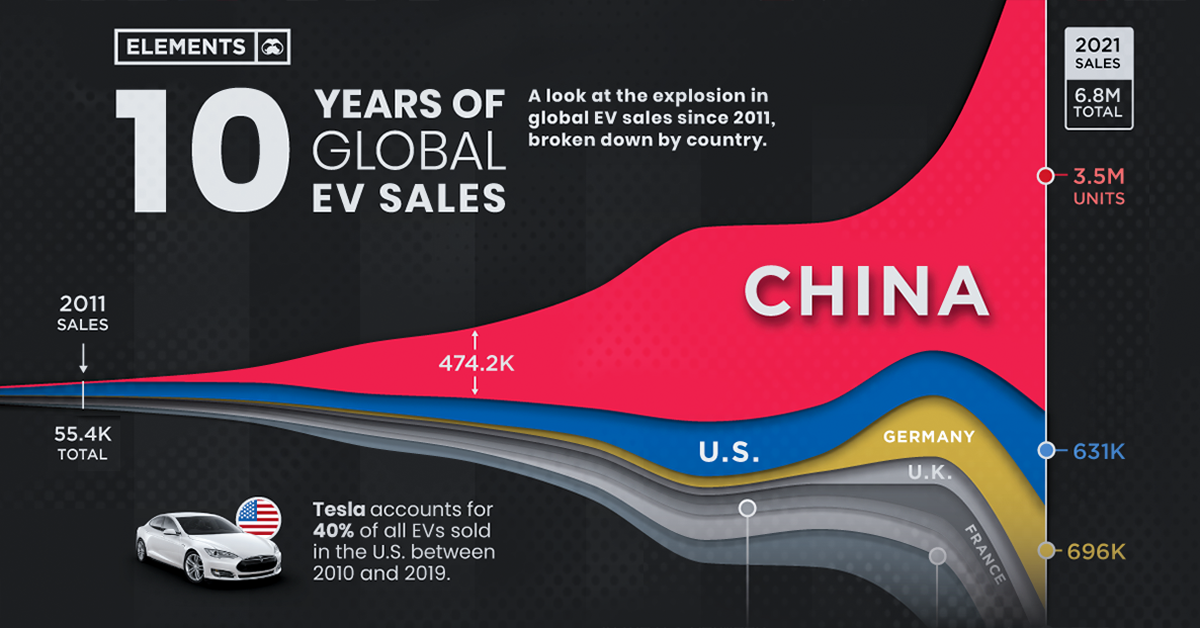

Lack of Investment in Electric Vehicles

Ford's limited investment in electric vehicles for the Brazilian market is another critical factor contributing to its decline. Compared to other global automakers, Ford's EV portfolio in Brazil is notably underdeveloped.

- Limited EV model availability: Few, if any, competitive electric vehicle models are offered by Ford in Brazil, significantly hindering its ability to tap into the growing EV market.

- Insufficient charging infrastructure support: A lack of investment in charging infrastructure further limits the appeal of EVs, making it difficult to compete with brands that offer both the vehicles and the supporting ecosystem.

- Lack of a clear EV strategy: The absence of a dedicated and visible EV strategy for the Brazilian market shows a lack of commitment to this crucial segment of the future automotive landscape. The resulting lack of "Ford electric vehicles Brazil" significantly impacts its market position.

The limited "Ford EV strategy Brazil" represents a major strategic oversight in a market increasingly prioritizing sustainable transportation.

Competition from Other Automakers

The Brazilian auto competition is fierce, with established and emerging automakers aggressively vying for market share, particularly in the rapidly expanding EV sector.

- Volkswagen's strong presence: Volkswagen, with its diverse range of vehicles and a more robust EV strategy, has significantly increased its market share in Brazil.

- Fiat's success in the compact segment: Fiat's continued success in the compact car segment puts further pressure on Ford's declining sales of similar models.

- New EV entrants: The arrival of new players in the Brazilian market, offering competitive and innovative EVs, is further squeezing Ford's market position.

Analyzing "EV competition Brazil" highlights the considerable challenges Ford faces in its attempt to regain market share. Ford competitors Brazil are increasingly outpacing the company in innovation and market responsiveness.

BYD's Global EV Dominance

Rapid Growth and Technological Innovation

BYD's meteoric rise in the global EV market is characterized by rapid expansion and groundbreaking technological advancements.

- Successful EV models: Models like the BYD Atto 3 and Han have achieved significant success in various markets, demonstrating BYD's ability to produce high-quality, competitive electric vehicles.

- Blade Battery Technology: BYD's innovative Blade Battery technology offers increased safety and range, providing a competitive advantage in the EV market.

- Vertical Integration: BYD's vertical integration strategy, controlling much of its supply chain, contributes to its efficiency and cost competitiveness.

"BYD electric vehicles" are quickly becoming synonymous with innovation and affordability, driving its global expansion.

Strategic Partnerships and Market Penetration

BYD's success is also attributed to its astute market penetration strategy, including strategic partnerships and localization efforts.

- Partnerships with governments and businesses: BYD has successfully forged partnerships with governments and businesses across the globe, facilitating market entry and access to local infrastructure.

- Localization strategies: BYD adapts its vehicles and manufacturing processes to suit the specific needs and preferences of different regions, increasing its appeal to local consumers.

- Leveraging government incentives: BYD proactively utilizes government incentives and subsidies in various markets to increase its competitiveness and affordability.

Understanding "BYD market strategy" provides insights into its remarkable global success.

Aggressive Pricing and Affordability

BYD's competitive pricing strategy is crucial to its success. The company focuses on offering high-quality EVs at accessible price points.

- Competitive pricing: BYD's pricing strategy often undercuts competitors, making its EVs more attractive to a wider range of consumers.

- Cost-effective manufacturing: Efficient manufacturing processes and vertical integration allow BYD to keep production costs low, facilitating competitive pricing.

- Focus on affordability: BYD prioritizes making its vehicles affordable to a broad consumer base, contributing significantly to its market penetration.

Analyzing "BYD pricing strategy" demonstrates a clear focus on accessibility and value for money.

Conclusion: Learning from BYD's Success and Addressing Ford's Brazilian Struggle

Ford's struggle in the Brazilian market, marked by declining sales and a lack of investment in EVs, stands in stark contrast to BYD's global success, driven by technological innovation, strategic partnerships, and a focus on affordability. Ford could learn valuable lessons from BYD's approach, particularly regarding the importance of early and substantial investment in EVs, proactive market penetration strategies, and competitive pricing in emerging markets. To understand the future of the Brazilian automotive market and the global EV landscape, further research into Ford's Brazilian struggle and BYD's global EV leadership is essential. The success of BYD highlights the crucial need for adaptation and innovation in the face of a rapidly changing automotive landscape, offering a valuable case study for automakers worldwide.

Featured Posts

-

Atalanta Vs Venezia Analisis Pertandingan Serie A Prediksi Skor Dan Data Lengkap

May 13, 2025

Atalanta Vs Venezia Analisis Pertandingan Serie A Prediksi Skor Dan Data Lengkap

May 13, 2025 -

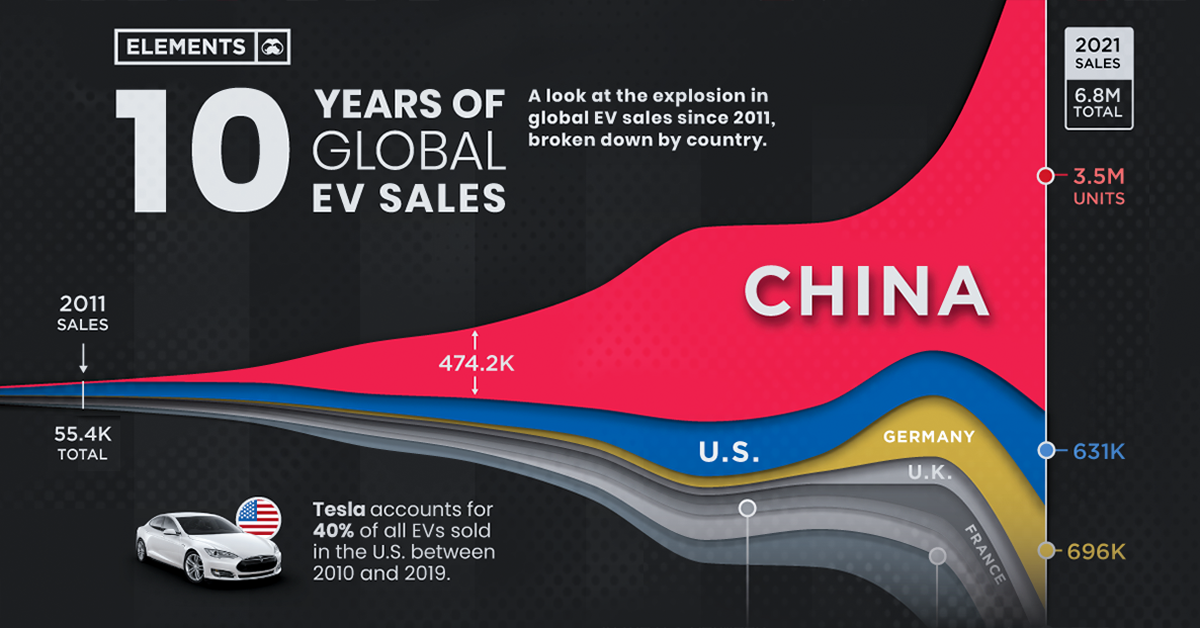

Increased Cybersecurity Spending 63 5 Of Manufacturers Invest In Enhanced Security

May 13, 2025

Increased Cybersecurity Spending 63 5 Of Manufacturers Invest In Enhanced Security

May 13, 2025 -

Post Roe America How Over The Counter Birth Control Impacts Womens Health

May 13, 2025

Post Roe America How Over The Counter Birth Control Impacts Womens Health

May 13, 2025 -

Pochemu Lishili Roditelskikh Prav Syna Tatyany Kadyshevoy Podrobnosti Skandala

May 13, 2025

Pochemu Lishili Roditelskikh Prav Syna Tatyany Kadyshevoy Podrobnosti Skandala

May 13, 2025 -

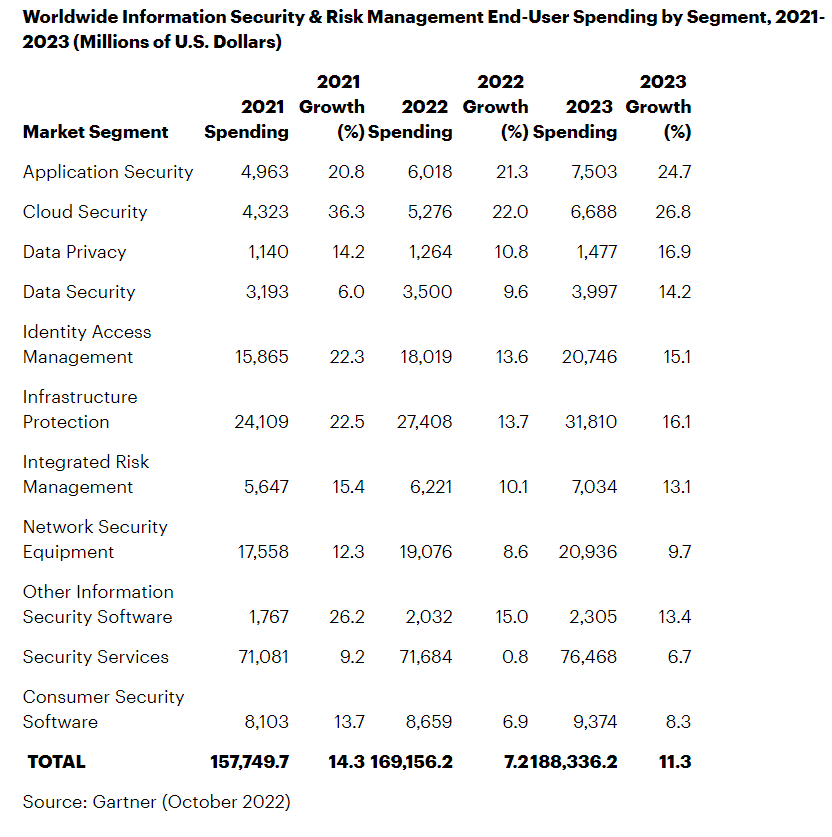

Lower Box Office Receipts Contribute To Cineplexs Q1 Financial Losses

May 13, 2025

Lower Box Office Receipts Contribute To Cineplexs Q1 Financial Losses

May 13, 2025