Foot Locker Inc (FL): Jim Cramer's Analysis And Investment Recommendation

Table of Contents

Jim Cramer's Past Statements on Foot Locker (FL)

Understanding Jim Cramer's historical perspective on Foot Locker is crucial to grasping his current recommendation. Tracking his comments on Mad Money and other appearances reveals a fluctuating view, often influenced by the prevailing market conditions and specific news surrounding FL.

Analyzing Cramer's Jim Cramer Foot Locker commentary requires considering the broader context. For example, his assessment during bull markets might differ significantly from his opinions during periods of economic downturn. His Cramer's FL analysis frequently focuses on key performance indicators (KPIs) and emerging trends within the athletic footwear industry.

- Example: In [Insert Date], Cramer discussed FL's positive performance, citing strong consumer demand for specific sneaker releases. He highlighted the company's successful marketing campaigns as a key driver of growth.

- Example: Conversely, in [Insert Date], during a period of market uncertainty, he expressed concerns regarding FL's exposure to potential supply chain disruptions and increased competition. This led him to adopt a more cautious stance on the historical stock performance of FL.

Current Market Conditions and their Impact on FL

The current retail sector landscape, particularly the athletic footwear market, significantly impacts Foot Locker's performance. Understanding the dynamics of this competitive environment is essential for interpreting Cramer's retail sector analysis and his consequent recommendation.

- Increased competition from companies like Nike, Adidas, and smaller, specialized brands is impacting FL's market share. These competitors are employing various strategies to reach consumers directly and offering exclusive products.

- Economic uncertainty and potential inflation may lead to decreased consumer spending on discretionary items like athletic footwear, directly affecting Foot Locker's sales. This ties into broader consumer spending trends.

- Supply chain issues, while perhaps less impactful than in previous years, remain a potential concern for FL, influencing its inventory management and potentially pricing strategies.

Foot Locker's Financial Performance and Future Outlook

Foot Locker's financial performance is a central aspect of any investment analysis. Examining Foot Locker financials, including FL revenue and earnings report data, provides critical insights into the company's health and growth trajectory.

- FL's Q[Insert Quarter] earnings showed [Insert Percentage]% growth in revenue, exceeding analysts' expectations. This suggests positive momentum, although this needs to be analyzed within the context of the overall market.

- The company's new strategy focusing on enhancing its omnichannel presence and expanding its selection of exclusive products may impact future growth prospects. The success of this strategy will play a key role in FL's future.

Jim Cramer's Predicted Investment Recommendation for FL (if available)

Based on the information available (replace bracketed information with actual data), we can infer Jim Cramer's Jim Cramer's FL recommendation. However, it is crucial to understand that his recommendations are opinions, not guarantees.

- Cramer's recommendation is to [Buy/Sell/Hold] FL stock due to [Reasoning based on previous analysis]. This recommendation should be considered within the context of his overall market outlook.

- He suggests investors consider [Alternative action, e.g., diversifying their portfolio] if [Condition, e.g., the broader market experiences a significant downturn].

Conclusion: Investing in Foot Locker Inc (FL) Based on Jim Cramer's Analysis

Jim Cramer's overall assessment of Foot Locker Inc. (FL) reflects a nuanced view shaped by the company's financial performance, competitive landscape, and prevailing market conditions. Key factors influencing his recommendation include the level of consumer spending, the competitive intensity within the athletic footwear market, and Foot Locker's ability to adapt to changing consumer preferences.

While Jim Cramer's insights are valuable, remember that investing in Foot Locker Inc. (FL) or any stock involves inherent risk. Foot Locker investment decisions should be made after conducting thorough due diligence and considering personal risk tolerance. Remember to review FL stock analysis from multiple sources and potentially consult a financial advisor before making any informed investment decisions. Therefore, explore FL stock further, conduct your own research, and make informed investment choices.

Featured Posts

-

Understanding The Gop Mega Bill Key Details And Expected Controversy

May 15, 2025

Understanding The Gop Mega Bill Key Details And Expected Controversy

May 15, 2025 -

Dijital Veri Tabani Ve Isguecue Piyasasi Ledra Pal Daki Carsamba Rehberi

May 15, 2025

Dijital Veri Tabani Ve Isguecue Piyasasi Ledra Pal Daki Carsamba Rehberi

May 15, 2025 -

Ancelottis Rest Request For Real Madrid Sparks Heated Debate With Tebas

May 15, 2025

Ancelottis Rest Request For Real Madrid Sparks Heated Debate With Tebas

May 15, 2025 -

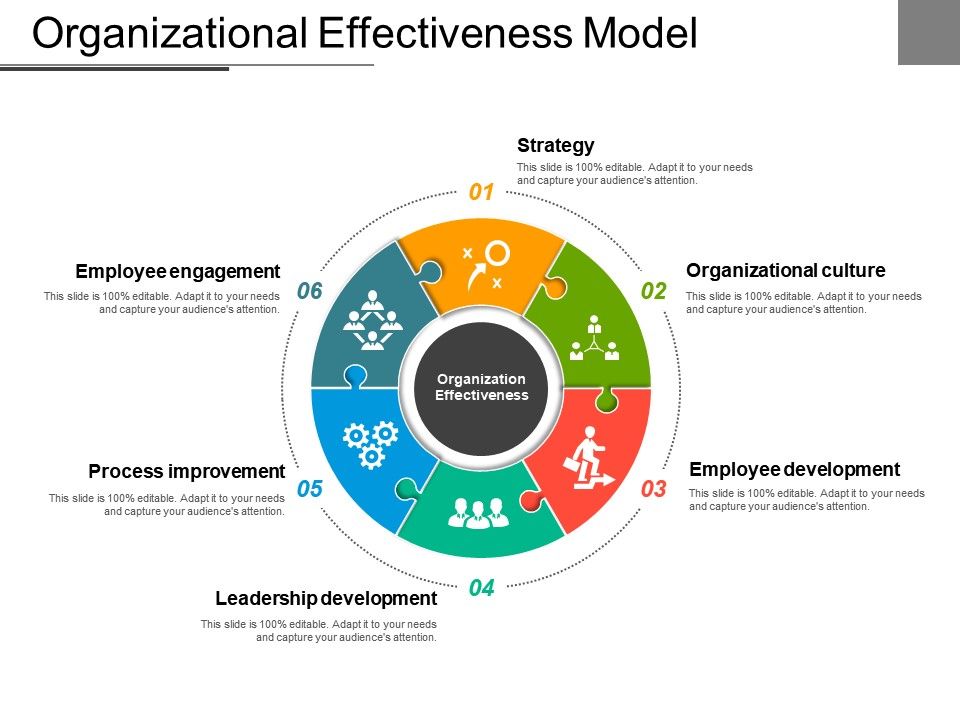

Investing In Middle Management A Key To Organizational Effectiveness

May 15, 2025

Investing In Middle Management A Key To Organizational Effectiveness

May 15, 2025 -

Criticism Mounts As Warren Fails To Defend Bidens Mental Capacity

May 15, 2025

Criticism Mounts As Warren Fails To Defend Bidens Mental Capacity

May 15, 2025

Latest Posts

-

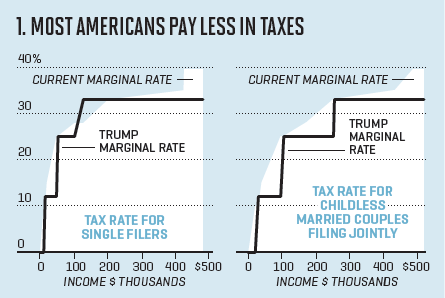

Analysis The House Gops Unveiling Of Trumps Tax Proposals

May 16, 2025

Analysis The House Gops Unveiling Of Trumps Tax Proposals

May 16, 2025 -

Revised Trump Tax Plan Key Details From House Republicans

May 16, 2025

Revised Trump Tax Plan Key Details From House Republicans

May 16, 2025 -

Trumps Second Term And The Expansion Of Executive Clemency Power

May 16, 2025

Trumps Second Term And The Expansion Of Executive Clemency Power

May 16, 2025 -

The Human Cost Of Military Discharge A Transgender Soldiers Story

May 16, 2025

The Human Cost Of Military Discharge A Transgender Soldiers Story

May 16, 2025 -

Transgender Service Member Fights For Recognition After Discharge

May 16, 2025

Transgender Service Member Fights For Recognition After Discharge

May 16, 2025