Revised Trump Tax Plan: Key Details From House Republicans

Table of Contents

Keyword: Revised Trump Tax Plan

The Revised Trump Tax Plan, as proposed by House Republicans, represents a significant overhaul of the US tax code. Understanding its intricacies is crucial for individuals and businesses alike, as it could dramatically reshape financial landscapes for years to come. This article delves into the key proposed changes, analyzing their potential impact on various sectors of the economy.

Individual Income Tax Changes

The proposed revisions to the individual income tax system under the Revised Trump Tax Plan aim to simplify certain aspects while potentially altering tax burdens for different income groups.

Standard Deduction Adjustments

The plan suggests substantial increases to the standard deduction. This could benefit many taxpayers, particularly those with lower incomes, by reducing their taxable income.

- Increased standard deduction for single filers: A proposed increase (specific number would go here if available from the plan, e.g., to $15,000).

- Increased standard deduction for married couples filing jointly: A proposed increase (specific number would go here if available from the plan, e.g., to $30,000).

- Impact on taxpayers itemizing deductions: Fewer taxpayers might itemize deductions under this plan due to the higher standard deduction, simplifying tax preparation for many. This could reduce the overall complexity associated with the tax code.

Tax Rate Modifications

The Revised Trump Tax Plan may also include alterations to individual income tax brackets and rates. While the precise numbers are subject to change, the general direction indicates potential adjustments to:

- Changes to specific tax brackets (e.g., 10%, 12%, etc.): (Insert proposed changes in tax brackets and rates here if available from the plan). For example, a reduction in the highest tax bracket could benefit high-income earners.

- Potential impact on taxpayers in different income brackets: Low-to-middle-income taxpayers might see a relatively larger benefit from the increased standard deduction, while the impact on high-income earners will depend significantly on the specific changes to tax rates.

- Comparison to previous tax plans: This revised plan should be compared and contrasted with previous versions, highlighting specific differences and potential implications.

Child Tax Credit and Other Credits

Modifications to existing tax credits, such as the Child Tax Credit, are central to the Revised Trump Tax Plan.

- Changes to the Child Tax Credit amount: (Insert proposed changes to the Child Tax Credit if available from the plan). A potential increase could significantly benefit families with children.

- Eligibility requirements for the Child Tax Credit: Any changes to eligibility requirements should be detailed here, including potential alterations to income limits or age restrictions.

- Impact on families with children: The adjustments to the Child Tax Credit will have a substantial effect on household budgets and financial planning for families with dependents.

Corporate Tax Rate Changes

The corporate tax rate is another key area affected by the proposed Revised Trump Tax Plan.

Proposed Corporate Tax Rate

The plan may propose a reduction in the corporate tax rate. This has significant implications for businesses of all sizes.

- The new proposed corporate tax rate: (Insert the proposed corporate tax rate here if available from the plan). This should be compared to the current rate.

- Comparison to the current corporate tax rate: This comparison will highlight the magnitude of the proposed change and its potential effects.

- Potential effects on corporate profits and investments: A lower corporate tax rate may stimulate business investment and increase profitability, potentially leading to job growth.

Impact on Business Investment

The proposed corporate tax rate changes aim to influence business investment and economic growth.

- Incentives for small businesses: The plan may include specific provisions to encourage investment and growth among small and medium-sized enterprises (SMEs).

- Impact on large corporations: The effect on large corporations will likely depend on other factors, such as global economic conditions and competition.

- Potential for job creation or loss: While proponents argue for job creation, a critical analysis should examine potential job displacement or shifts in industries.

Potential Economic Impacts

The Revised Trump Tax Plan carries profound potential implications for the US economy.

Impact on the National Debt

A central concern surrounding the plan is its potential effect on the national debt.

- Estimated increase or decrease in the national debt: (Include estimates if available from official sources or credible economic analyses). Transparency regarding debt projections is crucial.

- Long-term fiscal sustainability concerns: A thorough examination of the long-term fiscal implications and potential consequences of the proposed tax cuts is vital.

Impact on Economic Growth

The plan's impact on various economic indicators is a subject of intense debate.

- Projected GDP growth rates: Including projected GDP growth rates based on credible economic forecasts is vital for a balanced assessment.

- Potential impact on employment: This section needs to analyze the potential job creation effects as well as the risks of job losses.

- Inflationary pressures: The plan's potential to increase inflationary pressures requires in-depth analysis.

Conclusion

The Revised Trump Tax Plan represents a complex set of proposals with potentially far-reaching consequences. Understanding the proposed changes to individual income tax brackets, deductions, credits, and the corporate tax rate is paramount for both individuals and businesses. While proponents emphasize potential economic growth, concerns remain about its impact on the national debt and its distributional effects. To fully grasp the implications of this Revised Trump Tax Plan, further research and consultation with tax professionals are recommended. Continue your research on the Revised Trump Tax Plan to make informed financial decisions.

Featured Posts

-

2025 San Diego Padres Broadcast Schedule Where To Watch

May 16, 2025

2025 San Diego Padres Broadcast Schedule Where To Watch

May 16, 2025 -

Max Muncys 2025 Home Run Snapping A Long Slump

May 16, 2025

Max Muncys 2025 Home Run Snapping A Long Slump

May 16, 2025 -

Empate Sin Goles Everton Vina Y Coquimbo Unido Terminan 0 0

May 16, 2025

Empate Sin Goles Everton Vina Y Coquimbo Unido Terminan 0 0

May 16, 2025 -

Remember Vont Weekend See The April 4 6th 2025 Photos From 97 3 Kiss Fm

May 16, 2025

Remember Vont Weekend See The April 4 6th 2025 Photos From 97 3 Kiss Fm

May 16, 2025 -

Canadas Resource Sector Gets A Bulldog Banker Addressing Key Challenges

May 16, 2025

Canadas Resource Sector Gets A Bulldog Banker Addressing Key Challenges

May 16, 2025

Latest Posts

-

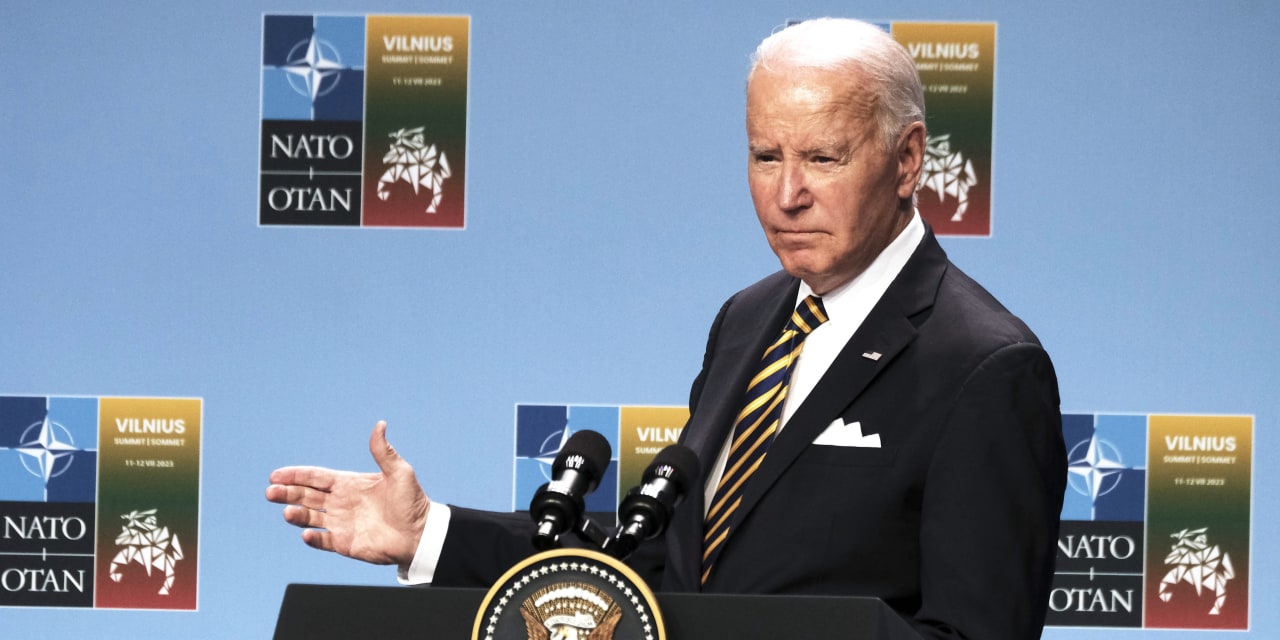

Vances Effective Response To Bidens Ukraine Attack

May 16, 2025

Vances Effective Response To Bidens Ukraine Attack

May 16, 2025 -

The View Full Interview With First Lady Jill Biden And President Joe Biden

May 16, 2025

The View Full Interview With First Lady Jill Biden And President Joe Biden

May 16, 2025 -

Trump Administrations Russia Ukraine Actions Vance Presses Biden For Comment

May 16, 2025

Trump Administrations Russia Ukraine Actions Vance Presses Biden For Comment

May 16, 2025 -

Watch Miss Joe And Jill Bidens Full The View Interview

May 16, 2025

Watch Miss Joe And Jill Bidens Full The View Interview

May 16, 2025 -

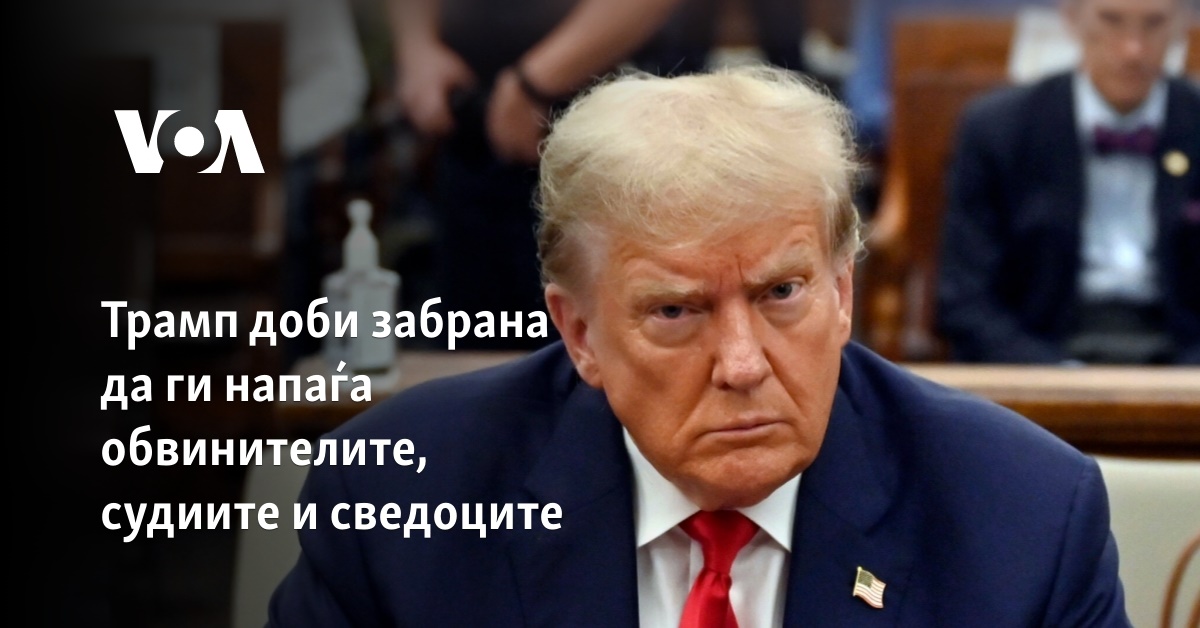

Na Avena Chistka Vo Sudstvoto Tramp Gi Napa A Mediumite Koi Go Kritikuvaat

May 16, 2025

Na Avena Chistka Vo Sudstvoto Tramp Gi Napa A Mediumite Koi Go Kritikuvaat

May 16, 2025