Figma's Quiet IPO Pursuit: A Look Back At The Adobe Deal

Table of Contents

The Allure of an Independent Figma IPO

An independent Figma IPO held immense potential. The company's rapid growth and strong market position suggested a highly successful public offering. Several key advantages made an IPO an attractive proposition:

-

Increased Capital: An IPO would have provided Figma with significant capital infusion. This could have fueled further product development, expansion into new markets, and strategic acquisitions to solidify its position as a design software leader. This influx of funds would have allowed for aggressive R&D in areas like AI-powered design tools and enhanced collaborative features.

-

Brand Recognition and Prestige: Going public significantly boosts brand visibility and credibility. An IPO would have elevated Figma's status, attracting even more users and developers to its platform. The prestige associated with a successful IPO often translates to increased customer trust and loyalty.

-

Employee Equity Realization: For early investors and employees, an IPO offers a significant opportunity to realize their equity stakes. This provides financial rewards for those who contributed to Figma's success and incentivizes continued dedication.

-

Market Valuation: An IPO would have provided a clear market assessment of Figma’s value through public trading. This would have provided a benchmark for future investment decisions and strategic planning.

The market conditions at the time generally favored IPOs. The tech sector experienced robust growth, and investor appetite for Software as a Service (SaaS) companies was high. However, challenges existed. Market volatility and regulatory hurdles associated with IPOs are always potential stumbling blocks.

Adobe's Strategic Acquisition – Why it Happened

Adobe's decision to acquire Figma was a strategic move driven by several factors:

-

Eliminating a Competitor: Figma was quickly emerging as a major competitor to Adobe XD, threatening Adobe's dominance in the design software market. Acquiring Figma eliminated this threat and secured Adobe's position.

-

Expanding Product Portfolio: Figma's collaborative design capabilities perfectly complemented Adobe's existing Creative Cloud suite. The acquisition broadened Adobe's offerings and enhanced its overall value proposition.

-

Synergies and Cross-selling Opportunities: Integrating Figma into the Creative Cloud ecosystem opened up numerous cross-selling opportunities. Adobe could leverage its existing customer base to market Figma and vice-versa, driving revenue growth.

-

Access to a New User Base: Figma had attracted a substantial user base, many of whom were not existing Adobe customers. The acquisition gave Adobe access to this new market segment, expanding its reach and potential customer pool.

The financial aspects of the deal are crucial. While the exact terms remained private, the acquisition price was substantial, reflecting Figma's valuation. Adobe's long-term ROI will depend on successful integration and the realization of synergies. The acquisition's impact on Adobe's stock price was initially positive, reflecting investor confidence in the strategic rationale.

Comparing Figma's IPO Potential vs. the Adobe Deal

A comparison of Figma's potential paths highlights the complexities of the decision:

-

Long-Term Growth: Independent operation through an IPO would have allowed Figma to pursue its own strategic direction, potentially leading to faster innovation and market expansion. However, integration within Adobe’s ecosystem provides access to resources and a broader market, albeit potentially at the cost of independent development.

-

Financial Outcomes: An IPO might have yielded higher returns for early investors and employees in the long run, depending on Figma's continued growth and market performance. The Adobe acquisition provided immediate liquidity, albeit perhaps at a price lower than a potentially sky-high IPO valuation.

-

Risks and Uncertainties: Both routes involved significant risks. An IPO exposes a company to market volatility and investor scrutiny. An acquisition carries the risk of integration challenges and potential loss of autonomy.

Data points and industry analysis comparing similar SaaS company acquisitions and IPOs would strengthen this comparison. Unfortunately, due to the private nature of many aspects of the deal, detailed quantitative analysis is limited.

Conclusion: Figma's Path – IPO Deferred, but the Story Continues

The Adobe acquisition of Figma, instead of an IPO, resulted from a complex interplay of factors. Adobe's strategic goals of eliminating competition, expanding its product portfolio, and accessing new markets outweighed the potential benefits of an independent IPO for Figma. While an IPO might have yielded higher long-term growth for Figma independently, the acquisition offered immediate liquidity and integration into a powerful ecosystem. The long-term implications for the design software market and the competitive landscape remain to be seen, but one thing is clear: the story of Figma continues within the context of Adobe's broader strategy. Stay tuned for future developments in the design software world, and learn more about the evolving landscape of Figma and Adobe’s integrated offerings.

Featured Posts

-

Federal Wholesale Fibre Policy Bells Plea For Change

May 14, 2025

Federal Wholesale Fibre Policy Bells Plea For Change

May 14, 2025 -

The Voice Season 27 Episode 3 Did Adam Levine Find His Mojo

May 14, 2025

The Voice Season 27 Episode 3 Did Adam Levine Find His Mojo

May 14, 2025 -

Novakov Stil Patike Od 1 500 Evra I Alternative

May 14, 2025

Novakov Stil Patike Od 1 500 Evra I Alternative

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Extra

May 14, 2025

Zdrajcy 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Extra

May 14, 2025 -

Disney Snow White Jewelry Kendra Scott Collection Highlights Under 100

May 14, 2025

Disney Snow White Jewelry Kendra Scott Collection Highlights Under 100

May 14, 2025

Latest Posts

-

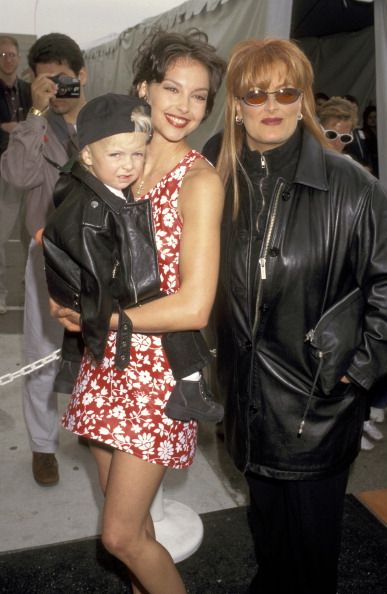

Wynonna Judd And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna Judd And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025 -

Wynonna And Ashley Judd Open Up Intimate Family Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up Intimate Family Story In New Docuseries

May 14, 2025 -

Wynonna Judd And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025

Wynonna Judd And Ashley Judd A Family Docuseries Unveils Untold Stories

May 14, 2025 -

Wynonna And Ashley Judd Open Up In New Family Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up In New Family Docuseries

May 14, 2025 -

Find Your Weekend Joy Netflixs New Charming Film

May 14, 2025

Find Your Weekend Joy Netflixs New Charming Film

May 14, 2025