Finding The Right Funding For Your Sustainable SME

Table of Contents

A sustainable SME is defined by its commitment to environmental, social, and governance (ESG) factors. This includes minimizing its environmental footprint, ensuring fair labor practices, and promoting ethical governance within the company. This commitment often requires a different approach to financing compared to traditional businesses.

Understanding Your Funding Needs

Before exploring funding options, you need a clear understanding of your financial requirements. This involves meticulous planning and realistic projections.

Assessing Your Financial Requirements

Creating a robust sustainable business plan is crucial. This plan should include:

- Startup costs: Initial investments in equipment, technology, and infrastructure, potentially including sustainable materials and technologies.

- Operational expenses: Ongoing costs, considering the use of eco-friendly materials, energy-efficient technologies, and potentially higher initial investment costs associated with sustainability.

- Marketing and sales: Budget for promoting your sustainable products or services to your target market.

- Potential expansion: Funding needed for growth and scaling your business, accounting for sustainable expansion practices.

Conducting a thorough funding gap analysis will help you determine the exact amount of funding needed. Consider options like bootstrapping (using personal savings) to cover some initial expenses before seeking external funding or obtaining seed funding to jumpstart your venture.

Defining Your Funding Stage

Your funding needs will vary depending on your business stage:

- Seed funding: Securing initial capital for product development, market research, and building a minimum viable product (MVP). Sustainability initiatives might increase seed funding needs due to higher initial investment in sustainable technologies.

- Series A funding: Raising capital for scaling operations, expanding market reach, and further developing your product or service. This stage might require more substantial funding to implement broader sustainability strategies.

- Later-stage funding (Series B, C, etc.): Further expansion, potentially including acquisitions or international expansion, necessitating larger investments.

Understanding your stage helps you target appropriate funding sources; venture capital or angel investors are more likely to be interested in later stages. Debt financing, such as bank loans, might be more suitable for established businesses.

Exploring Funding Sources for Sustainable SMEs

Numerous funding avenues exist for sustainable businesses. The ideal choice depends on your specific needs and business stage.

Green Grants and Subsidies

Governments and organizations offer green grants and subsidies specifically designed to support sustainable initiatives. These can significantly reduce your financial burden.

- Research government funding programs at both national and regional levels.

- Explore EU funding opportunities if applicable (e.g., Horizon Europe).

- Seek out grants from private foundations and organizations focused on environmental sustainability and social impact.

- Carefully review eligibility criteria and application procedures for each grant program.

Impact Investing and Venture Capital

Impact investors and venture capitalists are increasingly interested in sustainable businesses. They prioritize both financial returns and positive social and environmental impact.

- Impact investors focus on measurable social and environmental outcomes alongside financial returns. They often invest in companies with strong ESG profiles.

- Venture capitalists interested in sustainable businesses seek high-growth potential with strong ESG performance. They look for clear metrics demonstrating the positive impact of your business.

- Examples include specialized impact investment firms focusing on sustainable and green technologies.

Crowdfunding and Community Investment

Crowdfunding platforms allow you to raise capital from a large number of individuals. Community investment networks connect you with local investors interested in supporting local businesses.

- Rewards-based crowdfunding: Offer non-equity incentives to backers in exchange for their contributions.

- Equity crowdfunding: Offer equity stakes in your company in exchange for investment.

- Donation-based crowdfunding: Seek donations without offering any tangible rewards.

- Community investment networks often prioritize supporting local businesses with a strong community engagement focus.

Green Loans and Debt Financing

Traditional lenders are increasingly offering green loans and other sustainable debt financing options specifically for environmentally friendly businesses.

- Green bonds: Bonds issued to finance projects with environmental benefits.

- Sustainable loans from banks: Loans with preferential terms for businesses demonstrating a strong commitment to sustainability.

- Explore options from specialized lenders focusing on responsible finance and sustainability.

Strengthening Your Funding Application

A compelling application is essential for securing funding. This requires a well-structured business plan and clear communication of your sustainability credentials.

Developing a Compelling Business Plan

Your business plan should showcase your business's potential and your commitment to sustainability.

- Clearly define your target market and market opportunity.

- Articulate your unique selling proposition (USP), highlighting what makes your sustainable business unique and competitive.

- Present realistic and well-supported financial projections.

- Detail your sustainability strategy, outlining your commitment to ESG principles and your plans to minimize your environmental impact. This might include a dedicated section on your sustainability initiatives in your investor pitch deck.

Highlighting Your Sustainability Credentials

Clearly communicate your company's dedication to sustainability.

- Obtain relevant certifications (e.g., B Corp certification).

- Adhere to recognized sustainability reporting frameworks like the GRI standards.

- Quantify your sustainability impact using clear metrics and data in your ESG reporting. This allows investors to assess your business's positive contributions towards environmental and social goals.

Securing the Future of Your Sustainable SME

This article explored various funding avenues available to sustainable SMEs, ranging from green grants and impact investing to crowdfunding and green loans. The best approach depends on your specific needs and business stage. Remember that a well-developed sustainable business plan, strong sustainability credentials, and a clear understanding of your funding needs are crucial for success in finding the right funding for your sustainable SME. Start exploring these options today and take the next step towards securing the future of your sustainable business. Don't delay in pursuing sustainable SME funding - your business's future depends on it!

Featured Posts

-

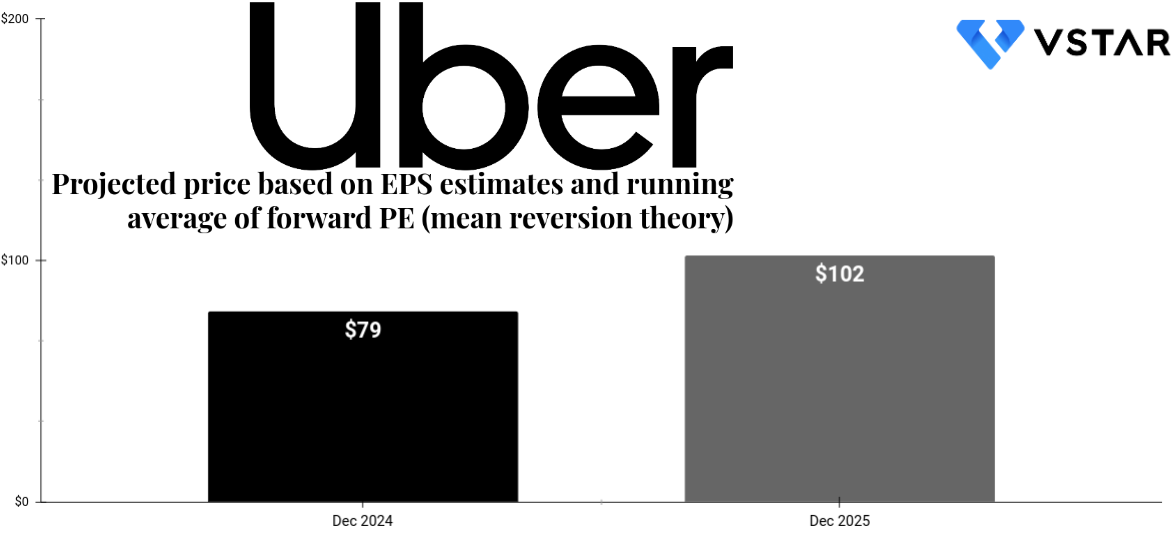

Will Uber Stock Survive A Recession A Deep Dive

May 19, 2025

Will Uber Stock Survive A Recession A Deep Dive

May 19, 2025 -

Trump Administration Cuts Jeopardize Library Services

May 19, 2025

Trump Administration Cuts Jeopardize Library Services

May 19, 2025 -

Gazze Ye Giden Yardim Konvoyundaki Tirlarin Durumu

May 19, 2025

Gazze Ye Giden Yardim Konvoyundaki Tirlarin Durumu

May 19, 2025 -

Become A Postman Power User Expert Tips And Tricks

May 19, 2025

Become A Postman Power User Expert Tips And Tricks

May 19, 2025 -

La Observacion Electoral De Cohep Aseguramiento De La Integridad

May 19, 2025

La Observacion Electoral De Cohep Aseguramiento De La Integridad

May 19, 2025