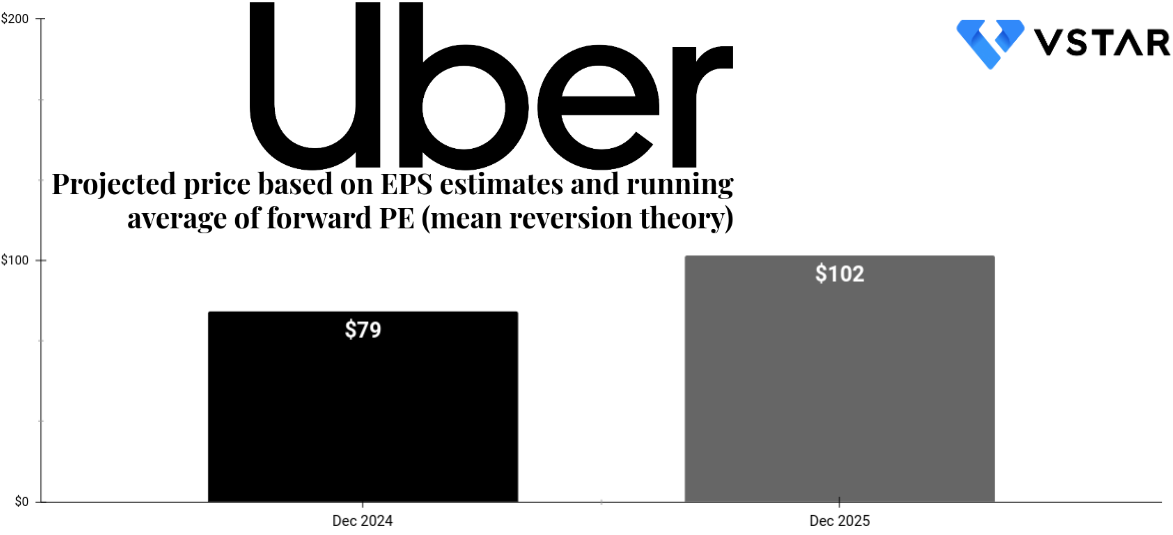

Will Uber Stock Survive A Recession? A Deep Dive

Table of Contents

Uber's Business Model: Diversification and Recession Resistance

Uber's success hinges on its diversified business model, which offers potential resilience against economic downturns. While some segments are more vulnerable than others, this diversification could act as a buffer.

Ride-Sharing's Vulnerability:

- Reduced Demand: During a recession, people often cut back on non-essential travel, directly impacting ride-sharing demand. This is especially true for leisure trips, while business travel might see a more moderate decrease.

- Price Elasticity: Ride-hailing services are relatively price-elastic. As incomes fall, consumers are more likely to switch to cheaper alternatives like public transport or carpooling.

- Fuel Price Volatility: Fluctuations in fuel prices directly impact driver costs and, consequently, ride prices, further influencing demand.

Analyzing historical data from previous recessions reveals a significant drop in ride-sharing usage. For example, during the 2008 financial crisis, many ride-sharing platforms (though less established then) experienced a substantial decrease in ridership. This underscores the vulnerability of this segment to economic downturns. The substitution effect of public transportation becomes even more pronounced during economic hardship as individuals seek to cut costs.

Food Delivery's Resilience:

- Essential Service Argument: Unlike discretionary ride-sharing, food delivery services like Uber Eats might be viewed as more essential, especially as people reduce restaurant dining.

- Increased Home Delivery: Economic hardship often leads to increased demand for home delivery as people reduce their grocery shopping trips and opt for convenience.

- Market Share: Uber's significant market share in the food delivery sector provides a competitive advantage.

The growth of food delivery during previous economic downturns suggests a degree of resilience. Data indicates that even during recessions, the demand for convenient food delivery options often remains relatively stable, or even increases in some cases. This contrasts sharply with the more significant drop experienced by ride-sharing services. Uber’s established brand recognition and substantial market share in many regions further enhances its competitive position in this sector.

Freight and Other Emerging Businesses:

- Long-Term Growth Potential: Uber Freight and other emerging businesses, such as its logistics and micromobility ventures, offer long-term growth potential, potentially mitigating losses in other sectors.

- Economic Insensitivity: Certain freight and logistics services are less susceptible to economic cycles, as essential goods still need transportation regardless of the economic climate.

The expansion into these less cyclical sectors could prove crucial in offsetting the negative impact of reduced ride-sharing and food delivery demand during a recession. The resilience of these divisions acts as a safety net, bolstering the overall financial health of the company.

Uber's Financial Health and Liquidity

Uber's financial health and liquidity will be key determinants of its ability to survive a recession. A strong financial position allows for strategic investments and weathering periods of reduced revenue.

Debt Levels and Cash Reserves:

- Debt-to-Equity Ratio: A high debt-to-equity ratio indicates a higher level of financial risk, making it more vulnerable to economic shocks. A low ratio, however, suggests a stronger financial standing.

- Cash Flow: Positive cash flow is crucial for a company to navigate a recession. Strong cash reserves provide a buffer against decreased revenue.

Examining Uber's latest financial statements reveals its debt levels and cash reserves. A detailed analysis of its debt-to-equity ratio, combined with an evaluation of its operating cash flow, provides a clear picture of its financial resilience. A healthy cash reserve is critical for weathering a recession, allowing for continued operations and strategic investments even amidst falling revenue.

Profitability and Cost-Cutting Measures:

- Profit Margins: Improving profit margins during a recession is paramount. This can be achieved through various cost-cutting strategies.

- Operational Efficiency: Streamlining operations, reducing marketing expenses, and optimizing driver compensation models are potential cost-cutting measures.

Uber's history demonstrates a capacity for cost-cutting, impacting areas such as marketing and operational expenses. Further efficiency gains, achieved through technological advancements and optimized resource allocation, will be essential to navigate a potential economic downturn.

Competitive Landscape and Market Share

The competitive landscape significantly impacts Uber's ability to navigate a recession. Price wars and competitive pressures can further strain profitability.

Competition and Pricing Wars:

- Lyft and Other Competitors: Lyft and other ride-sharing and food delivery companies will likely react to decreased demand, potentially triggering price wars that squeeze profit margins.

- Market Share Dynamics: Aggressive competition could erode market share and further impact revenue.

During a recession, the competitive landscape becomes even more intense. Price wars amongst rival companies are likely, placing pressure on profit margins and potentially impacting Uber’s market share. Monitoring competitor strategies and maintaining a robust competitive position will be crucial for surviving a downturn.

Market Dominance and Network Effects:

- Network Effects: Uber's significant market share creates a network effect—more drivers attract more riders, and vice versa.

- Scale Advantages: This scale provides a significant advantage, especially during a downturn, allowing for greater cost efficiencies and bargaining power.

Uber's established network effects provide a crucial advantage in a recessionary environment. The large pool of drivers and riders creates a self-reinforcing cycle, making it difficult for competitors to gain traction even during periods of decreased demand. This substantial network effect provides a valuable buffer against competitive pressures.

Conclusion:

This deep dive into Uber's business model, financial position, and competitive landscape suggests that while a recession will undoubtedly impact its performance, its diversification and potential cost-cutting measures may provide a degree of resilience. Whether Uber stock survives a recession depends on the severity of the downturn and the company's ability to adapt. Investors should closely monitor its financial performance and strategic decisions in the coming months to make informed decisions regarding their Uber stock holdings. Further research into the specific economic indicators and industry trends is crucial for making a well-informed assessment of the future of Uber stock during a potential recession. Understanding the intricacies of Uber’s business model and its ability to navigate economic challenges is key to assessing its long-term viability.

Featured Posts

-

Ufc 313 Aftermath Pereira Breaks Silence On Loss And Future

May 19, 2025

Ufc 313 Aftermath Pereira Breaks Silence On Loss And Future

May 19, 2025 -

Fsu Shooting Victim Identified As School Employee Father A Former Cia Operative

May 19, 2025

Fsu Shooting Victim Identified As School Employee Father A Former Cia Operative

May 19, 2025 -

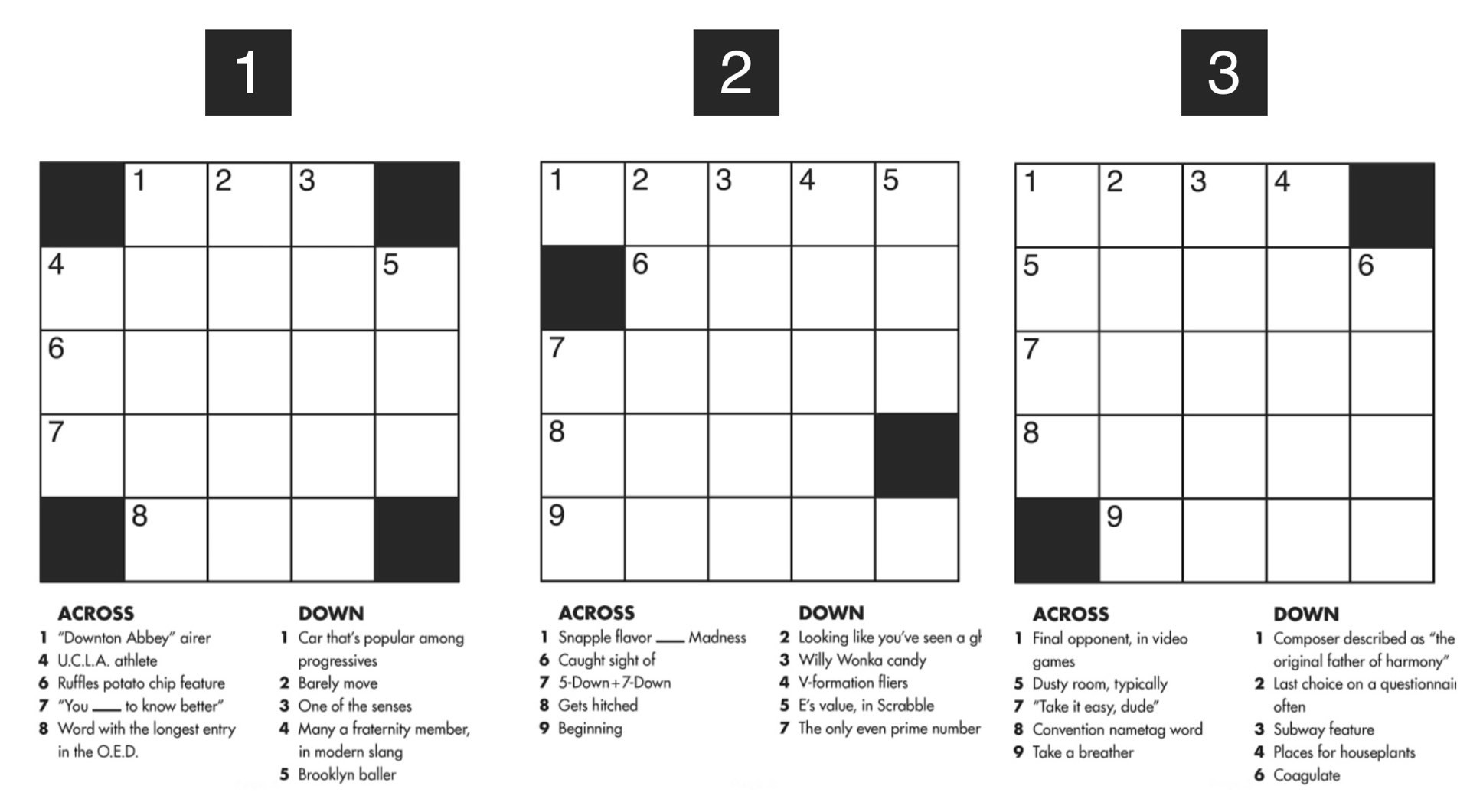

April 8 2025 Nyt Mini Crossword Clues Hints And Answers

May 19, 2025

April 8 2025 Nyt Mini Crossword Clues Hints And Answers

May 19, 2025 -

The Fsu Shooting Examining The Background Of A Victims Family

May 19, 2025

The Fsu Shooting Examining The Background Of A Victims Family

May 19, 2025 -

Investissement Immobilier Poitiers 46 Appartements Dans Anciens Batiments Judiciaires

May 19, 2025

Investissement Immobilier Poitiers 46 Appartements Dans Anciens Batiments Judiciaires

May 19, 2025

Latest Posts

-

Eurovision Song Contest 2026 Oernskoeldsviks Intresseanmaelan

May 19, 2025

Eurovision Song Contest 2026 Oernskoeldsviks Intresseanmaelan

May 19, 2025 -

Sverige Oernskoeldsvik Soeker Eurovision 2026

May 19, 2025

Sverige Oernskoeldsvik Soeker Eurovision 2026

May 19, 2025 -

Oernskoeldsvik Laegger Bud Pa Eurovision 2026

May 19, 2025

Oernskoeldsvik Laegger Bud Pa Eurovision 2026

May 19, 2025 -

Analyzing The Design And Reception Of Eurovisions Lumo Mascot

May 19, 2025

Analyzing The Design And Reception Of Eurovisions Lumo Mascot

May 19, 2025 -

Eurovision 2026 Oernskoeldsvik Visar Intresse

May 19, 2025

Eurovision 2026 Oernskoeldsvik Visar Intresse

May 19, 2025