Finding Reliable Tribal Lenders For Bad Credit

Table of Contents

Understanding Tribal Lenders

What are Tribal Lenders?

Tribal lenders are lending institutions operated by or in conjunction with Native American tribes. These lenders often operate under different regulatory frameworks than traditional banks and credit unions, which can sometimes lead to varying levels of oversight. This unique regulatory environment is a key factor in understanding both the advantages and disadvantages of using tribal lenders. It's essential to remember that not all tribal lenders are created equal.

- Legal Framework: The legal standing of tribal lenders is complex and often debated. Some argue that tribal sovereignty grants them greater autonomy in their lending practices, while others contend that this autonomy can lead to a lack of consumer protection.

- Potential Benefits: One perceived advantage is that tribal lenders may be more lenient with borrowers who have bad credit scores. They might offer loans to individuals who have been rejected by mainstream financial institutions.

- Potential Risks: However, the less stringent regulatory environment can also lead to higher interest rates and less transparent lending practices than those offered by traditional banks or credit unions. The potential for predatory lending is a significant concern.

- Comparison with Other Lenders: Before considering a tribal lender for bad credit, carefully compare their offers with other options available to those with impaired credit, such as payday loans (known for their extremely high interest rates and short repayment periods) and personal loans from online lenders or credit unions (which may have more stringent credit score requirements but generally offer more favorable terms).

Identifying Reliable Tribal Lenders

Due Diligence Before Applying

Thorough research is paramount when considering any lender, but it's especially crucial when dealing with tribal lenders for bad credit. Predatory lenders prey on vulnerable individuals, so due diligence is your strongest defense.

- Tribal Licensing and Affiliations: Verify that the lender is legitimately affiliated with a Native American tribe and holds the necessary licenses to operate. Look for clear evidence of this affiliation on their website.

- Reputation Check: Investigate the lender's reputation by searching for reviews on sites like the Better Business Bureau (BBB). Look for patterns of complaints regarding high fees, deceptive practices, or difficulty in contacting customer service.

- Terms and Conditions: Carefully examine the loan agreement's fine print. Pay close attention to the Annual Percentage Rate (APR), any associated fees (originations fees, late payment fees, etc.), and the repayment schedule. Understand the total cost of the loan before signing anything.

- Transparency: Reliable lenders will be transparent about their lending practices, fees, and repayment terms. Avoid lenders who are vague or evasive when questioned about these aspects.

- Avoid High-Pressure Tactics: Legitimate lenders will not use high-pressure sales tactics to push you into a loan you are not comfortable with. If a lender employs these tactics, walk away.

Comparing Loan Offers from Different Tribal Lenders

Factors to Consider When Choosing a Lender

Once you've identified a few potential tribal lenders, it's essential to compare their loan offers side-by-side to find the best terms.

- Interest Rates (APR): The APR reflects the total cost of borrowing, including interest and fees. Choose the lender with the lowest APR possible.

- Loan Fees and Charges: Be aware of all fees associated with the loan, including origination fees, late payment fees, and prepayment penalties.

- Loan Repayment Terms: Consider the loan's length and the frequency of payments. Choose a repayment plan that fits your budget and avoids potential financial strain.

- Customer Service and Support: Reliable lenders offer readily available and responsive customer service. Check for multiple contact options (phone, email, online chat).

- Transparency of the Lending Process: The application process, terms, and fees should be clearly explained and easy to understand.

Protecting Yourself from Predatory Lending Practices

Recognizing Red Flags

Predatory lenders often use deceptive tactics to lure in borrowers. Knowing the red flags can help you protect yourself.

- Excessively High Interest Rates: Unusually high interest rates (significantly above market rates) are a major red flag.

- Hidden Fees and Charges: Be wary of lenders who don't clearly disclose all fees and charges upfront.

- Aggressive or Misleading Sales Tactics: High-pressure sales tactics designed to push you into a loan quickly are a warning sign.

- Lack of Clear Terms and Conditions: If the terms and conditions are vague, confusing, or difficult to understand, it's a cause for concern.

- Difficulty Contacting the Lender: If you have difficulty reaching the lender by phone or email, it's a potential problem.

Conclusion

Finding reliable tribal lenders for bad credit requires careful research, comparison shopping, and a healthy dose of skepticism. Understanding the potential benefits and risks associated with tribal lending is crucial. Remember to thoroughly investigate each lender's reputation, carefully review the loan terms, and be wary of predatory lending practices. By following these steps, you can increase your chances of securing a loan responsibly and avoiding financial hardship. Find the right tribal lender for your needs by conducting thorough research and comparing offers from multiple sources. Secure a loan responsibly by prioritizing transparency, fair terms, and reputable lenders. Research reliable tribal lenders for bad credit today, but always proceed cautiously and consider all your financial options. For further information on responsible borrowing, consider visiting the [link to a reputable consumer finance website].

Featured Posts

-

Update Pacers Reinstates Tyrese Haliburtons Father

May 28, 2025

Update Pacers Reinstates Tyrese Haliburtons Father

May 28, 2025 -

Chinas Economic Growth A Gamble On Consumer Confidence

May 28, 2025

Chinas Economic Growth A Gamble On Consumer Confidence

May 28, 2025 -

Bad Credit Personal Loans No Credit Check Options And Direct Lenders

May 28, 2025

Bad Credit Personal Loans No Credit Check Options And Direct Lenders

May 28, 2025 -

Kanye Wests Escape Did He Flee After Bianca Censori Split

May 28, 2025

Kanye Wests Escape Did He Flee After Bianca Censori Split

May 28, 2025 -

French Open 2024 Alcaraz And Swiatek Dominate Early Rounds Fritz Navarro And Osaka Upset

May 28, 2025

French Open 2024 Alcaraz And Swiatek Dominate Early Rounds Fritz Navarro And Osaka Upset

May 28, 2025

Latest Posts

-

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025

Europe 1 Soir Du 19 03 2025 L Integrale De L Emission

May 30, 2025 -

Hbo To Adapt Gisele Pelicots Story A French Rape Victims Memoir

May 30, 2025

Hbo To Adapt Gisele Pelicots Story A French Rape Victims Memoir

May 30, 2025 -

Emission Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025

Emission Integrale Europe 1 Soir 19 Mars 2025

May 30, 2025 -

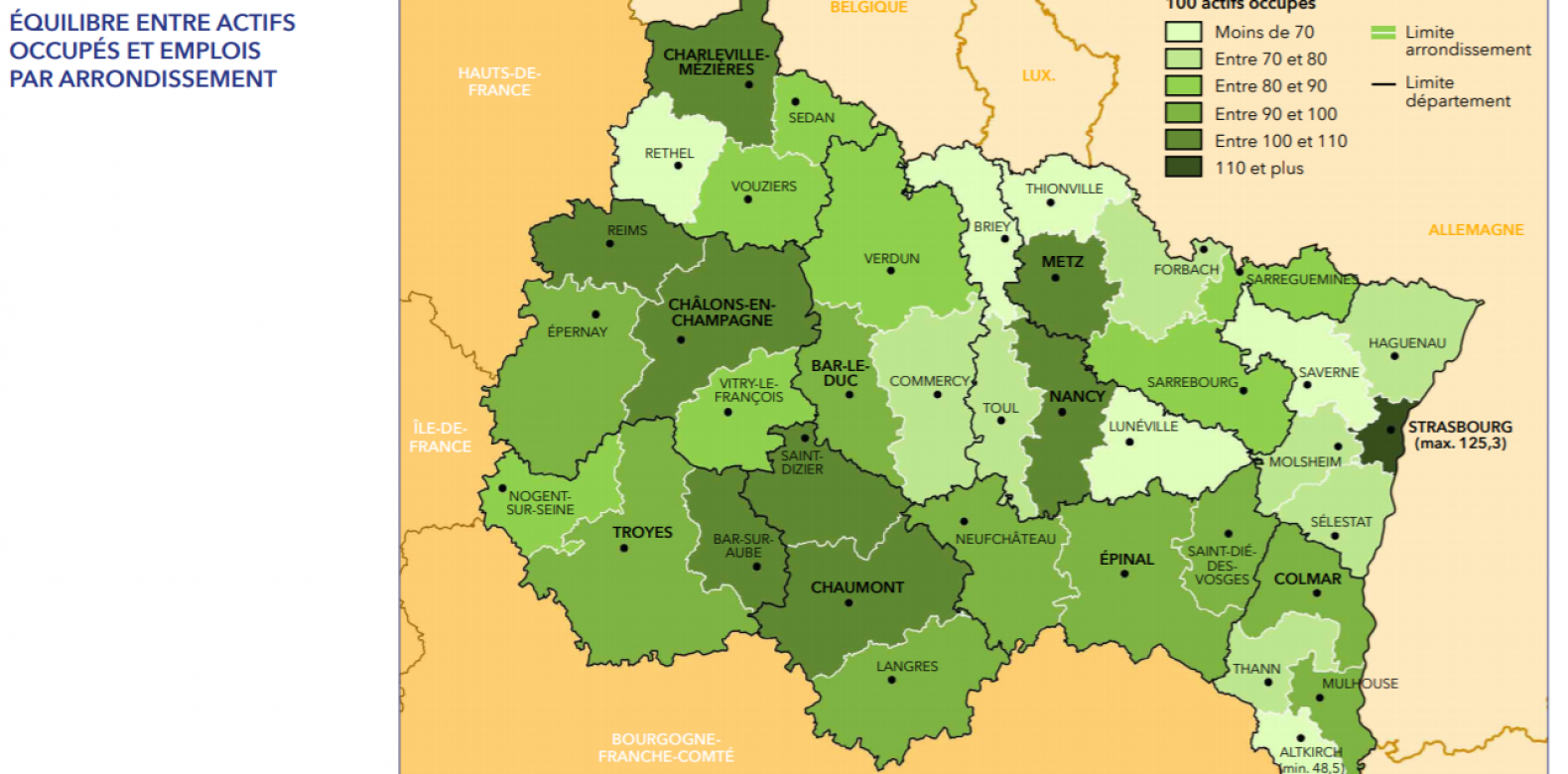

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025 -

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025