Bad Credit Personal Loans: No Credit Check Options & Direct Lenders

Table of Contents

Understanding Bad Credit Personal Loans

"Bad credit" generally refers to a credit score below 670, significantly impacting your loan application chances. Lenders perceive borrowers with bad credit as higher risk, resulting in higher interest rates on personal loans. This means you'll pay more in interest over the life of the loan compared to someone with good credit. Despite this, responsible borrowing remains crucial. Even with a bad credit history, you can still manage your finances effectively and avoid further damaging your credit score.

- Factors Affecting Credit Scores: Late payments, high credit utilization (using a large percentage of your available credit), bankruptcies, and collections all negatively impact your credit score.

- Consequences of Defaulting: Defaulting on a bad credit loan can severely damage your credit score, making it even harder to obtain loans in the future. It can also lead to legal action and collection efforts.

- Bad Credit Loan vs. Payday Loan: While both cater to borrowers with poor credit, bad credit personal loans generally offer larger loan amounts and longer repayment periods than high-interest, short-term payday loans. Payday loans often carry extremely high fees and APRs, making them a riskier option.

No Credit Check Personal Loans: The Pros and Cons

A "no credit check" personal loan doesn't mean lenders completely disregard your financial history. Instead, they often utilize alternative credit checks. While this can make securing a loan easier with bad credit, it's crucial to understand both the advantages and disadvantages.

Advantages: No credit check loans offer accessibility to those with poor credit who might otherwise be denied a traditional loan. They provide a financial lifeline for urgent needs when traditional options are unavailable.

Disadvantages: The convenience comes at a cost. These loans typically come with significantly higher interest rates and shorter repayment terms than loans for borrowers with good credit. Furthermore, the lack of a thorough credit check increases the risk of encountering predatory lenders.

- Types of Alternative Credit Checks: Lenders might review bank statements, employment verification, and other financial documents to assess your repayment ability.

- Potential Risks: High interest rates and hefty fees can quickly make the loan unaffordable if you can't repay on time. Always read the fine print carefully.

- Comparing Offers: Before accepting any loan, compare offers from multiple lenders to find the most favorable terms and interest rates. Don't rush into a decision.

Finding Reputable Lenders for No Credit Check Loans

Finding a trustworthy lender is paramount when dealing with no credit check loans. Avoid scams by thoroughly researching lenders before applying.

- Use Reputable Comparison Websites: Many comparison websites allow you to compare offers from various lenders, streamlining your search.

- Check Online Reviews and Ratings: Read reviews from previous borrowers to gauge the lender's reliability, customer service, and transparency.

- Red Flags: Be wary of unrealistic promises, hidden fees, and pressure tactics. Legitimate lenders will be transparent about their terms and conditions.

- Verify Lender Legitimacy: Check if the lender is properly licensed and registered. Look for contact information and a physical address.

- Read the Fine Print: Before signing any loan agreement, carefully review all the terms and conditions to ensure you understand the repayment terms, fees, and interest rates.

The Benefits of Direct Lenders for Bad Credit Loans

A direct lender provides loans directly to borrowers, eliminating intermediaries like brokers. This offers several key advantages:

- Simpler Application Process: Direct lenders often have simpler application processes, reducing paperwork and speeding up approval times.

- Potentially Faster Funding: Because there's no intermediary, the funding process is often faster than using a broker.

- More Transparency: Direct lenders typically offer clearer communication and more transparent terms and conditions.

- Faster Processing Times: Reduced bureaucracy means quicker approvals and faster access to funds.

- Potentially Lower Fees: The absence of intermediaries can result in lower fees compared to using a broker.

- Improved Customer Service: You have a single point of contact for all communication and support.

Tips for Improving Your Chances of Loan Approval

Improving your creditworthiness before applying for a loan significantly boosts your chances of approval and securing better terms.

- Pay Bills on Time: Consistent on-time payments are crucial for building a positive credit history.

- Reduce Credit Utilization: Keep your credit card balances low compared to your available credit limit.

- Seek Credit Counseling: If struggling with debt management, consider seeking professional credit counseling for guidance.

- Build a Positive Credit History: Use credit responsibly, and pay all your bills on time.

- Resources for Improving Credit Scores: Utilize resources from credit reporting agencies and credit repair services to understand and improve your credit score.

- Create a Budget: Budgeting helps you manage your finances effectively, reducing the risk of missed payments.

Conclusion

Securing a bad credit personal loan can be challenging, but understanding your options and choosing the right lender can make the process smoother. By carefully considering no credit check options and the advantages of direct lenders, you can increase your chances of finding suitable financing. Remember to thoroughly research lenders and compare offers before committing to a loan. Don't let bad credit hold you back – explore your options for bad credit personal loans and find the financial solution that best fits your needs. Start your search for the right bad credit personal loan today!

Featured Posts

-

Ryan Reynolds And Justin Baldoni A Lawyers Perspective On Their Feud

May 28, 2025

Ryan Reynolds And Justin Baldoni A Lawyers Perspective On Their Feud

May 28, 2025 -

Raphinha Inspires Barcelona To Quarter Finals Victory

May 28, 2025

Raphinha Inspires Barcelona To Quarter Finals Victory

May 28, 2025 -

Last Friday Sequel Confirmed Ice Cube To Return

May 28, 2025

Last Friday Sequel Confirmed Ice Cube To Return

May 28, 2025 -

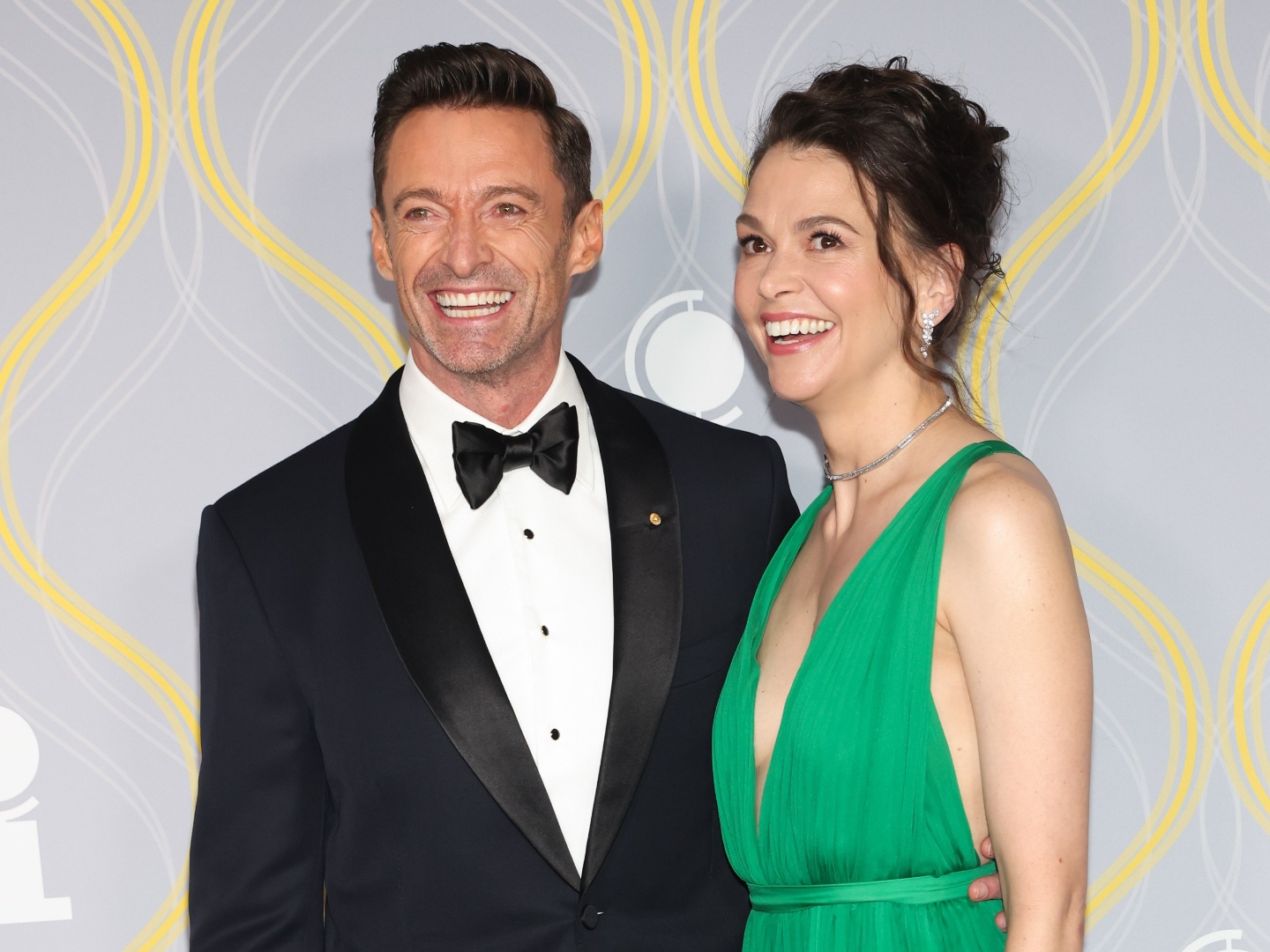

Hugh Jackman And The Younger Actress Relationship Details And Sutton Fosters Reaction

May 28, 2025

Hugh Jackman And The Younger Actress Relationship Details And Sutton Fosters Reaction

May 28, 2025 -

Mc Kenna Cajuste And Ipswich Towns Injury Situation A Weekly Review

May 28, 2025

Mc Kenna Cajuste And Ipswich Towns Injury Situation A Weekly Review

May 28, 2025

Latest Posts

-

Freedom Of The Press Under Siege Sierra Leone And The Bolle Jos Drug Trafficking Investigation

May 30, 2025

Freedom Of The Press Under Siege Sierra Leone And The Bolle Jos Drug Trafficking Investigation

May 30, 2025 -

Enimerotheite Gia Tis Tileoptikes Metadoseis Toy Pasxa Sto E Thessalia Gr

May 30, 2025

Enimerotheite Gia Tis Tileoptikes Metadoseis Toy Pasxa Sto E Thessalia Gr

May 30, 2025 -

Ti Na Deite Stin Tileorasi Tin Tetarti 23 Aprilioy

May 30, 2025

Ti Na Deite Stin Tileorasi Tin Tetarti 23 Aprilioy

May 30, 2025 -

Study Reveals High Rates Of Child And Family Services Intervention Among Manitoba First Nations Families

May 30, 2025

Study Reveals High Rates Of Child And Family Services Intervention Among Manitoba First Nations Families

May 30, 2025 -

Programma Metadoseon M Savvatoy 19 4

May 30, 2025

Programma Metadoseon M Savvatoy 19 4

May 30, 2025