Falling Iron Ore Prices: Analysis Of China's Steel Industry Slowdown

Table of Contents

- China's Reduced Steel Production: A Key Driver of Falling Iron Ore Prices

- The Impact of Global Economic Slowdown on Iron Ore Prices

- Increased Iron Ore Supply and its Effect on Prices

- Speculation and Market Sentiment: Contributing to Price Volatility

- Conclusion: Navigating the Future of Falling Iron Ore Prices and China's Steel Industry

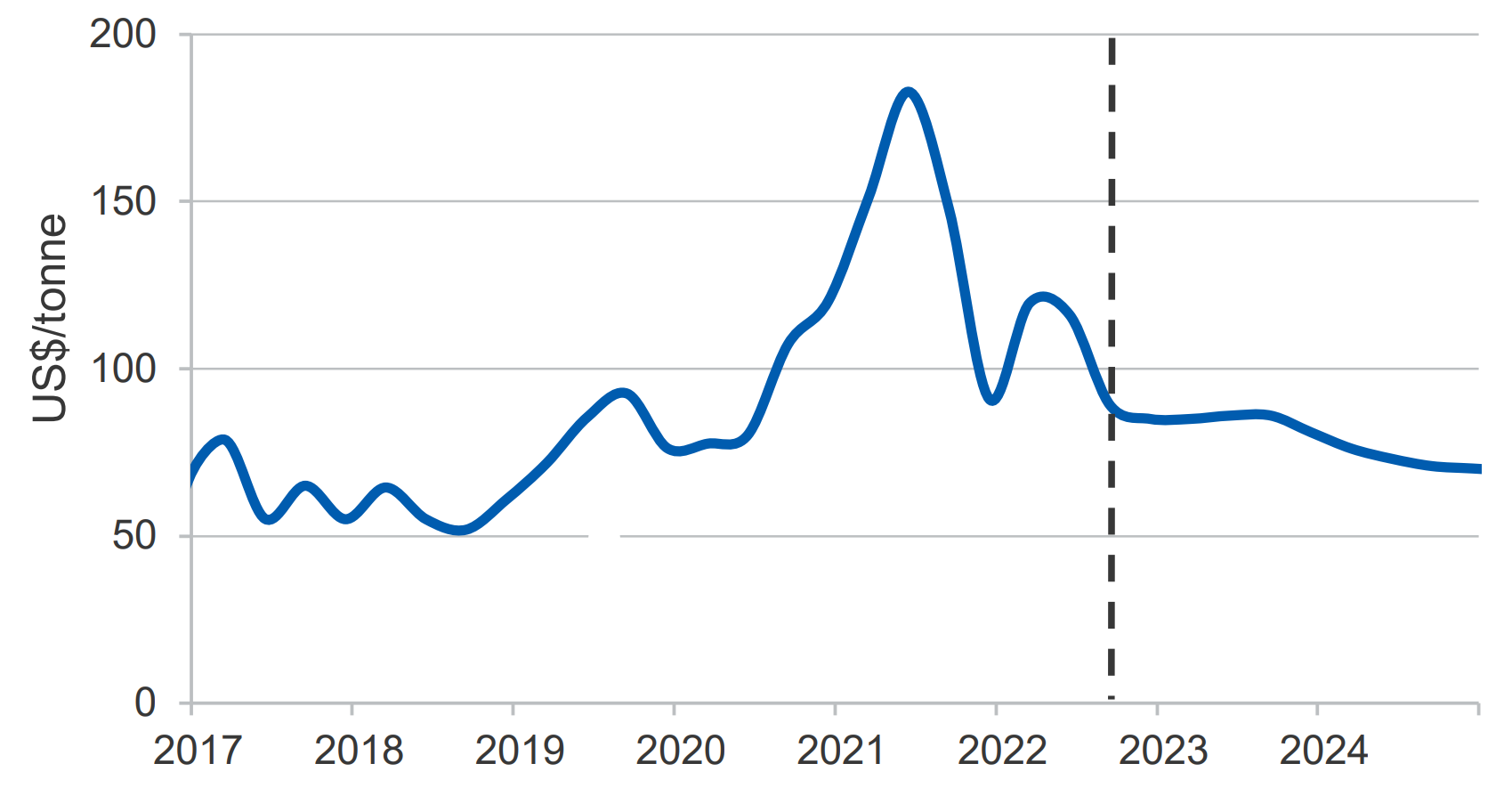

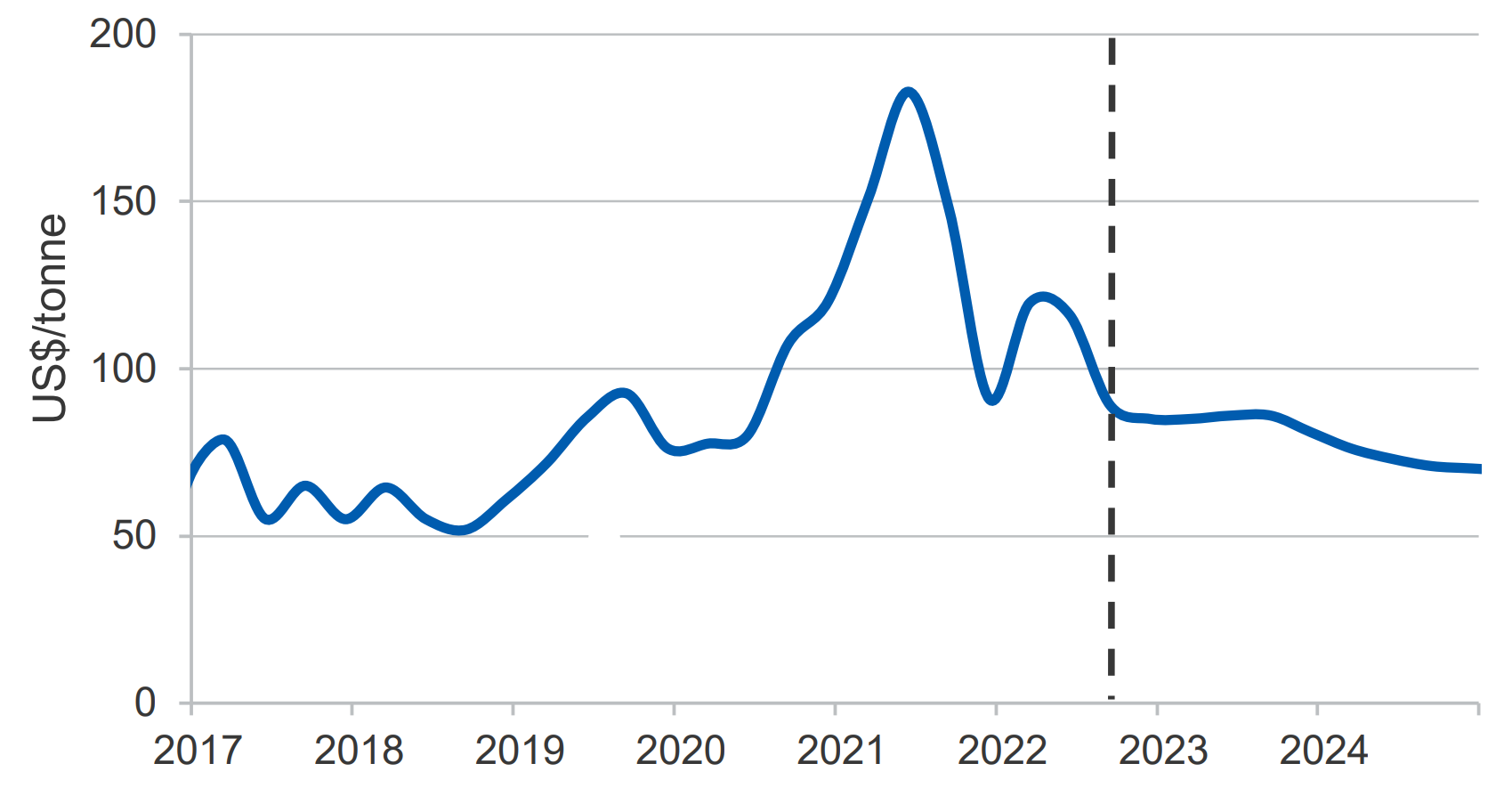

China's Reduced Steel Production: A Key Driver of Falling Iron Ore Prices

The most significant factor contributing to falling iron ore prices is the undeniable decrease in China's steel production. This reduced demand directly impacts the price of iron ore, the primary raw material in steel manufacturing. Several factors have converged to cause this decline:

-

Government Policies: China's government has implemented stringent policies aimed at curbing pollution and addressing overcapacity within its steel industry. These measures, while environmentally beneficial, have led to production cuts in numerous steel mills.

-

Weakening Domestic Construction and Infrastructure Spending: A slowdown in China's domestic construction and infrastructure projects has significantly reduced the demand for steel. This is partly due to a shift in economic priorities and a cooling property market.

-

Decreased Exports: The global economic slowdown has dampened demand for Chinese steel exports, further contributing to the decline in domestic production. International trade tensions and competition from other steel-producing nations have also played a role.

Statistics highlight this correlation: China's steel production decreased by X% in [Year], directly impacting iron ore demand and causing a Y% drop in iron ore prices during the same period. This demonstrates the strong link between China steel production, steel demand, iron ore demand, and government policies aimed at addressing overcapacity.

The Impact of Global Economic Slowdown on Iron Ore Prices

Beyond China's internal dynamics, the global economic slowdown has played a crucial role in driving down iron ore prices. Reduced infrastructure projects worldwide, stemming from factors like inflation and rising interest rates, have significantly decreased the global demand for steel.

-

Inflation and Interest Rates: High inflation and rising interest rates globally have increased borrowing costs, making infrastructure investments less attractive and hindering new project commencements.

-

Geopolitical Uncertainty: Geopolitical uncertainties and ongoing conflicts create instability, impacting global trade flows and discouraging investment in long-term infrastructure projects that rely on steel. This uncertainty further contributes to reduced steel exports.

This global economic climate directly translates to reduced demand for iron ore, adding further downward pressure on iron ore prices. The interconnectedness of the global economy means that a slowdown in one region significantly affects demand in others, highlighting the importance of understanding global factors beyond just China steel production.

Increased Iron Ore Supply and its Effect on Prices

The increased supply of iron ore from major producing countries like Australia and Brazil has exacerbated the downward pressure on prices.

-

Increased Mining Production: New mines opening, coupled with improved mining techniques and increased production from existing mines, has led to a surplus in the global iron ore market.

-

Australia Iron Ore & Brazil Iron Ore: Both Australia and Brazil, the world's leading iron ore exporters, have seen significant increases in their production output, flooding the market and impacting market equilibrium.

This increase in iron ore supply has outpaced the decrease in demand, leading to a significant imbalance and consequently lower iron ore prices. This underscores the importance of considering both supply and demand dynamics when analyzing price fluctuations.

Speculation and Market Sentiment: Contributing to Price Volatility

Market speculation and investor sentiment play a significant role in the volatility of iron ore prices. News and forecasts about the Chinese economy and global growth heavily influence market expectations.

-

Iron Ore Futures: Futures trading and hedging strategies by investors further contribute to the fluctuations. Negative sentiment, driven by concerns about economic slowdowns or geopolitical risks, can lead to sharp price drops.

-

Market Forecasts: Market analysts' predictions regarding future supply and demand greatly influence investor behavior, potentially creating self-fulfilling prophecies that exacerbate price volatility.

Understanding market speculation, investor sentiment, and the impact of iron ore futures is vital for comprehending the dynamics of price volatility in the iron ore market.

Conclusion: Navigating the Future of Falling Iron Ore Prices and China's Steel Industry

In conclusion, the decline in iron ore prices is a complex issue driven by a confluence of factors: reduced China steel production, the global economic slowdown, increased iron ore supply, and prevailing market sentiment. Predicting the future trajectory of iron ore prices requires close monitoring of policy changes in China, key economic indicators, and prevailing market trends. The interplay of these factors will continue to shape the future of both the iron ore market and China's steel industry. Stay updated on the latest developments in falling iron ore prices and their impact on China's steel industry by subscribing to our newsletter and following our research.

10 Film Noir Movies Guaranteed To Grip You

10 Film Noir Movies Guaranteed To Grip You

Fox News Internal Debate Trump Tariffs And Economic Consequences

Fox News Internal Debate Trump Tariffs And Economic Consequences

Strengthening Financial Cooperation Joint Venture Between Pakistan Sri Lanka And Bangladesh Capital Markets

Strengthening Financial Cooperation Joint Venture Between Pakistan Sri Lanka And Bangladesh Capital Markets

Chinas Canola Strategy Beyond The Canada Trade Dispute

Chinas Canola Strategy Beyond The Canada Trade Dispute

King Protiv Maska Pisatel Vernulsya V X S Rezkoy Kritikoy

King Protiv Maska Pisatel Vernulsya V X S Rezkoy Kritikoy