Falling Dutch Stock Prices: Impact Of US Trade Conflict

Table of Contents

Export Dependence and Trade Vulnerability

The Netherlands' economy is heavily reliant on international trade, making it particularly vulnerable to trade disputes and contributing significantly to falling Dutch stock prices. Exports account for a substantial percentage of its GDP, leaving it exposed to the ripple effects of global trade tensions.

The Netherlands' Reliance on International Trade

The Dutch economy's success is intrinsically linked to its robust export sector. This high dependence on international trade, while historically beneficial, now presents a significant vulnerability. The country’s open economy, characterized by a high degree of globalization and specialization, means that disruptions in global trade directly impact its economic performance and stock market valuations.

- High dependence on specific sectors: Key sectors like agriculture (particularly flowers, dairy, and horticultural products), technology (including semiconductors and high-tech equipment), and manufacturing (chemicals, machinery) are heavily reliant on export markets.

- Significant trade relationships with the US and EU: The Netherlands boasts strong trade ties with both the US and the EU, making it susceptible to trade disputes between these economic powerhouses. Disruptions in either relationship can significantly impact Dutch businesses and the broader economy, influencing falling Dutch stock prices.

- Impact of tariffs and trade restrictions: Tariffs and trade restrictions imposed as part of the US trade conflict directly increase the cost of Dutch exports, reducing competitiveness in international markets and decreasing profitability for Dutch businesses. This negatively affects investor confidence and can drive down stock prices.

Analyzing specific examples reveals a clear correlation between escalating trade tensions and a decline in exports. For instance, the imposition of tariffs on certain Dutch agricultural products by the US has demonstrably reduced export volumes and revenues for affected Dutch farmers and agri-food companies, directly contributing to negative market sentiment and falling Dutch stock prices. Further analysis of export data from these sectors provides quantifiable evidence supporting this correlation.

Investor Sentiment and Market Volatility

Uncertainty surrounding the US trade conflict has significantly impacted investor sentiment and market volatility in the Netherlands, directly leading to falling Dutch stock prices. The ongoing uncertainty creates a risk-averse environment, causing investors to reassess their holdings and potentially withdraw investments.

Uncertainty and Market Reactions

The fluctuating nature of trade negotiations and the unpredictable imposition of tariffs and trade restrictions create significant uncertainty for investors. This uncertainty makes it difficult to forecast future profits and economic stability, leading to risk aversion and a decline in investment.

- Decreased foreign investment in Dutch companies: Uncertainty discourages foreign investment, reducing capital inflows and dampening economic growth. This leads to lower valuations of Dutch stocks and contributes to falling Dutch stock prices.

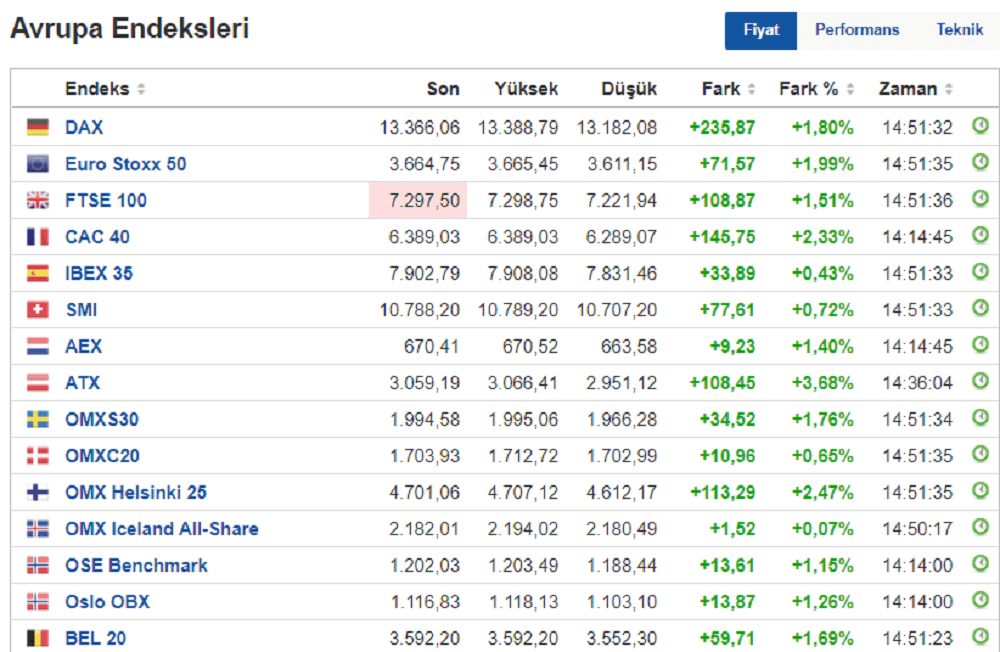

- Increased volatility in the Amsterdam Stock Exchange (AEX): The AEX, the primary stock exchange in the Netherlands, has experienced increased volatility, reflecting the heightened uncertainty surrounding the trade conflict and its impact on the Dutch economy.

- Flight to safety from riskier assets: Investors tend to move their investments away from riskier assets, including Dutch stocks, into safer havens like government bonds during periods of heightened global uncertainty.

News about trade negotiations directly correlates with stock market fluctuations in the Netherlands. Positive developments in trade talks can lead to a temporary increase in stock prices, while negative news, such as the imposition of new tariffs, tends to trigger declines. This demonstrates a clear link between trade conflict and the volatility in the Dutch stock market. For example, the announcement of new tariffs on [mention specific examples, e.g., agricultural products or tech goods] by the US led to immediate and significant drops in the share prices of affected Dutch companies.

Impact on Specific Sectors

The US trade conflict has had a disproportionate impact on specific sectors of the Dutch economy, directly impacting falling Dutch stock prices. Two key examples are the agriculture and technology sectors.

Agriculture and Agri-Food

The Dutch agricultural sector, renowned for its efficiency and exports, has been severely impacted by tariffs imposed by the US. This has led to reduced export volumes, lower prices for Dutch products, and increased operational costs for Dutch agricultural businesses.

Technology and Semiconductor Industry

The Dutch technology sector, a significant contributor to the national economy, is also vulnerable to the trade conflict. Disruptions in global supply chains, resulting from tariffs and trade restrictions, can impact the production and export of Dutch technology products.

- Specific examples of affected companies: [mention specific examples of companies affected in both sectors].

- Loss of revenue and market share: Tariffs and trade restrictions have directly resulted in a loss of revenue and market share for many Dutch companies in these sectors.

- Potential job losses: The prolonged trade conflict could lead to job losses in these sectors, further dampening economic growth and negatively impacting investor sentiment, contributing to falling Dutch stock prices.

Data demonstrating the financial impact on these sectors is crucial in providing concrete evidence supporting the link between the trade war and the decline in the Dutch stock market. Analyzing financial reports of affected companies will reveal quantifiable losses and highlight the overall economic burden.

Government Response and Mitigation Strategies

The Dutch government has implemented various measures to mitigate the negative economic consequences of the US trade conflict, aiming to alleviate the impact on businesses and prevent further falling Dutch stock prices.

Government Initiatives to Support Businesses

The Dutch government has recognized the vulnerability of its economy and has introduced several initiatives to support affected businesses and stimulate economic growth.

- Financial aid packages for affected businesses: The government has offered financial aid and support packages to businesses struggling with reduced exports and declining revenues.

- Trade diversification initiatives: The government is actively promoting trade diversification, encouraging Dutch companies to explore new export markets to reduce reliance on the US and EU.

- Lobbying efforts to resolve trade disputes: The Dutch government has actively engaged in diplomatic efforts and lobbying to resolve the trade disputes and reduce the negative impact on the Dutch economy.

Analyzing the effectiveness of these policies is crucial in understanding their impact on mitigating falling Dutch stock prices. While support packages can provide temporary relief, long-term solutions require strategic adjustments to the economy and its exposure to trade disputes. The effectiveness of diversification initiatives can be evaluated through a change in export market distribution, while the success of lobbying efforts can be measured through progress in trade negotiations.

Conclusion

The US trade conflict has had a profound impact on the Dutch economy, significantly contributing to falling Dutch stock prices. The Netherlands' high dependence on exports, particularly to the US and EU, makes it exceptionally vulnerable to trade disputes. Uncertainty surrounding the trade conflict has negatively affected investor sentiment, leading to increased market volatility and a flight from riskier assets. Specific sectors like agriculture and technology have been disproportionately affected, experiencing losses in revenue, market share, and potential job losses. While the Dutch government has implemented several measures to mitigate the negative impacts, the long-term consequences remain to be seen. Understanding the intricate relationship between the US trade conflict and the performance of the Dutch stock market is crucial for investors and policymakers.

Call to Action: Understanding the factors contributing to falling Dutch stock prices is crucial for investors and policymakers. Stay informed about ongoing trade negotiations and their impact on the Dutch economy. Continue to monitor the situation and consider diversifying investments to mitigate the risk related to falling Dutch stock prices and protect your portfolio.

Featured Posts

-

Best New R And B Songs This Week Leon Thomas And Flo Top The Charts

May 25, 2025

Best New R And B Songs This Week Leon Thomas And Flo Top The Charts

May 25, 2025 -

Avrupa Borsalari Buguen Nasil Kapandi Detayli Analiz

May 25, 2025

Avrupa Borsalari Buguen Nasil Kapandi Detayli Analiz

May 25, 2025 -

Glastonbury 2025 Lineup Announcement A Disappointment For Many

May 25, 2025

Glastonbury 2025 Lineup Announcement A Disappointment For Many

May 25, 2025 -

Sharp Drop In Amsterdam Stock Market Plunges 7 On Trade War Fears

May 25, 2025

Sharp Drop In Amsterdam Stock Market Plunges 7 On Trade War Fears

May 25, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Najib Razak

May 25, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Najib Razak

May 25, 2025

Latest Posts

-

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025 -

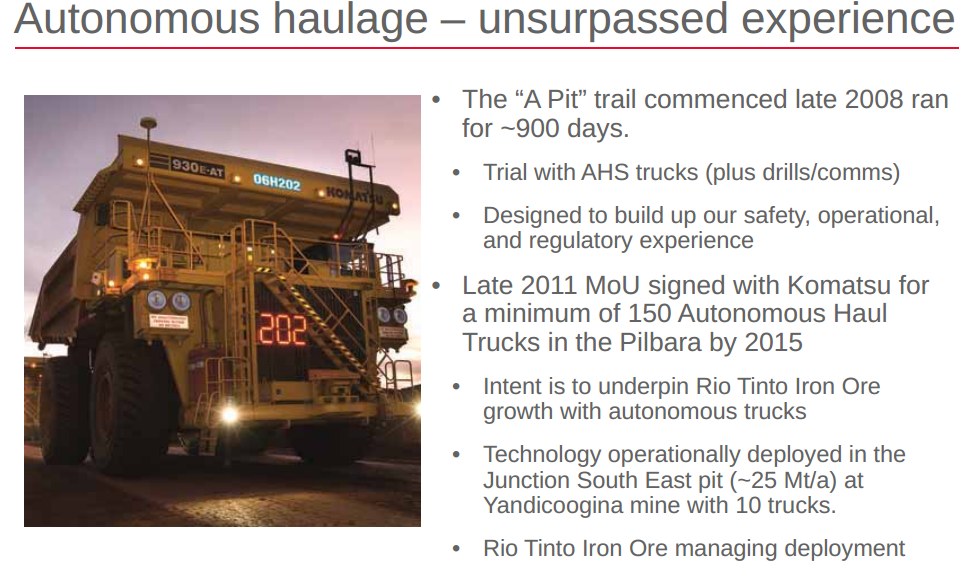

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025 -

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025 -

Rio Tintos Pilbara Operations A Response To Environmental Criticism

May 25, 2025

Rio Tintos Pilbara Operations A Response To Environmental Criticism

May 25, 2025 -

Sse Announces Significant Spending Cuts Amidst Economic Slowdown

May 25, 2025

Sse Announces Significant Spending Cuts Amidst Economic Slowdown

May 25, 2025