Ethereum's Bullish Trend: Analyzing Price Strength And Future Outlook

Table of Contents

Analyzing Ethereum's Recent Price Strength

Technical Indicators Pointing Towards a Bull Run:

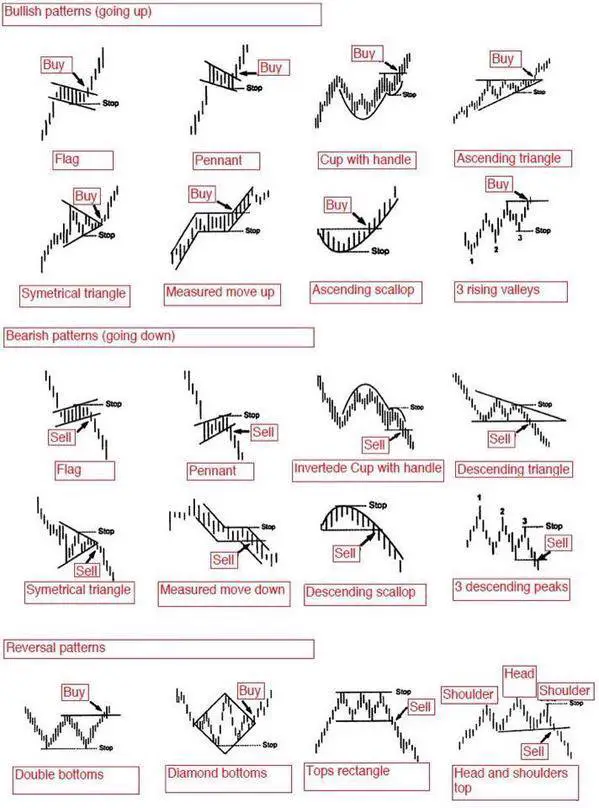

Technical analysis provides valuable insights into potential price movements. Several key indicators suggest a bullish trend for Ethereum. The Relative Strength Index (RSI), often used to identify overbought and oversold conditions, shows Ethereum moving away from oversold territory, suggesting further upward potential. The Moving Average Convergence Divergence (MACD), another popular momentum indicator, is exhibiting a bullish crossover, indicating a potential shift in momentum. Furthermore, sustained movement above crucial moving averages, such as the 200-day moving average, confirms the strength of the upward trend. Support and resistance levels also play a crucial role. A successful break above key resistance levels often signifies further price appreciation.

- Strong upward momentum evidenced by a sustained break above the 200-day moving average.

- Bullish crossover in the MACD indicator suggests a shift in momentum.

- RSI moving out of oversold territory indicates reduced selling pressure.

- Successful break above key resistance levels signals potential for further price appreciation.

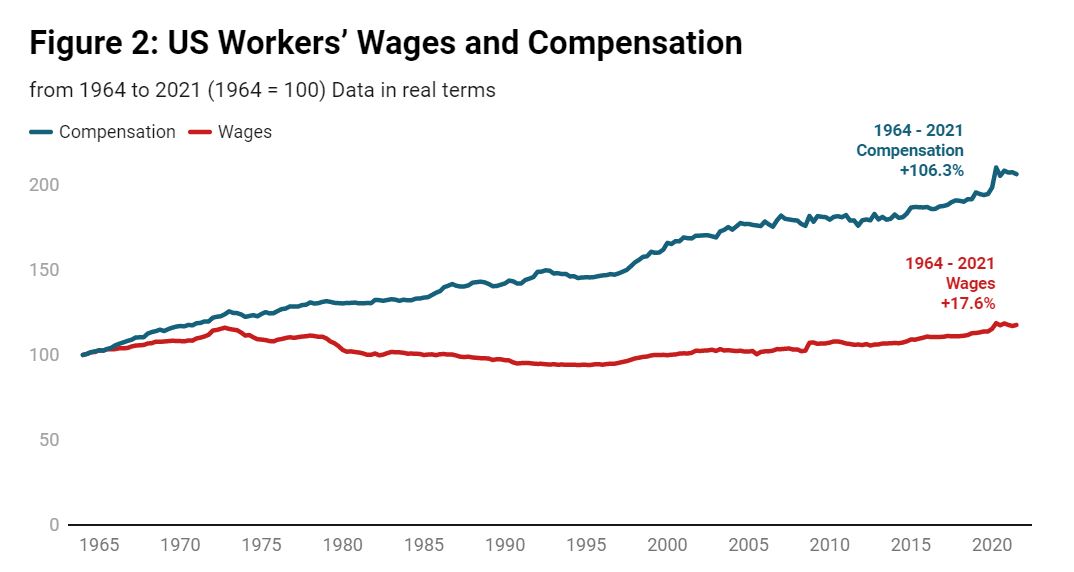

[Insert chart/graph showing RSI, MACD, and moving averages for Ethereum]

On-Chain Metrics Supporting the Bullish Narrative:

Beyond technical analysis, on-chain metrics provide valuable insights into the underlying health and activity of the Ethereum network. Increased transaction volume signifies growing user adoption and network activity, directly impacting price. A rise in the number of active addresses indicates a growing user base and network engagement. High gas fees, while sometimes frustrating for users, reflect high demand for network usage, again supporting a bullish narrative.

- Increased daily transaction volume indicates growing user adoption and network activity, a positive sign for Ethereum's price.

- Rising number of active addresses reflects a growing user base and increased network engagement.

- High gas fees, while potentially inconvenient, signify high demand for network usage.

- Increased smart contract deployments indicate a thriving decentralized application (dApp) ecosystem.

Market Sentiment and Investor Confidence:

Positive market sentiment plays a significant role in driving price appreciation. News articles highlighting Ethereum's technological advancements, positive social media trends, and bullish predictions from analysts all contribute to increased investor confidence. The overall feeling within the crypto community is a key factor to consider in evaluating the Ethereum bullish trend.

- Positive news surrounding Ethereum's scalability solutions and upcoming upgrades has boosted investor confidence.

- Increased institutional interest and investment signal growing legitimacy and adoption.

- Positive social media sentiment and discussions within the crypto community contribute to bullish momentum.

- Favorable analyst predictions and price targets reinforce the positive market sentiment.

Key Developments Fueling the Ethereum Bullish Trend

The Role of Ethereum 2.0 and Staking:

Ethereum 2.0, with its transition to a proof-of-stake consensus mechanism, is a game-changer. This upgrade significantly enhances scalability, transaction speed, and energy efficiency. The staking mechanism, where users lock up their ETH to validate transactions, incentivizes long-term holding and contributes to price stability.

- The increasing number of ETH staked reflects growing confidence in the network's future and contributes to price stability.

- Improved scalability and transaction speed with Ethereum 2.0 attract more users and developers.

- Reduced energy consumption makes Ethereum a more environmentally friendly and sustainable platform.

- Staking rewards provide additional incentives for holding and securing the network.

Growing DeFi Ecosystem and Applications:

Ethereum's dominance in the decentralized finance (DeFi) space is undeniable. The numerous DeFi applications built on Ethereum, ranging from decentralized exchanges (DEXs) to lending and borrowing platforms, attract significant capital and drive up demand for ETH. This thriving ecosystem fosters innovation and attracts further investment.

- The booming DeFi ecosystem attracts significant capital inflow, driving up demand for ETH.

- Popular DeFi projects built on Ethereum contribute to network growth and usage.

- Innovation within the DeFi space continues to attract new users and investment.

- Increased usage of ETH within the DeFi ecosystem fuels price appreciation.

Institutional Adoption and Investments:

The increasing adoption of Ethereum by institutional investors is a significant factor supporting the bullish trend. Large financial institutions, hedge funds, and corporations are allocating resources to Ethereum, recognizing its potential as a valuable asset and a crucial component of the evolving digital economy.

- Major financial institutions adding ETH to their portfolios underscores the growing legitimacy and investment potential of the asset.

- Strategic partnerships with major corporations signal growing enterprise-level adoption.

- Increased institutional investment provides liquidity and stability to the market.

- Growing institutional interest legitimizes Ethereum as a valuable investment asset.

Potential Risks and Challenges

While the outlook for Ethereum is positive, it's crucial to acknowledge potential risks and challenges. Regulatory uncertainty remains a significant concern, with varying regulations across different jurisdictions potentially impacting the price and adoption of cryptocurrencies. Competition from other blockchain platforms offering similar functionalities could also affect Ethereum's market share. Finally, the inherent volatility of the cryptocurrency market means price fluctuations are inevitable.

- Regulatory uncertainty remains a significant risk that could affect the price of Ethereum.

- Competition from other blockchain platforms could impact Ethereum's market share.

- Market volatility remains a significant risk factor for all cryptocurrencies, including Ethereum.

- Security risks and potential vulnerabilities within the Ethereum network could impact investor confidence.

Conclusion:

This analysis suggests that several factors currently contribute to a bullish trend for Ethereum. Strong on-chain metrics, positive technical indicators, significant developments like Ethereum 2.0, and growing institutional adoption all point towards a positive outlook for ETH. However, it’s crucial to remember that the cryptocurrency market is inherently volatile, and investors should always conduct their own research and manage risk appropriately. Stay informed on the latest developments to effectively navigate the dynamic world of Ethereum and capitalize on the potential of this evolving Ethereum bullish trend. Learn more about investing in the Ethereum bullish trend today!

Featured Posts

-

Auto Analyst Links Gms Decreased Canadian Activity To Us Tariffs

May 08, 2025

Auto Analyst Links Gms Decreased Canadian Activity To Us Tariffs

May 08, 2025 -

Are Ps 5 Games Stuttering Troubleshooting Common Problems

May 08, 2025

Are Ps 5 Games Stuttering Troubleshooting Common Problems

May 08, 2025 -

Inter Milans Historic Champions League Final Victory Over Barcelona

May 08, 2025

Inter Milans Historic Champions League Final Victory Over Barcelona

May 08, 2025 -

Sharp Rise In Ethereum Address Activity A 10 Increase In Two Days

May 08, 2025

Sharp Rise In Ethereum Address Activity A 10 Increase In Two Days

May 08, 2025 -

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Latest Posts

-

The Great Decoupling A New Era Of Economic Relations

May 08, 2025

The Great Decoupling A New Era Of Economic Relations

May 08, 2025 -

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025 -

Surviving The Crypto Crash Caused By Trade Wars

May 08, 2025

Surviving The Crypto Crash Caused By Trade Wars

May 08, 2025 -

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025 -

Is The Great Decoupling Inevitable A Critical Analysis

May 08, 2025

Is The Great Decoupling Inevitable A Critical Analysis

May 08, 2025