Ethereum Forecast: Rising Accumulation Signals Potential Price Increase

Table of Contents

On-Chain Data Reveals Increasing Accumulation

Several key on-chain metrics paint a picture of increasing Ethereum accumulation, suggesting a potential shift in market sentiment and a bullish outlook for ETH price.

Exchange Outflows Indicate Reduced Selling Pressure

A significant indicator of accumulating interest in Ethereum is the consistent outflow of ETH from cryptocurrency exchanges. This suggests that holders are moving their assets to more secure, private wallets, indicating a long-term holding strategy rather than a short-term trading approach. Reduced selling pressure is a crucial factor in price appreciation.

- 20% decrease in exchange reserves over the past 12 weeks. (Source: [Link to Glassnode data])

- Negative exchange netflow consistently observed for the past month. (Source: [Link to IntoTheBlock data])

- Increased difficulty in obtaining ETH on exchanges leading to higher premiums.

These data points collectively signal a shift from a selling-driven market to one characterized by accumulation and reduced selling pressure, a strong positive sign for the Ethereum forecast.

Growing Number of Addresses Holding ETH

The number of unique Ethereum addresses holding ETH is steadily increasing. This signifies broader adoption and an expanding user base, directly correlating with price appreciation. More holders often lead to greater demand and reduced selling pressure.

- A 15% increase in the number of addresses holding at least 1 ETH in the last six months. (Source: [Link to relevant on-chain data])

- Significant growth in the number of addresses holding smaller amounts of ETH, suggesting increased participation from retail investors.

- This widespread distribution of ETH among a larger number of addresses strengthens the overall network and decreases the likelihood of large sell-offs.

High ETH Supply Held in Long-Term Wallets

A substantial portion of the total ETH supply is now held in long-term wallets, indicating a strong belief in the long-term potential of the Ethereum network. This signifies reduced selling pressure, bolstering the potential for future price growth.

- Over 60% of the total ETH supply is currently held in wallets that haven't moved their coins for over a year. (Source: [Link to relevant on-chain data])

- This "hodling" behavior suggests strong conviction among long-term investors, further supporting a positive Ethereum forecast.

- This trend significantly contributes to the reduced likelihood of a sudden market correction driven by large-scale selling.

Factors Contributing to Ethereum Accumulation

Several factors beyond on-chain data contribute to the ongoing Ethereum accumulation trend, painting a bullish picture for the future.

The Ethereum Merge and Proof-of-Stake Transition

The successful transition to a Proof-of-Stake (PoS) consensus mechanism drastically improved Ethereum's energy efficiency and environmental footprint. This significant upgrade boosted investor confidence, attracting new capital and enhancing the network's long-term sustainability.

- A substantial reduction in energy consumption, making Ethereum a more environmentally responsible investment.

- The merge has also reduced ETH inflation, creating a more deflationary environment that can drive up its value.

- Increased regulatory clarity and favorable media coverage have contributed to growing confidence in the Ethereum ecosystem.

Growing DeFi Ecosystem and Utility

Ethereum remains the dominant platform for Decentralized Finance (DeFi) applications, offering a robust and secure environment for various financial instruments. This growing utility strengthens the demand for ETH, further driving accumulation.

- The Total Value Locked (TVL) in Ethereum-based DeFi protocols continues to grow, demonstrating robust ecosystem growth.

- The increasing adoption of Ethereum for NFTs and other decentralized applications also boosts demand for ETH.

- Key DeFi applications like Aave, Uniswap, and MakerDAO solidify Ethereum's position as the leading DeFi platform.

Institutional Investor Interest

Institutional investors are increasingly recognizing the potential of Ethereum, leading to significant investments in ETH. This growing institutional adoption contributes to price stability and paves the way for future price growth.

- Several large investment firms have added ETH to their portfolios, signifying a growing level of institutional confidence.

- This inflow of institutional capital provides increased stability and liquidity to the ETH market.

- Increased regulatory clarity in certain jurisdictions has further encouraged institutional participation.

Potential Price Increase Scenarios and Risks

While the indicators point towards a potential price increase, it's essential to consider both bullish and bearish scenarios.

Bullish Price Targets and Supporting Factors

Based on on-chain data, technical analysis, and growing adoption, several analysts predict significant price increases for Ethereum. These predictions are supported by the accumulation trends, growing utility, and increasing institutional investment.

- Conservative estimates suggest a price target of [Insert Price Target] within the next [Timeframe].

- More bullish forecasts predict prices reaching [Insert Higher Price Target] based on continued adoption and network growth.

- Sustained accumulation, positive market sentiment, and regulatory clarity contribute to a positive outlook.

Bearish Scenarios and Potential Risks

While the outlook is positive, several factors could negatively impact the price of ETH. Understanding these risks is crucial for informed investment decisions.

- Macroeconomic factors, such as inflation and interest rate hikes, could negatively impact the cryptocurrency market.

- Regulatory uncertainty in different jurisdictions could create volatility and negatively affect investor sentiment.

- Competition from other Layer-1 blockchains could potentially impact Ethereum's market share and price.

Conclusion

The rising accumulation of Ethereum, as evidenced by on-chain data and several key factors, suggests a potential price increase in the near future. While risks always exist in the cryptocurrency market, the confluence of positive indicators points towards a bullish outlook. By understanding the dynamics of ETH accumulation and the factors influencing its price, investors can make informed decisions. Stay informed on the latest Ethereum forecast and continue to monitor on-chain metrics for a more comprehensive understanding of the market. Learn more about the potential of Ethereum and its future price by [link to relevant resource, e.g., Glassnode, CoinMarketCap].

Featured Posts

-

Inter Beat Barca A Classic Champions League Showdown

May 08, 2025

Inter Beat Barca A Classic Champions League Showdown

May 08, 2025 -

Rogue Unleashes Cyclops Style Abilities New X Men Reveal

May 08, 2025

Rogue Unleashes Cyclops Style Abilities New X Men Reveal

May 08, 2025 -

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025

Champions League Semi Final Arsenals Chances Against Psg

May 08, 2025 -

New Superman Footage Shows Kryptos Adorable Side

May 08, 2025

New Superman Footage Shows Kryptos Adorable Side

May 08, 2025 -

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Films

May 08, 2025

Beyond Saving Private Ryan A Military Historians Guide To Realistic Wwii Films

May 08, 2025

Latest Posts

-

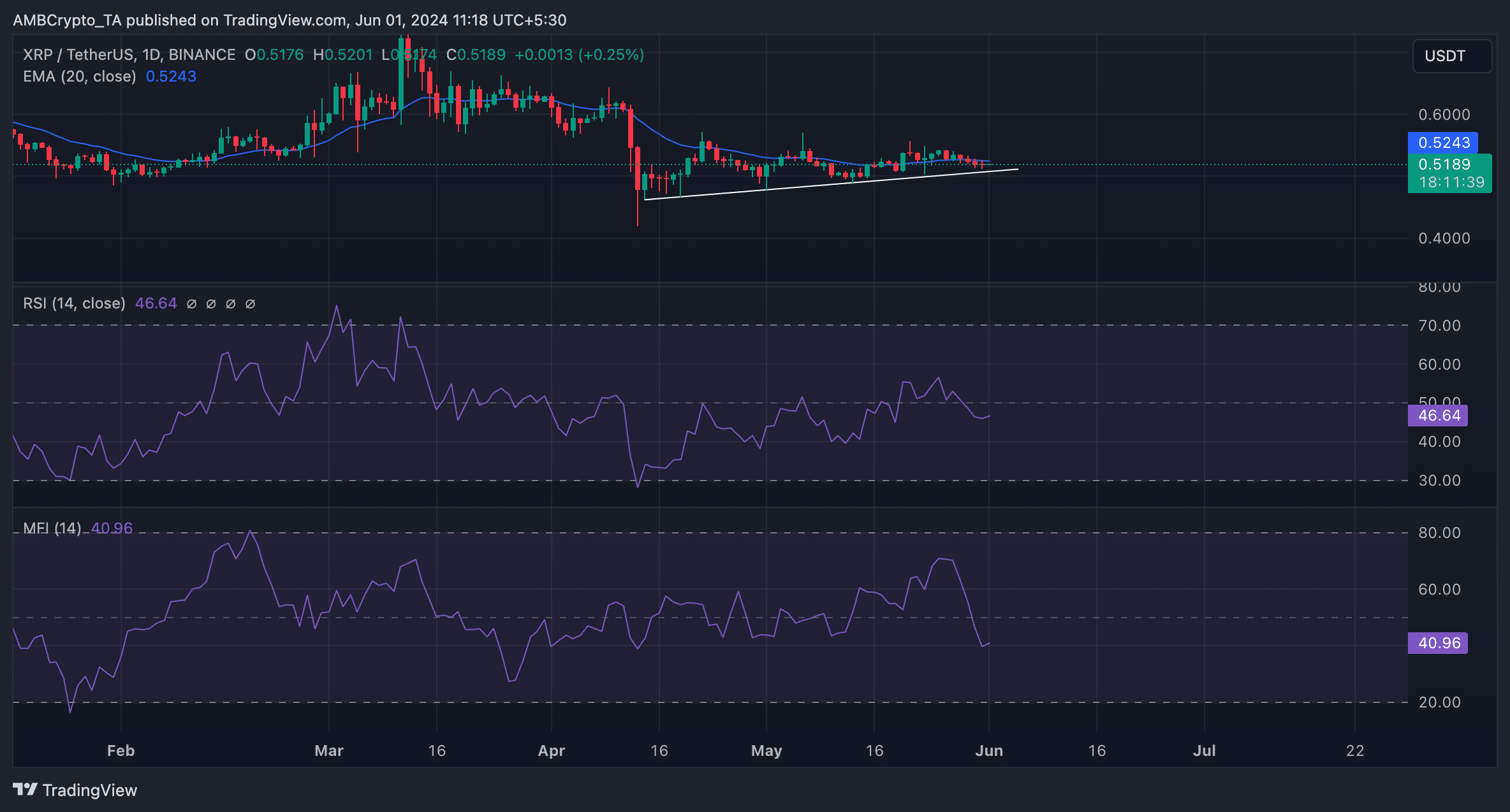

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025

Ripple And Xrp Remittix Ico Boost And 3 Factors Fueling Xrp Growth

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Remittix Ico Raises 15 M

May 08, 2025 -

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For An Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025

Xrp Market Analysis Three Reasons Why Xrp May Be Ready To Explode

May 08, 2025 -

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025

3 Key Indicators Suggesting Xrp Could Be Poised For A Significant Rally

May 08, 2025