ETFs Thrive Despite Market Turmoil: Understanding The Investor Surge

Table of Contents

Diversification and Risk Management: The ETF Advantage

One of the primary reasons for the ETF surge is their inherent ability to diversify investment portfolios effectively. Unlike investing in individual stocks, which carries significant risk, ETFs allow investors to spread their capital across a wide range of assets. This diversification reduces the overall portfolio risk, mitigating the impact of any single investment performing poorly.

- Lower risk compared to individual stock picking: By owning a basket of assets, the negative impact of one poorly performing stock is diluted.

- Access to global markets through single investments: Many ETFs track international indices, providing exposure to global markets without the complexities of international investing.

- Strategic asset allocation simplified: ETFs make it easy to implement a well-diversified asset allocation strategy, blending stocks, bonds, and other asset classes according to investor risk tolerance and goals.

- Reduced impact of individual company performance fluctuations: The performance of a single company has less impact on the overall ETF value compared to owning that company's stock directly.

For example, a diversified ETF tracking the S&P 500 provides exposure to 500 large-cap US companies, significantly reducing the risk compared to investing in just one or two individual stocks. Similarly, international ETFs provide diversification across various global markets, potentially smoothing out volatility caused by regional economic downturns. During periods of market downturn, well-diversified ETFs often demonstrate greater resilience than individual stocks.

Cost-Effectiveness: Lower Fees, Higher Returns

ETFs are generally far more cost-effective than actively managed mutual funds. Their lower expense ratios translate into higher returns over the long term. This is a significant factor driving investor interest, especially during periods when maximizing returns is crucial.

- Comparison of ETF expense ratios vs. mutual fund expense ratios: ETFs typically boast expense ratios significantly lower than actively managed mutual funds, often in the range of 0.1% to 0.5% compared to 1% or more for actively managed funds.

- Illustrate the long-term impact of lower fees on investment growth: Even small differences in expense ratios can have a substantial impact on investment growth over several decades. A lower expense ratio means more of your investment earnings are reinvested, leading to compound growth.

- Mention the availability of low-cost index ETFs tracking major market indices: Index ETFs passively track major market indices like the S&P 500 or Nasdaq 100, offering broad market exposure at incredibly low costs.

These cost savings directly contribute to better returns for investors. Over time, these seemingly small differences accumulate into substantial gains, making ETFs a compelling choice for long-term investors.

Trading Flexibility and Accessibility: ETFs for Every Investor

ETFs offer remarkable trading flexibility, mirroring the ease of trading individual stocks. This accessibility is a major draw for both novice and experienced investors.

- Intraday trading opportunities: Unlike mutual funds, ETFs can be bought and sold throughout the trading day at fluctuating market prices.

- Accessibility through online brokerage accounts: ETFs are easily accessible through most online brokerage accounts, making them convenient for investors to trade.

- Transparency in pricing and holdings: Real-time pricing and ETF holdings are readily available, providing investors with clear visibility into their investments.

- Ability to buy and sell fractional shares: Many brokerages allow buying fractional shares of ETFs, making it easier for investors with smaller capital to participate.

This ease of trading makes ETFs incredibly appealing to a wide spectrum of investors, from beginners building their first portfolios to seasoned professionals managing complex investment strategies.

Specific ETF Categories Gaining Traction During Market Uncertainty

During periods of market turmoil, certain ETF categories experience a surge in demand due to their perceived safety or hedging capabilities.

- Examples of high-performing ETF categories during market uncertainty: Bond ETFs, defensive sector ETFs (like consumer staples or utilities), and gold ETFs often see increased investment during uncertain times.

- Explain the reasons behind the increased demand for these specific ETFs (e.g., safety, hedging): Investors often seek safety in bonds during market volatility, while defensive sectors are considered less susceptible to economic downturns. Gold is often viewed as a safe haven asset.

- Provide data to support the claims: Market data from recent downturns can illustrate the relative performance of these ETF categories compared to others.

Investor sentiment plays a crucial role in driving these trends. When uncertainty reigns, investors often shift towards ETFs perceived as less risky, further fueling their popularity.

Conclusion: ETFs: A Resilient Investment Strategy for Uncertain Times

In summary, the popularity of ETFs, particularly during periods of market uncertainty, stems from their key advantages: diversification, cost-effectiveness, and trading flexibility. Their ability to provide broad market exposure at low costs, while offering the ease of trading like individual stocks, makes them an attractive option for investors of all levels. Consider diversifying your portfolio with ETFs to mitigate risk and potentially enhance returns. Explore the various ETF options available and make informed investment decisions to build a resilient investment strategy for the future. Invest in ETFs today and navigate market volatility with confidence.

Featured Posts

-

Liverpool Linked With Rayan Cherki Lyon Exit Imminent

May 28, 2025

Liverpool Linked With Rayan Cherki Lyon Exit Imminent

May 28, 2025 -

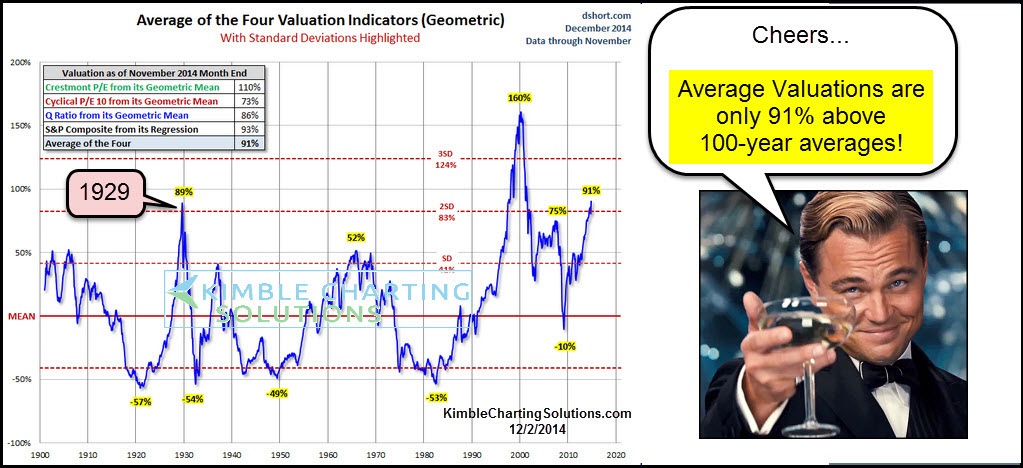

Addressing Investor Concerns Bof As Take On Stretched Stock Market Valuations

May 28, 2025

Addressing Investor Concerns Bof As Take On Stretched Stock Market Valuations

May 28, 2025 -

Osimhen Transferi Ingiliz Kulueplerinin 45 Milyon Euroluk Teklifi

May 28, 2025

Osimhen Transferi Ingiliz Kulueplerinin 45 Milyon Euroluk Teklifi

May 28, 2025 -

Another A Lister Enters Blake Lively Justin Baldoni Legal Battle

May 28, 2025

Another A Lister Enters Blake Lively Justin Baldoni Legal Battle

May 28, 2025 -

Padre Cubs Matchup A Deep Dive Into The Series Results

May 28, 2025

Padre Cubs Matchup A Deep Dive Into The Series Results

May 28, 2025