Estimating The Cost: Trump's Tariffs And California's $16 Billion Revenue Drop

Table of Contents

H2: The Impact of Trump's Tariffs on California's Economy

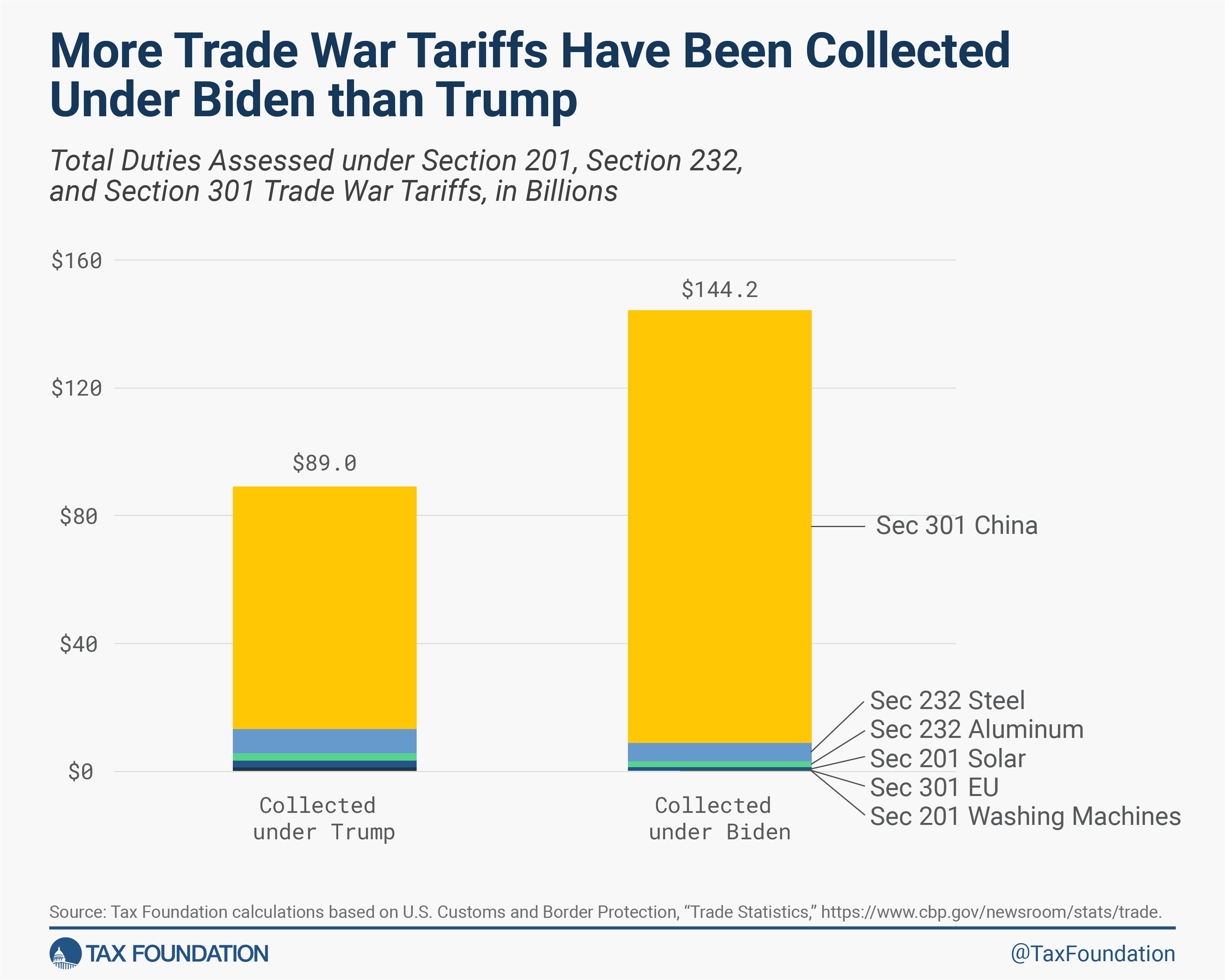

Trump's tariffs, implemented through Section 301 of the Trade Act of 1974, targeted various goods from countries like China. These tariffs, ranging from 10% to 25%, significantly impacted California's diverse economy. Key industries like agriculture, manufacturing, and technology faced considerable challenges due to increased import costs and retaliatory tariffs from affected countries.

- Specific examples of tariff-affected industries in California: Agriculture (almonds, wine, dairy), manufacturing (electronics, apparel), and technology (semiconductors, consumer electronics).

- Quantifiable data showing the revenue losses in these sectors: While precise figures for each sector are difficult to isolate, studies indicate significant losses in agricultural exports due to reduced demand from China and other countries imposing retaliatory tariffs. Similarly, increased costs of imported components hampered California's manufacturing and technology sectors.

- Explanation of how increased import costs affected businesses and consumers: Businesses faced higher production costs, leading to reduced profits or price increases for consumers. Consumers faced higher prices for goods, impacting disposable income and overall economic activity.

H3: Agricultural Sector Losses: California's agricultural sector, a cornerstone of the state's economy, suffered immensely. The imposition of tariffs on agricultural products led to decreased exports to China, a major market for California almonds, wine, and dairy products. Estimates suggest billions of dollars in lost revenue for California farmers, leading to farm closures and job losses.

H3: Manufacturing and Technology Sector Impacts: The tariffs also impacted California's manufacturing and technology sectors. Increased costs of imported components, coupled with retaliatory tariffs on California exports, led to reduced production, job losses, and decreased investment. The technology sector, heavily reliant on global supply chains, experienced disruptions due to tariff-related delays and increased costs.

H2: Methodology for Estimating the $16 Billion Revenue Drop

The $16 billion figure represents an estimate of the total revenue drop in California's economy due to Trump's tariffs. This estimate is derived from a combination of sources and methodologies:

- Detailed explanation of the data sources used: The calculation draws upon data from the US Department of Commerce, the California Department of Food and Agriculture, industry association reports, and economic modeling studies.

- Description of the economic models (if any) employed in the calculations: Econometric models were used to estimate the indirect effects of the tariffs, considering factors like reduced consumer spending and investment. These models considered various scenarios and attempted to quantify the ripple effects throughout the economy.

- Acknowledgement of potential uncertainties and limitations of the estimates: It’s crucial to acknowledge that estimating the precise economic impact of tariffs is inherently complex. The $16 billion figure is an approximation, and the actual impact might vary based on the specific methodologies and assumptions employed.

H2: Wider Economic Ripple Effects Beyond the $16 Billion

The $16 billion revenue drop is only the tip of the iceberg. The tariffs had far-reaching consequences:

- Examples of secondary economic impacts: Reduced tax revenue for the state government, job losses in industries related to the affected sectors (e.g., transportation, logistics), and decreased consumer spending due to higher prices.

- Discussion of potential long-term economic consequences: The tariffs could have long-term negative effects on California's competitiveness, potentially leading to decreased investment and slower economic growth.

- Analysis of the effects on different socioeconomic groups in California: Low-income families, who spend a larger proportion of their income on essential goods, were disproportionately affected by the price increases caused by the tariffs.

H2: Political and Policy Implications of the Revenue Drop

The significant revenue drop caused significant political fallout:

- Discussion of the state's response to the economic downturn: California's government implemented various measures to mitigate the economic impact, including targeted assistance programs for affected industries.

- Analysis of any policy changes implemented as a result of the tariff impacts: The experience highlighted the vulnerability of the state's economy to global trade policies and prompted discussions about diversifying trade partners and strengthening domestic supply chains.

- Examination of the political debates surrounding trade policies and their effects on California: The tariffs fueled political debates about the benefits and drawbacks of protectionist trade policies and their impact on specific regions and industries.

3. Conclusion:

Trump's tariffs inflicted significant damage on California's economy, resulting in an estimated $16 billion revenue drop. This estimate, derived from various data sources and economic models, reflects the direct and indirect costs across multiple sectors. The wider economic consequences included job losses, reduced consumer spending, and long-term impacts on California's competitiveness. The political fallout led to policy discussions and debates on trade strategies and economic diversification. Understanding the full impact of Trump's tariffs on California revenue requires further investigation. Explore related resources and continue the conversation on the lasting effects of these trade policies.

Featured Posts

-

Examining The Controversies Presidential Pardons During Trumps Second Term

May 16, 2025

Examining The Controversies Presidential Pardons During Trumps Second Term

May 16, 2025 -

Pboc Daily Yuan Support Below Estimates A First In 2024

May 16, 2025

Pboc Daily Yuan Support Below Estimates A First In 2024

May 16, 2025 -

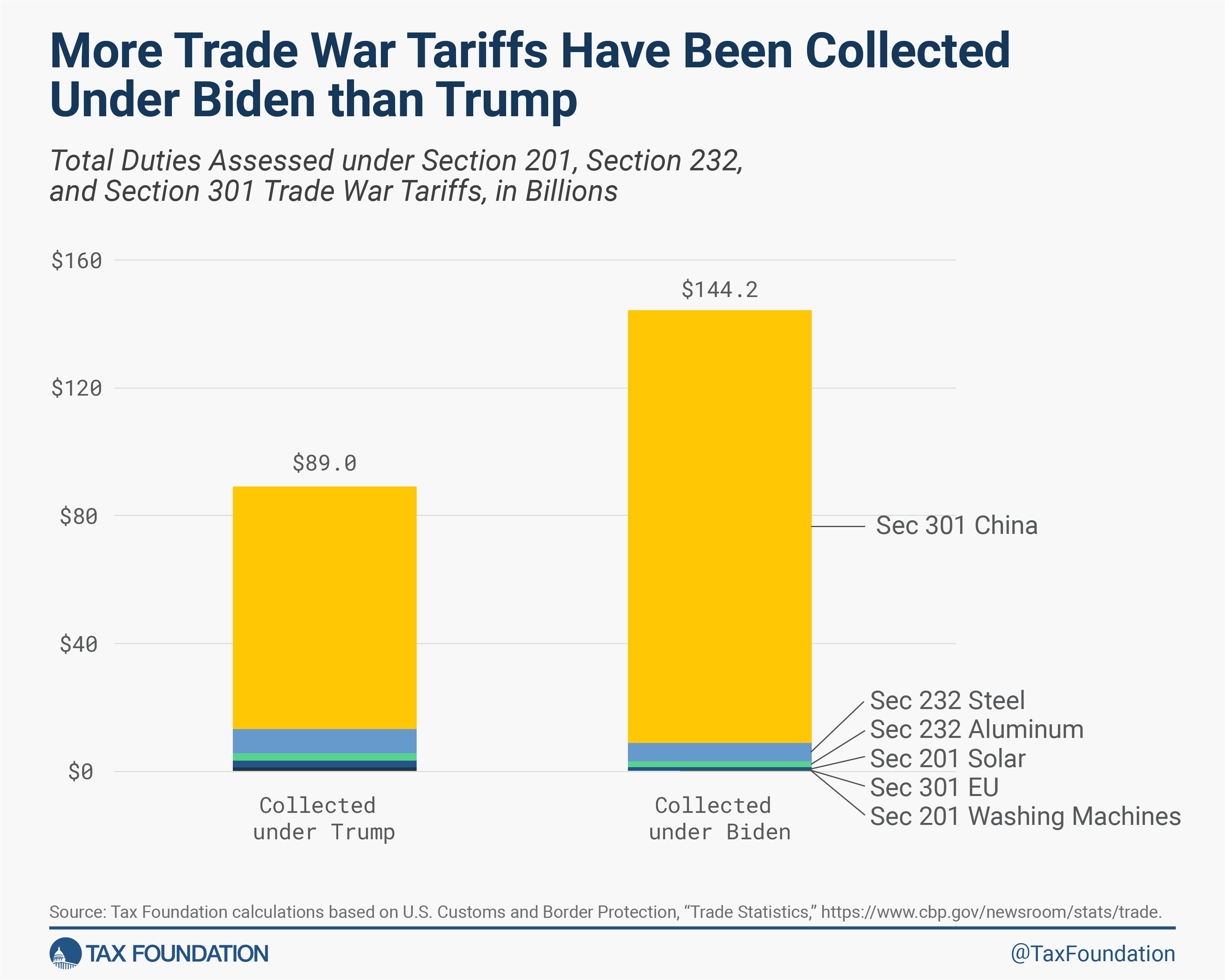

26 Eama Tfsl Bynhma Tfasyl Elaqt Twm Krwz Wana Dy Armas

May 16, 2025

26 Eama Tfsl Bynhma Tfasyl Elaqt Twm Krwz Wana Dy Armas

May 16, 2025 -

Will The Padres Overcome The Rockies This Time A Preview Of The Series

May 16, 2025

Will The Padres Overcome The Rockies This Time A Preview Of The Series

May 16, 2025 -

Rays Complete Sweep Of Padres Tampa Bay Dominates San Diego In Series

May 16, 2025

Rays Complete Sweep Of Padres Tampa Bay Dominates San Diego In Series

May 16, 2025

Latest Posts

-

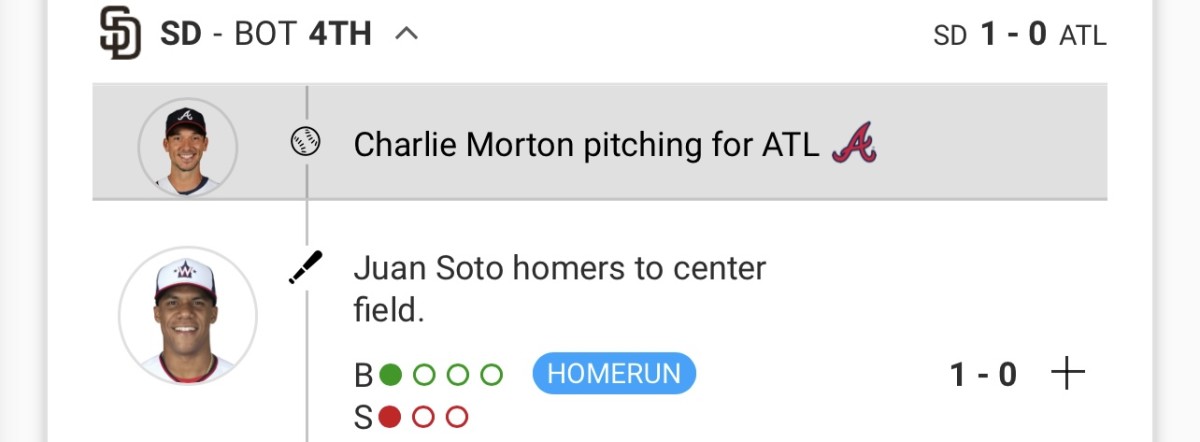

Gurriels Pinch Hit Delivers Padres Win Against Braves

May 16, 2025

Gurriels Pinch Hit Delivers Padres Win Against Braves

May 16, 2025 -

Rays Commanding Sweep Of Padres Key Moments And Player Highlights

May 16, 2025

Rays Commanding Sweep Of Padres Key Moments And Player Highlights

May 16, 2025 -

Padres Defeat Braves Gurriels Clutch Pinch Hit Rbi

May 16, 2025

Padres Defeat Braves Gurriels Clutch Pinch Hit Rbi

May 16, 2025 -

Pinch Hit Magic Gurriels Rbi Single Propels Padres To 1 0 Win Over Braves

May 16, 2025

Pinch Hit Magic Gurriels Rbi Single Propels Padres To 1 0 Win Over Braves

May 16, 2025 -

Padres Fall To Rays In Series Sweep Post Game Analysis

May 16, 2025

Padres Fall To Rays In Series Sweep Post Game Analysis

May 16, 2025