Elon Musk's X Debt: Exclusive Details On Final Bank Sale

The Total Debt Burden and its Origins

Elon Musk's acquisition of Twitter, now rebranded as X, was a highly leveraged transaction, resulting in a substantial debt burden. The exact figure remains somewhat opaque, but estimates place the total debt incurred at over $13 billion. This significant sum stems primarily from the leveraged buyout, which relied heavily on loans from various banks and private equity firms to finance the acquisition. The rebranding to X, while potentially aiming for a broader market appeal, has not yet demonstrably eased the financial pressure associated with Musk's X debt.

- Specific numbers related to debt incurred: While precise figures are not publicly available, estimates consistently point to a debt exceeding $13 billion, a substantial amount even for a company of X's scale.

- Names of major banks and financial institutions involved: Several major financial institutions participated in the initial financing, including Morgan Stanley, Bank of America, and others. The precise composition of lenders involved in the final bank sale is still emerging.

- Timeline of key financial events: The acquisition of Twitter closed in late 2022. The rebranding to X followed shortly after. Debt restructuring and negotiations leading to the final bank sale spanned several months, creating considerable uncertainty in the market.

The Final Bank Sale: Key Participants and Terms

The final bank sale of Musk's X debt involved a complex restructuring and negotiation process. While the exact names of all purchasing banks are yet to be fully disclosed, reports suggest a consortium of financial institutions took part, likely motivated by a combination of risk mitigation and potential for profit from debt restructuring. The terms of the sale likely involve discounts on the original debt amount, adjusted repayment schedules, and possibly collateralized assets to secure the loan.

- Names of purchasing banks and their market share: Details surrounding the precise composition of the consortium purchasing X's debt are still being released. The involved banks likely hold substantial market share across various financial sectors.

- Specific details about debt restructuring and repayment terms: The restructuring probably includes extended repayment schedules, potentially involving lower interest rates initially and gradual increases over time. The specifics are confidential until official disclosures.

- Analysis of the banks' motivations and potential returns: Banks likely assessed the risk inherent in X's current financial situation. The potential for future returns, given X's substantial user base and potential for revenue growth, likely played a crucial role in their decision to participate.

Impact on X's Future and Elon Musk's Finances

The final bank sale of Elon Musk's X debt will undoubtedly impact both X's future operations and Elon Musk's personal wealth. The reduced debt burden should alleviate some immediate financial pressure, potentially freeing up resources for X to invest in product development, marketing, and expansion. However, the exact long-term effects are uncertain and depend on X's ability to generate substantial revenue growth to justify the terms of the debt restructuring. The sale will also affect Musk's net worth, reducing some of the financial strain related to his acquisition.

- Projections of X's financial performance post-debt sale: Analysts are divided on X's future financial prospects. Successful implementation of monetization strategies will be crucial for long-term financial health.

- Potential future investment rounds or acquisitions by X: The reduced debt could open opportunities for X to seek further investment or potentially make strategic acquisitions to enhance its services and broaden its revenue streams.

- Analysis of Musk's personal financial position after the debt restructuring: The debt sale will undoubtedly lessen the personal financial pressure on Elon Musk, though the full impact on his overall net worth remains to be fully analyzed.

Risk Assessment and Market Reactions

The final bank sale of Elon Musk's X debt presents both opportunities and risks. For the purchasing banks, the inherent risk is that X might fail to generate sufficient revenue to meet its repayment obligations. The market's reaction to the news will likely be influenced by the specific terms of the sale and investor confidence in X's future prospects. Regulatory scrutiny is another potential risk factor, especially given the high-profile nature of the acquisition and the ensuing financial complexities.

- Credit rating changes for X after the debt sale: Credit rating agencies are likely to reassess X's creditworthiness following the debt restructuring, potentially affecting its ability to raise capital in the future.

- Stock market fluctuations related to the news: The announcement of the final bank sale could trigger significant stock market fluctuations, reflecting the market's assessment of the associated risks and opportunities.

- Potential regulatory challenges and their implications: Any potential regulatory investigations could add further complexity to X's already challenging financial situation.

Conclusion

The final bank sale of Elon Musk's X debt marks a significant turning point in the saga of the rebranded social media platform. The sale, while relieving some immediate pressure, presents ongoing financial challenges and uncertainties. The terms of the deal, the identity of the participating banks, and the market's reaction will all contribute to shaping X's future and its impact on the tech landscape. The long-term outlook for X hinges on its ability to generate sustainable revenue growth and navigate the complex regulatory environment.

Stay tuned for more updates on the evolving story of Elon Musk's X debt. Keep checking back for further analysis and exclusive insights into the future of X and its financial strategies, including developments in X's financial situation and Elon Musk's debt resolution, and the future of X's finances.

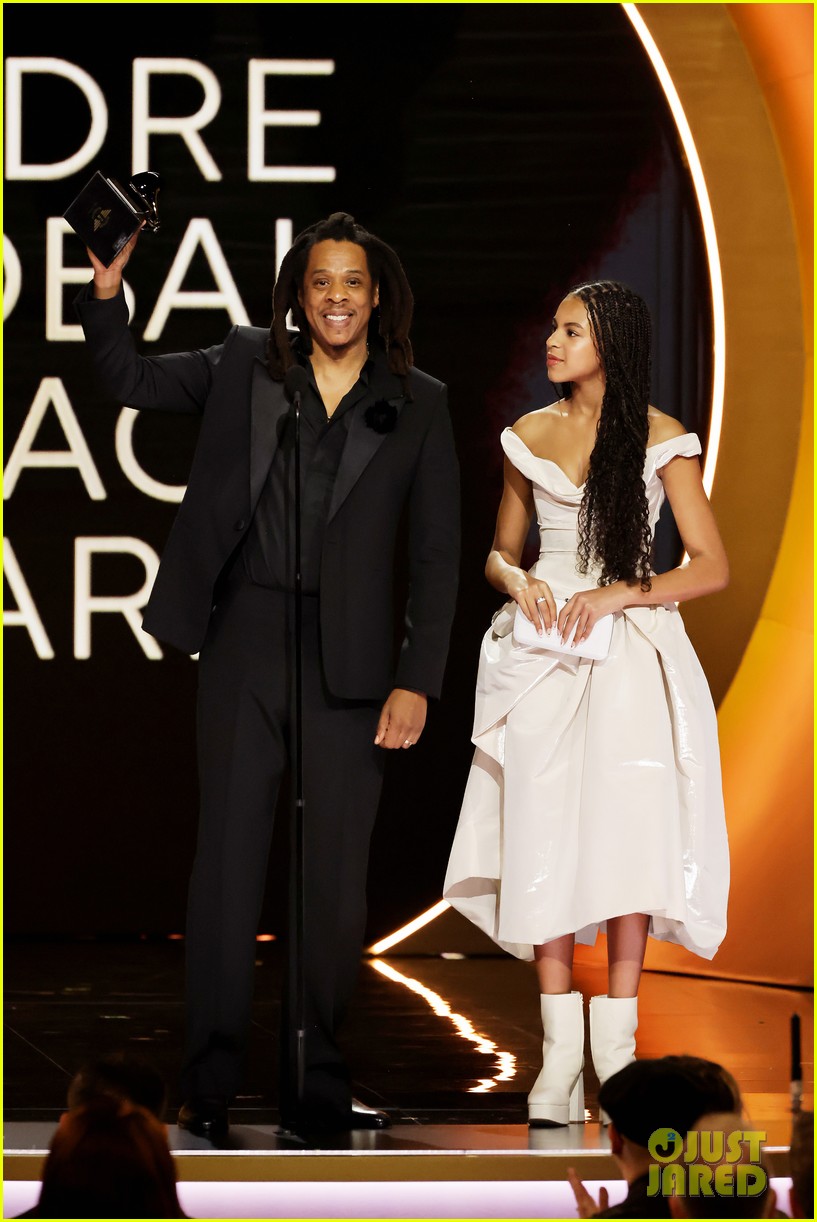

Naacp Image Awards Celebrating Beyonce Blue Ivy Carter And Kendrick Lamars Success

Naacp Image Awards Celebrating Beyonce Blue Ivy Carter And Kendrick Lamars Success

Sbs Eurovision Courtney Act And Tony Armstrong Announced As Presenters

Sbs Eurovision Courtney Act And Tony Armstrong Announced As Presenters

Income Needed For Middle Class Status A State By State Guide

Income Needed For Middle Class Status A State By State Guide

Is Asparagus Healthy A Comprehensive Guide To Its Nutritional Value

Is Asparagus Healthy A Comprehensive Guide To Its Nutritional Value

Ace Power Promotions March 26th Boxing Seminar Skills And Techniques

Ace Power Promotions March 26th Boxing Seminar Skills And Techniques