Income Needed For Middle Class Status: A State-by-State Guide

Table of Contents

Understanding the Challenges of Defining "Middle Class"

Defining a universal "middle class" income is surprisingly difficult. The cost of living varies drastically across states, making a single national figure misleading. What constitutes middle-class income in Mississippi is vastly different from that in California. Several methodologies attempt to define middle-class income: some use median household income, while others utilize income percentiles within a population. However, these figures often fail to account for crucial nuances.

The impact of household size and family structure is significant. A single individual needs a considerably lower income to achieve a comfortable standard of living compared to a family with multiple children. Further complicating the issue are various other factors:

- Variations in housing costs significantly affect middle-class income thresholds. Rent or mortgage payments often represent the largest expense for most households.

- Transportation costs vary widely by region, influencing necessary income levels. Access to public transportation, gas prices, and the need for a vehicle all impact the overall budget.

- Access to healthcare and education significantly impact the required income. High healthcare premiums and educational expenses can quickly strain a family's budget, especially for larger families.

State-by-State Breakdown of Middle Class Income

This section provides a snapshot of the income needed for middle-class status in various states. Note that these figures are estimates and can vary based on individual circumstances and lifestyle choices. Comprehensive, up-to-date data for every state requires extensive research beyond the scope of this article. Always consult local resources and official statistics for the most accurate information.

(This section would then include H3 subheadings for each of the 50 US states. Each H3 would contain data on median household income, cost of living analysis for that state, estimated income ranges for middle-class families of different sizes, and relevant statistics and sources. Due to the extensive nature of this task, it cannot be fully completed here. Example for California is shown below):

Income Needed for Middle Class Status in California

California consistently ranks among the states with the highest cost of living. The median household income provides a starting point, but the true picture is far more complex. Housing costs in major California cities like San Francisco and Los Angeles are exorbitant, significantly impacting the income required to achieve middle-class status. Transportation, especially in sprawling urban areas, adds another layer of expense.

- Estimated Income Ranges (2023, approximate and subject to change):

- Single individual: $60,000 - $80,000

- Family of four: $120,000 - $160,000

- These ranges are highly dependent on location within California.

(Repeat similar analysis for all 50 states – this section would be very lengthy.)

Factors Influencing Middle Class Income Levels

Several interwoven factors influence the income needed to achieve middle-class financial stability. Understanding these factors is crucial for effective financial planning.

-

Cost of Living: This encompasses housing costs (rent or mortgage), transportation (car payments, gas, public transport), groceries, healthcare (insurance premiums, medical expenses), taxes (federal, state, local), and childcare. Regional variations are immense; a comfortable middle-class lifestyle in a rural area may require significantly less income than in a major metropolitan center.

-

Household Size: The income required increases proportionally with family size. Additional dependents mean higher costs for food, clothing, housing, and other essentials.

-

Geographic Location: Urban areas generally have higher costs of living than suburban or rural areas within the same state. This difference is mainly driven by housing prices and transportation expenses.

-

Education Levels: Higher education levels often correlate with higher earning potential, influencing the likelihood of achieving middle-class status.

Tips for Achieving Middle Class Financial Stability

Achieving and maintaining middle-class financial stability requires proactive planning and diligent management of resources.

- Creating a realistic budget: Track your income and expenses meticulously to identify areas for improvement.

- Strategies for saving money: Reduce unnecessary expenses, explore ways to increase your income (side hustle, career advancement), and prioritize needs over wants.

- Importance of emergency funds: Build a savings cushion (ideally 3-6 months' worth of expenses) to handle unexpected events without derailing your financial stability.

- Investing for the long term: Explore various investment options to grow your wealth and secure your financial future.

- Resources for financial education: Numerous online resources, books, and workshops can enhance your financial literacy and empower you to make informed decisions.

Achieving Middle Class Financial Security

This guide highlights the significant variability in the income needed for middle-class status across different states and emphasizes the influence of various factors like cost of living, household size, and geographic location. Understanding these factors is critical for assessing your own financial situation and developing a plan to achieve and maintain middle-class financial security. Use this state-by-state guide on income needed for middle-class status to plan your financial future and explore resources to improve your financial well-being. Consider using online budgeting tools and consulting with a financial advisor to create a personalized financial plan tailored to your specific circumstances.

Nebraska Senators Express Concerns Over Proposed Gretna Development

Nebraska Senators Express Concerns Over Proposed Gretna Development

Retailers Urgent Warning Tariff Price Hikes To Resurface

Retailers Urgent Warning Tariff Price Hikes To Resurface

Why Beyonce And Jay Z Shield Son Sir Carter From The Public Eye

Why Beyonce And Jay Z Shield Son Sir Carter From The Public Eye

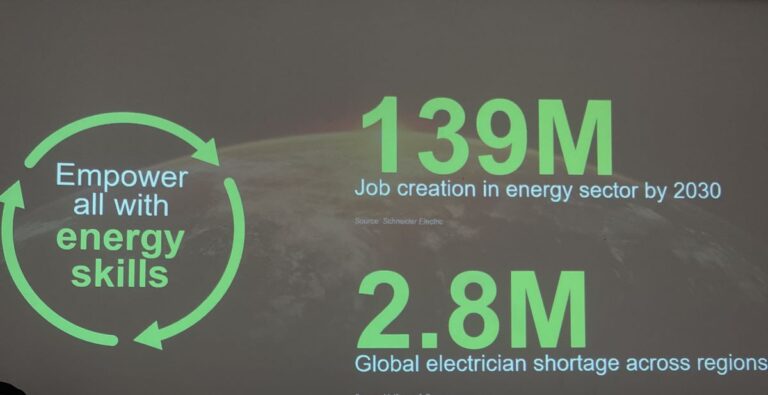

Schneider Electrics Commitment To Accelerating Womens Careers In Nigeria For Iwd

Schneider Electrics Commitment To Accelerating Womens Careers In Nigeria For Iwd

Germanys Spd Coalition Talks Amidst Growing Youth Unrest

Germanys Spd Coalition Talks Amidst Growing Youth Unrest