Mercer International's 2024 Fourth Quarter And Annual Report: $0.075 Dividend

Table of Contents

Mercer International's Q4 2024 Financial Performance

Revenue and Earnings

Mercer International's Q4 2024 financial performance reflects the ongoing dynamics of the pulp and paper market. While specific figures will be detailed in the official report, a preliminary analysis might reveal trends such as:

- Revenue: [Insert estimated revenue figure]. This represents a [percentage change]% increase/decrease compared to Q3 2024 and a [percentage change]% increase/decrease compared to Q4 2023.

- Earnings: [Insert estimated earnings figure]. This shows a [percentage change]% increase/decrease compared to Q3 2024 and a [percentage change]% increase/decrease compared to Q4 2023.

- Key Contributing Factors: Fluctuations in global demand for pulp and paper products, changes in production costs (including energy and raw materials), and pricing strategies all play a significant role in shaping Mercer International's quarterly results. Stronger-than-expected demand in specific market segments could positively influence earnings, while increased input costs may negatively affect profitability.

Pulp and Paper Market Conditions

The Q4 2024 pulp and paper market presented a complex landscape for Mercer International. Key factors influencing performance included:

- Industry Trends: [Discuss relevant trends, e.g., increasing demand for sustainable packaging solutions, fluctuations in global trade, competition from alternative materials].

- Price Indices: Tracking key price indices for pulp and paper products (e.g., pulp prices, paper prices) provides insight into market dynamics and their effect on Mercer International's profitability. [Discuss specific index movements and their impact].

- Market Forecasts: Analysts' forecasts for the pulp and paper industry in 2025 will provide context for evaluating Mercer International's future prospects. [Discuss market forecasts and their implications for the company].

Operational Highlights

Operational performance in Q4 2024 is a crucial aspect of Mercer International's results. Key metrics to consider include:

- Production Volumes: [Insert estimated production volumes for pulp and paper]. This reflects the company's capacity utilization and efficiency.

- Capacity Utilization Rates: High capacity utilization indicates strong operational efficiency and the ability to meet market demand. [Discuss capacity utilization rates and any significant changes].

- Major Operational Milestones: Any significant operational improvements, upgrades, or challenges should be noted. [Mention any relevant achievements or setbacks].

The $0.075 Dividend: Implications for Investors

Dividend Announcement Details

Mercer International's official announcement details the $0.075 dividend per share. Key elements to note are:

- Dividend per share: $0.075

- Ex-dividend date: [Insert date]

- Payment date: [Insert date]

- Dividend Yield: [Calculate and state the dividend yield based on the current stock price].

Investor Sentiment and Stock Performance

The market's reaction to the dividend announcement is crucial for understanding investor sentiment. Key observations include:

- Stock Price Changes: Analyze the stock price movements before and after the announcement. A positive reaction suggests that the market viewed the dividend favorably.

- Analyst Commentary: Examine analyst reports and commentary to gauge their assessment of the dividend and its implications for Mercer International's future performance.

- Investor Reactions: Monitor investor forums and news sources to understand investor sentiment and the overall market reaction.

Dividend Sustainability

The long-term sustainability of the $0.075 dividend is a critical factor for investors.

- Key Financial Ratios: Analyzing Mercer International's financial health, including metrics such as debt-to-equity ratio and payout ratio, is crucial to assess the sustainability of the dividend.

- Management Commentary: Management's commentary on future dividend plans offers valuable insight into the company's intentions and its outlook.

Outlook for Mercer International in 2025

Management Guidance

Mercer International's management typically provides guidance on expected performance for the upcoming year.

- Key Elements of Guidance: [Summarize management's key projections for revenue, production, and capital expenditure].

- Projected Financial Performance: This will provide investors with an understanding of the company's anticipated financial performance in 2025.

- Strategic Initiatives: Any significant strategic initiatives planned for 2025 should be noted.

Key Risks and Opportunities

Mercer International faces various risks and opportunities in 2025.

- Potential Risks: These could include macroeconomic factors (e.g., global economic slowdown, inflation), industry-specific risks (e.g., increased competition, changes in raw material prices), and operational risks.

- Opportunities: Potential opportunities include expansion into new markets, technological advancements, and increasing demand for sustainable products.

Conclusion: Understanding Mercer International's Q4 2024 and Annual Report: The $0.075 Dividend and Beyond

The $0.075 dividend announced by Mercer International is a key takeaway from its Q4 2024 and annual report. The dividend's impact on investor sentiment and the sustainability of this payout will significantly influence the Mercer International stock price. The company's outlook for 2025 hinges on navigating market dynamics, managing risks, and capitalizing on opportunities within the pulp and paper industry. To stay informed about Mercer International's financial performance, dividend policy, and future announcements, visit their official investor relations page: [Insert Link to Investor Relations Page]. Learn more about the Mercer International dividend and the Mercer International stock by regularly reviewing their investor updates.

Featured Posts

-

Ashton Jeanty The Cowboys Next Big Draft Pick

Apr 25, 2025

Ashton Jeanty The Cowboys Next Big Draft Pick

Apr 25, 2025 -

2024 Nfl Mock Draft Analyzing The Saints Potential Top 10 Selection

Apr 25, 2025

2024 Nfl Mock Draft Analyzing The Saints Potential Top 10 Selection

Apr 25, 2025 -

Ankara Emniyet Mueduerluegue Nuen Yeni Binasi Kapsamli Bilgiler Ve Fotograflar

Apr 25, 2025

Ankara Emniyet Mueduerluegue Nuen Yeni Binasi Kapsamli Bilgiler Ve Fotograflar

Apr 25, 2025 -

Bayern Munich Cruise To Victory Kane Scores Two Against Werder Bremen

Apr 25, 2025

Bayern Munich Cruise To Victory Kane Scores Two Against Werder Bremen

Apr 25, 2025 -

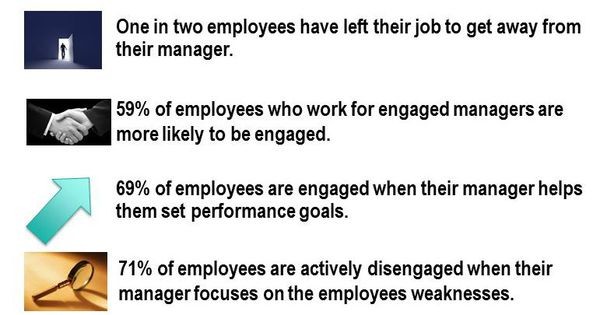

The Impact Of Middle Managers On Employee Engagement And Business Outcomes

Apr 25, 2025

The Impact Of Middle Managers On Employee Engagement And Business Outcomes

Apr 25, 2025

Latest Posts

-

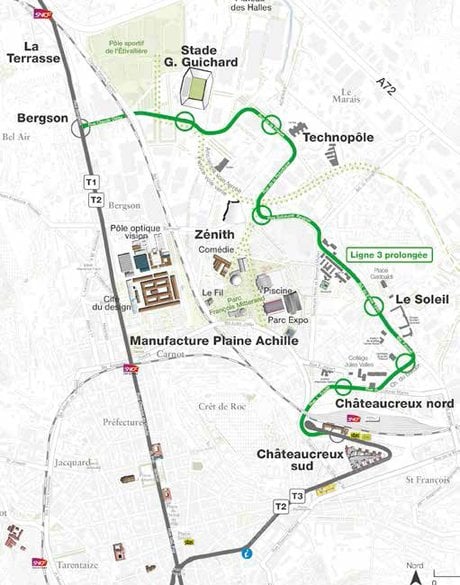

Dijon Concertation Lancee Pour La Troisieme Ligne De Tram

May 10, 2025

Dijon Concertation Lancee Pour La Troisieme Ligne De Tram

May 10, 2025 -

L Heritage Meconnu De Melanie Eiffel A Dijon

May 10, 2025

L Heritage Meconnu De Melanie Eiffel A Dijon

May 10, 2025 -

La Cite De La Gastronomie Et La Crise D Epicure A Dijon

May 10, 2025

La Cite De La Gastronomie Et La Crise D Epicure A Dijon

May 10, 2025 -

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Adoptee

May 10, 2025

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Adoptee

May 10, 2025 -

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour

May 10, 2025