Economists Forecast Bank Of Canada Interest Rate Reductions Due To Tariff Impacts

Table of Contents

The Impact of Tariffs on Canadian Inflation

Tariffs, essentially taxes on imported goods, directly increase the cost of these products for Canadian consumers and businesses. This increase in prices fuels inflation, eroding the purchasing power of Canadians. The Bank of Canada, mandated to maintain price stability, is likely to respond to this inflationary pressure. The impact of tariffs on inflation is multifaceted:

- Increased prices for consumer goods: Higher tariffs translate directly into higher prices at the retail level for a wide range of goods, from clothing and electronics to food and automobiles.

- Reduced purchasing power for Canadians: With higher prices, consumers have less disposable income, leading to reduced spending and potentially impacting overall economic growth.

- Potential for wage stagnation or decline: Businesses facing increased input costs may struggle to maintain wage growth, leading to stagnant or even declining real wages for workers.

- Impact on specific sectors: Industries heavily reliant on imported inputs, such as manufacturing and agriculture, are particularly vulnerable to the inflationary pressures caused by tariffs. The "inflation rate Canada" will be significantly affected. The impact of these tariffs on the "consumer price index Canada" is already becoming evident. The relationship between "tariff impact on inflation" needs careful monitoring.

Slowdown in Economic Growth Due to Tariff Uncertainty

The uncertainty surrounding tariffs creates a chilling effect on business investment and economic activity. Businesses hesitate to commit to long-term investments when faced with unpredictable changes in input costs and market access. This uncertainty has a knock-on effect, impacting various aspects of the Canadian economy:

- Decreased business investment: Businesses postpone expansion plans and new projects, leading to a slowdown in capital spending.

- Reduced export opportunities: Retaliatory tariffs from other countries can restrict Canadian exports, further dampening economic growth.

- Job losses in affected industries: Companies struggling to compete with higher input costs may resort to layoffs, increasing unemployment.

- Weakening of the Canadian dollar: Economic slowdown can lead to a weaker Canadian dollar, making imports more expensive and potentially exacerbating inflationary pressures. The "Canadian GDP growth" is expected to slow down significantly due to the "economic slowdown Canada" and the impact of "business investment Canada" and "tariff uncertainty."

Predicting the Bank of Canada's Response: Interest Rate Reductions

Given the potential for a significant economic slowdown and increased inflation, the Bank of Canada is expected to respond by lowering interest rates. Analyzing the Bank of Canada's historical responses to similar economic challenges reveals a clear pattern of using interest rate cuts to stimulate economic activity. The potential impact of Bank of Canada interest rate reductions includes:

- Analysis of past Bank of Canada rate decisions: Historical data demonstrates a correlation between economic slowdowns and interest rate reductions by the Bank of Canada.

- Possible scenarios for future rate changes: Economists are currently predicting various scenarios, ranging from modest reductions to more substantial cuts depending on the severity of the economic impact of tariffs.

- Potential impact on mortgage rates and borrowing costs: Lower interest rates will translate to lower mortgage rates and reduced borrowing costs for consumers and businesses. This should encourage spending and investment.

- Expert opinions on the likelihood of interest rate reductions: Many financial experts believe that Bank of Canada interest rate reductions are highly probable given the current economic climate. The "Bank of Canada monetary policy" will likely focus on "interest rate forecast Canada" and will use "monetary policy tools" to manage the "Canadian interest rates."

Alternative Economic Policies and Mitigation Strategies

While interest rate reductions are a key tool, the Bank of Canada isn't the only player in addressing the economic challenges posed by tariffs. The Canadian government can also implement fiscal policy measures to mitigate the negative impacts:

- Government spending programs to stimulate the economy: Increased government spending on infrastructure projects or social programs can boost economic activity and create jobs.

- Tax cuts to boost consumer spending: Tax reductions can put more money in the hands of consumers, encouraging them to spend more, thus stimulating demand.

- Support for affected industries: Targeted support for industries disproportionately affected by tariffs can help them weather the economic storm.

- International trade negotiations to reduce tariff barriers: The Canadian government can actively work to negotiate trade deals that reduce tariff barriers and promote free trade. This is crucial in managing "fiscal policy Canada" and "economic stimulus Canada" alongside appropriate "government intervention."

Conclusion: The Future of Bank of Canada Interest Rates and Tariff Impacts

In summary, the current economic climate, heavily influenced by the negative impacts of tariffs, strongly suggests that Bank of Canada interest rate reductions are on the horizon. The combination of rising inflation, slowing economic growth, and uncertainty regarding future tariff policies makes a case for intervention. The Bank of Canada's response, coupled with potential fiscal policy measures from the government, will shape the future trajectory of the Canadian economy. Stay informed about the evolving economic situation and the Bank of Canada's decisions regarding Bank of Canada interest rate reductions. Understanding the implications of these reductions for your personal finances and investment strategies is crucial. Further research into the Bank of Canada's monetary policy reports and economic forecasts will provide a deeper understanding of this critical issue. Monitoring changes in the "inflation rate Canada" and "Canadian GDP growth" will also be essential.

Featured Posts

-

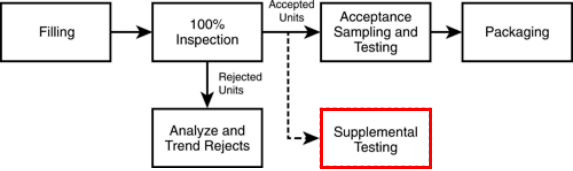

Strategies For Effective Automated Visual Inspection Of Lyophilized Vials

May 11, 2025

Strategies For Effective Automated Visual Inspection Of Lyophilized Vials

May 11, 2025 -

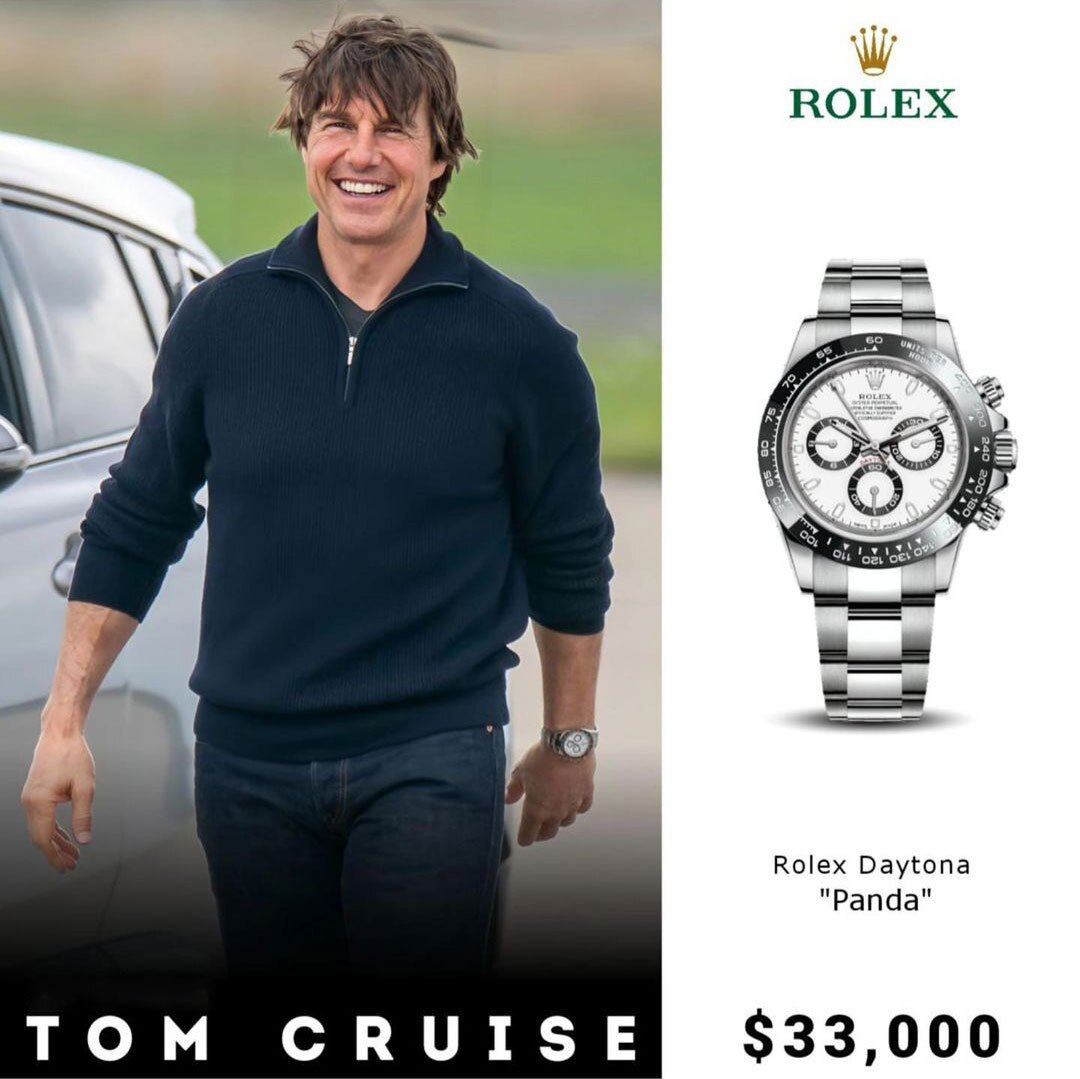

Tam Krwz Ky Mwjwdh Grl Frynd Kwn He

May 11, 2025

Tam Krwz Ky Mwjwdh Grl Frynd Kwn He

May 11, 2025 -

Boris Dzhonson Prodaet Fotografii S Soboy Pravda Ili Vymysel

May 11, 2025

Boris Dzhonson Prodaet Fotografii S Soboy Pravda Ili Vymysel

May 11, 2025 -

Chicago Bulls And New York Knicks Injury Updates Whos In And Whos Out

May 11, 2025

Chicago Bulls And New York Knicks Injury Updates Whos In And Whos Out

May 11, 2025 -

Pokhudenie Dzhessiki Simpson Istoriya Uspekha I Sovety

May 11, 2025

Pokhudenie Dzhessiki Simpson Istoriya Uspekha I Sovety

May 11, 2025