ECB's Holzmann: Trump Tariffs And Their Disinflationary Impact

Table of Contents

Holzmann's Core Argument: The Disinflationary Effect of Tariffs

ECB member, Holzmann, presented a compelling, albeit controversial, thesis: that Trump's tariffs, despite initial inflationary pressures, ultimately led to a dampening of inflation. This seemingly paradoxical effect stems from a complex interplay of economic forces.

-

Reduced consumer spending due to higher import prices: The tariffs directly increased the cost of imported goods, leading to higher prices for consumers. This, in turn, reduced consumer purchasing power and overall spending, dampening demand across various sectors.

-

Disruptions and increased costs impacting final product pricing: The tariffs disrupted established supply chains, causing delays and increased costs for businesses. These added costs were often passed on to consumers in the form of higher prices, but the reduced consumer demand limited the ability of businesses to fully pass on these increased costs, thus curbing inflation.

-

Weakened demand from tariff-affected sectors: Sectors directly impacted by the tariffs faced reduced demand both domestically and internationally. This decreased production and, consequently, reduced inflationary pressures within those specific sectors. The ripple effect across related industries further contributed to the overall disinflationary impact.

Evidence Supporting Holzmann's Claims

While controversial, Holzmann's claims aren't without supporting evidence. Several economic indicators and analyses seem to corroborate his thesis, though the interpretation remains a subject of debate.

-

Specific economic indicators (CPI, PPI, etc.) showing reduced inflationary pressure: Studies analyzing Consumer Price Index (CPI) and Producer Price Index (PPI) data during and after the implementation of Trump's tariffs have shown a reduction in inflationary pressures compared to projected levels. While inflation didn't necessarily turn negative, the rate of increase slowed significantly in certain sectors.

-

Specific sectors significantly impacted by tariffs and their subsequent price adjustments: Sectors heavily reliant on imported components, like manufacturing and certain consumer goods industries, experienced increased costs. However, the muted consumer demand prevented a sharp increase in final product prices. This limited price adjustment partially supports Holzmann's disinflationary argument.

-

Reference to relevant research papers or publications: Several academic papers and economic reports have explored the impact of Trump's tariffs on inflation, providing varying levels of support for Holzmann's conclusions. Further research is needed to definitively establish the causality and long-term effects.

Counterarguments and Criticisms of Holzmann's Analysis

Naturally, Holzmann's analysis has faced significant criticism. Several economists argue against the assertion that Trump's tariffs had a net disinflationary effect.

-

Arguments that suggest temporary inflationary effects outweigh the long-term disinflationary impacts: Critics point out that the initial inflationary surge caused by tariffs, though ultimately muted, could have had lasting consequences on consumer behavior and investment decisions. The short-term inflation, they argue, may have outweighed any long-term disinflationary effects.

-

Criticisms regarding the methodology or data used in Holzmann's analysis: The methodology used to isolate the impact of tariffs from other macroeconomic factors has been questioned. The complex interplay of global economic conditions makes it difficult to attribute disinflation solely to the tariffs. Data limitations and potential biases are also highlighted.

-

Highlighting potential limitations of the analysis: The analysis may not fully account for indirect effects, such as the impact on investment, productivity growth, and innovation, all of which are complex to quantify accurately. The long-term implications are still unfolding and remain a subject of ongoing investigation.

The Broader Implications of Holzmann's Findings

Holzmann's analysis, regardless of its final validation, has significant implications for economic policymakers and international trade relations.

-

Impact on central bank policy responses: The unexpected disinflationary pressure caused by tariffs could force central banks to reconsider their monetary policy strategies. A lower-than-expected inflation rate might lead to further stimulus measures, potentially impacting interest rates and exchange rates.

-

The role of international trade agreements: The debate surrounding Holzmann's findings underscores the complexities of international trade and the potential unforeseen consequences of protectionist measures. It highlights the need for careful consideration of the potential impacts of trade policies on inflation and overall economic stability.

-

Effects on global economic growth: Trade wars and tariff disputes can disrupt global supply chains, impacting production and economic growth worldwide. The impact of Trump’s tariffs, as analyzed by Holzmann, serves as a case study on the potential negative effects of trade protectionism on global economic growth.

Conclusion

Holzmann's analysis of the disinflationary impact of Trump's tariffs presents a complex and controversial picture. While supporting evidence exists, significant counterarguments and methodological limitations warrant caution in drawing definitive conclusions. The interplay between trade policy and inflation remains a dynamic and crucial area for ongoing research. Understanding the complex interplay between trade policy and inflation is crucial for navigating the global economic landscape. Further research and analysis of the long-term effects of Trump tariffs, along with similar trade policies, are essential for informed decision-making. Learn more about the impact of Trump Tariffs and their economic consequences.

Featured Posts

-

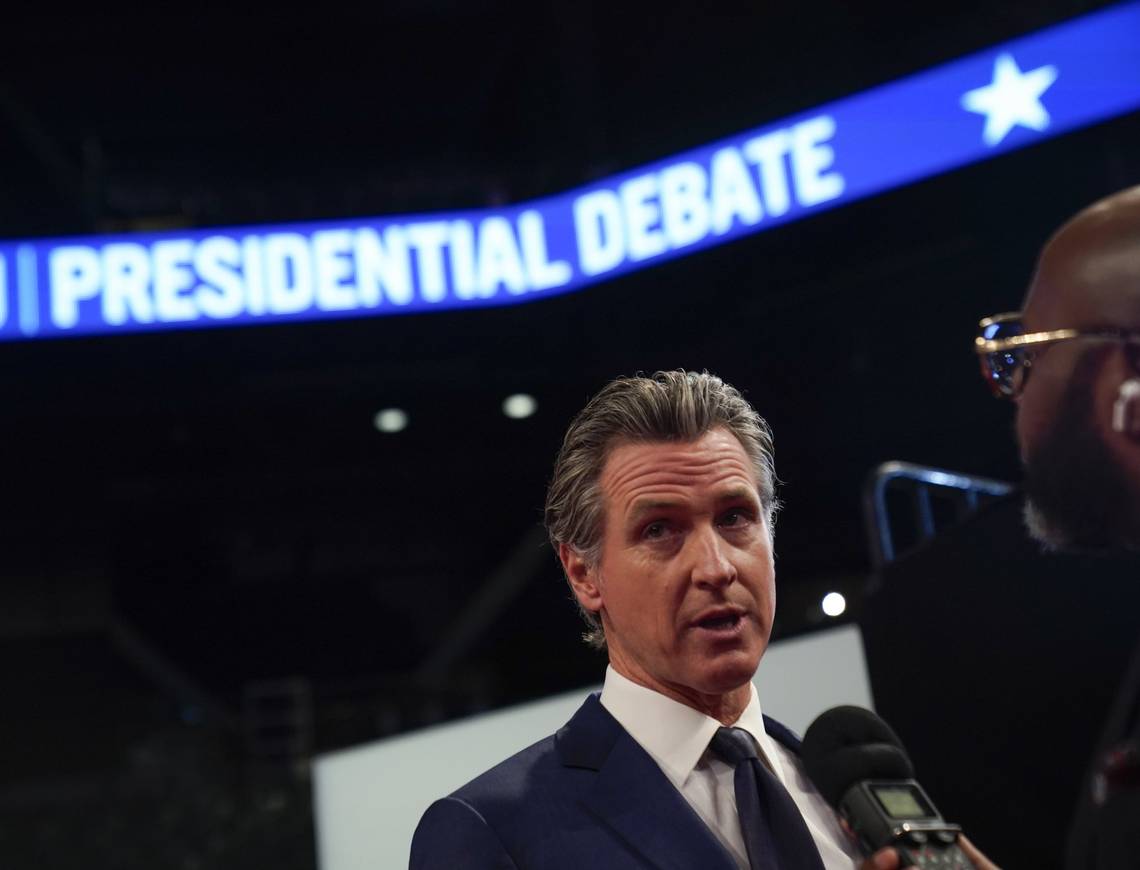

Newsom Faces Backlash Over Toxic Democrat Label

Apr 26, 2025

Newsom Faces Backlash Over Toxic Democrat Label

Apr 26, 2025 -

Het Onlogische Zoete Broodje Uit Nederland

Apr 26, 2025

Het Onlogische Zoete Broodje Uit Nederland

Apr 26, 2025 -

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 26, 2025

Stock Market Valuations Bof As Reassuring Take For Investors

Apr 26, 2025 -

Lando Norriss Bizarre Party Injury Details Emerge

Apr 26, 2025

Lando Norriss Bizarre Party Injury Details Emerge

Apr 26, 2025 -

Santos Last Ditch Defense A Failing Strategy

Apr 26, 2025

Santos Last Ditch Defense A Failing Strategy

Apr 26, 2025

Latest Posts

-

Top Seed Pegula Claims Charleston Title After Collins Battle

Apr 27, 2025

Top Seed Pegula Claims Charleston Title After Collins Battle

Apr 27, 2025 -

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Ponytail

Apr 27, 2025

Swarovski Campaign Showcases Ariana Grandes Unique Dip Dyed Ponytail

Apr 27, 2025 -

Ariana Grandes New Dip Dyed Ponytail For Swarovski

Apr 27, 2025

Ariana Grandes New Dip Dyed Ponytail For Swarovski

Apr 27, 2025 -

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025

Ariana Grandes Swarovski Campaign A Dip Dyed Ponytail Debut

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025