Dutch Stock Market Volatility: A Trade War Consequence

Table of Contents

Impact of Trade Wars on the Dutch Economy

The Netherlands, as a highly export-oriented economy, is particularly susceptible to the shocks caused by global trade wars. Reduced international trade directly impacts Dutch businesses, leading to increased Dutch Stock Market Volatility.

Reduced Export Demand

The Netherlands' strong reliance on exports makes it vulnerable to decreased global demand. A significant portion of the Dutch economy depends on selling goods and services internationally. Trade wars create uncertainty and reduce purchasing power in key markets.

- Decreased exports of agricultural products (flowers, etc.): The Dutch flower industry, a globally recognized sector, has experienced reduced demand due to trade tensions and increased import costs in several key markets.

- Lower demand for manufactured goods from key export markets (EU, US, China): Dutch manufacturing companies face reduced orders from major trading partners, leading to production cuts and impacting stock valuations.

- Negative impact on logistics and transportation sectors: Trade disruptions directly impact logistics companies, reducing their activity and profitability, which is reflected in their stock performance and contributes to overall Dutch Stock Market Volatility.

Supply Chain Disruptions

Trade tariffs and restrictions significantly disrupt global supply chains. Dutch businesses, heavily integrated into these complex networks, face increased challenges sourcing raw materials and intermediate goods.

- Increased costs of imported components for manufacturing: Tariffs on imported components raise production costs, reducing profit margins and negatively impacting the profitability of Dutch companies.

- Delays in delivery of goods affecting production schedules: Trade disruptions lead to delays in delivering essential materials, disrupting production and impacting company performance and contributing to Dutch Stock Market Volatility.

- Uncertainty and hesitancy in business investment: The uncertainty created by trade wars discourages businesses from investing, further dampening economic growth and impacting the stock market.

Specific Sectors Affected by Dutch Stock Market Volatility

Certain sectors of the Dutch economy are more susceptible to the negative effects of trade wars, resulting in heightened Dutch Stock Market Volatility within those specific sectors.

Technology and Semiconductor Stocks

The technology sector, reliant on complex global supply chains, is highly vulnerable to trade disputes. Tariffs and trade restrictions increase costs and create significant uncertainty.

- Price fluctuations due to tariff uncertainty: The imposition and removal of tariffs causes significant price swings in technology stocks, contributing to volatility.

- Impact on semiconductor manufacturers: Dutch semiconductor companies face challenges due to global supply chain disruptions and trade restrictions.

- Reduced consumer confidence affecting demand: Trade uncertainty can lower overall consumer confidence, reducing demand for technology products and impacting the performance of related companies.

Agricultural and Export-Oriented Stocks

The Dutch agricultural sector, a large exporter of products, faces considerable challenges from trade disputes. Tariffs and trade barriers directly reduce market access and decrease export revenues.

- Fluctuations in agricultural commodity prices: Trade wars often lead to significant fluctuations in the prices of agricultural commodities, impacting the profitability of Dutch agricultural companies.

- Impacts of trade sanctions and retaliatory tariffs: Retaliatory tariffs imposed by trading partners significantly reduce the competitiveness of Dutch agricultural exports.

- Reduced demand from international markets: Trade tensions directly result in decreased demand for Dutch agricultural products in key markets.

Investor Sentiment and Market Reactions

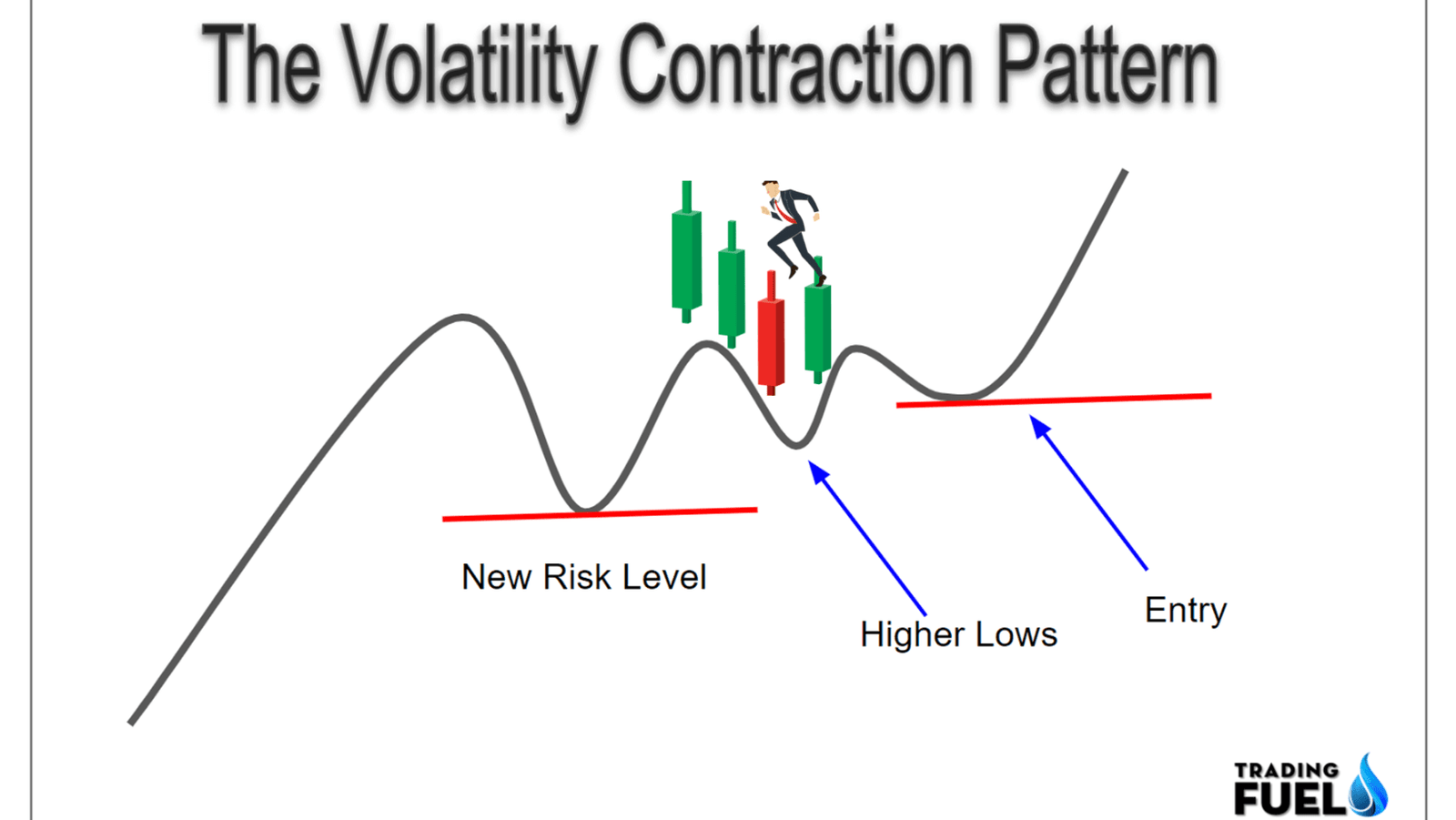

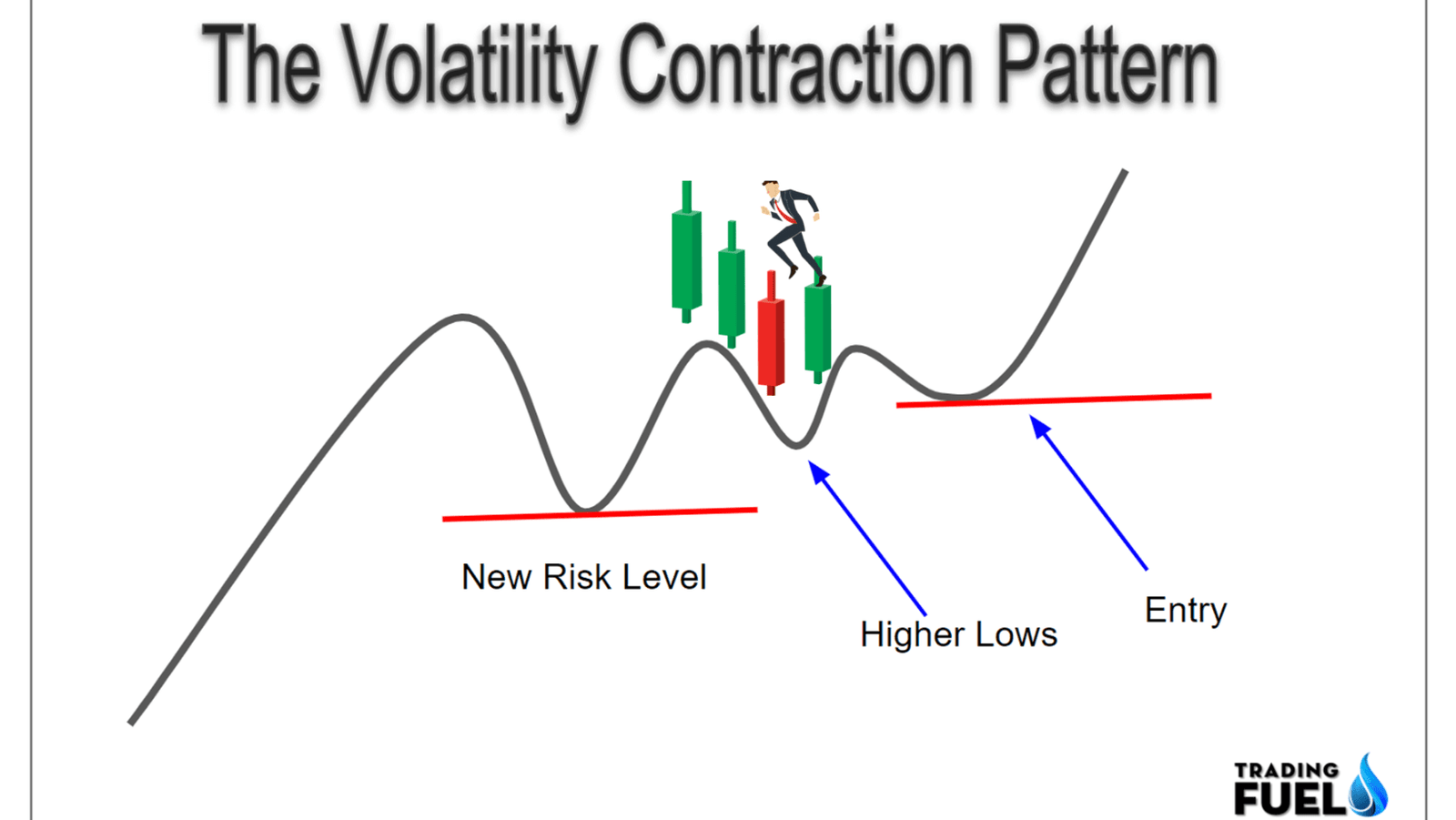

Trade wars significantly influence investor sentiment, leading to significant Dutch Stock Market Volatility.

Increased Uncertainty and Risk Aversion

The uncertainty generated by trade wars increases risk aversion amongst investors, leading to a shift away from equities and towards safer assets.

- Reduced investment in equities: Investors withdraw investments from the stock market, leading to decreased prices and increased volatility.

- Increased demand for safer assets like bonds and gold: Investors seek refuge in safer assets, further reducing the demand for equities.

- Negative impact on market liquidity: Reduced trading activity decreases market liquidity, making it harder to buy and sell stocks, exacerbating volatility.

Currency Fluctuations

Fluctuations in the Euro's exchange rate, partly influenced by trade war developments, further contribute to Dutch Stock Market Volatility.

- Impact on export competitiveness: Exchange rate changes affect the competitiveness of Dutch exports, impacting the profitability of exporting companies.

- Increased costs of imports: Currency fluctuations can increase the cost of imports, impacting profitability and contributing to inflation.

- Uncertainty for foreign investors: Exchange rate volatility creates uncertainty for foreign investors, impacting their investment decisions.

Conclusion

The Dutch Stock Market Volatility experienced in recent years is inextricably linked to the global trade war. Reduced export demand, supply chain disruptions, and negative investor sentiment have all contributed to market instability. Specific sectors like technology, semiconductors, and agriculture have felt the impact most acutely. To successfully navigate the ongoing uncertainty, investors need to carefully monitor global trade developments and their impact on the Dutch economy, diversifying their portfolios to mitigate risk. Understanding the drivers of Dutch Stock Market Volatility is essential for making informed investment decisions in this dynamic environment. Stay informed about the latest developments impacting Dutch stock market volatility and adjust your investment strategies accordingly.

Featured Posts

-

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 25, 2025

Jorja Smith Biffy Clyro Blossoms To Headline Bbc Radio 1 Big Weekend

May 25, 2025 -

Stijgende Rentes En Sterke Euro Live Marktontwikkelingen

May 25, 2025

Stijgende Rentes En Sterke Euro Live Marktontwikkelingen

May 25, 2025 -

M56 Traffic Delays Cheshire Deeside Accident

May 25, 2025

M56 Traffic Delays Cheshire Deeside Accident

May 25, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 25, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 25, 2025 -

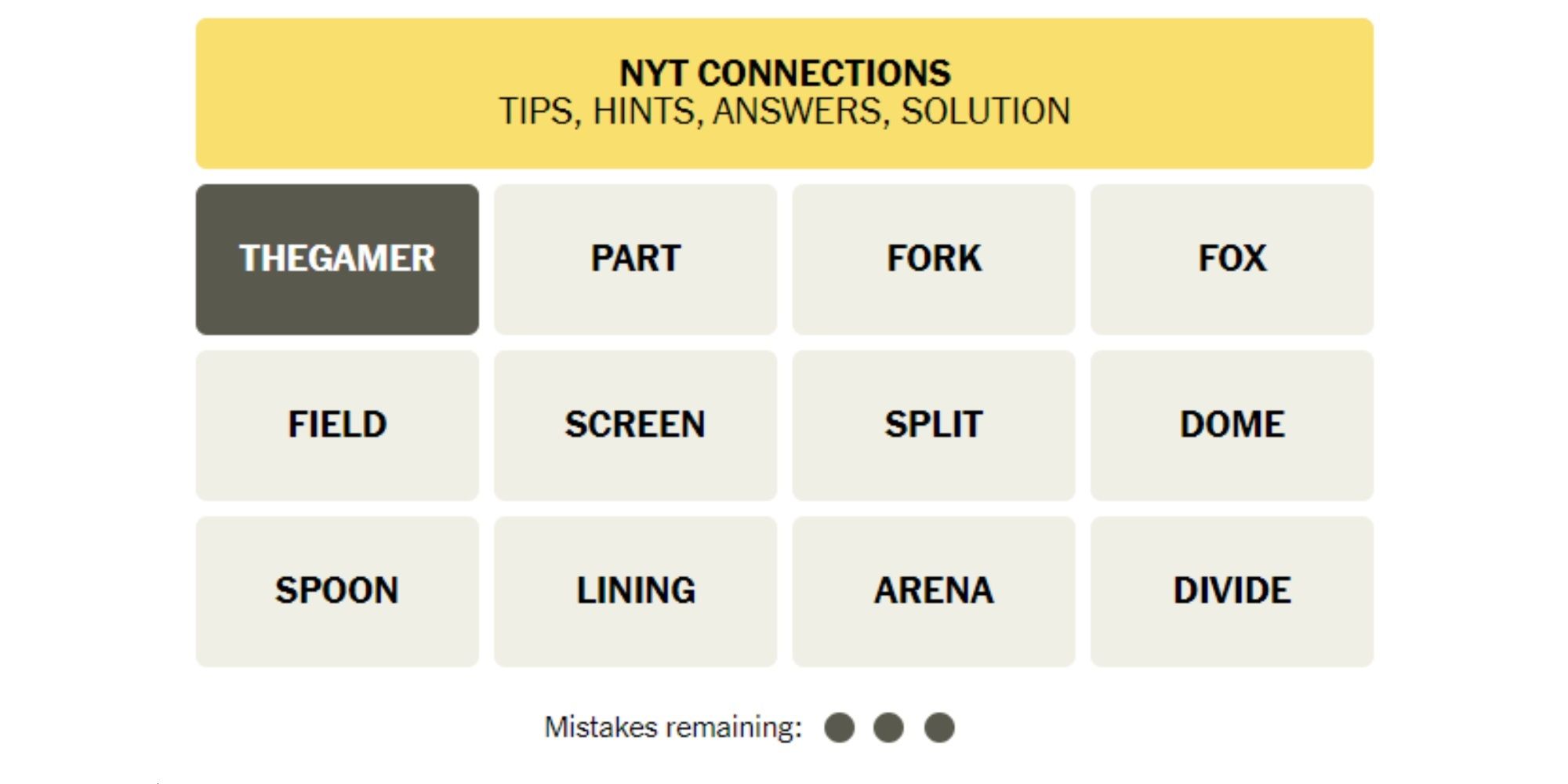

Solve New York Times Connections 646 March 18 2025 Hints And Answers

May 25, 2025

Solve New York Times Connections 646 March 18 2025 Hints And Answers

May 25, 2025

Latest Posts

-

Investing In Middle Management A Key To Improved Company Performance And Employee Satisfaction

May 25, 2025

Investing In Middle Management A Key To Improved Company Performance And Employee Satisfaction

May 25, 2025 -

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 25, 2025

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 25, 2025 -

Malaysias Former Prime Minister Najib Razak Faces New Allegations In French Submarine Case

May 25, 2025

Malaysias Former Prime Minister Najib Razak Faces New Allegations In French Submarine Case

May 25, 2025 -

The Value Of Middle Management How They Benefit Companies And Employees

May 25, 2025

The Value Of Middle Management How They Benefit Companies And Employees

May 25, 2025 -

Najib Razak And The 2002 French Submarine Bribery Allegations A Developing Story

May 25, 2025

Najib Razak And The 2002 French Submarine Bribery Allegations A Developing Story

May 25, 2025