Tracking The Net Asset Value (NAV) Of The Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For ETFs like the Amundi MSCI All Country World UCITS ETF USD Acc, which tracks a broad market index, the NAV reflects the collective value of all the stocks within the index that the ETF holds. This calculation provides a snapshot of the ETF's intrinsic worth.

Why is NAV important?

- Investment Decisions: NAV helps you determine a fair price for buying or selling the ETF. Comparing the NAV to the market price helps identify potential undervaluation (discount) or overvaluation (premium).

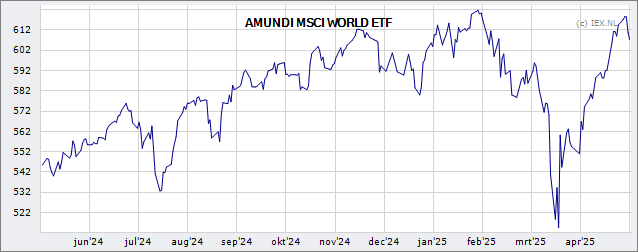

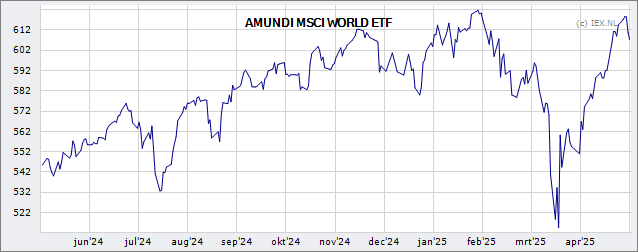

- Performance Assessment: Tracking NAV changes over time allows you to assess the ETF's performance, independent of short-term market fluctuations.

- Risk Management: Understanding NAV fluctuations helps gauge the ETF's sensitivity to market volatility and informs your risk management strategy.

- NAV vs. Market Price: The market price of an ETF can fluctuate throughout the trading day, while the NAV is calculated at the end of the trading day. This difference can provide opportunities for savvy investors.

How to Track the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Accessing accurate and timely NAV data for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Several reliable sources provide this information:

- Amundi Website: The official Amundi website is the primary source for the ETF's NAV. Look for dedicated fund pages offering historical and, often, daily closing NAV data.

- Financial Data Providers: Bloomberg Terminal, Refinitiv Eikon, and similar professional platforms provide real-time and historical NAV data for a wide range of ETFs, including the Amundi MSCI All Country World UCITS ETF USD Acc.

- Brokerage Platforms: Many online brokerage accounts display the NAV alongside the market price of the ETF you are invested in.

Interpreting NAV Data: The NAV is usually presented as a value per share. You can use this figure to calculate the total value of your investment by multiplying the NAV by the number of shares you own.

Delays in NAV Reporting: Keep in mind that there might be a slight delay (typically a few hours) between the market close and the official publication of the NAV. This is due to the time required to process all the transactions of the underlying assets.

Factors Affecting the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors directly influence the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Market Fluctuations: The performance of the underlying global equities heavily impacts the NAV. A rise in global stock markets generally leads to a higher NAV, while a downturn results in a lower NAV.

- Currency Exchange Rates: As this is a USD-denominated ETF investing globally, fluctuations in exchange rates between the USD and other currencies can affect the NAV.

- Dividends and Distributions: Dividend payments from the underlying companies are reinvested or distributed to ETF shareholders, impacting the NAV.

- Expense Ratio: The ETF's expense ratio, representing the annual cost of management, gradually erodes the NAV over time.

- Global Diversification: The ETF's global diversification strategy means the NAV is less susceptible to events affecting a single country or region, compared to more regionally focused ETFs.

Using NAV to Make Informed Investment Decisions

By carefully tracking the Amundi MSCI All Country World UCITS ETF USD Acc NAV, investors can make more informed decisions:

- Identifying Buying/Selling Opportunities: Compare the NAV with the market price. A significant discount (market price below NAV) might suggest a buying opportunity, while a premium (market price above NAV) might signal a potential selling opportunity.

- Performance Analysis: Analyzing historical NAV data reveals long-term trends, allowing you to assess the ETF's past performance and gauge its potential future returns.

- Assessing ETF Health: Consistent monitoring of NAV fluctuations helps you evaluate the overall health and performance of your investment.

Conclusion: Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV Tracking

Regularly tracking the Amundi MSCI All Country World UCITS ETF USD Acc NAV is essential for informed investment decisions. By utilizing the official Amundi website and reliable financial data providers, you can gain a clear understanding of your investment's performance and identify potential opportunities. Remember to consider market fluctuations, currency exchange rates, and the expense ratio when interpreting NAV data. Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV tracking is key to maximizing your investment's potential. Start monitoring your Amundi MSCI All Country World UCITS ETF USD Acc NAV today to make well-informed decisions and optimize your investment strategy!

Featured Posts

-

Controversial Hamilton Remarks Ferrari Boss Responds To Unfair Accusations

May 24, 2025

Controversial Hamilton Remarks Ferrari Boss Responds To Unfair Accusations

May 24, 2025 -

A Seattle Womans Pandemic Refuge Finding Solace In A Green Space

May 24, 2025

A Seattle Womans Pandemic Refuge Finding Solace In A Green Space

May 24, 2025 -

Untersuchung Der Essener Leistungstraeger Golz Und Brumme

May 24, 2025

Untersuchung Der Essener Leistungstraeger Golz Und Brumme

May 24, 2025 -

Polizeimeldung Essen Waldbrand In Heisingen Am 07 04 2025

May 24, 2025

Polizeimeldung Essen Waldbrand In Heisingen Am 07 04 2025

May 24, 2025 -

Complete Guide To The Nyt Mini Crossword March 24 2025 Answers

May 24, 2025

Complete Guide To The Nyt Mini Crossword March 24 2025 Answers

May 24, 2025

Latest Posts

-

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025

Glastonbury 2025 Lineup Fan Fury Over Headliners

May 24, 2025 -

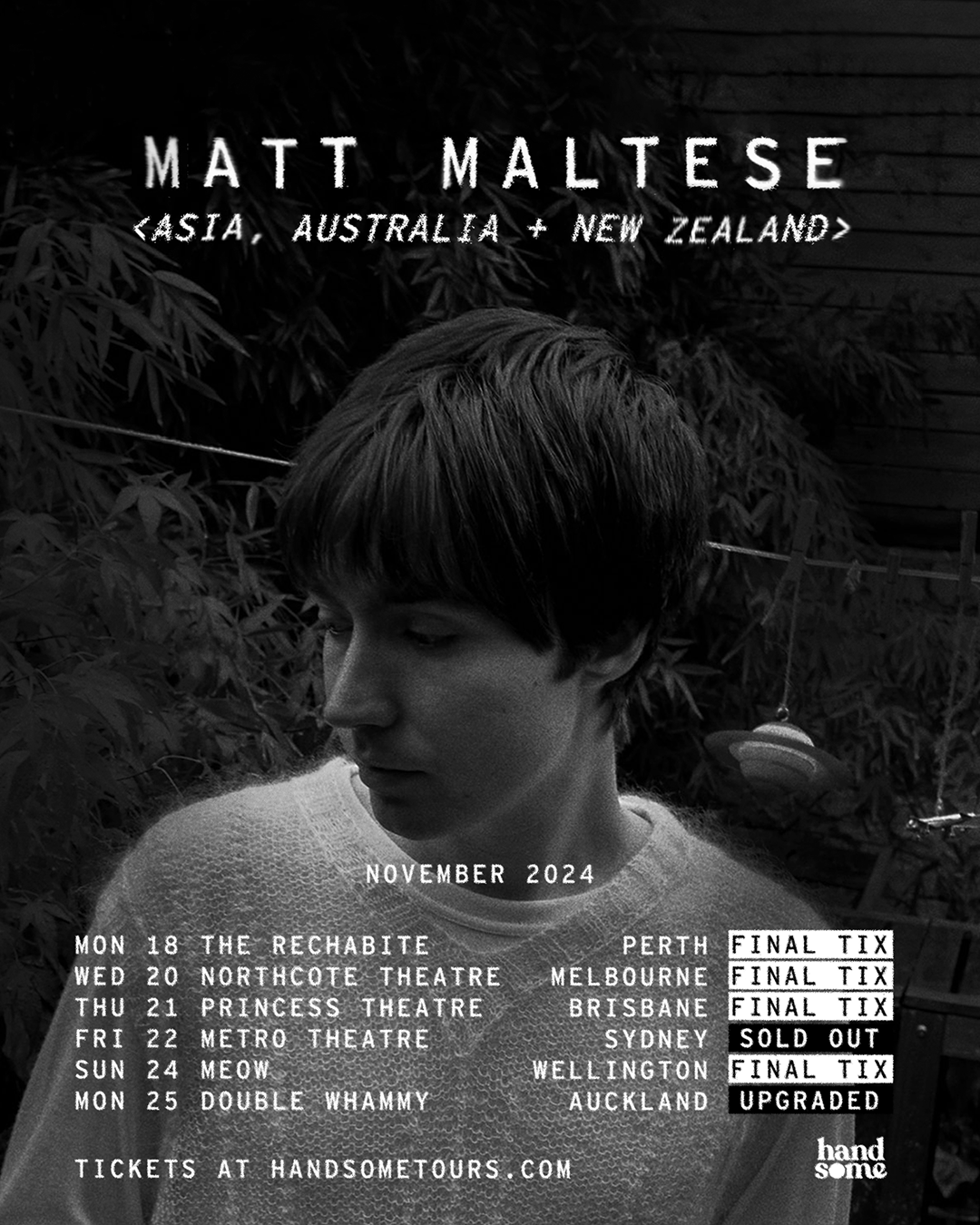

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025