Dow Futures Fall: Moody's Downgrade Sends Dollar Lower

Table of Contents

Moody's Downgrade: The Catalyst for Market Decline

Details of the Downgrade:

Moody's recent downgrade of the US government's credit rating from Aaa to Aa1 represents a significant blow to the nation's financial standing. The rationale cited by Moody's points to the increasing fiscal challenges facing the United States, including rising debt levels and the ongoing political gridlock surrounding the debt ceiling. This action marks a turning point, signifying a loss of confidence in the US government's ability to manage its finances effectively.

- Rating Change: Downgraded from Aaa to Aa1.

- Reasoning: Increased fiscal stress due to rising debt levels and projected deficits over the next few years. Concerns over governance and the erosion of institutional strength.

- Impact on Treasury Yields: The downgrade is expected to lead to higher yields on US Treasury bonds as investors demand a higher return for the increased perceived risk.

Immediate Market Reaction:

The announcement triggered an immediate and sharp reaction in the financial markets. Dow futures experienced a notable percentage drop, reflecting investor uncertainty and risk aversion. Trading volume surged as investors scrambled to react to the news.

- Dow Futures Drop: Futures contracts saw a significant percentage decline (insert specific percentage here if available at time of writing).

- Trading Volume Surge: Market activity increased dramatically, indicating high levels of investor concern and engagement. (Include data on increased volume if available).

Weakening Dollar: A Consequence of the Downgrade

Correlation between Dow Futures and the Dollar:

The decline in Dow futures is directly correlated with the weakening of the US dollar. When investors lose confidence in the US economy, they tend to move away from dollar-denominated assets, leading to a decrease in the dollar's value. This "flight to safety" often sees investors seeking refuge in alternative, perceived safer assets.

- Flight to Safety: Investors are seeking refuge in assets perceived as less risky, such as gold, Swiss francs, or Japanese yen.

- Safe-Haven Assets: The demand for these assets increases, pushing their prices up while simultaneously weakening the dollar.

Impact on International Markets:

The weakening dollar has significant global repercussions. It makes US goods cheaper for foreign buyers but increases the cost of imports for the United States. This impacts other currencies and global stock markets, creating ripple effects throughout the international financial system.

- Impact on Other Currencies: Expect fluctuations in other major currencies as investors readjust their portfolios.

- Global Stock Market Impact: Global markets often mirror the trends seen in the US, resulting in potential declines or increased volatility.

- Trade Implications: Changes in currency values directly influence the cost of international trade and can lead to trade imbalances.

Analyzing the Future Implications of the Downgrade

Potential Economic Consequences:

The long-term economic consequences of Moody's downgrade are potentially significant. Increased borrowing costs for the US government could lead to higher inflation and slower economic growth. The Federal Reserve's response to this situation will be crucial in determining the trajectory of the economy.

- Inflationary Pressure: Higher borrowing costs could fuel inflation.

- Economic Growth Slowdown: Increased uncertainty and higher interest rates may hamper economic growth.

- Federal Reserve Response: The Fed may need to adjust its monetary policy to mitigate the economic fallout.

- Future Rating Agency Actions: Other rating agencies may follow suit, potentially further impacting the dollar and market confidence.

Advice for Investors:

Navigating this period of market uncertainty requires caution and a proactive approach. Investors should prioritize diversification and robust risk management strategies.

- Diversification: Spread investments across various asset classes to reduce risk.

- Risk Management: Implement strategies to protect against potential losses.

- Professional Advice: Consider consulting a financial advisor for personalized guidance.

Conclusion

Moody's downgrade of the US credit rating has triggered a fall in Dow futures and a weakening of the dollar, highlighting growing concerns about the US economy's fiscal health. The interconnectedness of these events underscores the importance of monitoring market developments closely. The potential long-term economic consequences are significant, and investors should adopt a cautious approach, prioritizing diversification and risk management. Stay tuned for further updates on the Dow futures and how this Moody's downgrade impacts the global economy. Monitor the Dow Jones Industrial Average closely and consider diversifying your portfolio to mitigate risks associated with this market volatility.

Featured Posts

-

Moodys 5 30 Year Yield Forecast Reigniting The Sell America Narrative

May 21, 2025

Moodys 5 30 Year Yield Forecast Reigniting The Sell America Narrative

May 21, 2025 -

Gangsta Granny Exploring The Themes And Characters

May 21, 2025

Gangsta Granny Exploring The Themes And Characters

May 21, 2025 -

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rinku

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi Analiz Rinku

May 21, 2025 -

Appeal Against 31 Month Sentence For Anti Migrant Social Media Post

May 21, 2025

Appeal Against 31 Month Sentence For Anti Migrant Social Media Post

May 21, 2025 -

Canada Maintains Us Tariffs Despite Oxford Report Findings

May 21, 2025

Canada Maintains Us Tariffs Despite Oxford Report Findings

May 21, 2025

Latest Posts

-

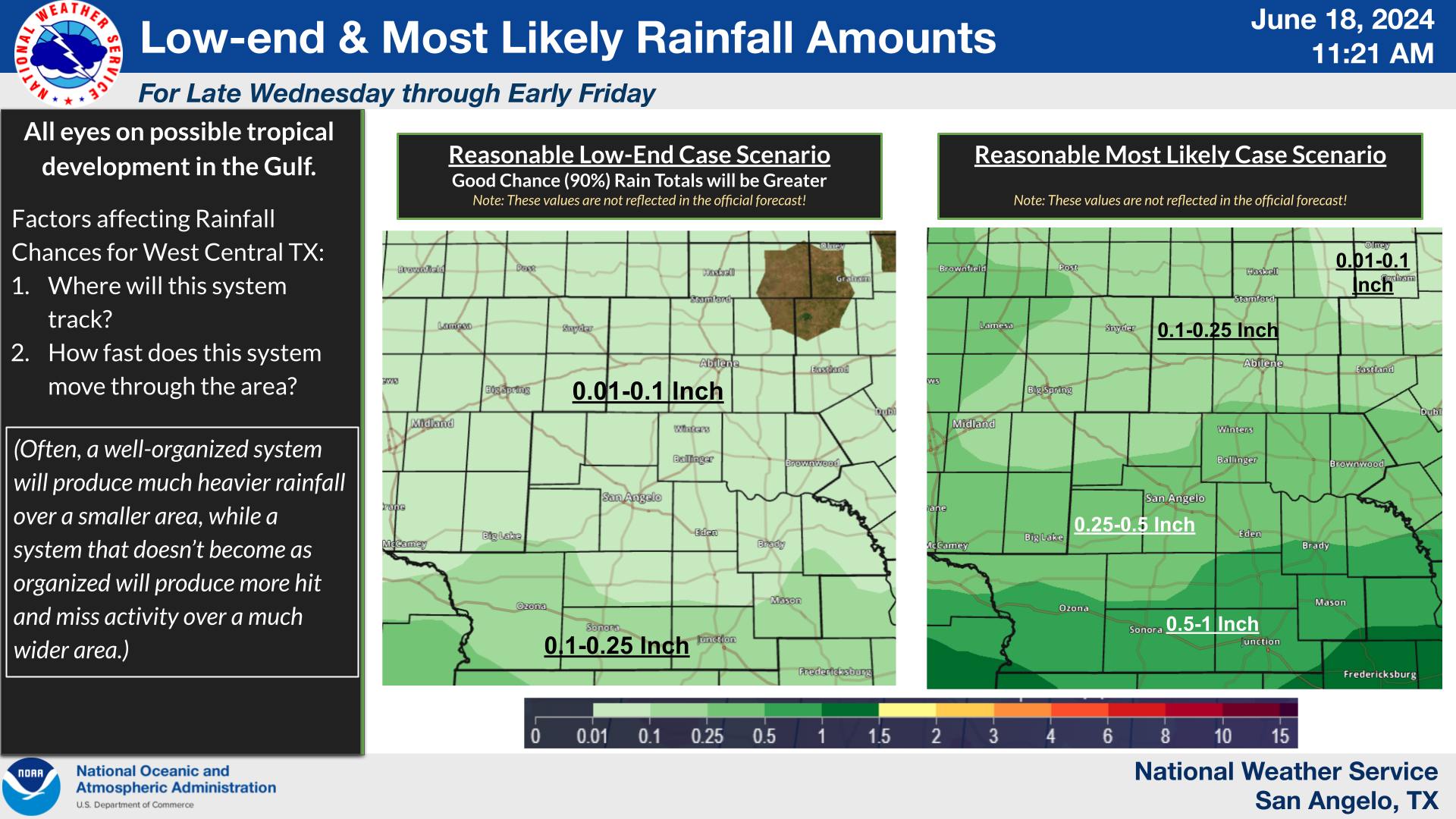

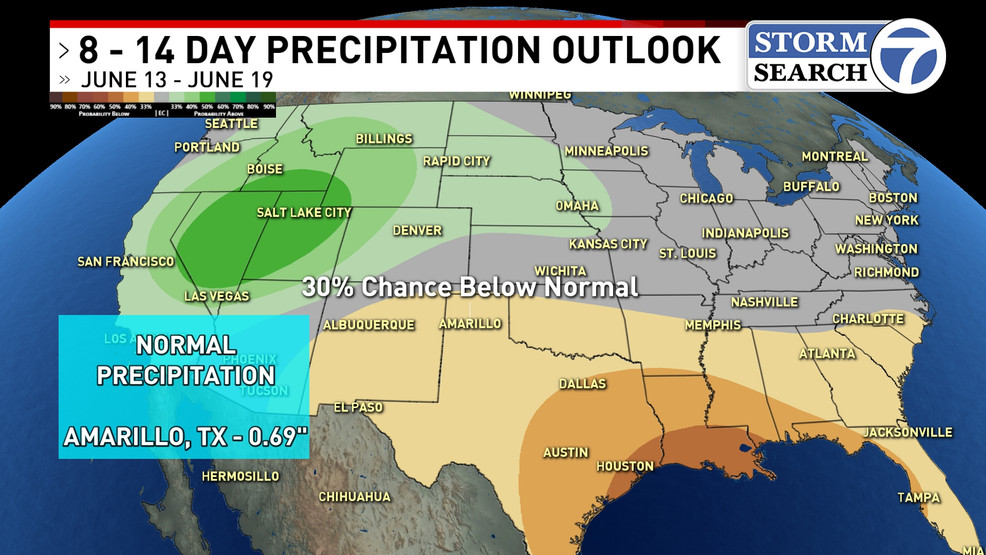

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025 -

Big Bear Ai Bbai Investor Lawsuit Contact Gross Law Firm Now

May 21, 2025

Big Bear Ai Bbai Investor Lawsuit Contact Gross Law Firm Now

May 21, 2025 -

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025 -

Investigating Big Bear Ai Bbai Contact Gross Law Firm Before June 10 2025

May 21, 2025

Investigating Big Bear Ai Bbai Contact Gross Law Firm Before June 10 2025

May 21, 2025 -

Drier Weather Is In Sight What To Expect

May 21, 2025

Drier Weather Is In Sight What To Expect

May 21, 2025