Moody's 5% 30-Year Yield Forecast: Reigniting The "Sell America" Narrative?

Table of Contents

Moody's 5% 30-Year Yield Forecast: A Deep Dive

The Forecast's Rationale:

Moody's 5% prediction for the 30-year Treasury yield is rooted in several key economic factors. The agency points to persistent inflationary pressures, the Federal Reserve's ongoing monetary tightening, and the substantial US government debt as primary drivers.

- Inflationary Pressures: Elevated inflation rates, fueled by supply chain disruptions and robust consumer demand, are expected to persist for some time. This necessitates continued interest rate hikes by the Federal Reserve to cool the economy and curb inflation.

- Monetary Tightening: The Federal Reserve's aggressive monetary policy, including multiple interest rate increases, aims to combat inflation. This tightening of monetary policy directly impacts long-term Treasury yields.

- Fiscal Deficit and Government Borrowing: The substantial US fiscal deficit necessitates increased government borrowing, which further increases demand for Treasury securities, pushing yields higher.

Historical Context:

While a 5% 30-year Treasury yield might seem alarming, it's crucial to put it into historical context. Similar yield levels have been observed in the past, albeit under different economic circumstances.

- The 1980s: The 1980s saw high 30-year Treasury yields, exceeding 15% at their peak, driven by high inflation and the Federal Reserve's fight against it. This period coincided with significant economic volatility.

- The early 2000s: The early 2000s saw a period of lower yields, following the dot-com bubble burst and the subsequent economic slowdown.

- The current environment: The current situation differs significantly from those past periods, creating a unique set of challenges and uncertainties. Comparing past economic cycles with current conditions necessitates understanding the specific differences in factors impacting long-term interest rates.

Impact on Long-Term Interest Rates and Borrowing Costs

Mortgages and Housing:

A 5% 30-year Treasury yield would translate to significantly higher mortgage rates, potentially cooling down the already slowing housing market.

- Mortgage Rate Increases: Mortgage rates closely track Treasury yields. A 5% 30-year yield would likely lead to a considerable increase in mortgage rates, making homeownership less affordable for many potential buyers.

- Reduced Housing Demand: Higher mortgage rates would curb housing demand, potentially leading to a decline in home prices in certain markets and slowing down the real estate investment sector.

- Affordability Crisis: The confluence of higher mortgage rates and already elevated home prices could exacerbate an affordability crisis, impacting the ability of first-time homebuyers to enter the market.

Corporate Debt and Business Investment:

Higher long-term interest rates increase the cost of borrowing for corporations, potentially dampening business investment and economic growth.

- Increased Borrowing Costs: Businesses rely on borrowing to finance expansion, equipment purchases, and hiring. Higher interest rates increase the cost of capital, making these investments less attractive.

- Reduced Business Investment: Reduced business investment can lead to slower job growth and reduced economic output.

- Impact on Economic Growth: The overall impact on economic growth is complex and depends on various other factors, but higher borrowing costs generally act as a headwind to expansion.

The "Sell America" Narrative: A Renewed Threat?

Investor Sentiment and Capital Flight:

A sustained increase in long-term Treasury yields could reignite the "Sell America" narrative, leading to capital flight and a weakening US dollar.

- Loss of Investor Confidence: Rising interest rates and concerns about US debt sustainability could erode investor confidence in US assets, prompting capital outflows to more attractive markets.

- Impact on the US Dollar: Capital flight can weaken the US dollar, making imports more expensive and potentially fueling further inflation.

- Foreign Investment Concerns: Higher interest rates might discourage foreign investment in US assets, impacting the overall health of the US economy.

Policy Responses and Mitigation Strategies:

To address concerns about rising interest rates and the potential for a "Sell America" scenario, the US government might adopt various policy responses.

- Fiscal Policy Adjustments: The government could implement fiscal policies aimed at reducing the deficit and controlling government borrowing to alleviate upward pressure on Treasury yields.

- Monetary Policy Calibration: The Federal Reserve could adjust its monetary policy, potentially slowing the pace of interest rate increases if inflation shows signs of abating.

- Debt Management Strategies: Effective debt management strategies, such as extending the maturity of debt, could help mitigate risks associated with rising interest rates and investor concerns.

Conclusion:

Moody's forecast of a 5% 30-year Treasury yield presents a significant challenge to the US economy. This projection, coupled with existing inflationary pressures and high government debt, has the potential to impact various sectors, from the housing market and corporate investment to investor sentiment and the US dollar. The potential resurgence of the "Sell America" narrative highlights the importance of carefully monitoring long-term interest rates and the government's response. Understanding the implications of this forecast is crucial. Stay informed about developments concerning the Moody's 5% 30-year yield forecast and its ongoing implications for the US economy by consulting reputable financial news sources and economic analysis. Further research into long-term Treasury yields, US debt management, and investor sentiment will be vital in navigating this complex economic landscape. The future trajectory of the 30-year Treasury yield will undoubtedly shape the economic outlook for years to come.

Featured Posts

-

Mummy Pigs Big Announcement Peppa Pigs Family Grows

May 21, 2025

Mummy Pigs Big Announcement Peppa Pigs Family Grows

May 21, 2025 -

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 21, 2025

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 21, 2025 -

La Petite Italie De L Ouest Charme Et Architecture Toscane

May 21, 2025

La Petite Italie De L Ouest Charme Et Architecture Toscane

May 21, 2025 -

Analyzing The Hunter Biden Tapes Evidence Of Joe Bidens Cognitive Decline

May 21, 2025

Analyzing The Hunter Biden Tapes Evidence Of Joe Bidens Cognitive Decline

May 21, 2025 -

Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025

Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025

Latest Posts

-

Big Bear Ai Stock Investment Analysis And Outlook

May 21, 2025

Big Bear Ai Stock Investment Analysis And Outlook

May 21, 2025 -

Big Bear Ai Stock Buy Or Sell

May 21, 2025

Big Bear Ai Stock Buy Or Sell

May 21, 2025 -

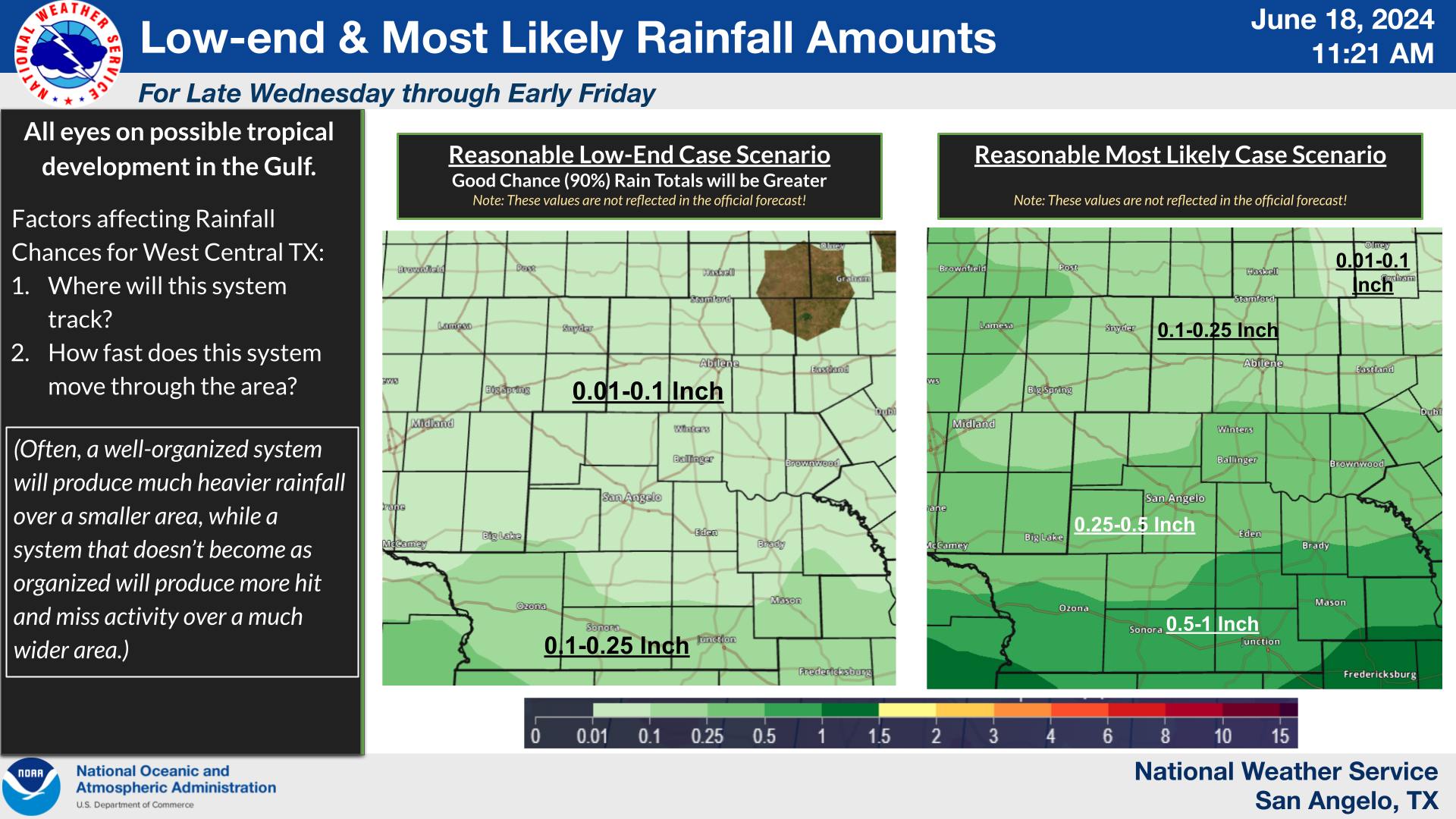

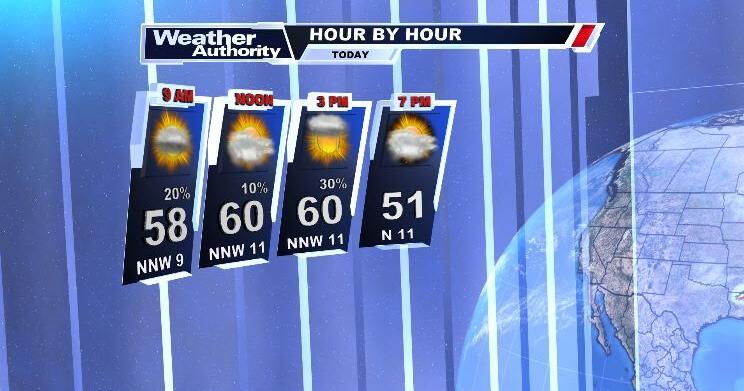

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025

Drier Weather On The Horizon Tips For Coping With Reduced Rainfall

May 21, 2025 -

Big Bear Ai Bbai Investor Lawsuit Contact Gross Law Firm Now

May 21, 2025

Big Bear Ai Bbai Investor Lawsuit Contact Gross Law Firm Now

May 21, 2025 -

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025

Is Drier Weather Finally In Sight Your Regional Forecast

May 21, 2025