Donald Trump's Billionaire Buddies: Post-Tariff Losses Since Liberation Day

The Impact of Tariffs on Specific Industries

Donald Trump's tariffs, implemented as part of his "America First" trade agenda, significantly impacted various sectors. The ripple effects of these trade wars extended far beyond initial targets, affecting supply chains and consumer prices. Key industries bearing the brunt of these tariffs include:

Keywords: Steel tariffs, aluminum tariffs, agricultural tariffs, retail tariffs, import tariffs, export tariffs, supply chain disruption.

-

Steel and Aluminum: The imposition of steep tariffs on steel and aluminum imports significantly impacted billionaire-owned businesses in the manufacturing sector. Companies reliant on imported raw materials faced increased costs, reduced competitiveness, and in some cases, reported substantial financial losses. For instance, [insert example of a steel company owned by a billionaire and quantify losses if possible, citing a reputable source]. This resulted in job losses and reduced profitability, highlighting the interconnectedness of global trade.

-

Agriculture: Agricultural tariffs, particularly those imposed by other countries in retaliation to US tariffs, dealt a heavy blow to US agricultural exports. Billionaire-owned agricultural businesses experienced significant declines in export volumes and revenues. [Insert example of a billionaire in the agricultural sector and quantify losses, citing source]. This had a cascading effect on farmers, farm workers, and related industries.

-

Retail: Tariffs on imported goods led to increased prices for consumers and reduced sales for many retail businesses. Billionaire-owned retail chains that relied heavily on imported goods faced squeezed profit margins and reduced consumer demand. [Insert example of a billionaire-owned retail company and discuss the impact, citing a source]. This demonstrates how tariffs can negatively impact consumer spending and overall economic growth.

-

Supply Chain Disruption: The imposition of tariffs created widespread disruption in global supply chains, particularly affecting billionaire-owned businesses with intricate international supply networks. The uncertainty and increased costs associated with tariffs forced many companies to reorganize their supply chains, often at considerable expense. This disruption underscored the interconnected nature of the global economy and the vulnerability of businesses reliant on international trade.

Case Studies: Billionaire Losses Attributed to Tariffs

Several billionaires with close ties to the Trump administration experienced significant financial setbacks potentially linked to the tariffs. Examining specific cases provides a clearer picture of the economic consequences:

Keywords: [Billionaire Name 1 - e.g., Wilbur Ross], [Billionaire Name 2 - e.g., Carl Icahn], [Billionaire Name 3 - e.g., Stephen Schwarzman], specific company names, stock performance, financial reports.

-

[Billionaire Name 1] and [Company Name]: [Provide a detailed case study, including quantifiable data on losses, stock performance charts, and links to reputable financial reports. Analyze any strategies employed to mitigate losses]. For example, Wilbur Ross's investments in the steel industry might be analyzed, showing how his portfolio was affected by both the tariffs and the subsequent retaliatory measures from other nations.

-

[Billionaire Name 2] and [Company Name]: [Repeat the process for a second billionaire, focusing on a different sector impacted by tariffs. Again, emphasize quantifiable data and verifiable sources. For example, analyze Carl Icahn’s investments and how they were impacted by the shifting trade landscape].

-

[Billionaire Name 3] and [Company Name]: [Repeat the process for a third billionaire, offering a diverse example across yet another sector. For example, analyze Stephen Schwarzman's Blackstone Group and how its global investment strategy might have been impacted by these shifts].

The Broader Economic Implications of Billionaire Losses

The financial difficulties faced by these billionaires extend beyond their individual portfolios, impacting the broader US economy.

Keywords: Economic downturn, job losses, investment decline, GDP impact, trickle-down economics, wealth inequality.

-

Job Losses: The losses experienced by these businesses directly and indirectly resulted in job losses within their companies and across associated industries. Reduced investment and decreased production led to layoffs and economic hardship for many workers.

-

Investment Decline: The uncertainty created by the tariffs and the resulting economic downturn discouraged investment, impacting overall economic growth. Billionaire investors may have become more hesitant to invest in new ventures, slowing down economic expansion.

-

GDP Impact: The combination of reduced investment, decreased consumer spending, and job losses negatively impacted the overall Gross Domestic Product (GDP) growth rate, highlighting the systemic risks associated with protectionist trade policies.

-

Trickle-Down Economics: The experiences of these billionaires challenge the principles of trickle-down economics, which posits that the wealth generated at the top eventually trickles down to benefit the wider economy. In this instance, the losses at the top appear to have exacerbated economic hardship at the bottom.

-

Wealth Inequality: The impact of the tariffs highlighted existing wealth inequality, demonstrating how the burden of economic hardship is not evenly distributed. Those with greater resources were better able to weather the storm, while others faced significant financial distress.

Conclusion:

This article has explored the financial impact of Donald Trump's tariffs on several prominent billionaires closely associated with his administration. By examining specific case studies and analyzing the broader economic implications, we've highlighted the potential negative consequences of trade protectionism. The data suggests significant losses in specific sectors, raising questions about the overall efficacy and fairness of the tariff strategy. The interconnectedness of the global economy and the impact of trade policies on various sectors became strikingly clear.

Call to Action: To stay informed on the ongoing economic repercussions of trade policies and their impact on high-profile figures, continue to follow our analysis of Donald Trump's billionaire buddies and their post-tariff financial performance. Further research into the long-term consequences of these tariffs is crucial for understanding their lasting effects on the US economy. Understanding the full impact of these trade wars requires continued monitoring and analysis of the effects on businesses of all sizes.

Viral Podcast Ignites Fierce Debate Is Daycare Detrimental To Child Development

Viral Podcast Ignites Fierce Debate Is Daycare Detrimental To Child Development

Todays Stock Market Sensex Nifty And Key Movers

Todays Stock Market Sensex Nifty And Key Movers

Barbashevs Overtime Goal Propels Vegas Golden Knights To Victory Over Minnesota Wild In Game 4

Barbashevs Overtime Goal Propels Vegas Golden Knights To Victory Over Minnesota Wild In Game 4

Uk Government Considers Visa Restrictions For Specific Countries

Uk Government Considers Visa Restrictions For Specific Countries

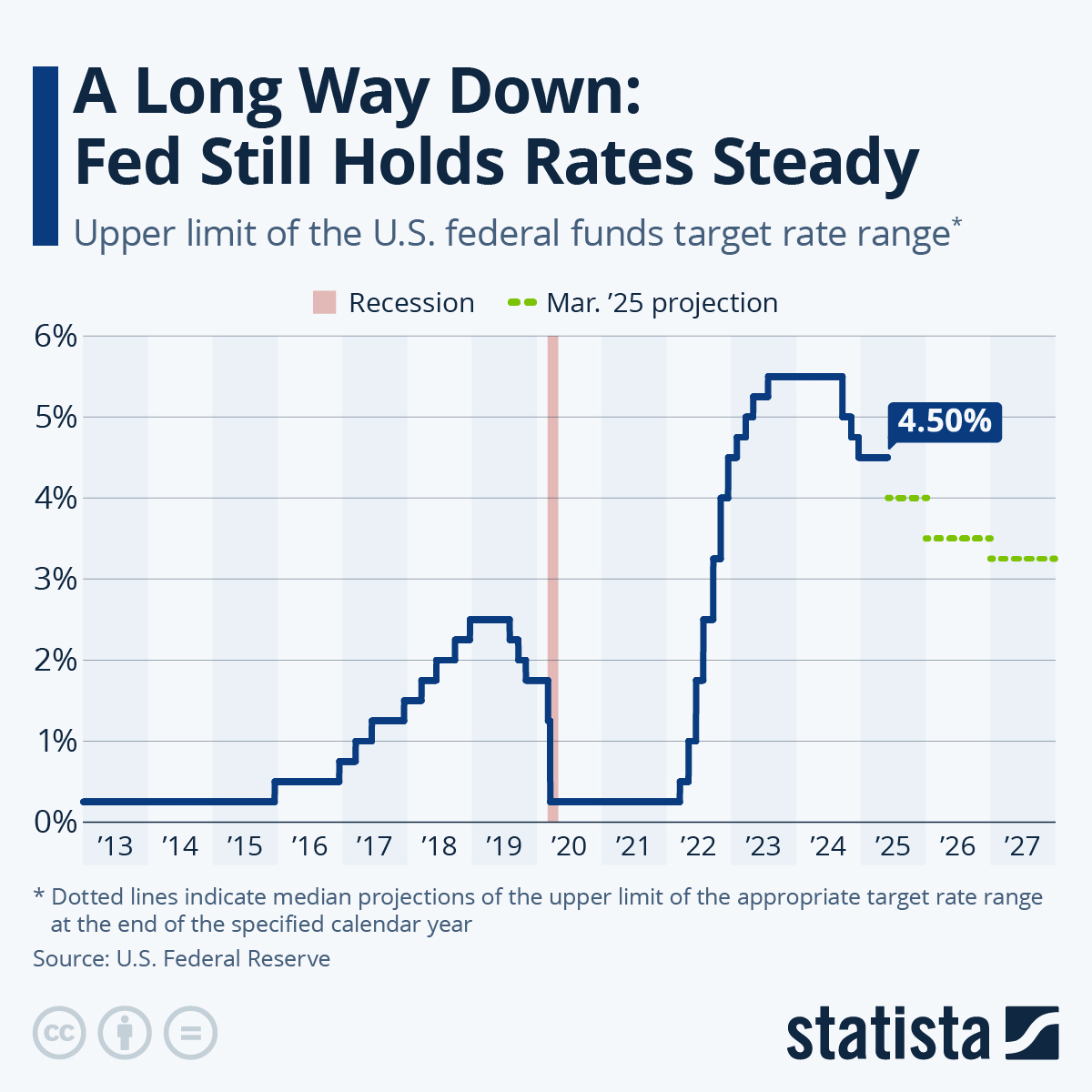

U S Federal Reserve Holds Steady Rate Decision Amid Rising Pressures

U S Federal Reserve Holds Steady Rate Decision Amid Rising Pressures