U.S. Federal Reserve Holds Steady: Rate Decision Amid Rising Pressures

Table of Contents

Inflation Remains a Key Concern

Inflation remains a primary concern for the U.S. Federal Reserve. Persistent inflation, significantly above the Fed's target of 2%, continues to erode purchasing power and poses a significant risk to long-term economic stability. The recent readings of the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index, key measures of inflation, are closely scrutinized by the FOMC.

- Persistent Inflation: Inflation figures remain stubbornly high, exceeding the Fed's target rate considerably. This necessitates a careful approach to monetary policy.

- CPI and PCE Data: Both the CPI and PCE data, released regularly, provide vital insights into the trajectory of inflation and influence the FOMC's decisions. Fluctuations in these indexes will be key indicators for future rate adjustments.

- Core Inflation: The Fed pays close attention to core inflation, which excludes volatile food and energy prices, to gain a clearer picture of underlying inflationary pressures within the economy. Sustained core inflation indicates deeper, more persistent inflationary pressures.

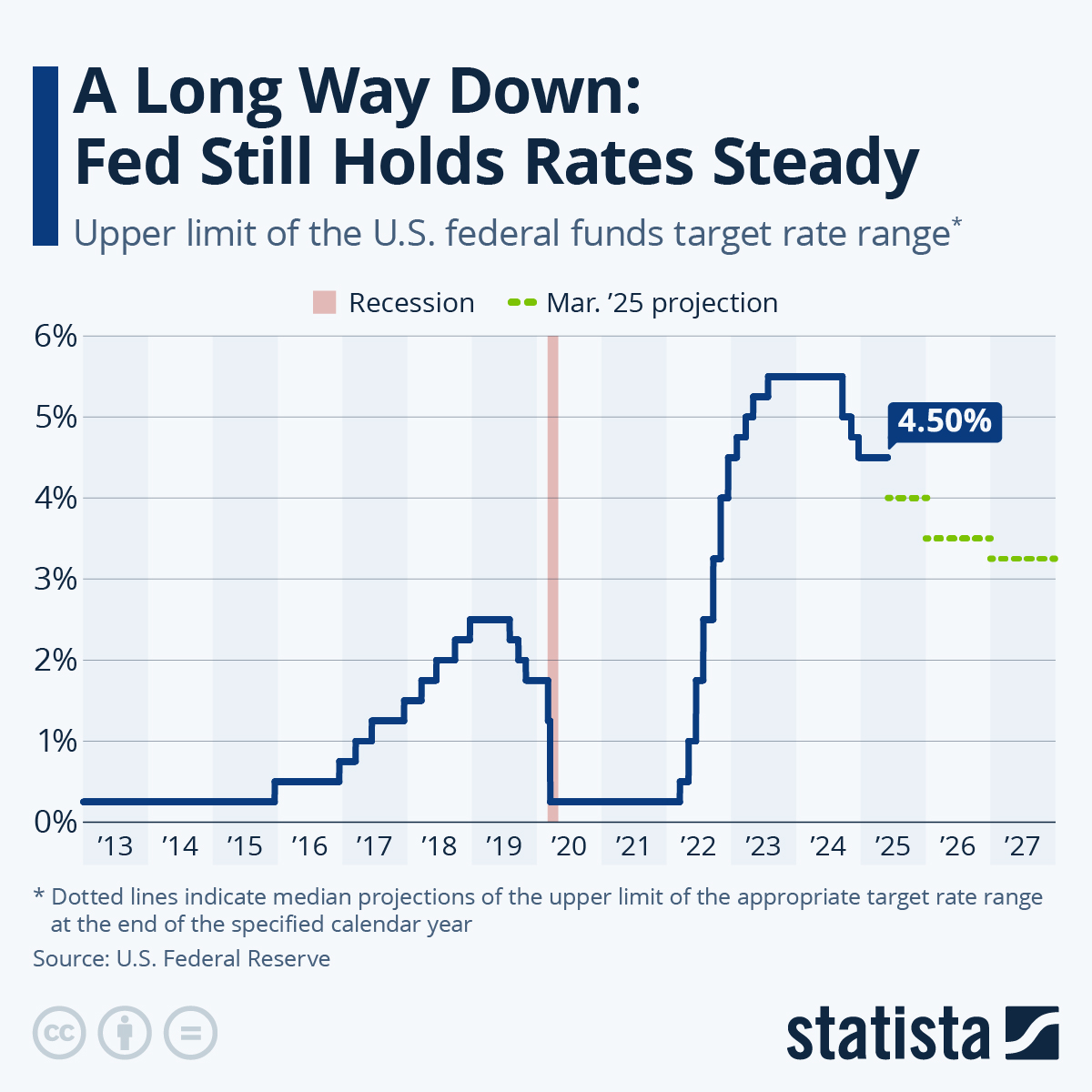

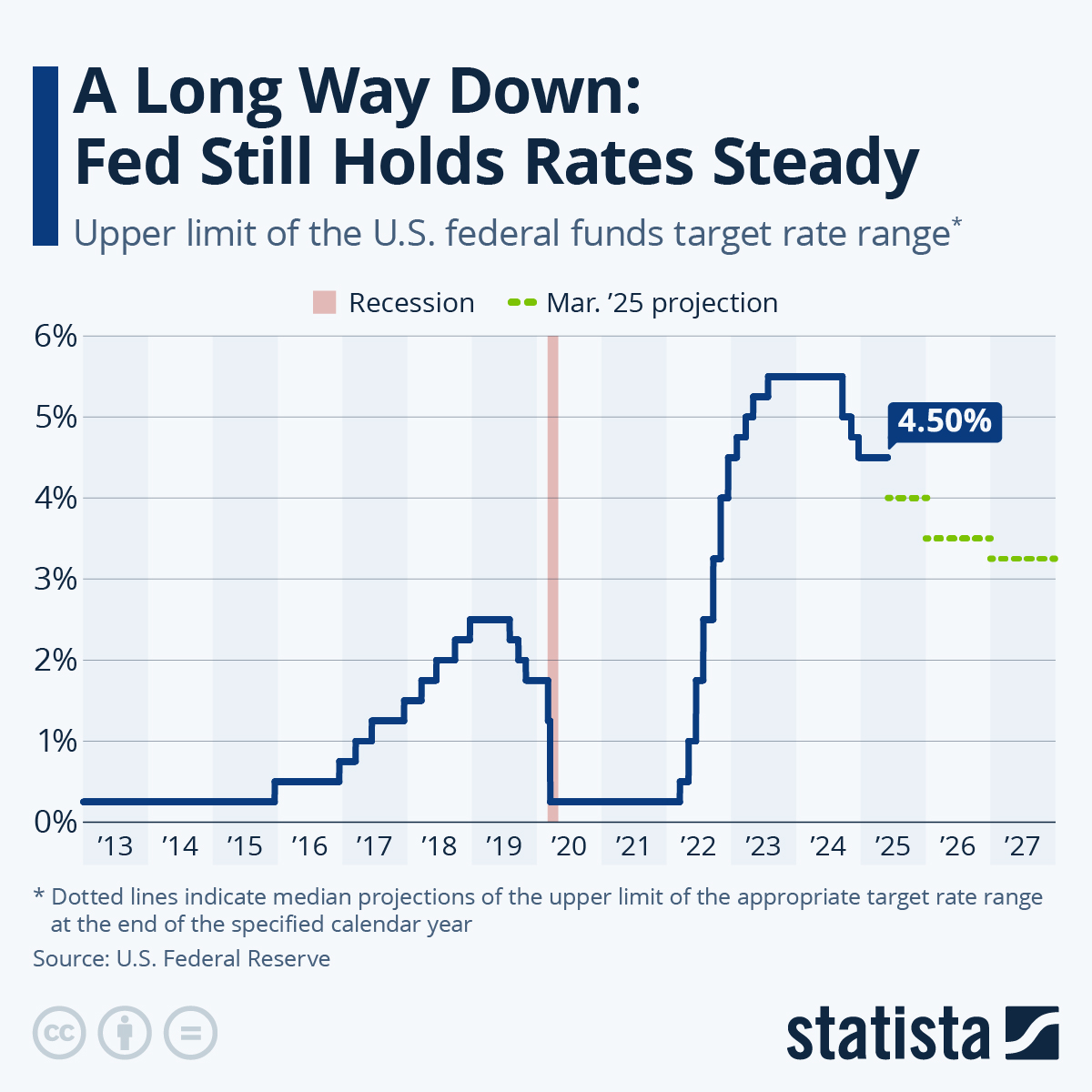

- Future Rate Hikes: While the current decision is to hold steady, the possibility of future interest rate hikes remains on the table should inflation not show signs of consistent decline. The Fed's commitment to returning inflation to its 2% target is unwavering.

The current inflation figures demonstrate a persistent upward trend, impacting consumer spending and business investment. This necessitates a cautious approach from the Fed, weighing the need to curb inflation against the risk of triggering a sharp economic downturn. Future scenarios will depend heavily on the success of current policies in curbing price increases.

Slowing Economic Growth and Recessionary Fears

Alongside persistent inflation, the U.S. economy is facing concerns of slowing economic growth and the potential for a recession. The latest Gross Domestic Product (GDP) figures indicate a deceleration in economic activity, adding to the complexity of the Fed's challenge.

- Slowing GDP Growth: A significant decrease in GDP growth signals a potential slowdown, and the possibility of a recession is being widely discussed among economists.

- Unemployment Rate: The unemployment rate is another crucial factor. While currently low, a significant rise could indicate weakening economic conditions and push the Fed towards more accommodative monetary policy.

- Trade-offs: The Fed faces a difficult trade-off between combating inflation and supporting economic growth. Raising interest rates too aggressively could stifle economic growth and potentially trigger a recession, while leaving rates unchanged risks allowing inflation to become entrenched.

Analyzing current economic growth indicators reveals a mixed picture. While the unemployment rate remains relatively low, the slowdown in GDP growth is a significant concern. The potential for a recession, and the associated societal and economic consequences, significantly influences the Fed's decision-making. The Fed might consider quantitative easing or other non-traditional measures to stimulate growth if conditions worsen.

Geopolitical Uncertainty and Global Economic Conditions

Geopolitical uncertainty and global economic conditions add another layer of complexity to the Fed's decision-making process. External factors can significantly influence the U.S. economy and impact inflation and growth.

- Russia-Ukraine War: The ongoing war in Ukraine continues to disrupt global energy markets and supply chains, significantly impacting energy prices and contributing to inflation worldwide.

- Global Economic Uncertainties: Other global economic challenges, including supply chain disruptions and international trade tensions, further complicate the economic outlook.

- Influence on the Fed's Decision: These global factors directly impact the Fed's ability to accurately assess the U.S. economy and make informed decisions regarding monetary policy.

The war in Ukraine, coupled with other global economic uncertainties, created considerable volatility in global markets. This unpredictability forces the Fed to consider international dynamics alongside domestic conditions when crafting monetary policy.

The Impact of the Fed's Decision on Financial Markets

The Fed's decision to hold steady has immediate and long-term implications for financial markets.

- Market Reaction: The initial market reaction was mixed, with stock prices and bond yields exhibiting some volatility. The dollar's exchange rate also responded to the announcement.

- Stock Prices & Bond Yields: The decision impacts stock valuations and bond yields, influencing investor behavior and investment strategies.

- Long-Term Implications: The long-term consequences for investors and businesses remain to be seen, depending on the future path of inflation and economic growth.

The Fed's decision will have ripple effects throughout financial markets, affecting investment strategies, borrowing costs, and exchange rates. The uncertainty surrounding the future direction of interest rates creates challenges for businesses and investors alike.

Conclusion

The U.S. Federal Reserve's decision to hold steady on interest rates reflects the delicate balancing act between controlling inflation and supporting economic growth amidst considerable uncertainty. The FOMC’s careful consideration of inflation, economic growth, and geopolitical factors highlights the complexity of the current monetary policy challenge. The interplay between these factors, and the potential for future shifts in any of them, will remain crucial in shaping the future path of the U.S. economy.

Call to Action: Stay informed about the evolving economic landscape and the U.S. Federal Reserve's upcoming rate decisions. Follow our updates on future U.S. Federal Reserve announcements and analyses to navigate the complexities of the current economic climate and make informed financial decisions.

Featured Posts

-

Nottingham Attacks Inquiry Judge Who Jailed Becker Appointed Chair

May 09, 2025

Nottingham Attacks Inquiry Judge Who Jailed Becker Appointed Chair

May 09, 2025 -

Sub System Failure Grounds Blue Origin Rocket Launch

May 09, 2025

Sub System Failure Grounds Blue Origin Rocket Launch

May 09, 2025 -

6

May 09, 2025

6

May 09, 2025 -

Uk Set To Implement Stricter Immigration Rules English Fluency A Must

May 09, 2025

Uk Set To Implement Stricter Immigration Rules English Fluency A Must

May 09, 2025 -

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 09, 2025

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 09, 2025