Dollar Weakness And Its Consequences For Asian Currency Stability

Table of Contents

Understanding the Dynamics of a Weak US Dollar

Several factors contribute to the weakness of the US dollar, creating a ripple effect across global currency markets.

Factors Contributing to Dollar Weakness:

- Inflationary Pressures in the US: High inflation erodes the purchasing power of the dollar, making it less attractive to foreign investors. The US Federal Reserve's response to inflation, through interest rate hikes, can also impact the dollar's value. [Link to relevant data from the Bureau of Labor Statistics]

- Rising Interest Rates in Other Countries: As other countries raise interest rates to combat inflation, their currencies become more attractive to investors seeking higher returns, putting downward pressure on the dollar. [Link to a reputable financial news source discussing global interest rates]

- Geopolitical Uncertainty: Global political instability and conflicts can cause investors to move their capital to perceived safer havens, weakening the dollar. [Link to a news source discussing relevant geopolitical events]

- US Trade Deficit: A persistent trade deficit, where the US imports more than it exports, can lead to a weaker dollar as demand for foreign currencies increases. [Link to data from the US Census Bureau on trade deficits]

The Ripple Effect on Global Currencies:

A weaker dollar doesn't exist in isolation. It influences other major currencies, creating a chain reaction. For instance, a weaker dollar often strengthens the Euro and Yen, affecting their exchange rates with Asian currencies. This interconnectedness means exchange rate fluctuations in one major currency quickly propagate throughout the global market, impacting Asian economies significantly. The strength or weakness of the dollar directly impacts the value of Asian currencies, influencing trade, investment, and overall economic stability.

Impact on Asian Economies and Currency Stability

A weak dollar presents several challenges for Asian economies and their currency stability.

Increased Import Costs:

- A weaker dollar makes imports more expensive for Asian countries, leading to higher inflation. This is particularly impactful for nations heavily reliant on imported goods, such as energy, raw materials, and manufactured products.

- Examples include rising costs of oil (priced in USD) for energy-dependent Asian economies and increased prices of imported consumer goods.

The impact varies depending on the level of import reliance. Countries with high import dependency experience a more significant inflationary pressure.

Capital Flows and Investment Decisions:

- A weak dollar can influence foreign direct investment (FDI) flows into Asian countries. Investors may become hesitant to invest in assets denominated in weaker currencies, potentially leading to capital flight.

- Investor sentiment and risk appetite play a crucial role. Uncertainty surrounding the dollar's value can deter investments and lead to capital outflows from Asian markets.

Competitive Devaluation and Currency Wars:

- Some Asian countries might respond to a weak dollar by engaging in competitive devaluation – deliberately weakening their own currencies to boost export competitiveness.

- However, this can trigger currency wars, where multiple countries engage in competitive devaluations, leading to instability and potentially harming global trade. Such actions risk destabilizing the entire region and can lead to unintended economic consequences.

Specific Examples of Asian Countries Affected

The impact of dollar weakness varies across Asian economies.

Case Study 1: Japan – Impact on the Yen

A weak dollar can strengthen the Yen, impacting Japanese exports and potentially slowing economic growth. [Insert data on Yen/USD exchange rate fluctuations and their correlation with economic indicators in Japan]

Case Study 2: China – Impact on the Yuan

China's managed exchange rate system offers a degree of insulation, but a weaker dollar can still influence the Yuan's value and impact China's trade balance. [Insert data on Yuan/USD exchange rate fluctuations and their impact on Chinese exports and imports]

Case Study 3: South Korea – Impact on the Won

South Korea's export-oriented economy is susceptible to fluctuations in the dollar. A weak dollar can affect the Won's value and impact the competitiveness of South Korean goods in the global market. [Insert data on Won/USD exchange rate fluctuations and their consequences for the South Korean economy]

Strategies for Mitigating the Risks of Dollar Weakness

Asian countries can employ several strategies to mitigate the risks associated with dollar weakness.

Central Bank Interventions:

- Central banks can use various tools, such as manipulating interest rates, intervening in foreign exchange markets, and adjusting reserve requirements, to manage currency fluctuations.

- Examples include past interventions by the Bank of Japan or the People's Bank of China to stabilize their respective currencies.

Diversification of Trade Partners:

- Reducing dependence on the US dollar through diversification of trade and investment partners can help mitigate risks associated with dollar fluctuations.

- This involves expanding trade relationships with other countries, reducing reliance on the US market and lessening exposure to dollar volatility.

Fiscal and Monetary Policy Adjustments:

- Appropriate fiscal and monetary policies can help stabilize the economy during periods of dollar weakness.

- Examples include expansionary fiscal policies to stimulate domestic demand or adjusting monetary policy to manage inflation.

Conclusion: Dollar Weakness and its Consequences for Asian Currency Stability – A Summary and Call to Action

Dollar weakness significantly impacts Asian currency stability, affecting import costs, capital flows, and potentially leading to competitive devaluations. Understanding the dynamics of a weak dollar and its implications for Asian economies is crucial for policymakers and investors alike. Staying informed about global currency markets and closely monitoring relevant economic indicators related to dollar weakness and its consequences for Asian currency stability is vital. Further research into the specific vulnerabilities of different Asian economies to dollar fluctuations is necessary for effective mitigation strategies. Proactive planning and diversification are key to navigating this complex landscape.

Featured Posts

-

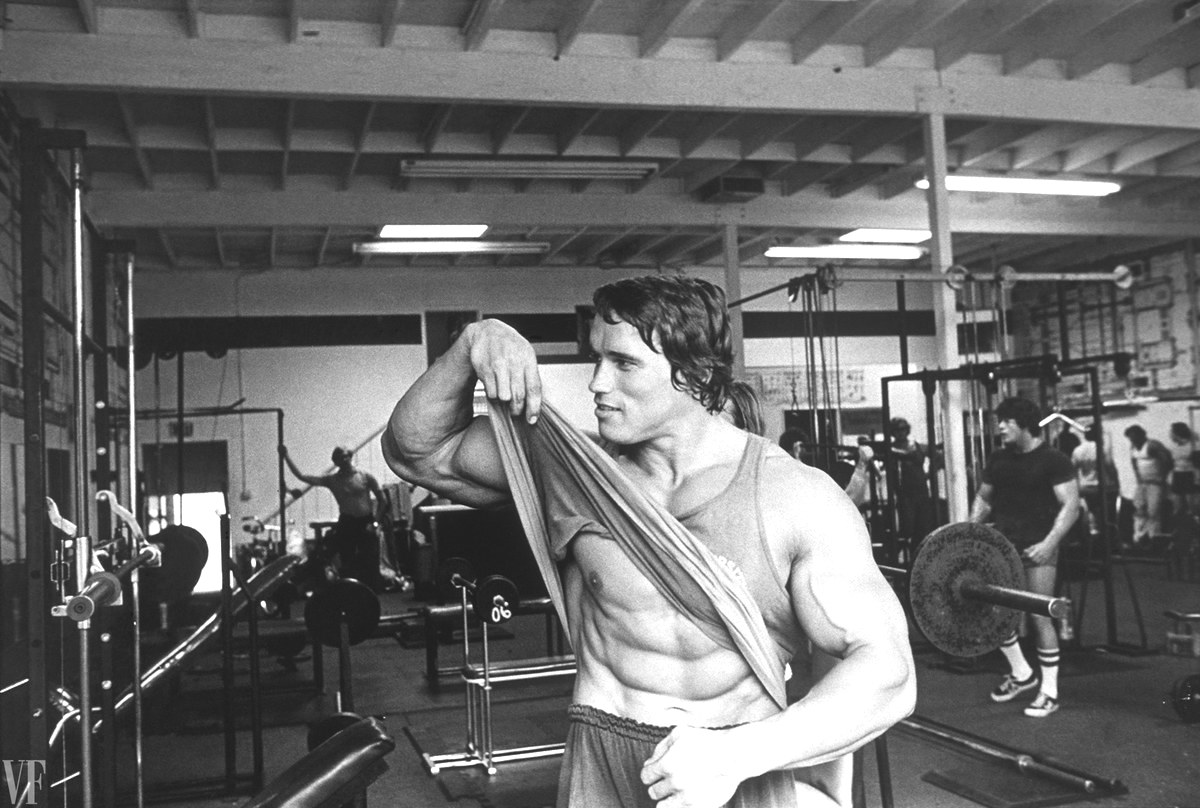

Patrick Schwarzeneggers White Lotus Role Hard Work And Nepotism Debate

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Hard Work And Nepotism Debate

May 06, 2025 -

Is Over The Counter Birth Control The Future Of Reproductive Healthcare

May 06, 2025

Is Over The Counter Birth Control The Future Of Reproductive Healthcare

May 06, 2025 -

Gigabyte Aorus Master 16 Powerful Gpu But Is The Fan Noise Worth It

May 06, 2025

Gigabyte Aorus Master 16 Powerful Gpu But Is The Fan Noise Worth It

May 06, 2025 -

What Warren Buffetts Biggest Investment Successes And Failures Teach Us

May 06, 2025

What Warren Buffetts Biggest Investment Successes And Failures Teach Us

May 06, 2025 -

Googles Ad Dominance Under Scrutiny Potential Breakup On The Horizon

May 06, 2025

Googles Ad Dominance Under Scrutiny Potential Breakup On The Horizon

May 06, 2025

Latest Posts

-

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

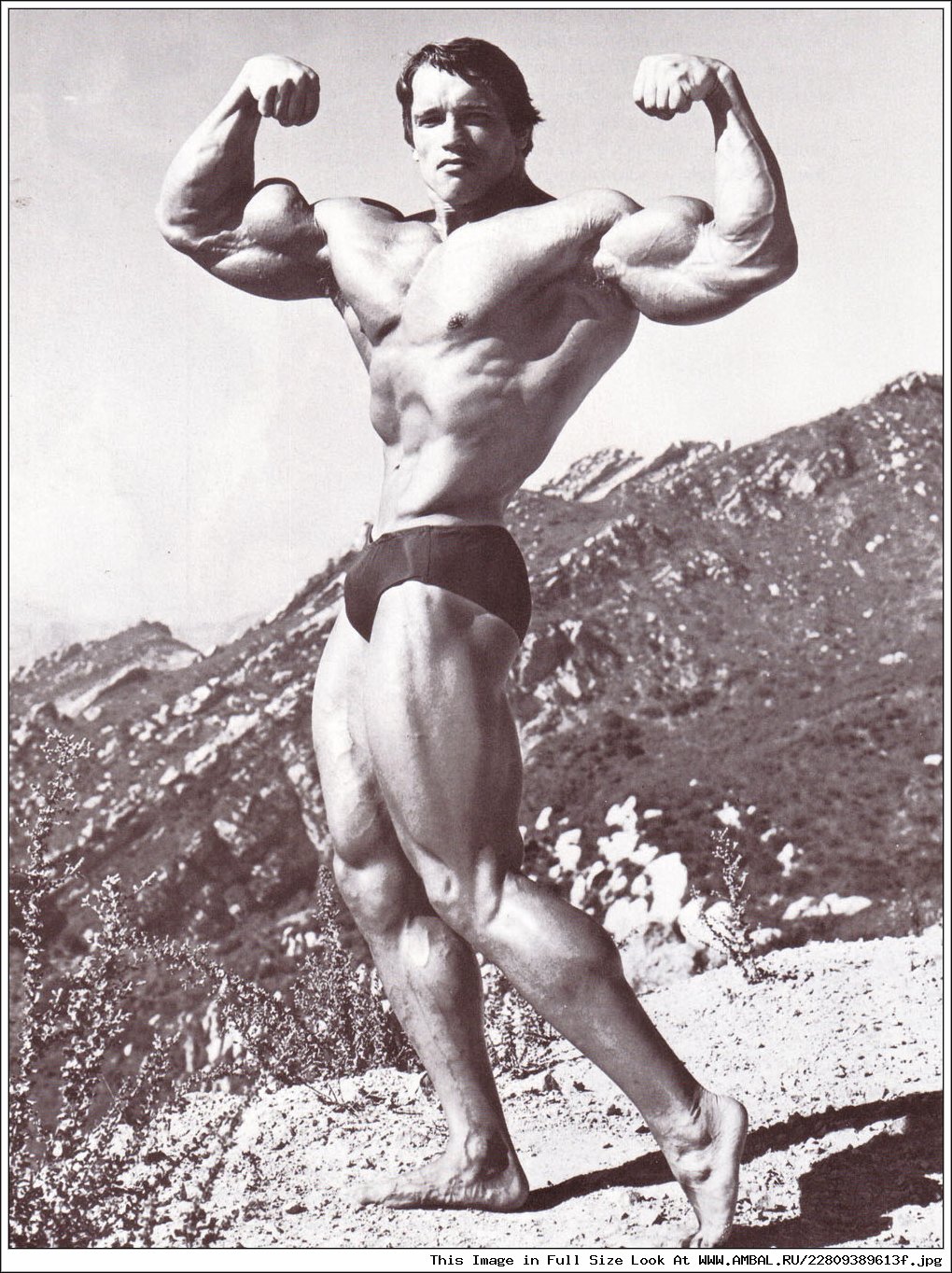

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nudity In Film

May 06, 2025